Investing in real estate is a lucrative way to potentially earn income and grow your wealth. But how do you navigate the world of buying an investment property? In this guide, we'll cover everything you need to know, from understanding what an investment property is to the pros and cons of investing in real estate. So let's dive in!

What Is an Investment Property?

An investment property is a piece of real estate that is purchased with the intention of generating income. This income can come from rental payments or the appreciation of the property over time. Unlike a primary residence, which is purchased for personal living, an investment property is solely focused on financial gain.

Image Source: Sanaulac.vn

Image Source: Sanaulac.vn

You can choose to buy an investment property for rental purposes, where you become a landlord or hire property management. Alternatively, you can invest in a property to earn money through appreciation or by increasing its value through renovations.

Why Buy an Investment Property?

There are several reasons why investors consider buying an investment property. Firstly, real estate has the potential to appreciate significantly over time. For example, between March 2012 and March 2022, the Case-Shiller U.S. National Home Price Index rose by nearly 115%.

Investing in property also offers a reliable source of cash flow, making it an attractive investment for those seeking steady income. Additionally, diversifying your investment portfolio with real estate can help mitigate risk and create a well-rounded investment strategy.

Pros and Cons of Buying an Investment Property

As with any investment, buying an investment property has both pros and cons that you should consider before making a decision.

Pros of Buying an Investment Property

Image Source: Sanaulac.vn

Image Source: Sanaulac.vn

- Value Tends to Increase: Real estate has a history of appreciating in value over time, allowing you to potentially earn money even without renting the property.

- Appreciation: Besides rental income, you can earn money through appreciation, which is the increased value of the property. However, it's important to note that appreciation rates can vary.

- Ongoing Income: Investing in an income-generating property provides a steady monthly income, which can be included in your budget for better financial planning.

- Tax Advantages: Real estate investments offer tax deductions and benefits like deducting mortgage interest payments and operating costs.

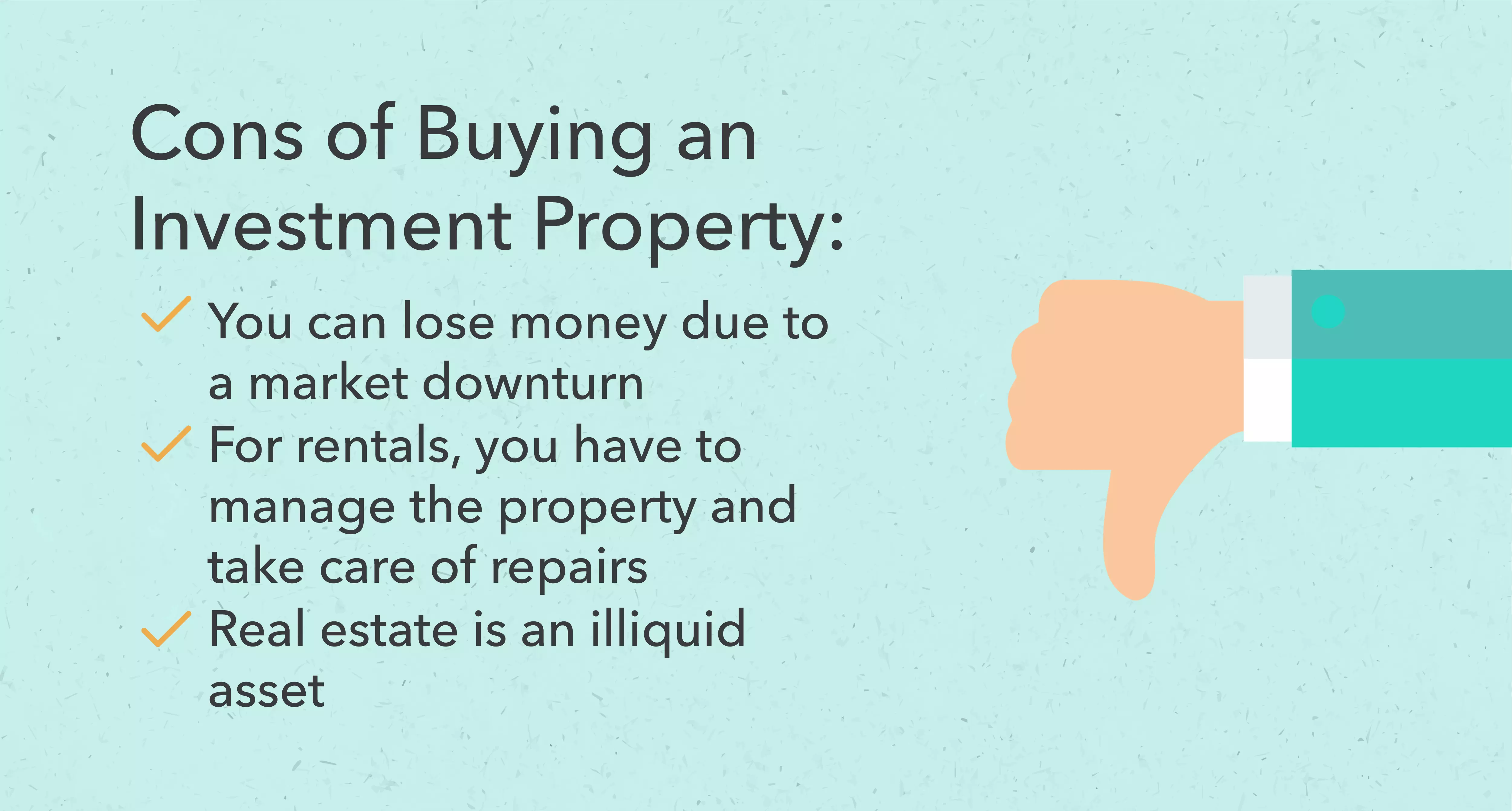

Cons of Buying an Investment Property

Image Source: Sanaulac.vn

Image Source: Sanaulac.vn

- Housing Market Crashes: Real estate investing can be volatile, and there's no guarantee that your investment property will increase in value.

- Property Management: If you choose to become a landlord, managing the property can be time-consuming and require additional expenses for repairs and tenant management.

- Liquidity: Real estate is considered an illiquid asset, meaning it can't be quickly converted to cash when needed, which may limit your financial flexibility.

How to Buy an Investment Property

If you're ready to dive into real estate investing, here are some steps to follow:

- Choose an Investment Strategy: Decide on a strategy, such as flipping properties for a quick profit, investing in long-term rentals for consistent cash flow, or purchasing vacation rentals.

- Find an Ideal Location: Research real estate trends and pick a location with projected value appreciation and potential for higher rental income.

- Get Pre-Approved: Before searching for properties, get pre-approved by a lender to determine your budget and improve your chances of securing a loan with favorable terms.

Image Source: Sanaulac.vn

Image Source: Sanaulac.vn

Remember that real estate investing is a long-term commitment, and it's crucial to consider factors like your financial situation and investment goals before making a purchase.

Final Notes

Investing in an investment property can be a rewarding addition to your investment portfolio. However, the decision ultimately depends on your priorities, finances, and investment objectives.

For more assistance with your investments and financial tracking, tools like Mint can provide valuable insights and help you stay on top of your finances. Remember to seek professional advice for personalized guidance related to taxes, legal matters, and investment strategies.

This article is for informational purposes only and should not be construed as legal, investment, credit repair, debt management, or tax advice. Third-party links provided are for convenience only, and Intuit does not endorse or guarantee the accuracy, legality, or content on these sites.