Real estate investment trusts (REITs) have become increasingly popular in both the public and private real estate sectors. They offer a range of advantages compared to partnerships, making them a valuable investment option for both US and non-US investors.

Understanding REIT Taxes

REITs function as corporations for income tax purposes and primarily hold rental real estate assets or debt secured by real estate. These assets are held for the purpose of generating income and long-term appreciation. One of the key benefits of REITs is that dividends paid by the trust are tax-deductible, provided that at least 90% of the net ordinary taxable income is distributed. To avoid REIT-level tax, 100% of the income must be distributed.

Additionally, REITs must have at least 100 shareholders and cannot be closely held. They are subject to various organizational, operational, asset, and income tests to ensure compliance. For shareholders, the impact is relatively straightforward. They receive a dividend documented on a 1099 form, which includes ordinary income and sales gains from their proportional share of the REIT's operations for the year.

While the rules surrounding REITs can be complex, they offer highly efficient and advantageous options for holding real estate assets and debt. It's worth noting that captive REITs, where a fund owns the common stock and has 100 direct preferred shareholders, are common structures in the fund setting.

Exploring the Benefits of REITs

Although REITs require extensive administration and technical precision, the benefits they provide are substantial, making them an attractive investment option for individuals and institutions alike.

State Tax Blocker

One major advantage is that REIT shareholders receive dividends that are generally only taxable in their state of domicile. This eliminates the need for additional state filings or liabilities. For individuals or partners domiciled in zero- or low-income tax states, the tax savings can be significant as they avoid income taxes in higher tax rate states.

Tax-Exempt Investor Tax Blocker

For tax-exempt investors, such as individual retirement accounts (IRAs) and foundations, REITs offer a tax-efficient solution. Dividends received from a REIT are not taxable, solving the issue of unrelated business taxable income (UBTI) that can arise when investing in leveraged rental real estate or debt funds.

Pass-Through Tax Deduction (IRC Section 199A)

Partnerships involved in rental real estate or certain debt funds may generate qualified business income for their partners. This income qualifies for a 20% partner-level deduction for individual investors, subject to certain limitations. However, REITs provide a simplified solution, as they produce ordinary dividends that categorically qualify for this deduction, without the wage and basis limitations applicable to partnerships.

Qualified Foreign Pension Funds (QFPFs)

Non-US investors can benefit from using REITs to achieve tax-free appreciation and gain on exit. The complex Foreign Investment in Real Property Tax Act (FIRPTA) regime generally taxes non-US investors on indirect US real estate gains. However, a QFPF can hold REIT shares indirectly through a fund, enjoying untaxed dividends and gains on sale.

Domestically Controlled REITs in Funds

In a fund setting, a domestically controlled REIT owned more than 50% by US persons falls outside the FIRPTA regime. This allows non-US owners to sell REIT shares or partnership units holding REIT shares without incurring US tax. This tax-efficient monetization path is not available for interests in partnerships owning real estate directly.

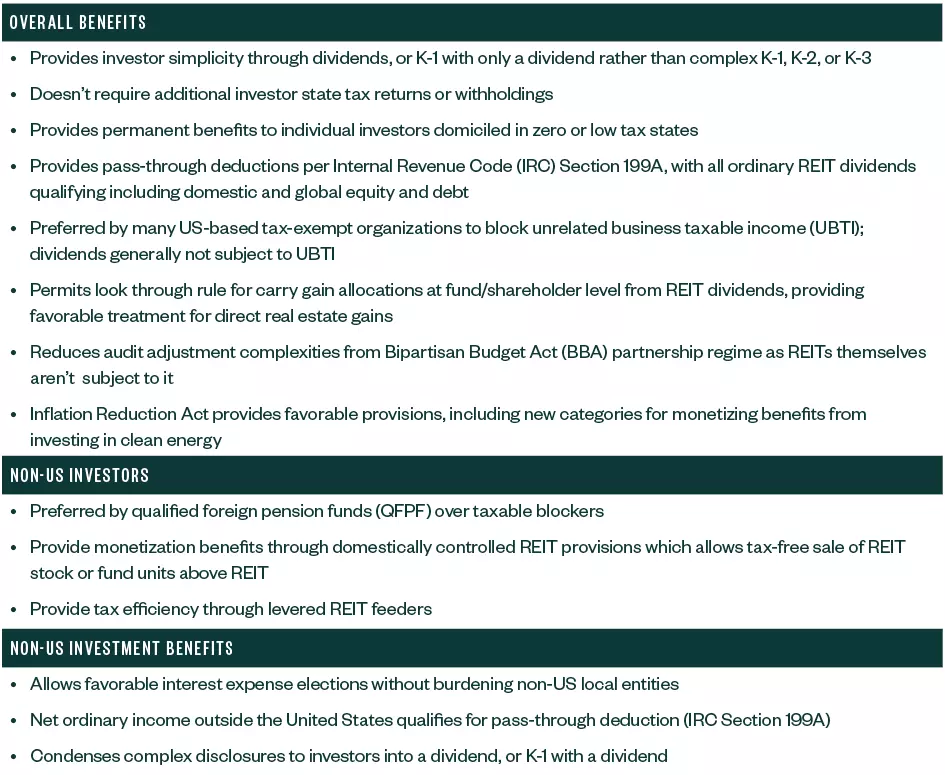

Chart detailing overall REIT Benefits

Chart detailing overall REIT Benefits

Conclusion

REITs offer a range of tax benefits and simplified investment options, making them an attractive choice for investors looking to optimize their real estate holdings. Whether you're a US investor or a non-US investor seeking tax-efficient strategies, REITs provide a valuable avenue for maximizing returns and simplifying investment structures. So, consider exploring the benefits of REITs and unlock the potential of tax savings and simplified investments.

Image Source: Sanaulac.vn and Sanaulac.vn