Recent data from the USDA indicates a rise in cash rents and farmland prices in 2023. However, there are predictions that downward pressures could soon be exerted on farmland prices due to declining farmland returns and stable interest rates. Despite this, historical trends do not suggest any significant declines in farmland prices in the near future.

Farmland Price Determinants

Two key factors drive farmland prices:

-

Farmland returns, typically represented as cash rents per acre. Higher returns lead to an increase in farmland prices. It is common for farmland prices to rise during periods of rising cash rents.

-

Interest rates. When interest rates increase, farmland prices often experience a downward trend, and vice versa.

2023 Illinois Cash Rents and Farmland Prices

The USDA recently released data on cash rents and farmland prices for major states in the US, including Illinois. In 2023, the average cash rent in Illinois was $259 per acre, a 6.6% increase from $243 per acre in 2022. Over the years, average cash rents have been steadily rising: $222 per acre in 2020, $227 in 2021, $243 in 2022, and $259 in 2023. The increase in cash rents by 16% from 2020 to 2023 can be attributed to strong returns on farmland.

Farmland Image Caption: Farmland prices and cash rents in Illinois have been on the rise over the years.

Farmland Image Caption: Farmland prices and cash rents in Illinois have been on the rise over the years.

Similarly, farmland prices in Illinois rose to $9,300 per acre in 2023, a 4.5% increase from $8,900 per acre in 2022. Since 2020, farmland prices have experienced a consistent upward trend: $7,300 per acre in 2020, $7,900 in 2021, $8,900 in 2022, and $9,300 in 2023. The strong returns on farmland have played a significant role in driving this price growth.

