Image source: JuSun

Image source: JuSun

Investing in real estate has always been a popular choice for many, and buying rental properties is a common way to enter this market. However, it's important to consider all the factors that affect investment returns, such as costs, taxes, and mortgage payments. That's why investing in Real Estate Investment Trusts (REITs) like AvalonBay Communities (NYSE:AVB) can provide a more streamlined and hassle-free approach to owning real estate.

Why AVB?

AvalonBay Communities is one of the largest multifamily REITs in the market today, with properties strategically located in major metropolitan areas across the United States. With a solid track record of generating a total return of 109% over the past 10 years, AVB has outperformed some of its competitors, including Equity Residential (EQR) and the Vanguard Real Estate ETF (VNQ). While this return may not be groundbreaking, AVB has consistently provided investors with a growing dividend and an annual return that aligns with the historical performance of commercial real estate.

Image source: Seeking Alpha

Image source: Seeking Alpha

AVB's strategic presence in supply-constrained regions gives it a competitive edge by limiting competition and maintaining higher barriers to entry. According to estimates, new apartments are expected to represent only 1.6% of the total supply in AVB's markets, which is significantly lower than the national average of 2.3%. This favorable market condition allows AVB to enjoy steady revenue growth and capitalize on the demand for quality rental properties.

Image source: Investor Presentation

Image source: Investor Presentation

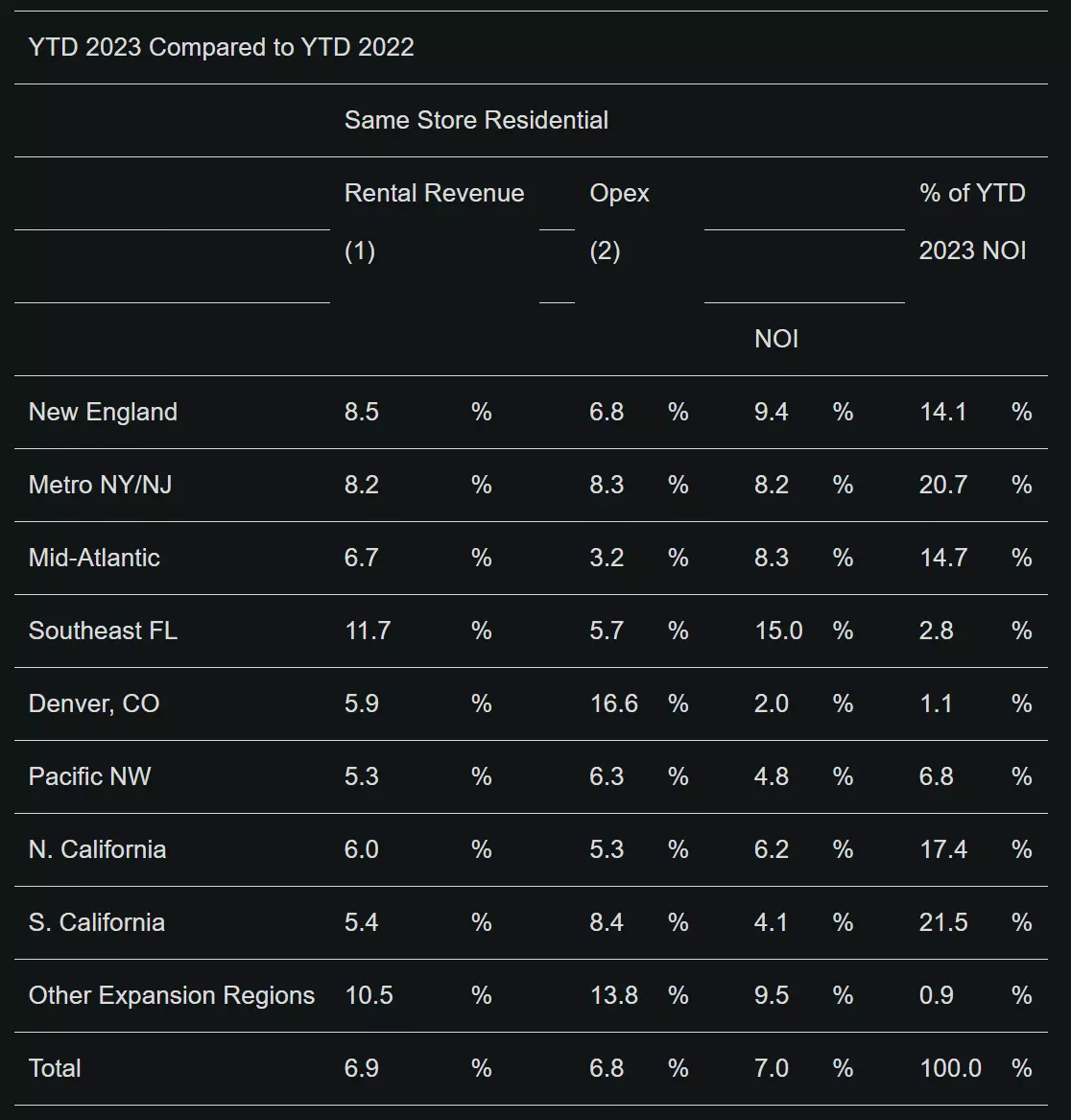

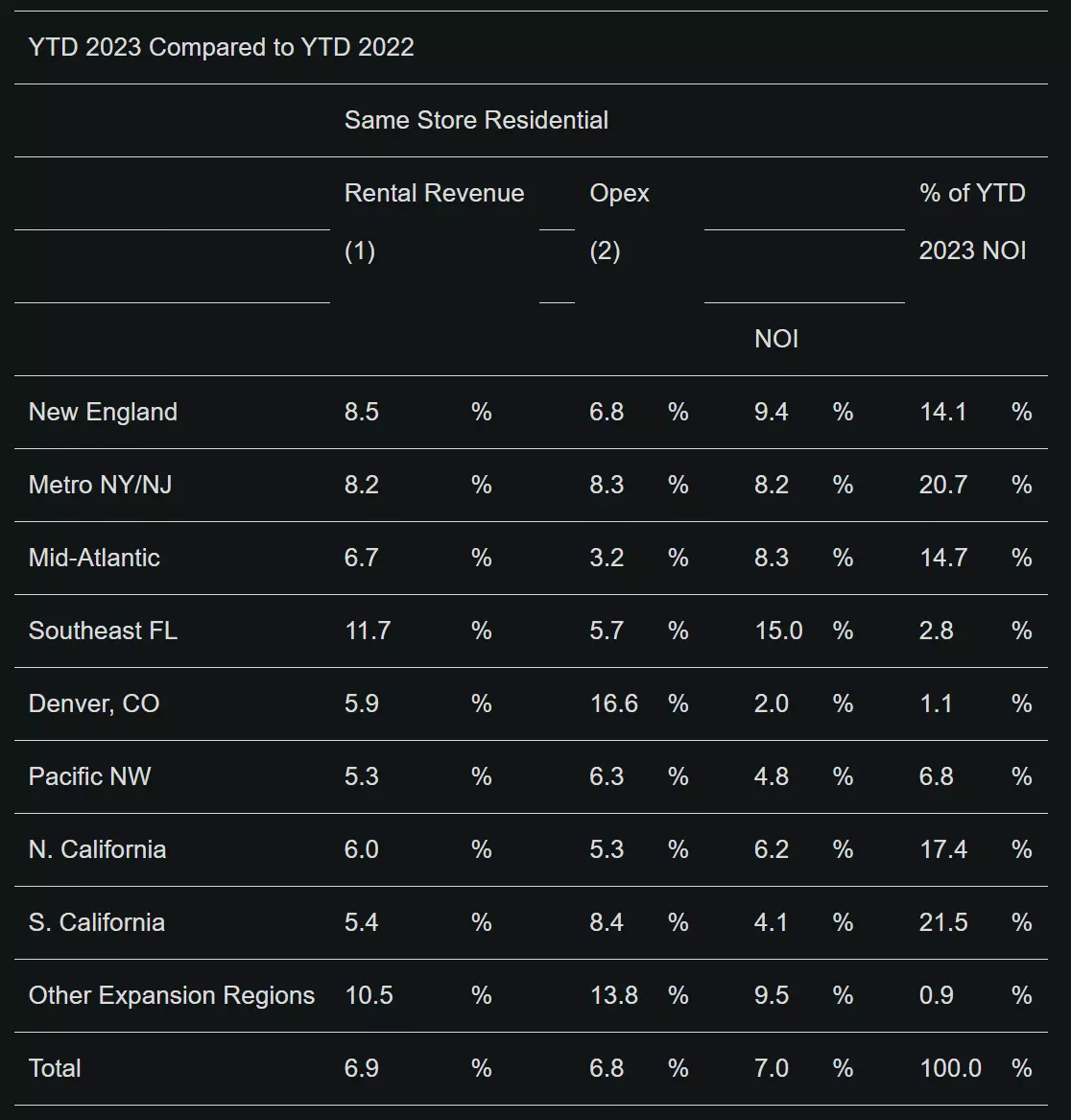

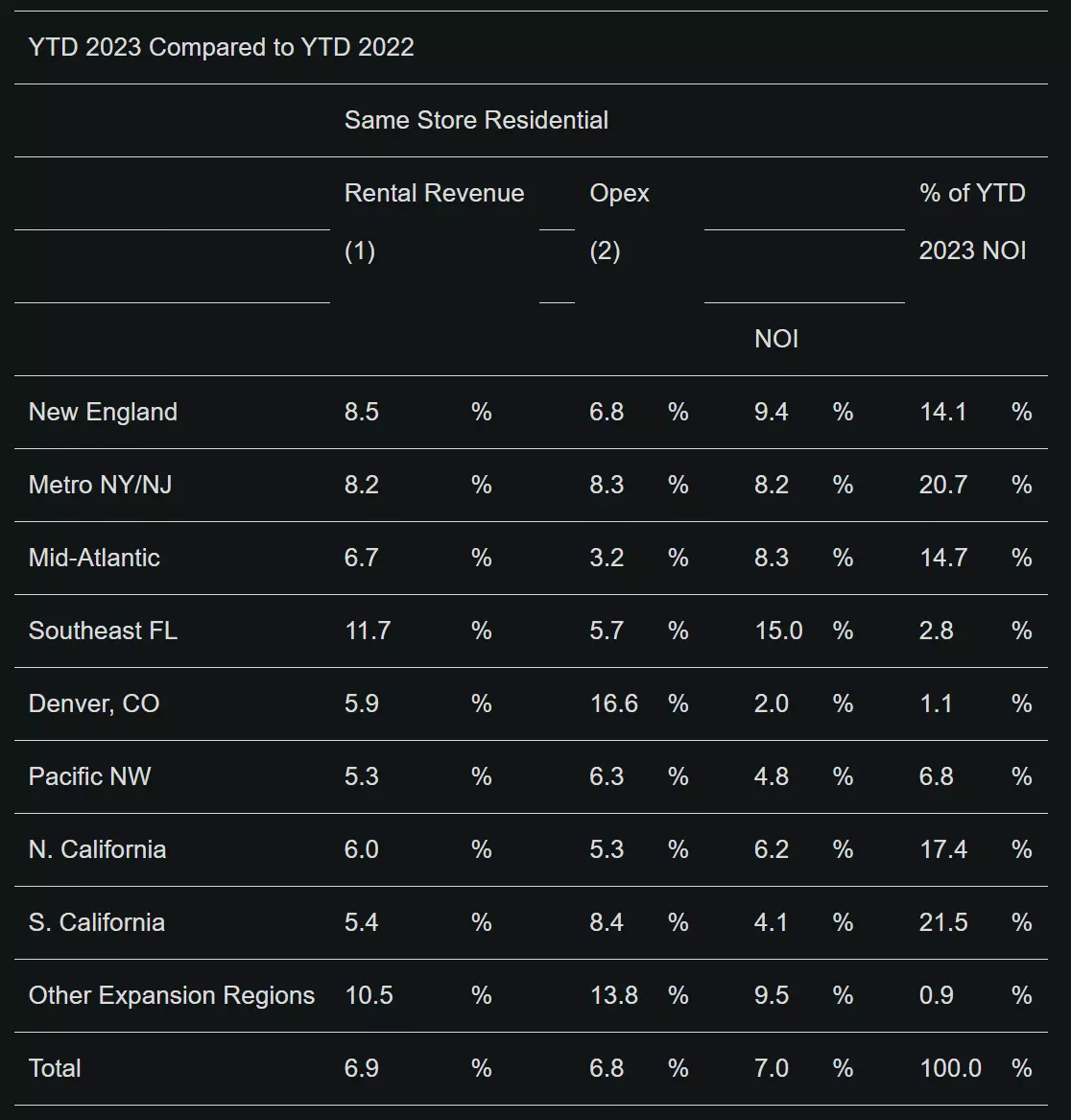

In addition to its market positioning, AVB has demonstrated strong growth in its Core FFO (Funds From Operations) per share, with a 6.4% year-over-year increase during the third quarter and a 9.7% growth for the first nine months of the year. This growth is attributed to healthy performance at the property level, as many regions experienced a rebound in demand. For example, cities like San Francisco, where AVB has a presence, have seen an increase in workers returning to the office, leading to favorable NOI (Net Operating Income) growth.

