Image by ryasick

Image by ryasick

Apartment REITs have faced challenges over the past year, with the sector performing poorly in 2023 despite previous years of growth. However, amidst this challenging environment, there lies an opportunity that shouldn't be overlooked. Enter Equity Residential (NYSE:EQR), a company that remains an appealing choice for investors seeking durable income and potentially strong returns.

Why Choose EQR?

Equity Residential is one of the largest multifamily REITs in the market today, alongside its peers AvalonBay Communities (AVB) and Essex Property Trust (ESS). With a focus on prime markets, EQR owns 305 properties in Tier 1 cities such as New York, Boston, Washington D.C., Seattle, and San Francisco. This strategic market positioning provides a solid foundation for future growth.

EQR was founded by the renowned real estate investor, Sam Zell, bringing with it a legacy of value creation and expertise in real estate cycles. Sam's perfect timing in selling Equity Office in 2007, just before the real estate crash, showcases his ability to navigate the market successfully.

EQR Stock (Seeking Alpha)

EQR Stock (Seeking Alpha)

Over the past 10 years, EQR has consistently outperformed the Vanguard Real Estate ETF (VNQ). While the apartment REIT sector has faced challenges recently, EQR's track record suggests that it has the potential for strong future performance.

Navigating Current Headwinds

EQR has experienced slower growth in same-store net operating income (NOI) due to a variety of factors, such as a slowdown in population migration and increased rental supply pressure. However, recent data from RealPage indicates strong demand during the fourth quarter of 2023, suggesting a potential recovery.

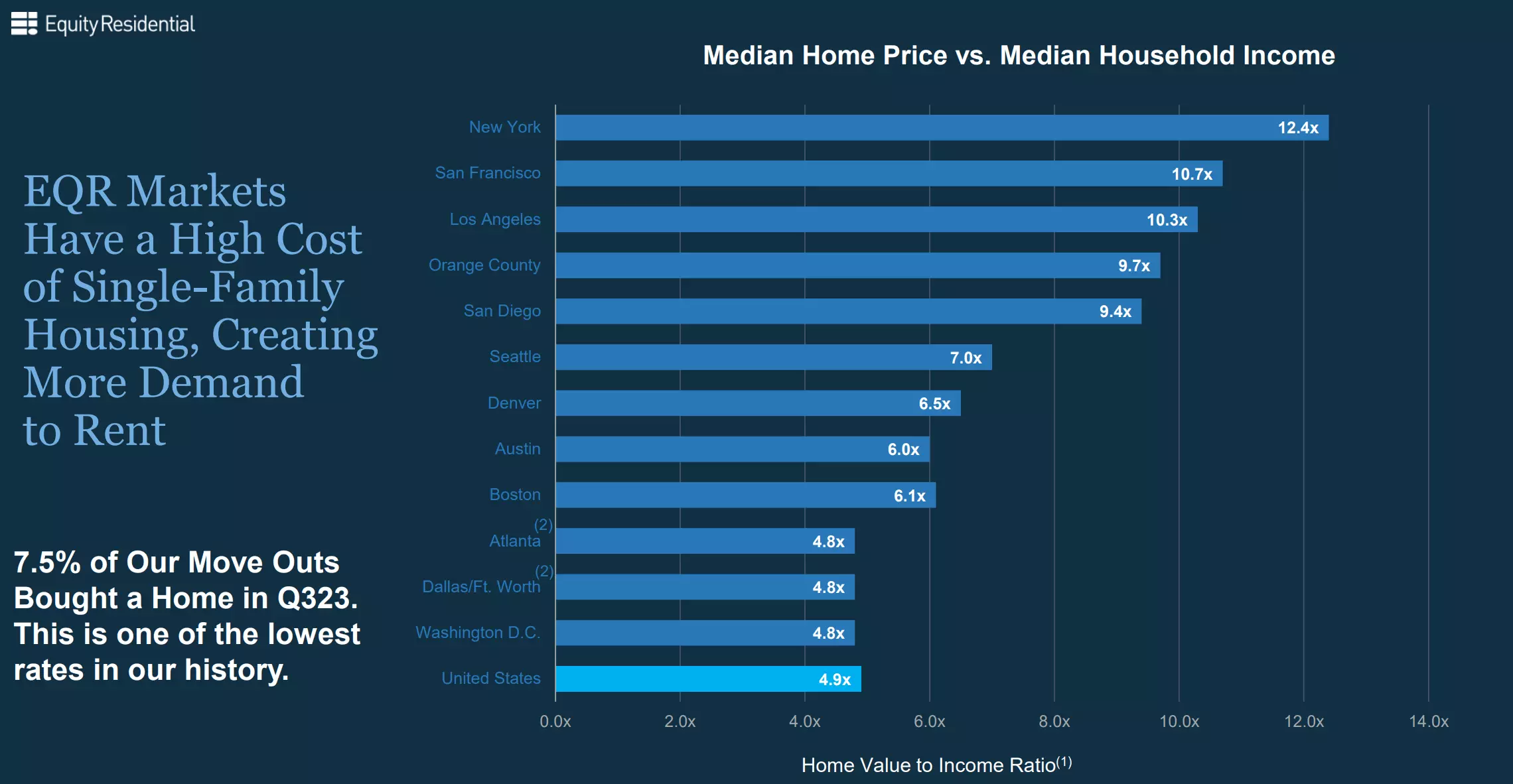

The company's markets benefit from low unemployment levels, wage growth, and elevated interest rates, creating a favorable environment for apartment living. When compared to the national average, the median home price to median household income ratio in EQR's markets remains high. This indicates the continued appeal of rental properties in these areas.

Leveraging Future Opportunities

Investor Presentation

Investor Presentation

EQR is well-positioned to capitalize on future opportunities, with lower expected deliveries of new supply compared to Sunbelt markets. Historical trends also suggest that the slowdown in rental growth due to new supply and lower demand will eventually normalize, leading to increased demand in the coming years.

The company maintains a strong balance sheet, with a credit rating of A-/A3 from S&P and Moody's. EQR's liquidity stands at $2.5 billion, and its debt ratios are well within safe levels for REITs. Additionally, the company's dividend is well-covered, providing income investors with a reliable source of returns.

FAST Graphs

FAST Graphs

At the current price of $61.33, EQR presents solid value, with a forward price-to-funds from operations (P/FFO) ratio of 16.3, well below its historical average. Analysts expect future growth in FFO per share, further supporting the investment case for EQR.

Investor Takeaway

Despite short-term headwinds, Equity Residential exhibits strong potential for long-term growth and income generation. Its strategic market positioning, proven track record, and favorable market dynamics make it an attractive investment opportunity.

EQR vs. Peers EV/EBITDA (Seeking Alpha)

EQR vs. Peers EV/EBITDA (Seeking Alpha)

With a discounted valuation and a higher dividend yield, EQR offers compelling value to income-seeking investors looking to tap into the US apartment market. Therefore, I maintain a 'Buy' rating on EQR stock.

Remember, investing always carries risks, and it's essential to conduct thorough research before making any financial decisions.