Discover the Best Real Estate Crowdfunding Platform for You

Real estate investing is a lucrative field that can be costly and time-consuming. Fortunately, real estate crowdfunding platforms offer a solution by allowing investors of all income levels to participate. In this article, we will compare three popular platforms – Fundrise, Diversyfund, and Groundfloor – and help you determine which one is the best fit for your personal finance goals.

Why Invest in Real Estate?

Investing in real estate offers several benefits. Firstly, real estate has a tendency to appreciate over time, providing a positive return on investment. Secondly, real estate investments are always in demand as everyone requires a place to live or work. Finally, real estate investments can generate passive income, providing a steady cash flow with little effort.

While traditional real estate investing can be labor-intensive and require a significant upfront investment, real estate crowdfunding allows investors to participate with smaller amounts of money and minimal time commitment.

Real estate crowdfunding platforms offer opportunities for investors of all income levels.

Real estate crowdfunding platforms offer opportunities for investors of all income levels.

What is Real Estate Crowdfunding?

Real estate crowdfunding is an online investment strategy that involves pooling funds from individual investors to finance real estate properties. It allows investors to purchase fractional shares in real estate assets, providing access to real estate investments without the high minimum investment requirements.

One platform that offers real estate crowdfunding is Fundrise. Fundrise allows investors to get started with as little as $10, providing a low-risk entry into real estate investing. Other platforms, like Diversyfund and Groundfloor, also offer real estate crowdfunding opportunities for non-accredited investors.

Real estate crowdfunding platforms offer diverse investment options.

Real estate crowdfunding platforms offer diverse investment options.

Accredited vs Non-Accredited Investors

Real estate crowdfunding is available to both accredited and non-accredited investors. Non-accredited investors are everyday investors who don't meet the specific criteria set for accredited investors. While accredited investors have access to a wider range of investment options, non-accredited investors can still participate in real estate crowdfunding.

Platforms like Fundrise, Diversyfund, and Groundfloor provide opportunities for non-accredited investors to invest in real estate crowdfunding and diversify their investment portfolios.

Debt vs Equity Crowdfunding

Real estate crowdfunding platforms typically offer two types of investments: debt and equity. Debt investments involve lending money to real estate buyers and earning interest on the loan. Equity investments, on the other hand, involve owning a stake in a particular property and earning returns through rental income and capital appreciation.

Debt investments are lower risk as the loan is secured by the property, while equity investments offer the potential for higher returns. Each option has its benefits and drawbacks, and investors must consider their risk tolerance and investment goals when choosing between the two.

Real estate crowdfunding offers both debt and equity investment options.

Real estate crowdfunding offers both debt and equity investment options.

Fundrise, Diversyfund, and Groundfloor - Which Is the Best Real Estate Crowdfunding Platform For You?

While all three platforms offer real estate crowdfunding opportunities, there are distinct differences between them. Let's take a closer look at each platform:

