The surge in home prices during the pandemic has been nothing short of remarkable. Factors such as increased demand, rising building costs, and long-term supply constraints in the housing market have all contributed to record-breaking price increases. According to the Case-Shiller U.S. National Home Price index, home prices have risen by 18.6 percent over the past 12 months, marking the strongest year-long growth in history [^1^]. Other indices also show similar trends, indicating the widespread nature of this phenomenon.

Image Source: Sanaulac

Image Source: Sanaulac

Interestingly, while rental prices initially fell during the pandemic, they have since recovered and now surpass their pre-pandemic levels [^1^]. However, the impact of these rising housing costs on overall inflation has been limited thus far.

Our analysis suggests that these increased shelter prices are likely to have a more substantial influence on monthly inflation in the future. It is anticipated that they could add several more basis points (hundredths of a percentage point) to monthly inflation than they do currently [^1^]. This acceleration would essentially represent a return to the normal pre-pandemic contributions of housing prices to inflation. It's worth noting that these dynamics are already factored into inflation forecasts, including our own, which indicate a deceleration in overall price growth in the coming quarters.

The ongoing pandemic has introduced exceptional volatility and uncertainty into economic data. While historical relationships between housing prices and inflation may not hold true in these unprecedented times, it is crucial to understand the factors contributing to the rise in home prices.

What factors have contributed to rising home prices?

In terms of economic variables, both demand growth and supply constraints play a significant role in boosting home prices. Long-standing issues like local zoning restrictions and limited affordable housing have hindered housing supply in the U.S. for years [^1^]. The pandemic has exacerbated these problems, leading to a surge in the cost of construction materials. For example, lumber prices increased by 114 percent over the past 12 months, while iron and steel prices rose by 73 percent [^1^]. However, recent data suggests that some of the price pressures are starting to ease, as lumber prices declined by more than 20 percent between June and July [^1^].

On the demand side, the pandemic has caused a significant shift in housing preferences. Many people have opted to move away from densely populated city centers, leading to increased migration to suburbs and other less crowded areas. Additionally, historically low mortgage rates have made borrowing more affordable, further driving demand for new homes [^1^].

These combined factors have widened the gap between supply and demand. The seasonally-adjusted inventory of homes has declined by over 50 percent since February 2020, according to Redfin. The Census Bureau also reports a decline of 37 percent in the inventory of for-sale homes since the last quarter of 2019 [^1^].

What is the relationship between housing prices and CPI inflation?

Rising home prices not only impact household wealth and neighborhood affordability but also play a crucial role in overall inflation. The Consumer Price Index (CPI) measures the prices of various goods and services that households regularly consume. It includes a shelter component that accounts for rental costs, the consumption value of owner-occupied housing, and other forms of lodging [^1^].

Understanding how housing affects inflation requires understanding what the CPI tries to measure. The CPI is a cost-of-living index that aims to capture the price of goods and services consumed by households. It does not intend to measure the value of investment assets like stocks. However, with owner-occupied housing, measuring both its value as an investment and its value as a service (providing shelter) poses a unique challenge.

