By [Your Name]

Image source: RiverNorthPhotography/iStock Unreleased via Getty Images

Image source: RiverNorthPhotography/iStock Unreleased via Getty Images

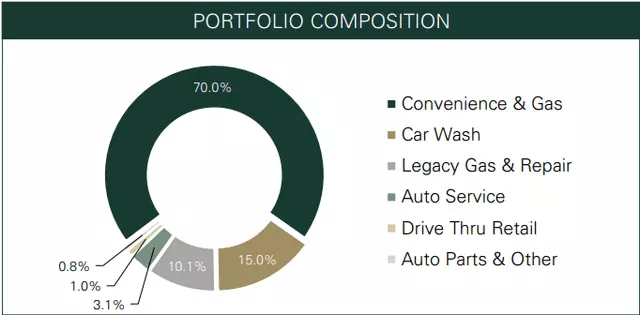

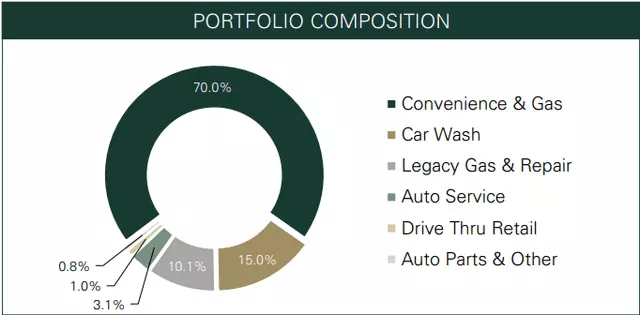

If you've ever taken a road trip across the United States, chances are high that you've stopped at one of Getty Realty Corp's locations to fill up your tank and grab some snacks. Getty Realty Corp (NYSE:GTY) is a specialized real estate investment trust (REIT) that focuses on developing, owning, or financing single-tenant properties, with nearly 90% of its properties consisting of gas stations, convenience stores, and car wash stations. With its current valuation presenting a potential entry point for investors interested in specialty REITs, let's take a closer look at what makes Getty Realty a compelling investment opportunity.

Resilience in Recession-Resistant Businesses

While gas stations and car wash places may not be entirely recession-proof like grocery stores and pharmacies, they do fall under the category of recession-resistant businesses. During economic downturns, people still need to buy fuel, service their cars, and wash their vehicles, albeit with potentially reduced frequency. These businesses thrive on high volumes rather than high margins per transaction, making busy highway locations or bustling intersections prime spots. Moreover, these properties offer stability, with long-term lease contracts that rarely change ownership. Getty Realty boasts an impressive occupancy rate of 99.7% and near-perfect rent collection, further solidifying its business stability.

Image source: Getty Portfolio Composition

Image source: Getty Portfolio Composition

Steady Revenue Growth and Dividends

Over the years, Getty Realty has provided investors with slow and steady revenue growth, with its growth rate matching the rate of GDP growth in the United States over the last decade. This promising trend is expected to continue in tandem with the country's GDP growth. Additionally, Getty Realty's dividend growth history is commendable, as the company has been raising its dividends at an annual compounded growth rate of 5.5% over the past eight years. Currently offering a dividend yield of 5.63%, which falls within the higher end of its 10-year range, Getty Realty's dividend history has become more stable compared to its volatile past.

Dilution and Share Appreciation Considerations

While the company's FFO (funds from operations) has grown by an impressive 225% in the last decade, FFO per share growth has been slower at 127% due to dilution caused by the issuance of approximately 50% more shares. Getty Realty has been actively acquiring new properties to fuel its growth, spending close to $1 billion since 2016. However, investors should carefully monitor the potential dilution of shares to ensure it remains under control.

Moreover, in terms of total returns, Getty Realty's share price has appreciated by about 59% in the last decade, although the majority of returns have been driven by dividends and dividend reinvestments. This steady appreciation has barely kept up with the GDP growth in the United States, partially influenced by the aforementioned share dilution. It's worth noting that REIT stocks, including Getty Realty, have faced challenges due to recession fears and rising interest rates, which have impacted share prices.

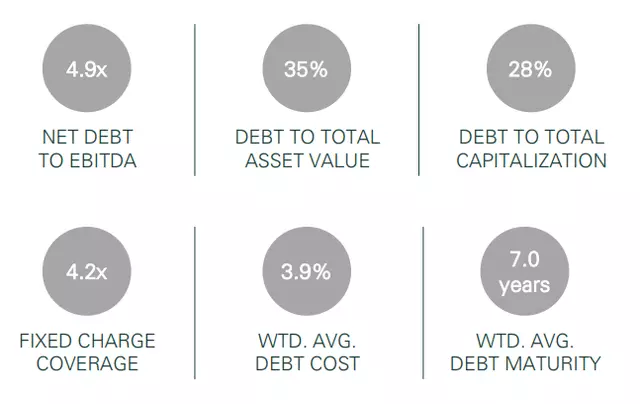

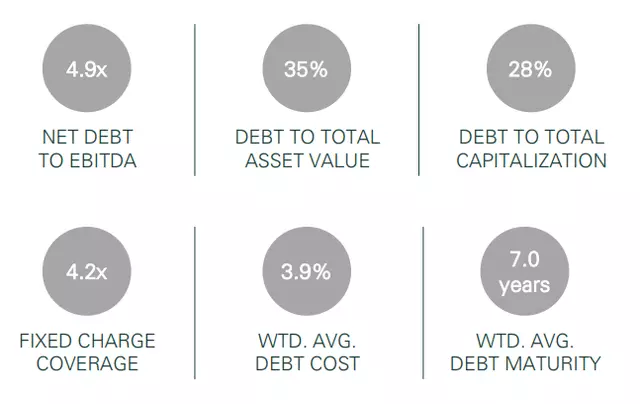

Favorable Debt Metrics and Valuation

Getty Realty boasts low debt levels and relatively low leverage, with its current EBITDA (earnings before interest, taxes, depreciation, and amortization) able to cover its net debt in only 4.9 years. Additionally, the majority of the company's debt is fixed-rate, offering protection against rising interest rates. While Getty Realty's credit rating is BBB-, its current average debt cost is only 3.9%, mainly due to issuing debt before interest rates began climbing. However, it's essential to consider the potential impact of issuing new debt in the current market.

Image source: Getty's debt metrics

Image source: Getty's debt metrics

Forward Expectations and Market Timing

Analysts anticipate that Getty Realty will generate FFO per share of $2.10 this year, $2.18 next year, and $2.24 in 2025. With forward P/FFO ratios of 14, 13.8, and 13.5 for the respective years, the valuation appears reasonable, especially considering the high dividend yield and consistent dividend growth. However, individual investors should assess their own criteria for a good valuation and determine if a well-covered 5.65% dividend yield that grows around 5% per year aligns with their investment goals.

Considering the current state of the market, where certain assets and sectors remain in a bear market, it might be an opportune time to consider investing in stocks like Getty Realty. While it is advisable to approach such investments with caution, gradually adding small positions can be a strategic move to take advantage of potential oversold opportunities. Waiting for further price dips is also a valid strategy, although it is uncertain whether they will materialize.

Image source: Data by YCharts

Image source: Data by YCharts

To summarize, Getty Realty presents an enticing investment opportunity, particularly for those interested in high-yielding REITs. With its focus on gas stations, convenience stores, and car wash stations, Getty Realty's stability, steady revenue growth, and attractive dividend history make it an appealing choice. As always, investors should conduct their thorough research and evaluate their risk tolerance before making any investment decisions.