Investing in farmland real estate investment funds (REITs) can be a lucrative opportunity for those looking to diversify their investment portfolio. In this guide, we will explore the world of farmland REITs and highlight two leading companies in the industry. If you're ready to venture into this exciting investment domain, Interactive Brokers (IBKR) is a trusted platform to consider.

What are REITs?

REITs, or real estate investment trusts, provide individual investors with access to large-scale real estate portfolios without the need to directly purchase properties or handle property management. This unique investment vehicle allows investors to benefit from income generation, potential price appreciation, and diversification.

What are farm REITs?

Farm REITs are specialized REITs that acquire and manage agricultural land, generating revenue by leasing it to farmers. These REITs can include various assets such as annual row crops, permanent crops, and commodity crops like soybeans, cattle, wheat, corn, cotton, rice, and sugar. They may also hold water rights and farming-related infrastructure like cooling, processing, and packaging facilities. Some farm REITs even provide loans to farmers, secured by agricultural real estate.

Investing in farm REITs allows shareholders to gain exposure to the agricultural real estate market without the need to directly buy or manage farmland. This provides investors with a unique opportunity to benefit from the steady appreciation and rental income potential of agricultural land while diversifying their investment portfolios beyond traditional real estate assets.

Best farmland REITs to invest in

If you're considering investing in farmland REITs, here are two leading companies worth exploring:

1. Gladstone Land (LAND)

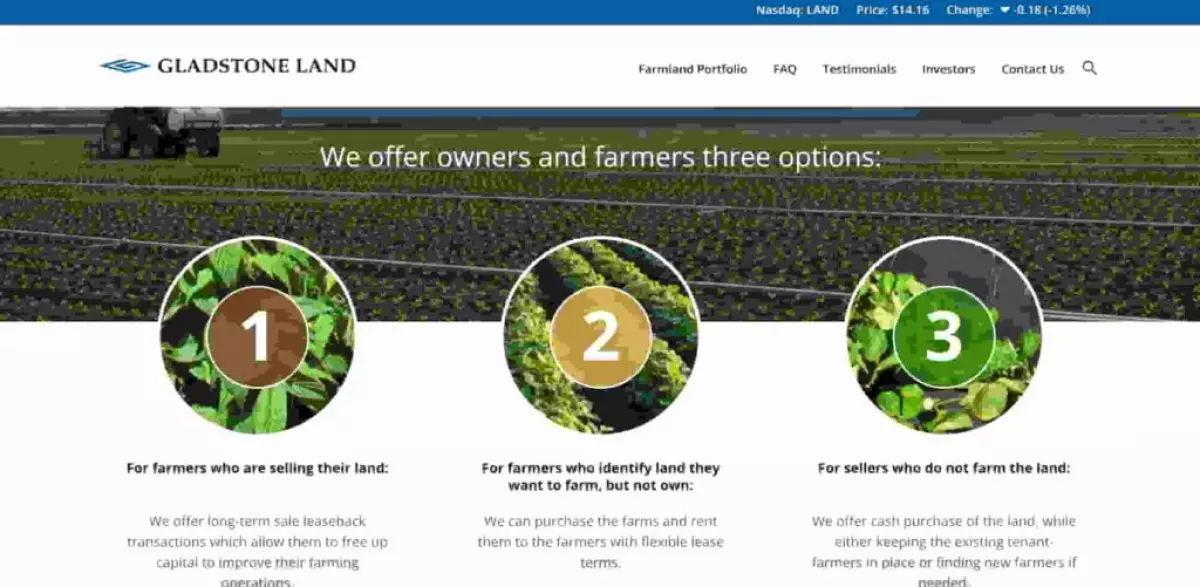

Image source: Gladstone Land

Image source: Gladstone Land

Gladstone Land is a publicly listed REIT that specializes in buying and owning farmland and farm-related properties in key U.S. agricultural regions. With a footprint in 15 states, including Arizona, California, and Texas, the company spans 169 farms across approximately 116,000 acres, boasting an estimated portfolio value of $1.6 billion.

The company focuses on farms suitable for cultivating fresh produce like berries and vegetables, as well as those that yield permanent crops such as almonds, apples, cherries, figs, lemons, olives, pistachios, and wine grapes. This strategic focus on fresh produce farms brings lower risk compared to commodity crops, with superior water accessibility, less reliance on governmental subsidies, lower storage expenses, and higher rental rates.

Gladstone Land is listed on the Nasdaq Exchange under the ticker LAND.

2. Farmland Partners (FPI)

Image source: Farmland Partners

Image source: Farmland Partners

Farmland Partners Inc. is a publicly traded REIT that specializes in acquiring, leasing, and managing farmland across North America. With a portfolio spanning 178,216 acres in 20 states and approximately 26 crop types, the company offers investors exposure to both commodity crops like corn, soybeans, wheat, rice, and cotton, as well as specialty crops like citrus and other fruits.

In addition to farmland ownership, Farmland Partners provides various services such as auctioning, brokerage, third-party farm and asset management, and revenue from solar and wind energy, recreational leasing, sales of crops, and crop insurance.

Farmland Partners shares trade on the New York Stock Exchange (NYSE) under the stock ticker FPI.

How to invest in farmland REITs: Step-by-step guide

Investing in farmland REITs is a straightforward process. Here's a concise guide on how to get started:

Step 1: Open a brokerage account

To trade farmland REITs, you'll need to open an online brokerage account. Interactive Brokers (IBKR) is highly recommended due to its extensive features and services, including commission-free stock trading, global stock trading on 90+ market centers, fractional shares, low financing rates, and no account minimum.

Step 2: Research farmland REITs

Before making any investment, it's important to research and understand the agricultural landscape. Familiarize yourself with major crop types, market dynamics, and trends in the farming industry. Once you have a solid understanding, delve into specific farmland REITs. Examine key financial metrics, portfolio composition, growth strategies, and historical performance.

Step 3: Place your order

Once you've chosen the farmland REIT to invest in, follow these steps to place your order:

- Access the trading or order section on your brokerage platform.

- Locate the REIT using its ticker symbol.

- Indicate the quantity of shares or monetary value you wish to invest.

- Select the order type (e.g., market order, limit order).

- Review all details and confirm your transaction.

Step 4: Monitor your investment

To effectively monitor your farmland REIT investment, follow these strategies:

- Check financial statements and reports to assess the company's performance and future strategies.

- Visit the REIT's official website for relevant updates and information.

- Familiarize yourself with key performance indicators for REITs.

- Stay updated with industry news and monitor market trends.

- Leverage your brokerage account's tools and resources.

- Engage with financial analysts' reports for market sentiment and future performance insights.

- Monitor dividend distributions and periodically assess your entire investment portfolio.

- Join online communities to gauge investor sentiment and learn from others' research.

Remember, investing requires careful consideration and should not be based solely on short-term market fluctuations. For well-informed decisions, consider seeking advice from a financial advisor.

Pros and cons of investing in farmland REITs

Investing in farmland REITs comes with its own set of advantages and disadvantages. Here are some points to consider:

-

Pros:

- Diversification beyond traditional real estate assets.

- Potential for steady appreciation and rental income.

- Access to the growing agricultural market.

-

Cons:

- Market uncertainties and risks associated with crop performance.

- Dependency on factors like weather conditions and government policies.

FAQs about investing in farmland REITs

Stay tuned for our FAQs section, where we will address common questions about investing in farmland REITs.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative, and your capital is at risk.