Fundrise, a Washington, D.C.-based real estate and alternative assets platform, has revolutionized the way non-accredited investors can invest in high-quality real estate and pre-IPO startups. With its innovative approach and user-friendly interface, Fundrise has become the go-to platform for retail investors looking to diversify their portfolios and earn passive income.

Fundrise: Empowering Individual Investors

Fundrise's mission is clear: to build a better financial system by empowering individual investors. Through their platform, investors can easily invest in a variety of real estate assets, tailoring their strategy to focus on growth, supplemental income, or a balanced approach. Fundrise's funds include high-quality multifamily apartments, industrial properties, single-family rentals, and private credit offerings, providing investors with the opportunity to diversify among hundreds of properties with a single investment.

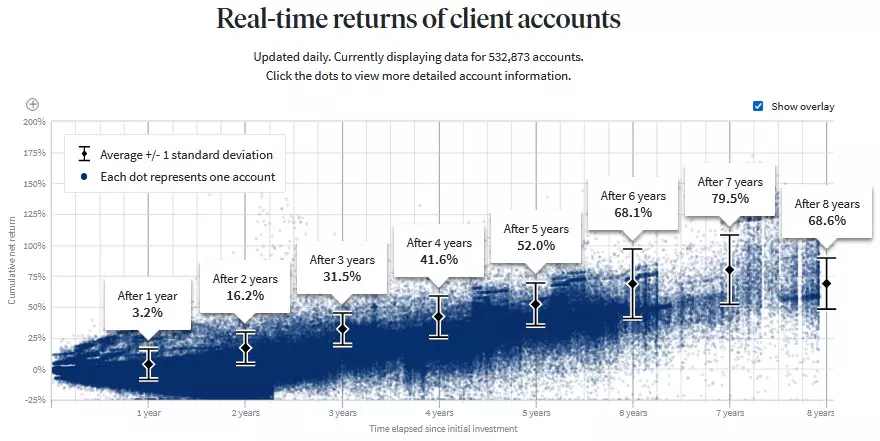

Real-time returns of client accounts as of November 6th, 2023.

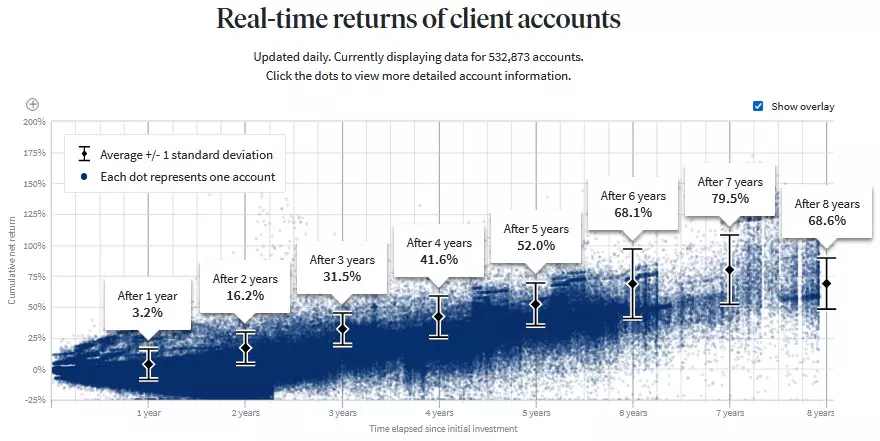

Real-time returns of client accounts as of November 6th, 2023.

How Fundrise Works

Fundrise operates as a separate investing platform, similar to a stock brokerage account. However, instead of stocks, investors own real estate and venture capital funds. By going through a simple questionnaire, investors establish their investor profile and strategy, connect their bank accounts, and deposit funds. Fundrise then automatically allocates new deposits into the most appropriate funds, building a diversified portfolio of real estate properties.

Fundrise Returns: What to Expect

Past performance is not indicative of future returns, but Fundrise provides an excellent visual representation of client returns over time. Generally, investment returns increase the longer an investor participates. According to the data, the average annualized return is 8.3% from February 2017 to January 2024.

Types of Investments

Fundrise offers three high-level categories of investments: real estate, private credit, and venture capital. Within these categories, investors can choose from funds that suit their investment goals. The offerings have evolved over time, but the flagship funds, strategy funds, and vintage funds remain popular options.

Fundrise Fees and Taxes

Fundrise charges a 0.15% advisory fee and an annual 0.85% flat management fee for their real estate funds. The Innovation Fund, which focuses on venture capital investments, has an annual 1.85% flat management fee. Dividends received from Fundrise investments are subject to taxes, and investors receive a 1099-DIV form for tax reporting.

Liquidity and Risks

Fundrise has improved its liquidity rules over the years, offering quarterly liquidity for flagship funds and income funds. However, some penalties may apply for early withdrawals. It's important to consider the long-term nature of real estate investments and the potential risks associated with market downturns.

Fundrise Pro and Additional Features

Fundrise Pro is a premium membership that gives investors more control over their portfolios. It allows for customizing investment allocations and provides access to proprietary market and portfolio data. Fundrise also offers a mobile app for convenient investing on the go.

The Verdict: Fundrise Review

Overall, Fundrise has solidified its position as a leading real estate crowdfunding platform. With its user-friendly interface, diverse investment options, and track record of solid returns, Fundrise is an excellent choice for retail investors looking to benefit from the real estate market. However, it's important to consider the platform's passive nature, limited liquidity, and potential risks associated with real estate investments.

If you're interested in diversifying your portfolio and earning passive income, Fundrise provides an accessible and innovative solution. With a minimum investment of just $10, anyone can become a part of the real estate market. Start your real estate investing journey with Fundrise today!

Disclaimer: The author of this article has personally invested in Fundrise funds and is an investor in Rise Companies Corp, the parent company of Fundrise.