Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the PropTech industry. This time, you get to explore five hand-picked startups that are revolutionizing the property aggregation space.

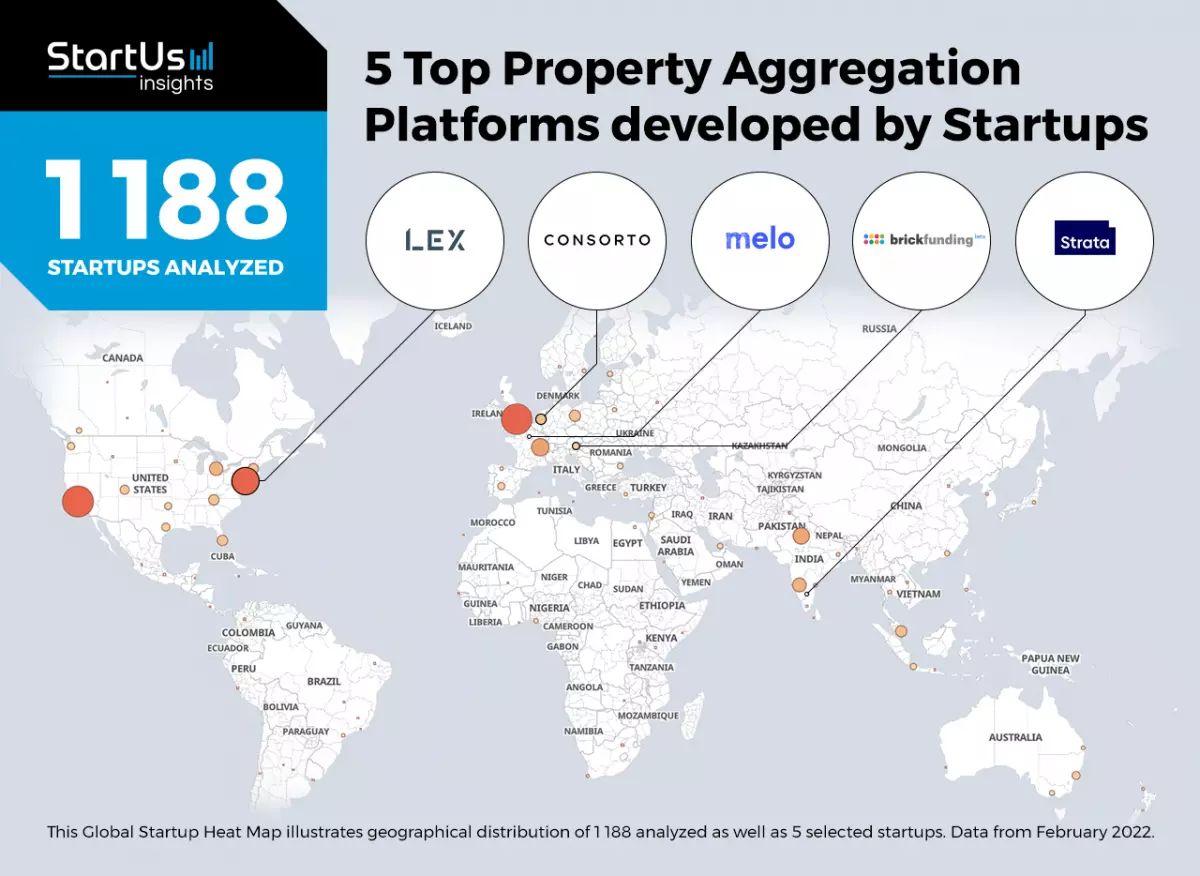

Out of 1,188, the Global Startup Heat Map highlights 5 Top Property Aggregation Platforms

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering over 2 million startups and scaleups globally. With just a few clicks, this platform provides an exhaustive overview of emerging technologies and relevant startups within a specific field.

The Global Startup Heat Map below reveals the distribution of the 1,188 exemplary startups and scaleups we analyzed for this research. These startups offer innovative solutions that cater to various property aggregation needs. Let's take a closer look at each of them.

Image Source: Property-aggregation-platforms-Heat-Map-StartUs-Insights

Image Source: Property-aggregation-platforms-Heat-Map-StartUs-Insights

Strata enables Fractional Real Estate Investments

- Founding Year: 2019

- Location: Bangalore, India

- Funding: USD 20 Million

- Partner For: Commercial Real Estate Investments

Indian startup Strata makes commercial real estate more accessible. By leveraging data analytics, Strata identifies properties with high potential returns. It then offers multiple investors the opportunity to invest in these high-yielding properties with a minimum threshold for investment. All investor data and capital are secured using advanced encryption technology. Strata is effectively liberalizing the commercial real estate market for investors with varying degrees of access to capital.

Consorto offers Real Estate Analytics

- Founding Year: 2018

- Location: Amsterdam, Netherlands

- Funding: USD 550,000

- Partner For: Commercial Real Estate Analytics

Consorto, a Dutch startup, is revolutionizing real estate analytics. Their platform allows investors to explore suitable commercial real estate assets based on personalized search criteria. With an automated deal flow mechanism and a smart dashboard, investors can efficiently manage multiple ongoing deals and make requests when needed. Consorto empowers investors with the necessary tools to make informed real estate investment decisions.

Brickfunding identifies Real Estate Crowdfunding Projects

- Founding Year: 2016

- Location: Destrnik, Slovenia

- Funding: USD 200,000

- Partner For: Crowdfunding Real Estate Projects

Slovenian startup Brickfunding brings together multiple real estate crowdfunding projects onto a single platform. Their search engine allows customers to explore crowdfunding projects with investment features in the pipeline. Brickfunding enables global investors to track international markets and discover suitable real estate investment opportunities. By democratizing access to crowdfunding, Brickfunding is transforming the way people invest in real estate projects.

Melo.io provides a Real Estate Search Engine

- Founding Year: 2020

- Location: Paris, France

- Partner For: Accessing Real Estate Listings Data

French startup Melo.io is simplifying access to real estate data. Their proprietary search engine application programming interface (API) allows businesses, such as insurance companies and real estate agencies, to easily access information from over 900 sources. Melo.io's API serves various use cases, including creating property listing platforms. By streamlining the process of gathering real estate data, Melo.io is driving efficiency and innovation in the industry.

LEX enables Real Estate Stock Trading

- Founding Year: 2017

- Location: New York, USA

- Funding: USD 12.6 Million

- Partner For: Real Estate Securities Investing

LEX, a US-based startup, offers a securities marketplace for real estate stock trading. Accredited and non-accredited investors can buy and sell shares of individual commercial real estate assets, starting from as low as USD 250. Powered by NASDAQ, LEX's trading platform is robust and offers low latency with fast performance. LEX provides property owners with the opportunity to unlock equity from their properties while retaining operational control.

Discover more Property Tech Startups

Startups like the ones highlighted in this report focus on property management, real estate tokenization, and immersive technologies. While these technologies play a significant role in advancing PropTech, they are just the tip of the iceberg. If you want to explore PropTech technologies in more detail or gain a general overview, download one of our free Industry Innovation Reports. Stay ahead of the curve and make informed strategic decisions.

Are you ready to revolutionize the property aggregation space? Let these startups guide you on your PropTech journey.