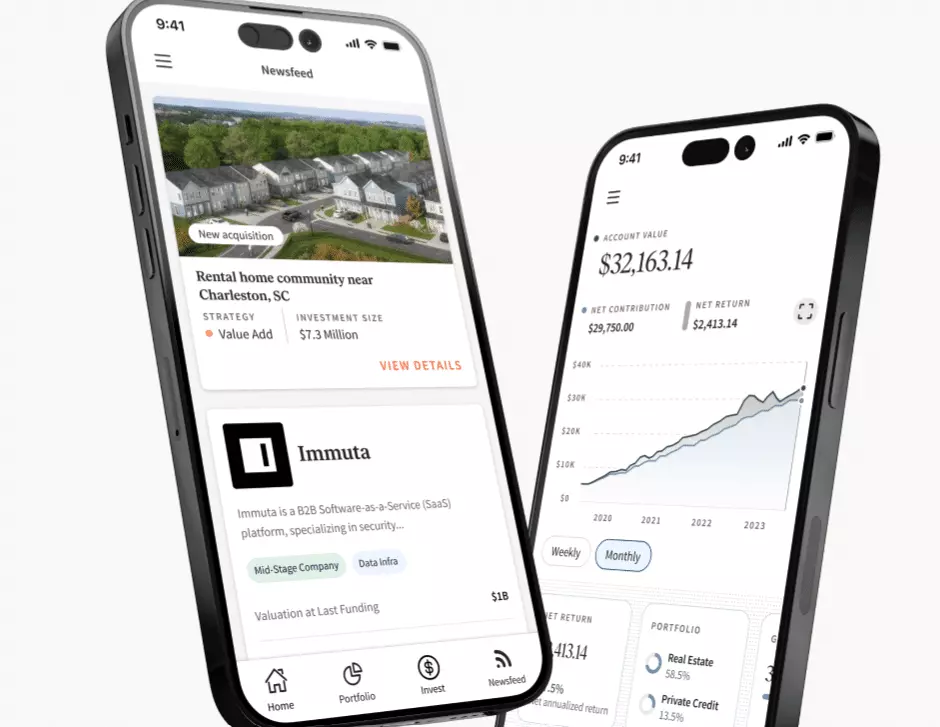

Fundrise

Fundrise is a real estate investing platform that offers diverse equity and debt investment options. They focus on providing high-quality assets with relatively low management fees. Fundrise is suitable for investors seeking long-term investments and offers both capital appreciation and steady cash flow opportunities.

The minimum investment amounts vary depending on the chosen investment package, ranging from $10 to $100,000. Fundrise is available to all investors and does not require accreditation.

Fundrise offers diverse investment options and low management fees.

Fundrise offers diverse investment options and low management fees.

