An Introduction to REITs

Real Estate Investment Trusts (REITs) are corporations that own and manage real estate, offering investors the opportunity to access the income generated by their property portfolios. Unlike traditional real estate investing, where individuals purchase and manage properties, REITs provide an alternative approach. By issuing units similar to stock shares, REITs allow investors to participate in the real estate market passively.

What Sets REITs Apart

Here are a few key points that distinguish REITs from other forms of real estate investing:

Access for All

REITs enable average investors to enter the real estate market without the burden of buying and managing properties directly. Instead, individuals can purchase company stocks or exchange-traded funds, giving them a stake in the income generated by the REIT's real estate assets.

Funding for Developers

For developers seeking financing alternatives to banks and insurance companies, REITs offer an attractive option. By utilizing REITs, developers can access the necessary funds to fuel their projects.

Institutional Investors' Haven

Institutional investors and mutual funds often choose REITs as a straightforward and liquid way to invest in real estate. They provide an efficient exit strategy, allowing investors to easily sell their units when needed.

The Expansive REIT Market

The REIT market boasts a staggering $3+ trillion in real estate assets. With various types of REITs available, they can be classified based on their trading status (private vs. public), asset type (equity vs. mortgage), and the sectors they operate in (such as retail and data centers).

How Do REITs Operate?

REITs operate similarly to mutual funds, but instead of stocks and bonds, they are backed by real estate properties and/or mortgages. These entities create portfolios of assets that back the units they issue to long-term investors through an initial public offering or private placement. They may also raise additional capital through secondary offerings and other means.

Trading publicly traded REIT units is possible on exchanges, while non-traded REIT units are traded through brokers. Private REITs, on the other hand, do not trade publicly.

Let's take a closer look at an example: Innovative Industrial Properties, Inc. (NYSE: IIPR). This REIT manages a portfolio of industrial properties leased to medical-use cannabis facilities. Since its initial public offering (IPO) in November 2016, Innovative Industrial Properties has provided investors with an opportunity to participate in the real estate market.

REITs vs. Direct Real Estate Investing

There are two primary strategies for making money through direct real estate investments: fix-and-flip and long-term income through rental properties. REITs offer an alternative approach that aligns with the long-term income strategy while occasionally generating gains from property sales.

Let's compare the attributes of publicly-traded REITs and direct real estate investments:

Liquidity: REITs offer high liquidity, as investors can sell their units when they want to cash out. On the other hand, selling a property can take months or even years.

Diversification: REITs provide instant diversification within the real estate sector, allowing investors to collect rental income from multiple leases. This reduces the impact of any individual lease or vacant unit. Conversely, diversifying direct real estate investments takes time as investors add one property at a time.

Investor Commitment: Investing in REITs requires relatively little time commitment in selecting and monitoring performance. REIT management acts as the landlord. In contrast, direct real estate investing demands substantial time commitment to handle leasing, property management, and rent collection.

Minimum Investment: With REITs, investors can start with as little as one unit. Direct real estate investments typically require a significant capital investment, typically 20% to 40% of the purchase price.

Short-Term Gains: REITs provide opportunities for short-term gains through the appreciation of units, while direct real estate investments may involve fix-and-flip projects to achieve the same.

Asset Allocation: Adjusting asset allocation to include REITs is relatively easy through trading units. Conversely, changing asset allocation to real estate in direct investments is challenging due to the lack of liquidity.

Shorting and Pledging: REIT units can be shorted to take advantage of a downturn in the real estate market. However, this option is not available for direct real estate investments. Additionally, REIT units can be pledged as collateral, while property owners can only pledge their equity if permitted by the loan agreement.

IRA Holding: Holding REITs in an Individual Retirement Account (IRA) is simple. Conversely, holding direct real estate investments in an IRA requires a self-directed IRA and a property manager as a custodian.

Control: Investors have control over buying and selling REIT units. In direct real estate investing, investors have complete control over their properties.

For more insights on the differences between REITs and real estate investing, and to determine which method suits you best, please read our detailed article.

Qualifying as a REIT

For a REIT to qualify as a tax-free, pass-through entity, it must meet specific criteria, including:

- Structured as a corporation or business trust

- Controlled by a board of trustees or directors

- Issues fully transferable units

- Must have at least 100 unitholders

- Distributes at least 90% of taxable income to unitholders

- No more than half of the REIT’s units can be held by up to five individuals

- 75% of assets must be invested in real estate

- Receives at least 75% of income from mortgage interest and rents

- 95% of gross income must derive from financial investments

- Invests no more than 25% of total assets in securities and no more than 5% in any one issuer’s securities

- Owns no more than 10% of any one issuer’s outstanding voting shares

- Limits ownership of stocks in taxable REIT subsidiaries to 20 percent of assets

- Earns no more than 30% of gross income from sales of properties held less than four years

The History of REITs

REITs emerged from the desire of investors to passively invest in diversified portfolios of income-producing real estate while avoiding double taxation. In the 1880s to the 1930s, trusts similar to REITs provided pass-through income, evading corporate taxes. However, double taxation was imposed in the 1930s, leading to a 30-year struggle to reverse this tax regime.

In 1960, President Eisenhower signed the Real Estate Investment Trust Act, which allowed investors to invest in diversified real estate portfolios through public units. The first REIT, American Realty Trust, began trading in 1961. The idea quickly gained traction worldwide.

Today, the Nareit FTSE Global Real Estate Index Series includes almost 500 exchange-traded REITs spanning 35 countries with a market cap exceeding $2 trillion.

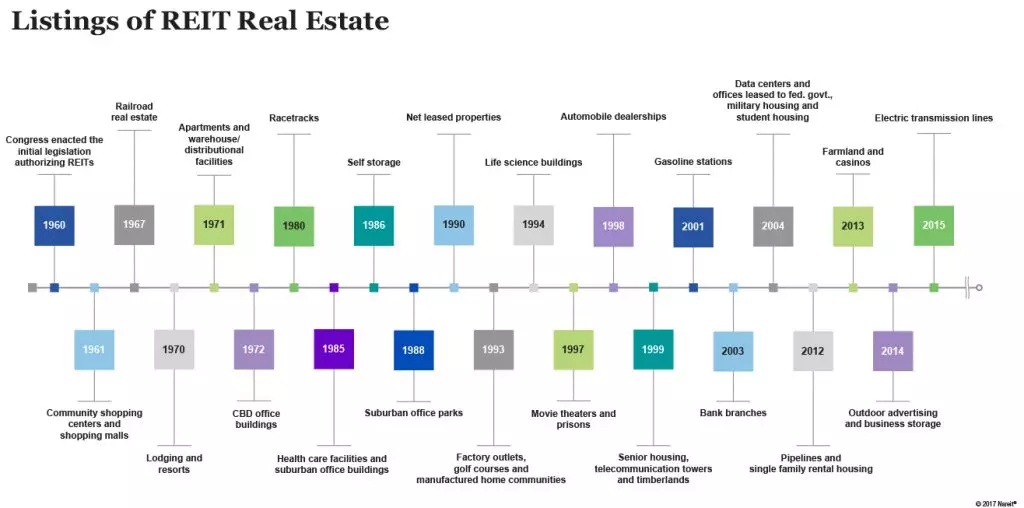

Take a look at the timeline below to see when each major REIT property sector was introduced.