The private real estate market is experiencing a period of transition as valuations face uncertainty due to persistently high inflation, rising interest rates, and a potentially looming economic slowdown. Recent sell-offs in public real estate investment trusts (REITs) and concerns regarding redemption limits at non-traded REITs have shaken confidence in the sector. However, understanding the current environment and potential catalysts, risks, and opportunities can help financial advisors make informed decisions regarding private real estate investments.

Private Real Estate Valuations: Frozen in Price Discovery

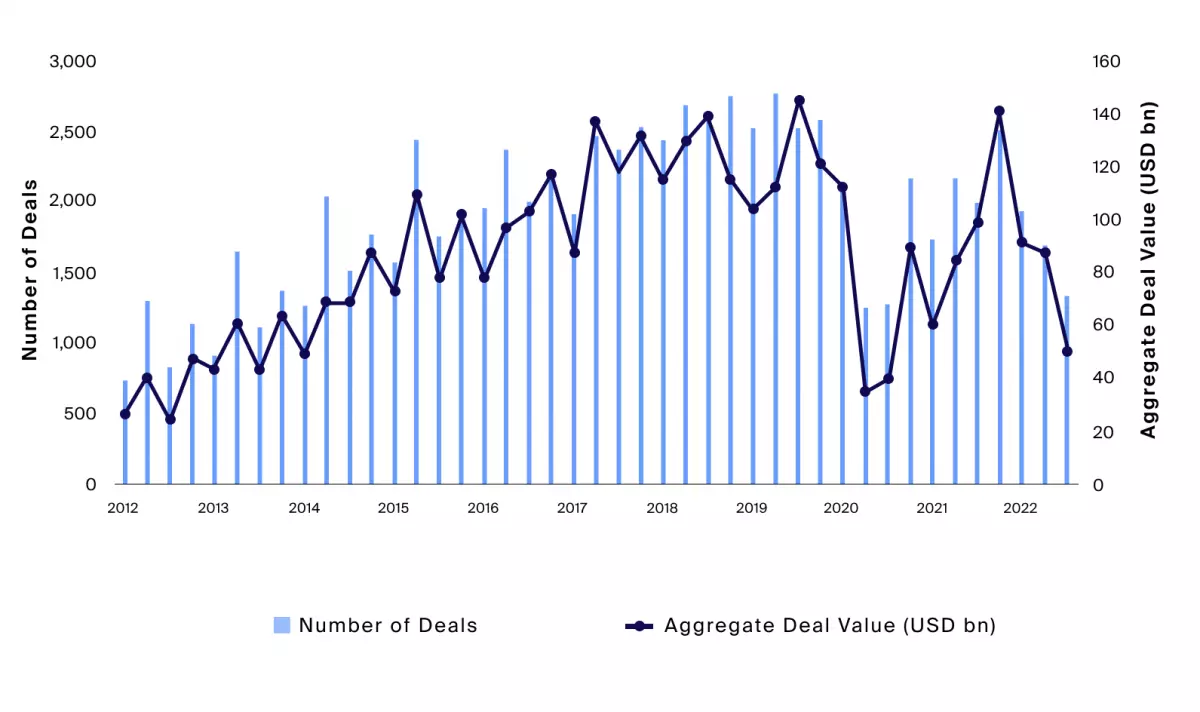

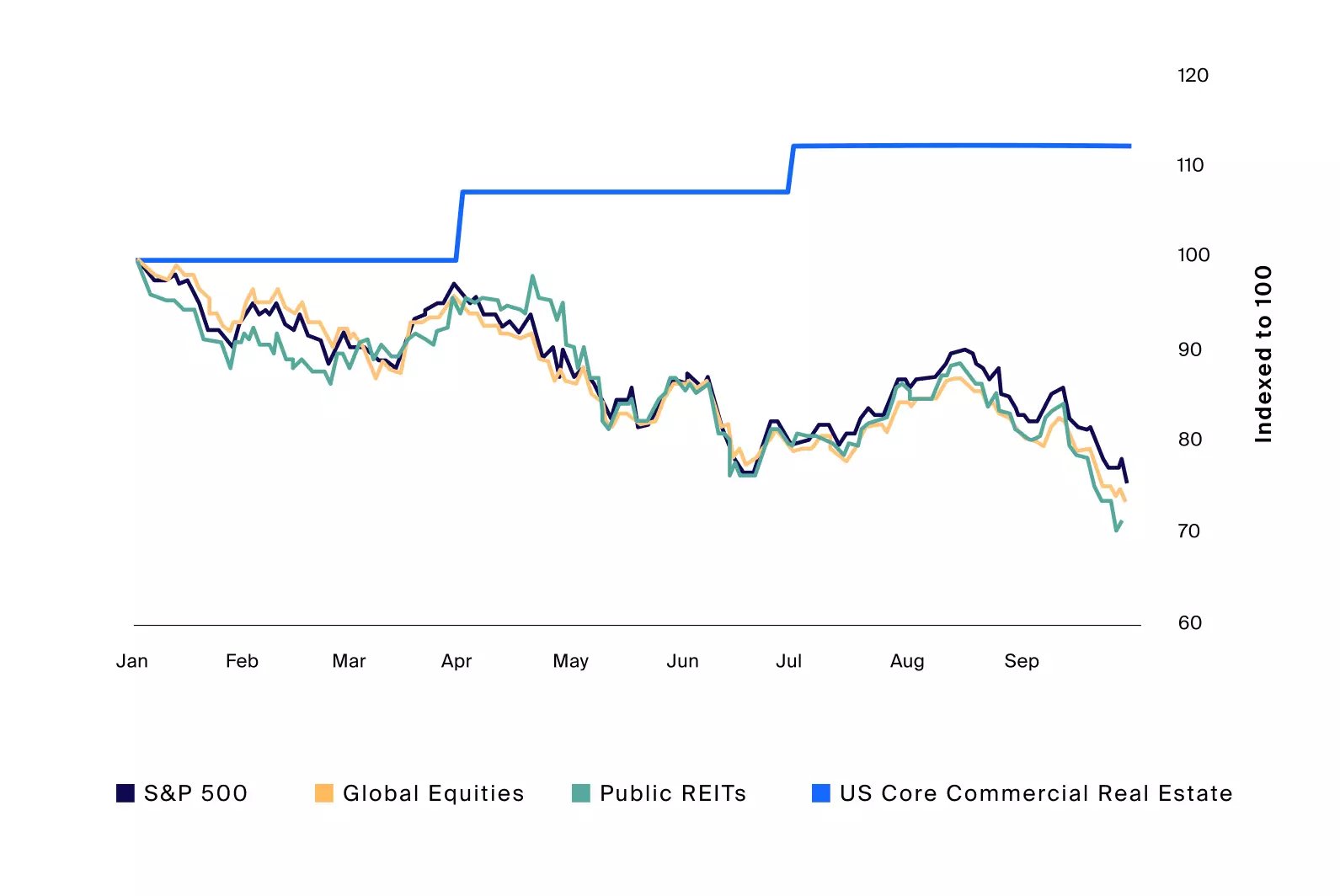

While publicly traded REITs have experienced a 27% decline as measured by the FTSE NAREIT Equity REITs index, private real estate markets have not yet undergone a similar repricing. The values of non-traded REITs and closed-end real estate funds are determined by appraisals of underlying real estate assets, which are updated less frequently than the daily trading of public REITs. The lack of comparable sales and economic uncertainty has stalled activity in private real estate transactions, resulting in a wide bid-ask spread and a 30% decrease in global transactions.

The cost of debt financing has also increased in some instances, surpassing the net operating income generated by the property. This negative leverage deteriorates short-term returns and drives bid prices lower. With limited transaction activity, it becomes challenging to estimate how much prices will fall, and a correction may persist until interest rates drop.

Potential Catalysts: Liquidity Needs and the Denominator Effect

Liquidity-seeking Asian investors have driven initial redemption requests from non-listed REITs, with concerns about margin calls in domestic equity markets. This wave of redemptions may affect investor confidence and create a ripple effect across the market. The overallocation of private real estate in investors' portfolios, due to its strong performance relative to other assets, may also lead to redemptions and a slowdown in fund flows.

Although immediate forced selling is unlikely, open-end funds may need to sell assets into an illiquid market to meet redemption requests, potentially pushing down valuations. However, gating mechanisms in non-listed REITs prevent fire-sale scenarios, and well-capitalized funds can fund redemptions without selling assets.