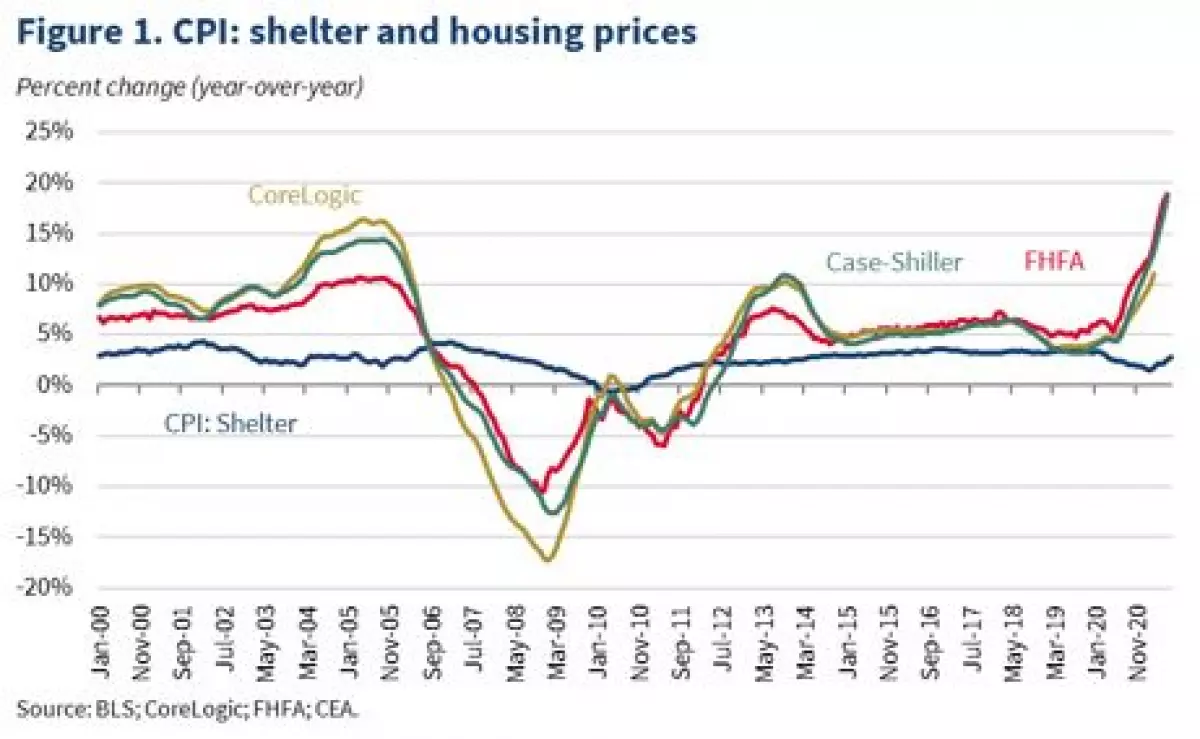

In the past, the CPI: Shelter was calculated based on housing prices, mortgage rates, property taxes, insurance, and maintenance costs. This approach captured both the asset investment and service flow aspects of housing expenditures. During this period, housing price movements were closely aligned with the CPI: Shelter [^1^]. However, in 1983, the methodology was changed to the "rental equivalent" approach. This new framework aimed to capture only the implicit value of services that homeowners receive from their homes, excluding the asset value of the house as an investment. The shift in methodology resulted in lower growth rates and reduced volatility in the CPI: Shelter [^1^].

As a consequence of these methodology changes, the relationship between housing prices and CPI: Shelter weakened in the mid- to late-1980s [^1^]. Despite this, a relationship between housing prices and CPI still exists, although it often shows up with a lag and is not a one-to-one correlation.

Recent behavior and expectations

Recent data shows that both CPI: Rent and CPI: Owners' Equivalent Rent (OER) have experienced accelerated growth from their pandemic lows [^1^]. Owners' equivalent rent has returned to pre-pandemic levels of growth, while CPI: Rent remains slightly below its pre-pandemic pace. Considering that CPI: Rent captures rents for both on-the-market and occupied homes, it tends to exhibit less volatility than measures of on-the-market asking rents [^1^].

There is a risk of further acceleration in the housing components of the CPI in the months ahead. Recent home price appreciation and the fact that rental and housing prices in the CPI are still below their pre-pandemic trend suggest a potential renormalization that could result in roughly 13 basis points added to core CPI inflation every month [^1^]. However, it's important to note that past relationships do not guarantee future dynamics, and the risks are two-sided. As input prices return to normal levels and pandemic-related demand dynamics fade, the pressure from housing inflation is expected to dissipate. Nevertheless, long-term structural issues with housing supply, which have been present even before the pandemic, may continue to pose challenges [^1^].

In conclusion, the surge in home prices during the pandemic has profound effects on household wealth, neighborhood affordability, and overall inflation. Understanding the relationship between housing prices and CPI inflation is essential for policymakers and economists. While historical analysis provides insights, the unprecedented nature of the current economic situation introduces uncertainties. Continuous monitoring of prices and their drivers will help provide a more accurate assessment in the months ahead.

[^1^]: Original content from "Housing Prices and Inflation" by Jared Bernstein, Ernie Tedeschi, and Sarah Robinson.