The Australian property market is experiencing a significant shift, with housing prices suddenly falling. This trend is primarily driven by aggressive interest rate rises by the Reserve Bank of Australia (RBA), making mortgages more expensive and causing people to retreat from the housing market, especially in Sydney. The repercussions of these changes are most strongly felt by tenants, who are being hit the hardest.

Image: Australian Property Market

Image: Australian Property Market

The decline in housing prices initially began in Sydney, followed closely by Melbourne. This pattern, witnessed during the last correction in the Australian property market in 2017-18, indicates that the fall in prices tends to start in the expensive segment of the market and then spreads.

According to Tim Lawless, CoreLogic's research director, historically, expensive housing markets lead both the upswing and the downturn. If history repeats itself, falling housing prices will spread from the expensive suburbs of Melbourne and Sydney to other parts of the country.

The Importance of Australian Property Prices

While property prices are often framed as social dividers or topics of generational debate, they serve a more significant purpose in the economy. As a critical moving part, they are the first to be impacted by changes in interest rates. Consequently, the RBA closely monitors property prices due to their influence on various sectors of the economy.

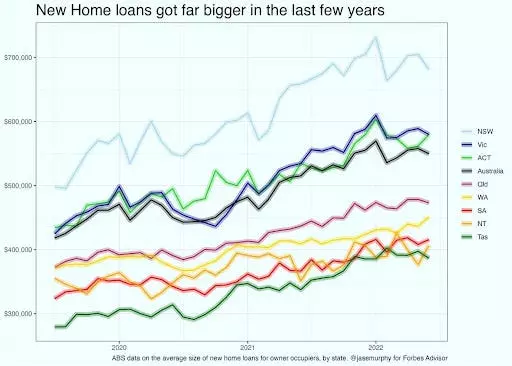

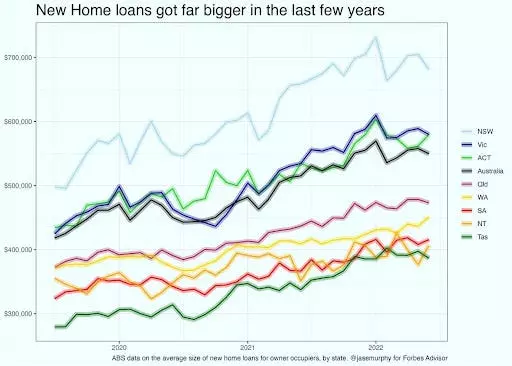

Recently, new housing loans in Australia have skyrocketed in size. This means that new borrowers are particularly sensitive to rising interest rates. The average size of an owner-occupier home loan now exceeds half a million dollars, predominantly thanks to Sydney's remarkable property market.

Image: Average Loan Sizes

Image: Average Loan Sizes

New borrowers with substantial mortgage repayments are most vulnerable to rising interest rates. Even those with minimal deposits face the highest risk of falling underwater when house prices decline. For instance, if the market value of a new home falls by over 20% and the borrower had only made a 20% deposit, they would now owe more to the bank than the house is worth. This situation can lead to defaults, which is a key reason why house prices matter significantly.

It is essential to note that Australians tend to continue paying off their home loans even when they owe more than the house's value, unlike borrowers in the United States who default more frequently. However, if a major economic calamity occurs, resulting in widespread unemployment, borrowers' inclination to pay down their mortgages can change, leading to defaults.

This combination of being underwater and losing one's job is enough to trigger a chain reaction, impacting the entire economy. In Australia, the domestic economy consists of 24% investment and 76% consumption. House prices play a crucial role in driving both these components, with consumption being the primary driver.

The Influential Effect of Falling House Prices

There are two main ways in which falling house prices impact the economy:

1. Consumption Effect

Property trading stimulates consumption. When properties are sold, it often leads to additional spending on renovations, hiring tradespeople, and purchasing new furniture. Conversely, when house prices fall, the desire to buy decreases, resulting in reduced consumption. Therefore, rising house prices directly cause an increase in consumption, while falling house prices have the opposite effect.

2. Wealth Effect

When home values rise, individuals tend to feel wealthier and, subsequently, spend more. This wealth effect is most significant among older households with more accumulated wealth. However, as luck turns against them with falling house prices, the wealth effect weakens.

The RBA is acutely aware of how declining house prices can impact the economy. A significant downturn in house prices directly affects the wealth effect, leading to reduced consumption. This decline can also result in rising unemployment, making it even more challenging for borrowers to repay their home loans.

Interest Rate Rises: Striking a Delicate Balance

The RBA's interest rate hikes must be carefully calibrated to avoid negative consequences. The ideal amount of rate hikes would cause inflation to retreat while allowing house prices to stabilize. However, if interest rates increase too much, it could trigger a downward spiral in house prices, potentially dragging the entire economy down with it. This concern is particularly critical as the Federal Government's debt levels make it less likely to step in and rescue the market through increased spending.

It is important to note that interest rate hikes take time to have their full effect on the economy. Thus, the rate cuts implemented this year will continue to dampen economic activity well into 2023. Only time will reveal whether the RBA's actions inadvertently place immense pressure on the Australian property market and the overall economy.