Photo by itakdalee/iStock via Getty Images

Photo by itakdalee/iStock via Getty Images

It's no secret that the COVID pandemic and the rise of remote work have led to an oversupply of office space nationwide. In fact, renowned investor Charlie Munger recently warned of a potential crash due to the troubled state of office buildings. However, in this sea of uncertainty, Armada Hoffler (NYSE:AHH) stands out as a mixed bag with a unique advantage.

While Armada Hoffler does have exposure to office buildings, it is primarily a diversified real estate investment trust (REIT) that has managed to weather the storm better than its peers. Unlike Office REITs such as Empire State Realty (ESRT), American Assets Trust (AAT), and Paramount Group (PGRE), Armada Hoffler's diverse portfolio includes other types of real estate, giving it a strategic advantage.

Data by YCharts

Data by YCharts

Meet the Company

Founded in 1979 and headquartered in Virginia Beach, Armada Hoffler went public as a REIT in 2013. With a market capitalization of $0.76 billion, it remains a small-cap company. According to their annual report, Armada Hoffler boasts a stabilized portfolio of 6 million rentable square feet, with an impressive occupancy rate of 97% as of March 31. The company's leasing spreads have consistently exceeded 10% on a GAAP basis, even within their office segment.

Armada Hoffler's high-quality portfolio is concentrated in the Mid-Atlantic and Southeastern U.S., with a particular focus on the Greater Baltimore/Washington, D.C. area. This strategic concentration of 35 properties in the region ensures a stable base for the company.

Geographic distribution of AHH assets (AHH annual report)

Geographic distribution of AHH assets (AHH annual report)

However, it is worth noting that population growth in the Baltimore and Washington, D.C. areas has been declining for years. Despite this, employment growth in these metro areas has shown signs of stabilization, with an average increase of approximately 50,000 jobs per month, according to the Bureau of Labor Statistics.

Population growth for Baltimore since 1950 (Macrotrends.com)

Population growth for Baltimore since 1950 (Macrotrends.com)

U.S. Bureau of Labor Statistics

U.S. Bureau of Labor Statistics

Despite these challenges, Armada Hoffler's revenue streams are well-diversified. While the company has a significant exposure to office properties, its 38 retail properties generate 44% of its net operating income (NOI), surpassing the 34% generated by its 9 office properties and the 22% generated by its 10 multifamily properties. The multifamily segment is expected to contribute 25% of the NOI by the end of 2023.