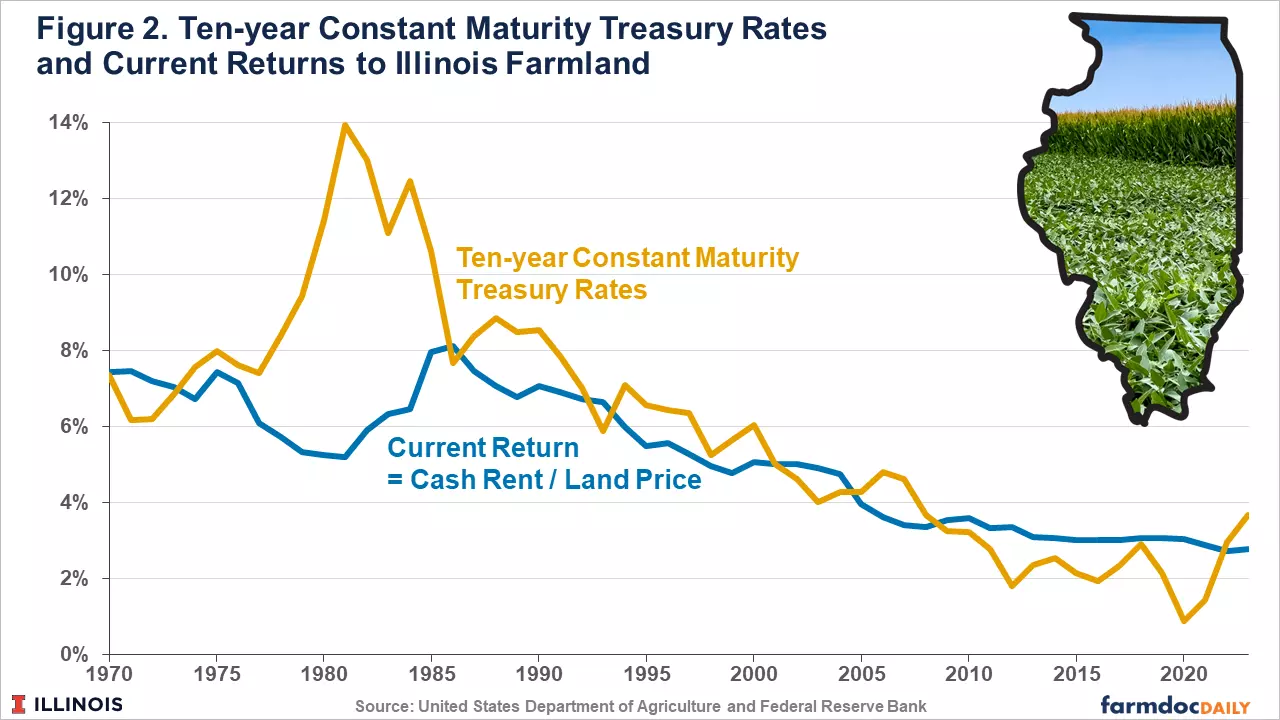

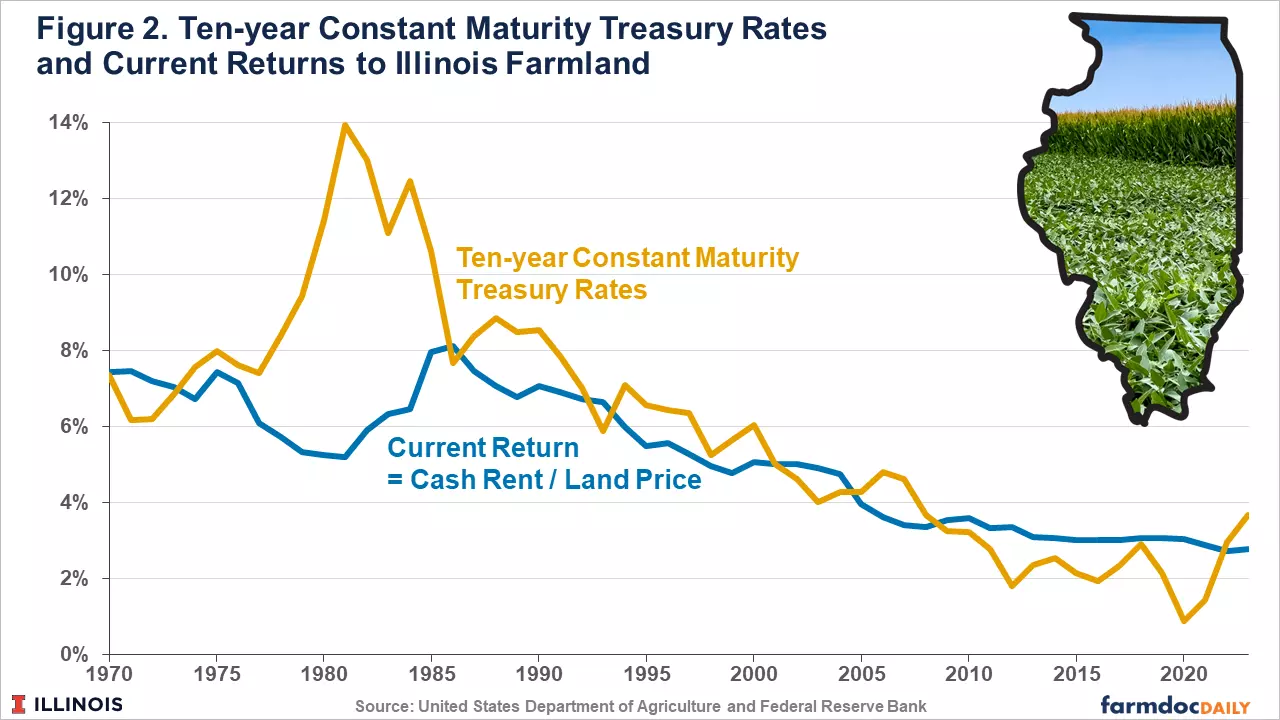

The current return on farmland is often measured by the cash rent divided by land value. It represents the interest payment on a debt instrument. However, it does not include gains on the value of farmland, which have historically contributed to the total return on farmland over time. The current return and interest rates are typically correlated.

Interest Rates and Current Returns to Farmland

The Federal Reserve Bank (FED) has implemented measures to increase interest rates in order to combat inflation. As a result, interest rates, including the Ten-year Constant Maturity Treasury (CMT) rate, have risen. The Ten-year CMT rate averaged 0.89% in 2020, a year marked by the COVID pandemic and various fiscal and monetary policies. Since then, the 10-year CMT rate has increased to 1.45% in 2021 and 2.95% in 2022. In 2023, the rate has averaged 3.67%.

Interest Rates Image Caption: Interest rates have been on the rise, potentially impacting farmland prices.

Interest Rates Image Caption: Interest rates have been on the rise, potentially impacting farmland prices.

During the late 1970s and early 1980s, the Ten-year CMT rate surpassed the current return. This coincided with a period of increased interest rates by the FED to combat inflation. Farmland prices declined in the mid-1980s, aligning the current return and the 10-year CMT rate. Since then, the ten-year CMT and current return have closely tracked each other.

From the mid-1980s to 2020, interest rates showed a general downward trend. This decline in interest rates exerted upward pressure on farmland prices. It could be argued that falling interest rates were just as influential as increasing rents in the upward trajectory of farmland prices since the mid-1980s.

Outlook

The current CMT rate for 2023 is 3.67%, higher than the current return of 2.78% ($259 cash rent / $9,300 land price). However, the difference between the Ten-year CMT and the current return is not significant. It is comparable to the differences observed between 1994-2000 and 2005-2008. Therefore, the current return and interest rates do not indicate any significant declines in farmland prices.

In the future, downward pressures on farmland prices are likely to emerge due to two main reasons:

-

Farmland returns are expected to be lower than the levels seen in 2021 and 2022, resulting in downward pressures on cash rents.

-

Interest rates are expected to remain in the range of 3 to 3.5%. While the FED may reduce interest rates in response to easing inflation, extremely low-interest rates should not be anticipated.

If the cash rent remains at $259 per acre, a farmland price of $8,633 per acre would result in a 3% current return, which is a likely range for the ten-year CMT rate in the coming years. An $8,633 price is below the current level of $9,300, indicating that current market dynamics would put downward pressure on prices. However, it may take a year or two for such downward pressures to translate into lower farmland prices.

Summary

Both cash rents and farmland prices have shown an upward trend over the years. However, declining returns and stable interest rates suggest that downward pressures may be exerted on farmland prices. While these pressures may materialize, any price declines are expected to occur in the future, rather than in the immediate term.