Image by Gary Yeowell

Image by Gary Yeowell

Dear readers,

Boston Properties (NYSE:BXP) has recently made a major announcement regarding the disposal of a significant stake in two of their prime life science developments. The company, known for its A-Class workspace in prominent cities such as Boston, New York, and San Francisco, continues to showcase its expertise in the real estate investment market.

In this article, we will delve into the details of this disposal deal, examine the impact it may have on Boston Properties' valuation, and shed light on the positive indicators for the company's future success.

Quality Matters

One of Boston Properties' distinguishing features is the high quality of its office portfolio. With a focus on A-Class space, the company ensures premier standards in 90% of its buildings, with an additional 5% undergoing redevelopment. This commitment to quality has proven advantageous, as top-grade space has consistently attracted and retained tenants at higher rates compared to lower-quality alternatives.

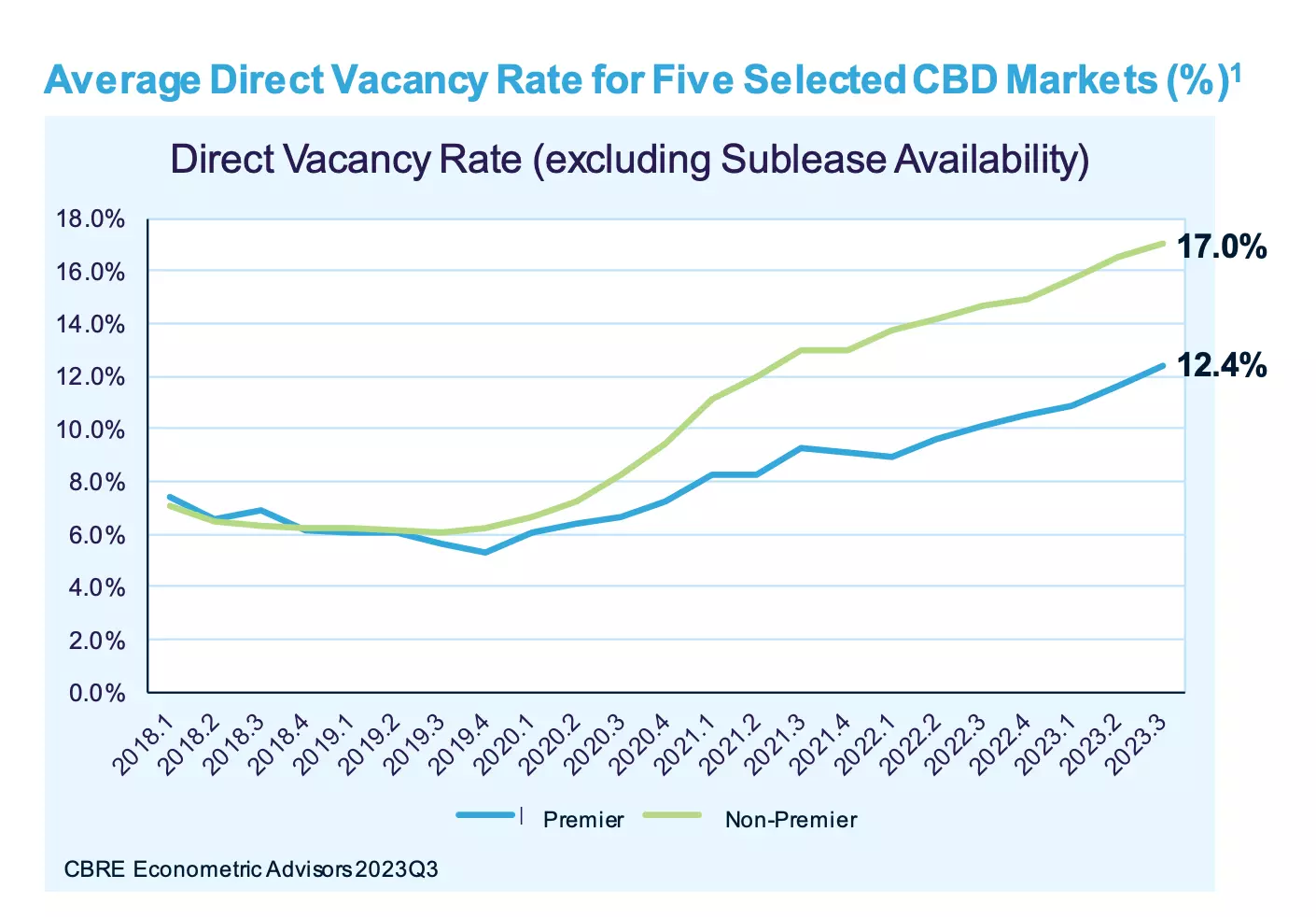

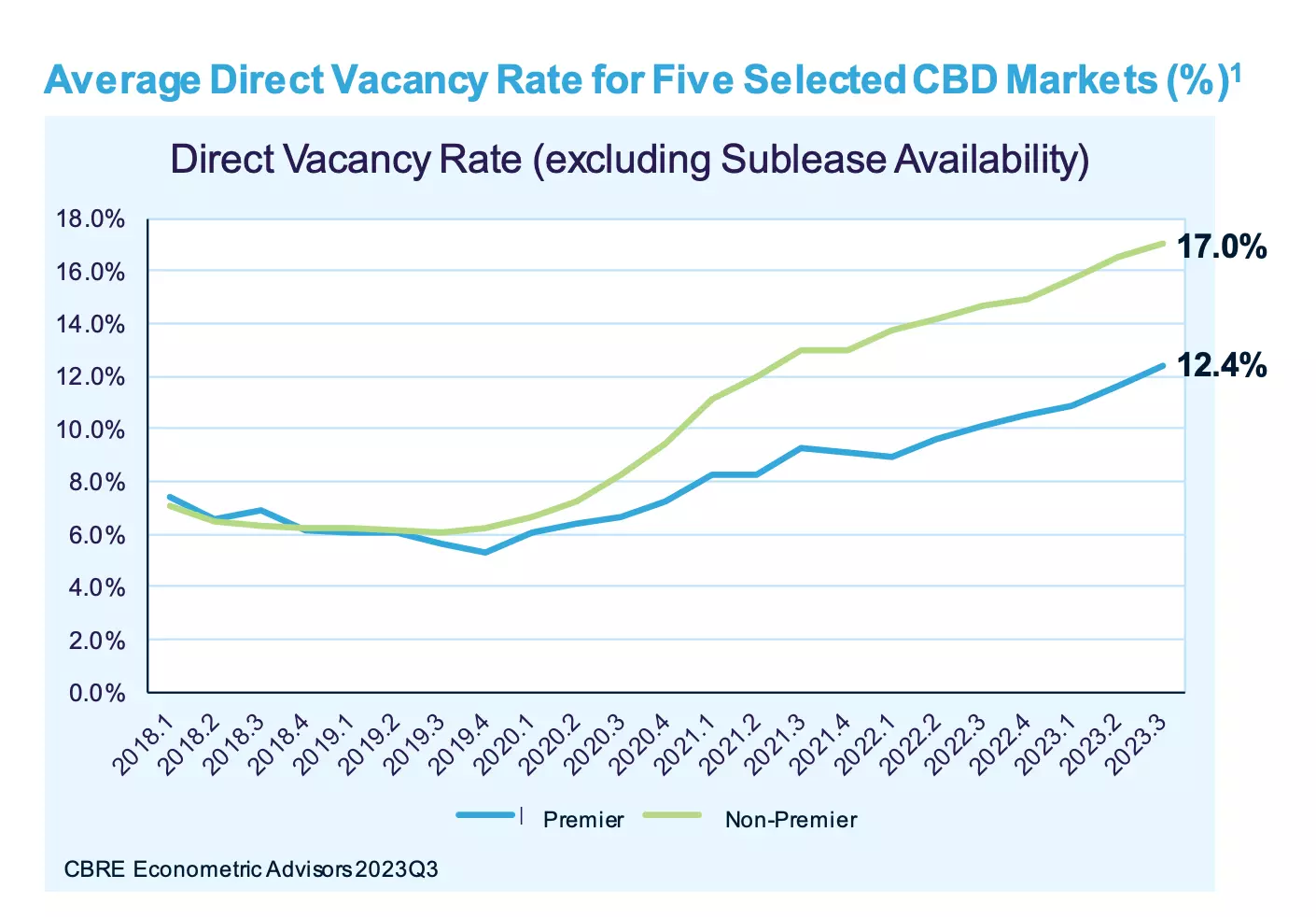

Recent data from a CBRE study confirms this trend, revealing that A-Class space within Boston Properties' market boasts significantly lower vacancy rates than lower-quality options. Additionally, premier space has experienced positive net absorption, while non-premier spaces have suffered negative absorption since the start of the pandemic. These indicators position Boston Properties' portfolio favorably in terms of tenant attraction and retention.

Image by CBRE

Image by CBRE

Capital Recycling Matters

Boston Properties' management has expressed intentions to play offense in the market, similar to their successful post-global financial crisis strategy. To prepare for this, the company has secured $4.1 billion in gross funding over the past year, resulting in $2.7 billion in liquidity. Active discussions with lenders and property owners looking to reduce their office exposure are ongoing, and Boston Properties aims to seize opportunities that align with their forward-thinking approach.