Image source: AVB Earnings Release

Image source: AVB Earnings Release

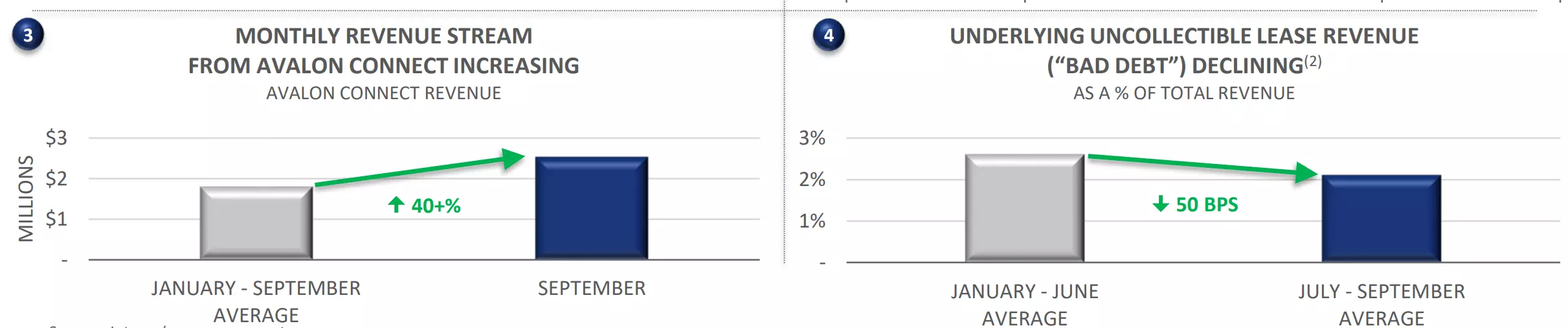

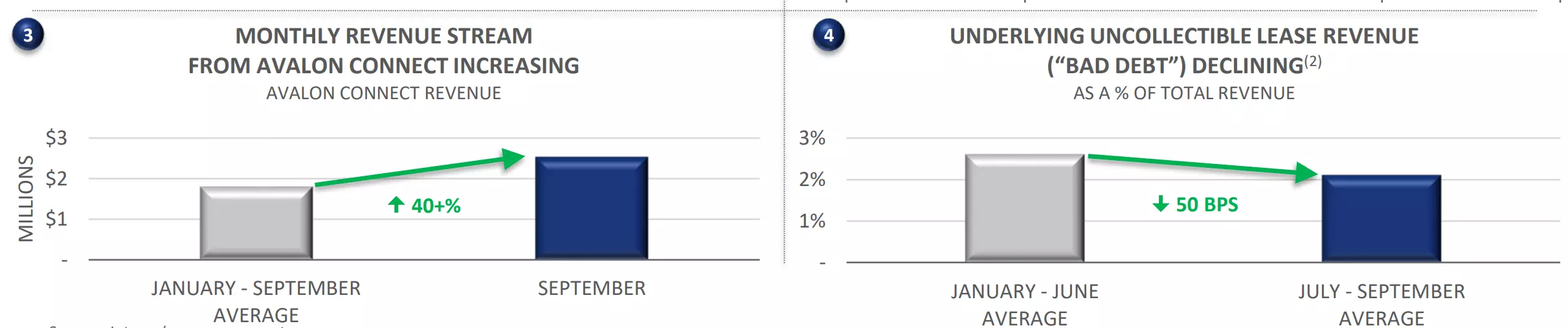

Looking ahead, AVB is well-positioned to sustain its revenue growth in 2024. Factors such as a strong labor market, low unemployment rates, and innovative offerings like AvalonConnect, which provides convenient services to residents, including WiFi and package delivery, contribute to the company's positive outlook.

Image source: Investor Presentation

Image source: Investor Presentation

AVB's commitment to external growth is evident by its projected 4,200 cumulative apartment unit deliveries by the end of this year. This expansion, coupled with attractive yields from its structured finance program, where AVB provides mezzanine loans to third-party apartment developers, ensures a diversified revenue stream for the company.

Image source: Investor Presentation

Image source: Investor Presentation

Moreover, AVB boasts one of the strongest balance sheets among REITs, with a low net debt-to-core EBITDAre ratio of 4.1x. With a high interest coverage ratio of 7.5 and the majority of its developments match-funded with debt, AVB maintains excellent financial stability. Additionally, the company has a long-standing track record of dividends, with uninterrupted payments for 29 years, including during the financial recession of 2008-2009 and the recent economic downturn in 2020.

