The investment landscape is constantly evolving, and 2022 was no exception. In this article, we will explore the top-performing and underperforming investment trusts of the year, providing insights into the trends and strategies that shaped their outcomes.

A Shift Towards Alternative Vehicles

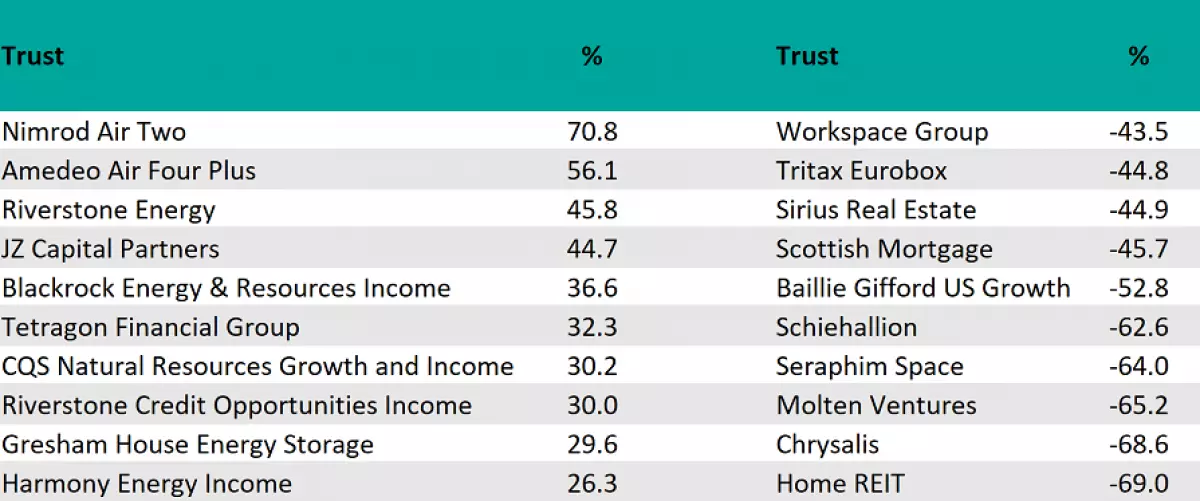

The list of top-performing investment trusts in 2022 was dominated by alternative vehicles, including energy and leasing strategies. These trusts showcased their resiliency and ability to capitalize on market opportunities.

One standout performer was Nimrod Air Two, a company that specializes in buying, leasing, and selling aircraft. Despite a challenging period during the pandemic, Nimrod Air Two experienced a strong recovery, resulting in a remarkable 70.8% gain for the year. The company's success can be attributed to a rebound from a low starting point and a significant narrowing of its discount.

Source: FE Analytics

Source: FE Analytics

Diversification within the Energy Sector

Energy-focused trusts also made a notable impact on the top-performing list, with four of the top ten positions being attributed to trusts in this sector. Riverstone Energy, for instance, secured third place with gains of 45.8%. This trust invests across all sectors of the global energy industry and has been progressively reorienting its portfolio towards renewable energy sources and related technologies. However, the high energy prices in 2022 worked in favor of its legacy energy investments, contributing to its success.

Challenges Faced by Property and Growth Trusts

On the flip side, property and growth trusts faced significant challenges in 2022. REITs (real investment trusts) particularly struggled due to several factors, including a re-pricing of assets, financial constraints on occupiers, and competition from bonds for income-seeking capital. As a result, discounts in the IT Property UK Residential and IT Property UK Logistics sectors reached approximately 40%.

Home REIT, which focuses on investing in social housing for homeless individuals, experienced the most significant decline, falling by 69% in 2022. The trust's trading was suspended after it failed to meet its annual financial report deadline. Home REIT faced allegations of buying property at inflated prices and concerns over the payment of rent by some tenants.

Insight into Baillie Gifford's Strategies

Baillie Gifford trusts, known for their focus on growth companies, encountered challenges in 2022. Scottish Mortgage, Baillie Gifford US Growth, and Schiehallion were among the worst performers. These trusts had previously excelled in a low-interest-rate environment, where future earnings played a significant role in their valuations. However, rising interest rates adversely affected their performance.

Similarly, Merian-run Chrysalis, which invests in later-stage private companies, experienced losses of 68.6% in 2022. The trust had performed well in previous years, but the market's shift away from growth stocks impacted its results.

Conclusion

The investment trust landscape in 2022 showcased the resilience and adaptability of alternative vehicle-focused trusts, particularly those in the energy and leasing sectors. While some trusts triumphed, others faced significant challenges due to changing market conditions. It is essential for investors to stay informed, analyze trends, and carefully consider their investment strategies in this ever-evolving financial landscape.

Remember, investing always carries risks, and it is crucial to consult with a financial advisor before making any investment decisions.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.