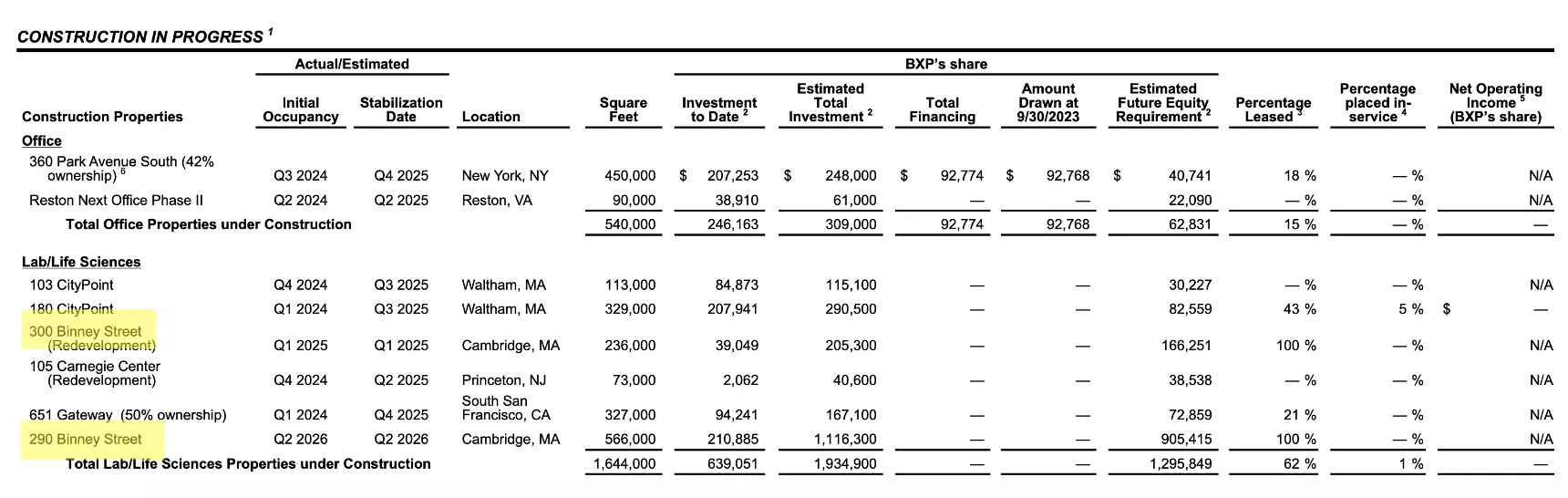

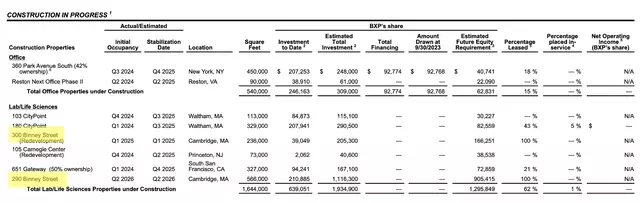

While recent acquisitions have been limited, with only one property acquired for $17 million in Q3, the company has recently announced a substantial disposal deal. Boston Properties has reached an agreement to sell a 45% stake in two of their prime life science developments in Cambridge, MA, to Norges Bank Investment Management. These properties, 290 Binney and 300 Binney, represent the pinnacle of Boston Properties' portfolio. The deal will provide Boston Properties with $213 million at closing, freeing up cash flow that can be used to pay off debt and pursue highly accretive acquisitions.

Image by BXP Presentation

Image by BXP Presentation

Leasing Matters

Boston Properties has achieved strong leasing results, leasing 1.1 million square feet of space in Q3, with an average lease term of 8.2 years. This level of leasing activity represents the highest recorded since Q4 2022. Rent spreads have also reached positive territory, reflecting a 4% quarter-on-quarter increase, driven by a remarkable 14% surge in Boston. As a result, occupancy levels have risen from 88.3% to 88.8% during the quarter.

Looking ahead, Boston Properties is well-positioned to maintain occupancy levels, with only 250,000 square feet of space remaining to be re-leased in the final quarter of this year. The company currently has nearly 1.2 million square feet of space under negotiation, making the re-leasing target highly achievable. Management expects flat occupancy levels in 2024, signaling stability and further potential for growth.

Image by BXP Presentation

Image by BXP Presentation

Valuation Matters

Investors can count on Boston Properties for a reliable dividend yield of 6.9%, which has remained stable over time and is not expected to be threatened due to the company's comfortable payout ratio of 53%. To assess the company's valuation, it is more meaningful to examine the spread to 10-year yields rather than the traditional P/FFO ratio, especially given the dynamic nature of interest rate expectations. Boston Properties currently trades at an implied cap rate of 8.2%, which is 370 basis points above 10-year Treasury yields.

In a conservative base case scenario, with a projected 4% 10-year yield by the end of 2025 and a slight contraction of the spread from 3.7% to 3.5%, Boston Properties exhibits a potential upside of 24% over two years, resulting in a price target of approximately $70 per share. When combined with the attractive 6.9% dividend yield, investors could potentially earn 15-20% per year, given favorable interest rate conditions.

Image by Author's calculations

Image by Author's calculations

In conclusion, Boston Properties continues to make strategic moves to enhance its position in the market. The recent disposal deal not only provides immediate cash flow benefits but also indicates ongoing investor interest in office space, particularly in the life science sector. The company's commitment to quality, strong leasing performance, and attractive valuation make it an appealing investment opportunity.

My BUY rating for Boston Properties remains intact, as I believe the company's forward-thinking approach and stable cash flow position make it an attractive choice for investors. As always, it's important to consider multiple scenarios and stay informed about market dynamics.