Are you in a situation where you've found your dream home or a promising investment opportunity, but you haven't sold your current property yet? Don't worry, there's a solution. Enter the bridge loan, also known as a "swing loan." It's a short-term financing option that bridges the gap between buying a new property and securing permanent financing. Let's delve deeper into how these loans work and explore their pros and cons.

How Does a Bridge Loan Work?

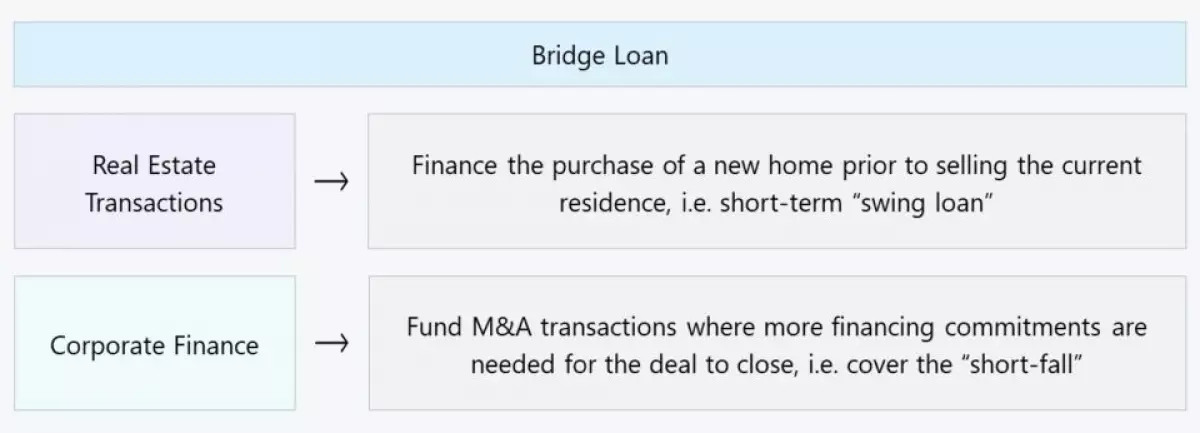

A bridge loan is a temporary financing option provided by a lender with the intention of retrieving the funds within six months to a year. These loans are most common in two sectors: real estate transactions and mergers and acquisitions (M&A).

In real estate, bridge loans can help finance the purchase of a new home before selling your current residence. This short-term funding ensures a smooth transition between the sale and purchase of properties.

Similarly, in M&A transactions, bridge loans serve as an interim financing option to bridge the gap when financing commitments are temporarily delayed. They provide companies the necessary funds to meet their total financing needs while awaiting long-term financing from the capital markets.

Bridge Mortgage Loan Example

Let's explore a typical scenario in real estate. Say you've found your dream home, but you need funds to purchase it before selling your current property. A bridge loan can come to the rescue. Here's how it usually works:

- The bridge loan is secured with your current home pledged as collateral, giving the lender assurance.

- The loan has a short-term lending term of six months to one year, ensuring you can replace it with permanent financing soon.

- Often, the same lender who provides the bridge loan also finances the new mortgage, streamlining the process.

- The borrowing ceiling is usually around 80% of your original home's value, giving you substantial financing.

By availing a bridge loan, you get the opportunity to purchase your dream home without the stress of selling your current property first.

Pros and Cons of Bridge Loans

As with any financial decision, there are advantages and disadvantages to consider. Let's explore them briefly:

Bridge Loan Advantages

- Quick and convenient source of financing.

- Increased flexibility, allowing you to bypass hurdles caused by delays in other parties involved in the transaction.

- Removes contingencies and uncertainties, increasing the probability of a successful deal.

- Can directly result in a successful deal, as it improves the chances of closure.

Bridge Loan Disadvantages

- Often comes with expensive fees, including upfront charges and higher interest rates.

- There's a risk of losing collateral, which may lead to default or property foreclosure.

- Origination fees, sometimes referred to as "commitment fees," can add to the cost.

- Short-term financing may have penalties such as funding fees and drawn fees to incentivize timely repayment.

- Approval for a bridge loan requires a strong credit history and stable financial performance.

Considering these pros and cons will help you make an informed decision regarding bridge loans.

The Function of Bridge Loans in M&A

In M&A transactions, bridge loans play a crucial role. They serve as an interim financing option used by companies to meet their immediate financial needs. Similar to their role in real estate, bridge loans in M&A are arranged with the aim of replacing them with long-term financing from the capital markets.

Investment banks, especially those with a balance sheet, often provide bridge loans in time-sensitive transactions where financing is needed promptly. Their involvement reduces uncertainty and ensures the deal can proceed smoothly. Additionally, venture capital firms or specialty lenders may contribute funding in the form of debt or equity.

Interest Rates on Bridge Loans

Interest rates on bridge loans are not standardized. They are determined based on the borrower's credit rating and default risk. Generally, bridge loan interest rates are higher than ordinary rates. Lenders may also incorporate an "interest rate step-up" provision, where the interest rate increases periodically throughout the term of the loan. This is because the primary purpose of these loans is to facilitate the closing of transactions, not to generate high returns.

Remember, bridge loans are not meant to be a long-term source of capital. Corporate banks prefer not to have outstanding bridge loans for extended periods. Conditional provisions are included to encourage clients to replace these loans as soon as possible.

So, if you find yourself in a situation where you need temporary financing to secure your dream property or facilitate an M&A deal, consider the benefits and drawbacks of bridge loans. They can be the bridge that leads you to your desired destination.