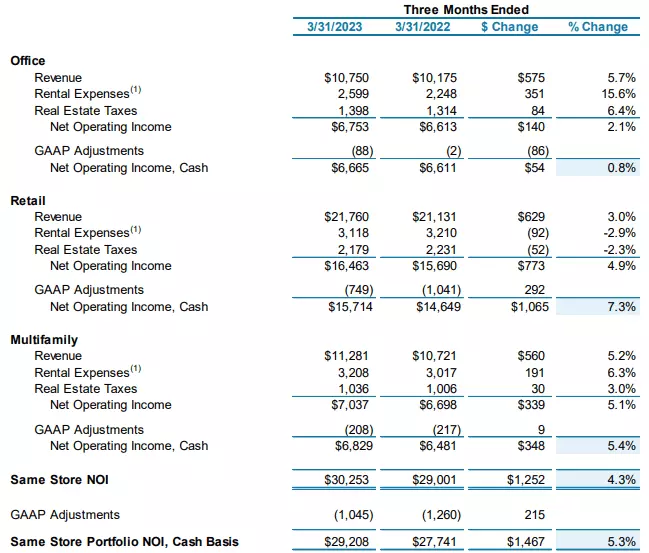

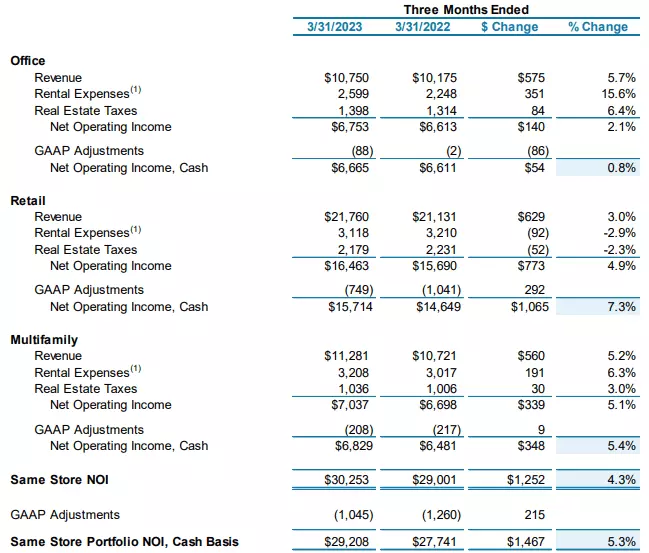

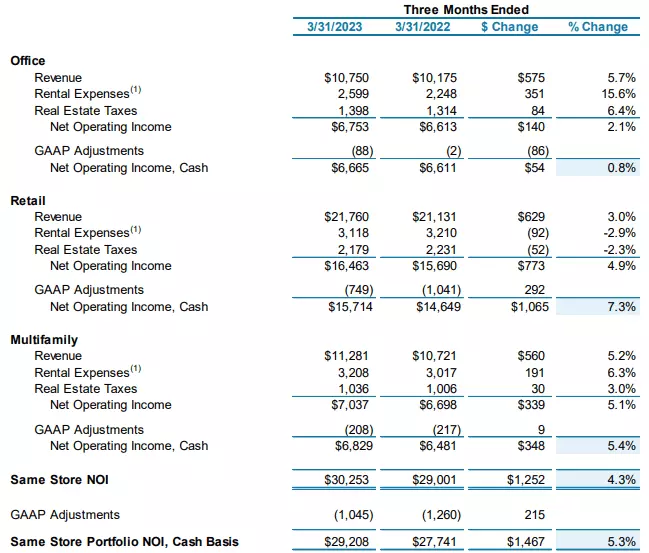

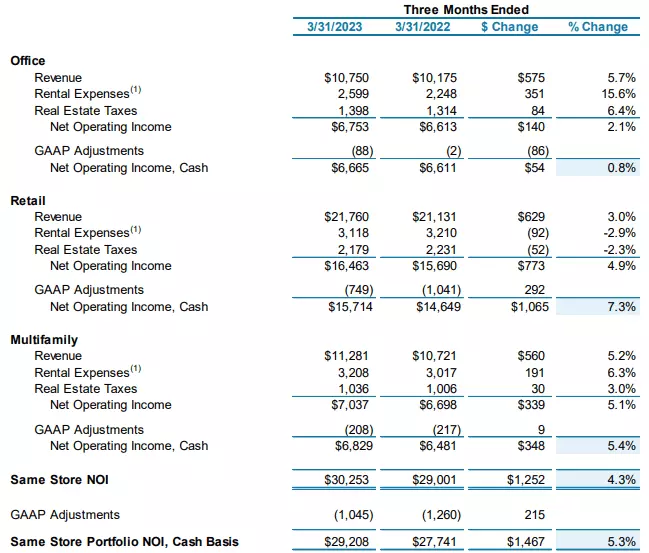

In terms of year-over-year growth, the retail segment demonstrated the healthiest performance, with a 7.3% increase in same-store NOI. The multifamily segment experienced a 5.4% increase, while the office segment trailed behind with a modest 0.8% growth.

Same Store NOI by segment (AHH Q1 2023 earnings supplemental)

Same Store NOI by segment (AHH Q1 2023 earnings supplemental)

Furthermore, Armada Hoffler boasts a well-diversified tenant roster. While Constellation Energy Generation accounts for 8.0% of the annual base rent (ABR), the top 20 tenants combined contribute only 29.1% of the ABR. This diversification helps mitigate risks associated with concentrated tenancy.

Top 20 AHH Tenants (AHH Q1 2023 earnings supplemental)

Top 20 AHH Tenants (AHH Q1 2023 earnings supplemental)

Quarterly Results

Here are some highlights from Armada Hoffler's Q1 results, reported on May 9:

- FFO of $20.6 million, down by 25.4% year-over-year (YoY).

- FFO per share of $0.23, down by 25.8% YoY.

- Maintained full-year FFO guidance.

- Maintained a portfolio occupancy rate of 97% (98% retail, 97% office, 96% multifamily).

- Acquired The Interlock, a retail and entertainment center in Atlanta, including 50,000 square feet of technology office space, for $100 million, financed mostly by fixed-rate loans and OP units, at a 6.5% going-in cap rate.

- Increased the dividend by 2.6%, to $0.195 per share, nearly restoring its pre-pandemic level of $0.22.

- A $60 million multifamily development in Belmont, N.C., is expected to stabilize in Q2 2023. It is 98% leased, and Armada Hoffler owns an 85% stake.

- A $119 million mixed-use facility in Roswell, Georgia, is expected to stabilize in Q4 2024. It is 100% owned by Armada Hoffler, and currently 61% leased.

- A $264 million T. Rowe Price office complex in Baltimore is 93% leased and expected to stabilize in Q3 2024. Armada Hoffler owns a 50% stake.

- A $225 million mixed-use facility in Baltimore is expected to stabilize also in Q3 2024. Armada Hoffler owns a 90% stake.

- Morningstar has issued a BBB credit rating for the company with a stable outlook.