While AVB's dividend yield may not be the highest in the market, it's important to consider its FFO yield. Based on the current share price of $183.71, AVB carries a 5.8% FFO yield, which is comparable to what private owners of real estate achieve from their rental properties. The advantage for AVB investors is the ability to reinvest retained capital to fuel future growth.

Of course, every investment carries risks. AVB's performance could be affected by economic downturns, increased competition from new supply, and potential losses related to its mezzanine lending program. However, when considering AVB's high-quality portfolio, low leverage, and analyst projections of 4% to 10% annual FFO/share growth, it remains an attractive choice for long-term investors.

Image source: FAST Graphs

Image source: FAST Graphs

For those seeking alternative options, Essex Property Trust, Camden Property Trust (CPT), and Equity Residential are worth considering. These companies also have strong multifamily portfolios in Tier 1 markets. However, AVB stands out with its higher valuation and superior EV/EBITDA ratio compared to its peers.

Image source: Seeking Alpha

Image source: Seeking Alpha

Investor Takeaway

In conclusion, AvalonBay Communities offers a better way to own real estate through its well-managed and strategically located properties. With its impressive growth, strong financial position, and reliable dividend history, AVB presents a compelling opportunity for long-term investors seeking a low-maintenance investment vehicle in the real estate market. Despite the current price, which represents a discount compared to its normal valuation, AVB remains an attractive choice for investors who value a high-quality portfolio and steady growth prospects. Therefore, I maintain a 'Buy' rating on AVB.