Impending Debt Maturities and Negative Leverage

Upcoming commercial real estate debt maturities may force property owners to sell their assets as refinancing becomes challenging. Inability to refinance due to liquidity issues may result in increased loan delinquencies. However, the volume of maturities is not comparable to the Global Financial Crisis, and borrowers believe that property values will remain above loan balances. Property owners struggling with existing costs may choose to sell their assets or face difficulty obtaining debt financing with lenders reinforcing leverage protections.

Macroeconomic Factors and Operating Fundamentals

Despite the technical challenges faced by the private real estate market, the underlying fundamentals of the assets remain relatively strong. Industrial real estate vacancies are at all-time lows, retail properties benefit from federal stimulus and increased store openings, office leasing is near long-term averages, and subleasing activity has increased. While multi-family rent growth has slowed, certain property types continue to exhibit growth potential.

Where Risks and Opportunities May Emerge in Private Real Estate

Investing in private real estate requires careful consideration of risk factors and the potential for opportunities. Manager selection, access to properties, and experience in managing and improving portfolios are key factors in taking advantage of opportunities. Concentration risks, illiquidity, and the J-curve typical in drawdown funds should also be considered. However, private credit funds focused on real estate lending may have an opportunity to provide debt capital as traditional sources of liquidity retreat.

A potential valuation correction may offer lower-priced entry points for drawdown funds and newly launched non-listed REITs. Additionally, certain property types that align with long-term secular trends, such as e-commerce and the digital economy, offer potential income and value growth. Private real estate can serve as part of a long-term strategic asset allocation, providing diversification, lower volatility, and potential tax benefits.

While private real estate may face valuation headwinds in the near term, it remains an important asset class for those seeking inflation hedge, diversification, and long-term investment strategies. Advisors with longer time horizons may find opportunities in the market, and a selective approach to private real estate investments is crucial in this transitional phase.