Growth Metrics

Let's take a look at Armada Hoffler's growth figures for the past three years. The company's funds from operations (FFO) have grown at a healthy rate of 10.0%. However, FFO per share has only increased by 3.5%. This suggests that the company's FFO gains have primarily come from issuing new shares.

| Metric | 2019 | 2020 | 2021 | 2022 | 3-year CAGR |

|---|---|---|---|---|---|

| FFO (millions) | $80.0 | $83.0 | $85.4 | $106.6 | 10.0% |

| FFO Growth % | - | 3.8% | 2.9% | 24.8% | - |

| FFO per share | $1.10 | $1.10 | $1.07 | $1.22 | 3.5% |

| FFO per share growth % | - | 0.0% | -2.7% | 14.0% | - |

| TCFO (millions) | $67.7 | $91.2 | $91.2 | $116.9 | 20.0% |

| TCFO Growth % | - | 34.7% | 0.0% | 28.2% | - |

Source: TD Ameritrade, Hoya Capital Income Builder, and author calculations

In terms of stock performance, Armada Hoffler has outperformed the Vanguard Real Estate ETF (VNQ) in each of the past three 12-month periods. However, its 3-year compounded annual growth rate (CAGR) of 16.0% is largely influenced by its recovery from the COVID pandemic.

| Metric | 2020 | 2021 | 2022 | 2023 | 3-yr CAGR |

|---|---|---|---|---|---|

| AHH share price May 16 | $7.07 | $13.08 | $13.06 | $11.04 | 16.0% |

| VNQ share price May 16 | $68.8 | $97.08 | $96.17 | $79.84 | 5.1% |

Source: MarketWatch.com and author calculations

Balance Sheet Metrics

Armada Hoffler's balance sheet metrics indicate room for improvement. When compared to the average REIT, Armada Hoffler falls short in terms of liquidity, debt ratio, and debt/EBITDA. These metrics highlight the company's need to address its indebtedness.

| Company | Liquidity Ratio | Debt Ratio | Debt/EBITDA | Bond Rating |

|---|---|---|---|---|

| AHH | 1.40 | 50% | 8.1 | BBB |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

As of March 31, Armada Hoffler held $33.8 million in cash and had $1.11 billion in outstanding debt with an average interest rate of 3.9% and an average maturity of 4.4 years. Approximately 21.0% of the debt is held at a variable interest rate, which could pose a risk if the Federal Reserve continues to raise interest rates. However, this risk could be mitigated if the Fed decides to pause on rate increases.

AHH Capital Structure (AHH Q1 2023 earnings supplemental)

AHH Capital Structure (AHH Q1 2023 earnings supplemental)

Armada Hoffler's debt service coverage ratio is 2.8x, and the fixed charge coverage ratio is 2.3x, indicating a reasonable level of financial stability. Chief Financial Officer Matthew Barnes-Smith reassured investors during the earnings call, stating that the company plans to transition towards long-term fixed-rate unsecured debt while maintaining liquidity and respectable financial metrics.

Dividend Metrics

Armada Hoffler's track record as a dividend payer is impressive. With a current yield of 6.95% and a 21.0% growth in dividends over the past three years, the company has earned a Dividend Score of 12.31. However, its debt situation raises concerns about the sustainability of these quarterly distributions, resulting in a Dividend Safety grade of D+ according to Seeking Alpha Premium.

| Company | Div. Yield | 3-yr Div. Growth | Div. Score | Payout | Div. Safety |

|---|---|---|---|---|---|

| AHH | 6.95% | 21.0% | 12.31 | 60% | D+ |

Source: Hoya Capital Income Builder, TD Ameritrade, Seeking Alpha Premium

Valuation Metrics

Armada Hoffler is currently undervalued, with a Price/FFO ratio below the REIT average. Furthermore, it offers a discount to its net asset value (NAV), making it an attractive option for value investors.

| Company | Div. Score | Price/FFO '23 | Premium to NAV |

|---|---|---|---|

| AHH | 12.31 | 9.2 | -22.6% |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

What Could Go Wrong?

One potential risk facing Armada Hoffler is the possibility of the Federal Reserve continuing its interest rate hikes. This would increase the company's interest expenses on its variable-rate debt, potentially impacting its cash flow. Additionally, the overall state of the real estate market could pose challenges for the company.

Investor's Bottom Line

Armada Hoffler is a strong company that has managed to navigate through challenging times, thanks to its diversified portfolio. With an attractive Price/FFO ratio and yield, as well as an impressive dividend growth track record, it offers potential opportunities for both value and growth investors. However, its debt situation raises concerns and adds an element of risk. As a growth investor, considering the company's pros and cons, I rate it as Tempting (Hold plus).

While this view aligns with the Seeking Alpha Quant Ratings, it differs from Wall Street analysts and some fellow contributors who consider AHH a Buy. It is essential to conduct thorough research and form your own opinion before making any investment decisions.

Factor grades for AHH: Valuation B, Growth B+, Profitability D, Momentum B-, Revisions A+ (Seeking Alpha Premium)

Factor grades for AHH: Valuation B, Growth B+, Profitability D, Momentum B-, Revisions A+ (Seeking Alpha Premium)

Three out of five Wall Street analysts rate AHH as a Strong Buy, with the remaining two giving it a Hold and a Sell rating. The average price target is $14.13, implying a 28% upside.

TipRanks rates AHH on the high side of Neutral, while The Street and Zacks rate it as a Hold, and Ford Equity Research deems it a Sell. Ultimately, the final opinion that matters most is yours.