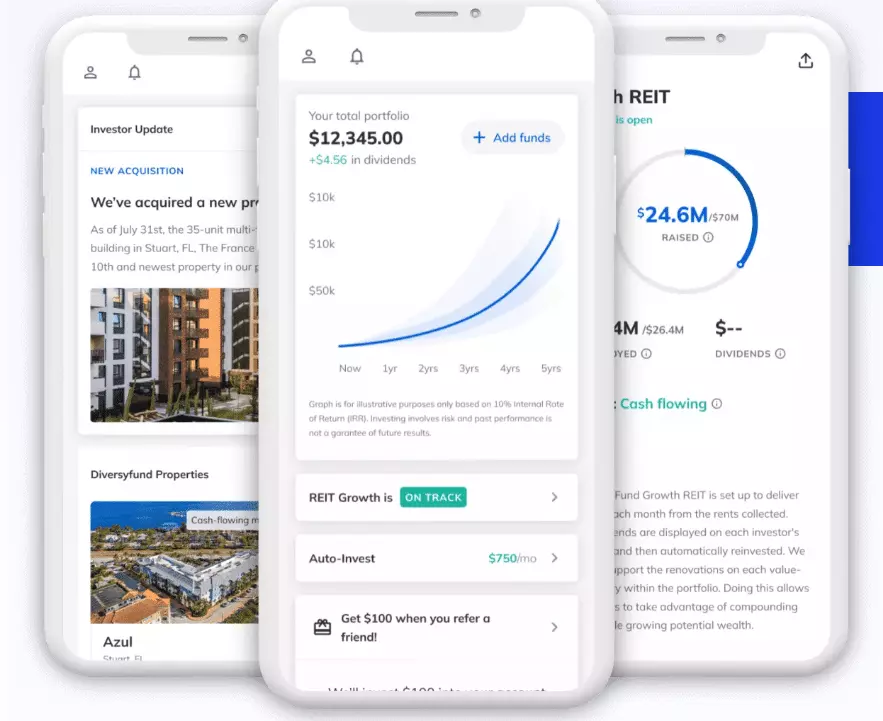

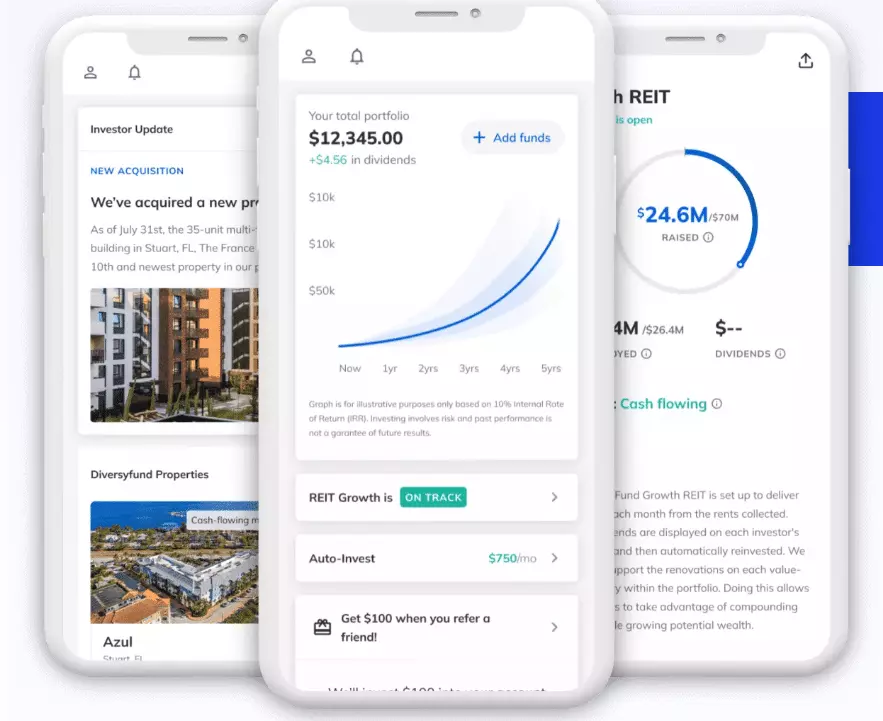

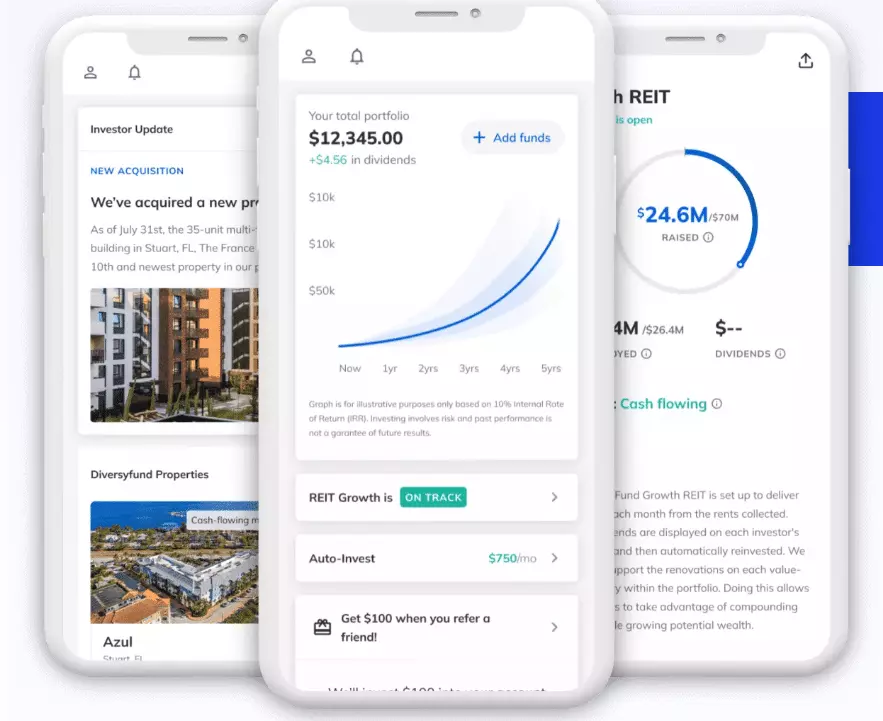

Diversyfund

Diversyfund follows a unique investment strategy by directly acquiring and improving real estate properties. They offer private real estate opportunities for both accredited and non-accredited investors. Diversyfund has three tiers of investments, each with different minimum investment amounts.

Diversyfund focuses on apartment buildings and offers the potential for cash flow and capital appreciation. They have a 5-step investment plan for each property, providing investors with transparency and predictability.

Groundfloor

Groundfloor is a debt-only real estate crowdfunding platform that allows investors to loan money to short-term real estate "flippers". It offers low minimum investments and shorter investment terms compared to other platforms. Groundfloor allows investors to choose their level of risk and offers different interest rates based on borrower rankings.

With no management fees and a minimum investment amount of $1,000, Groundfloor is an affordable option for investors seeking cash flow opportunities. However, it is important to note that Groundfloor focuses solely on single-family residential properties, limiting investment diversification.

Choosing the Best Platform

When choosing the best real estate crowdfunding platform, several factors should be considered. These include the initial investment amount, liquidity, potential return on investment, and investment diversity. Investors should also consider their risk tolerance and long-term investment goals.

Ultimately, the platform you choose should align with your financial situation, investment strategy, and provide a diversified investment portfolio.

Remember, all investments come with certain risks, and it is important to do your due diligence before investing in any platform. Real estate crowdfunding can be a valuable addition to your investment portfolio, but it should be part of a well-rounded and diversified approach to investing.

Conclusion

Fundrise, Diversyfund, and Groundfloor are all viable options for real estate crowdfunding, each with its own advantages and disadvantages. Affordability, transparency, and investment diversity are key factors to consider when making a decision.

Real estate crowdfunding provides an opportunity for investors of all income levels to participate in the lucrative real estate market. By choosing the right platform and diversifying your investments, you can achieve your financial goals and benefit from the potential returns of real estate crowdfunding.

Disclosure: Please note that this article may contain affiliate links, which means that - at zero cost to you - I might earn a commission if you sign up or buy through the affiliate link. Rest assured, I only recommend products and services that I personally believe are valuable.