The Case-Shiller Home Price Indices have become an essential tool to analyze housing market trends in the United States. With various indices available, including a national home price index, composite indices, and individual metro area indices, these indices provide valuable insights into the real estate market.

A Brief History and Methodology

The Case-Shiller indices were developed by economists Karl Case, Robert Shiller, and Allan Weiss. Their approach focuses on repeat sales of single-family homes, comparing the prices of the same properties over time. This method allows for a comprehensive study of home pricing trends.

Economists Case and Shiller, along with Weiss, founded Case Shiller Weiss in 1991. The company aimed to produce and sell home price index information to the market. In 2002, the FinTech company Fiserv acquired Case Shiller Weiss and collaborated with Standard & Poor's to develop tradable indices based on the data. CoreLogic later acquired the Case Shiller Weiss business in 2013.

Understanding Economic Implications

Shiller's analysis of long-term home prices in his book "Irrational Exuberance" challenges the notion of a continuous uptrend in home prices in the US. He argues that home prices have a strong tendency to return to their 1890 levels in real terms. Shiller also highlights the psychological factors that contribute to the perception of continuously increasing prices.

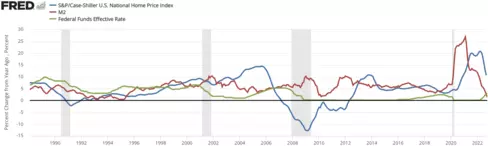

Contrary to popular belief, changes in home prices do not correlate with changes in construction costs, interest rates, or population growth. Shiller also suggests that factors like mobility, easing land restrictions, and technological improvements play a role in shaping real home prices.

Key Events and Episodes

Throughout history, there have been notable episodes where home prices deviated from the long-term trend. These episodes include periods of significant decline, such as during World War I, the Great Depression, and World War II. There were also periods of consistent growth, influenced by factors like post-World War II policies and regional economic bubbles.

Analyzing the Indices

The S&P CoreLogic Case-Shiller U.S. National Home Price Index provides a comprehensive overview of home prices in the United States. It consists of single-family home price indices from nine U.S. Census divisions. The index is calculated monthly using a three-month moving average.

Additional indices cover specific metropolitan areas, including composite indices and city-specific indices. These indices offer localized insights into housing market trends. They are also calculated using a three-month moving average and normalized to a value of 100 in January 2000.

Correlations and Securities

The Case-Shiller indices show a slightly negative correlation with stocks and bonds but a slight positive correlation with commodities and Real Estate Investment Trusts (REITs). However, it's important to note that REITs primarily track commercial real estate, which explains the low correlation.

It is also worth mentioning that Case-Shiller indexes are available for trading as futures and options. However, the trading volume in these markets is relatively low, posing a potential risk for investors due to illiquidity.

Exploring Historical Values

The Case-Shiller index values have experienced fluctuations throughout history. The national index reached its all-time high in 2006 Q1, with a value of 198.01. It then experienced a significant drop in December 2008. Since World War II, the index has generally fluctuated between 100 and 120.

Conclusion

The Case-Shiller indices provide invaluable insights into the housing market, enabling experts to analyze long-term trends and make informed predictions. By studying these indices, we can better understand the complex dynamics of the real estate market and its implications for investors and homeowners alike.

For more information on the Case-Shiller indices, visit the S&P/Case-Shiller Home Price Indices website or explore the data available on Robert Shiller's online data website.

Note: This article is based on the original source content and has been reimagined to provide a fresh perspective on the topic.