Just like Florida or California, there is always a high level of interest in buying homes and properties in Hawaii. The Hawaiian Islands offer a unique blend of natural beauty, a tropical paradise, and the benefits of being part of the US. The allure of the Hawaii housing market lies in the lifestyle it offers, with serene landscapes, warm climates, stunning beaches, and diverse microclimates.

A Paradise with Profit Potential

Buyers in Hawaii not only enjoy the lifestyle but also have opportunities for profit through appreciation and rental income. Many homeowners and condo owners in Hawaii benefit from the high demand for vacation rentals, making it a lucrative investment. Living in a tropical paradise with all the modern amenities and services is a dream for many, and Hawaii offers exactly that.

Challenges in the Market

However, the Hawaii housing market faced difficulties in 2023. The high mortgage rates of 8% made it challenging for buyers to obtain large home loans and purchase properties. Despite this hurdle, house prices in Hawaii have shown a slight increase, while condo prices have been rising quickly.

During the last two months, Hawaii's real estate market has behaved typically for a US state. However, the lower sales and prices might be a reflection of economic uncertainty. With higher home prices and mortgage rates at 6.5%, many buyers are finding it difficult to find their ideal property and close a sale.

A Buying Opportunity

While there may be challenges in the short term, some indicators point to a potential buying opportunity in the near future. House prices have dropped in recent months but are still up by an average of $12,000 compared to six months ago. For condos, prices have fallen by $109,000 since last July. With mortgage rates set to drop within the next two years and 2024 expected to be a strong year for travel, it could be an ideal time for cash buyers to consider purchasing a property in Hawaii.

Housing Market Demand in Hawaii

Hawaii.gov's report on housing demand across the islands reveals that demand exceeds supply by about 140%. However, much of the housing available is not within the affordable range for most buyers. The limited supply and high demand make it challenging for sellers as well, as fewer than a third of Hawaiians can afford to buy a house or condo.

Rental Opportunities for Landlords

Rent prices in Hawaii have been on the decline, although recent data shows a notable price rise. Rent/price yields have fallen over the past eight months. However, urban areas like Honolulu have experienced substantial price increases. This presents an opportunity for rental landlords to explore the market and potentially increase their rental income.

Honolulu Rent Prices by Number of Bedrooms

The rental market in Honolulu varies based on the number of bedrooms. Rental prices are influenced by factors such as location, amenities, and property size.

December Housing Market Report

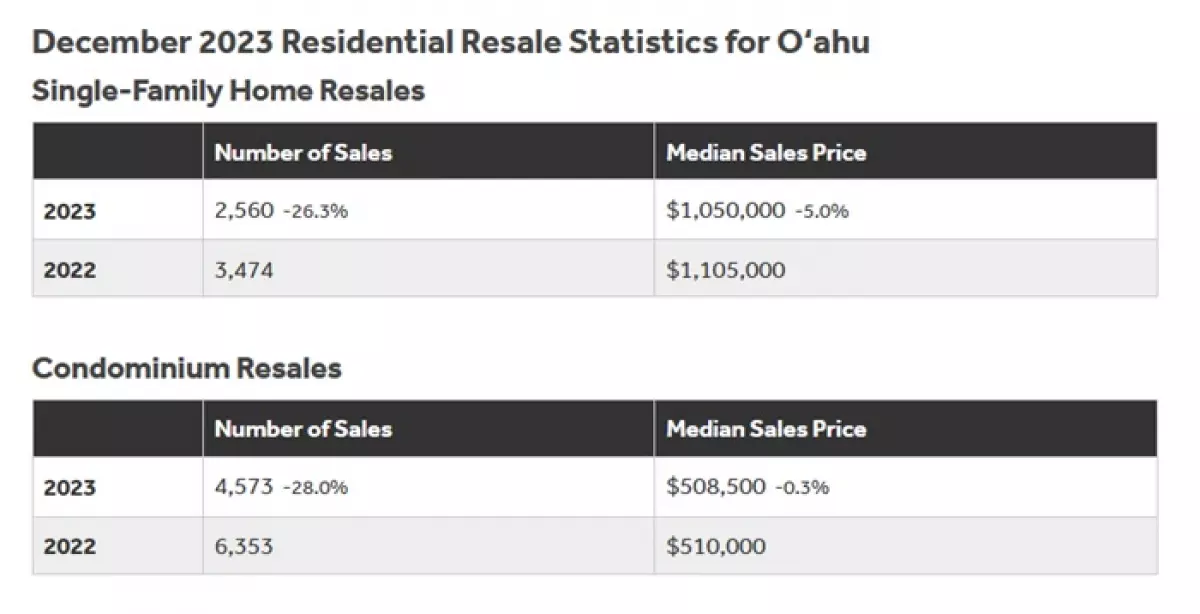

The Honolulu Board of REALTORS® reported a decline in home sales of over 25% during 2023. The median sales prices for single-family houses declined by 5% to $1,050,000, while the median sales price for condos eased by 0.3% to $508,500. Despite the decrease in sales, both homes and condos are selling at a faster pace compared to the previous year.

Caption: Hawaii's Real Estate Market

Caption: Hawaii's Real Estate Market

Oahu Real Estate Market

The real estate market on Oahu experienced a significant decline in sales, with single-family house sales dropping by 26.3% and condo sales plummeting by 28.0%. However, there was an increase in new listings for both single-family homes and condos. Although active inventory remained relatively stable, it is expected that prices will rise as demand surpasses supply.

Maui Real Estate Market

In Maui, home prices have risen while active and new listings have declined. Despite the decrease in sales, the median sales price for all home types rose by 11% year over year. The limited supply of homes and condos, coupled with growing demand, creates an opportunity for investment buyers to profit in the coming years.

Caption: Maui's Real Estate Market

Caption: Maui's Real Estate Market

Hawaii Housing Market Forecast: Demand to 2025

The Hawaii state government's report predicts a 19% growth in population by 2025, with each county experiencing an increase in demand for housing. The forecast indicates that Honolulu will need 25,847 units, Hawaii will need 19,610 units, Maui will require 13,949 units, and Kauai will have a demand for 5,287 units between 2015 and 2025.

The Role of Foreign Buyers

Foreign buyers from various countries, including the United States, China, Japan, and Canada, have played a significant role in driving up prices in the Hawaii real estate market. Bidding wars and ultrahigh prices have resulted from the competition for limited real estate. However, if international sales slow down, it raises questions about future demand.

Enjoying a Piece of Paradise

The peace, serenity, beautiful beaches, and unique cultural experiences in Hawaii make it irresistible for buyers and tourists worldwide. The Hawaiian real estate market has experienced substantial growth in recent years, with billions of dollars in investment pouring in. Honolulu, in particular, attracts significant interest from real estate investors and is likely to continue growing.

Housing Market Conditions

The Hawaiian economy is strong, with low unemployment rates and rising wages. This creates solid demand for rental units. However, rent prices in Hawaii remain beyond the reach of many residents, making it one of the least affordable housing markets in the country.

Types of Property Purchases in Hawaii

Hawaii's housing market faces challenges due to limited supply and unique real estate laws. Buyers have the option of fee-simple and leasehold properties. Fee-simple ownership provides complete ownership of the property, including the land, while leasehold ownership grants the right to use the land for a predetermined period. These factors can affect financing options and pose potential obstacles for multifamily property buyers.

Buyer Relief Programs

Hawaii lenders often prefer owner-occupied property financing, which may result in higher financing costs for rental property investors. Residency requirements also apply to qualify for government-backed loan programs. Buyers should explore the state's VA loans, FHA loans, USDA loans, and other programs to find the best financing options available to them.

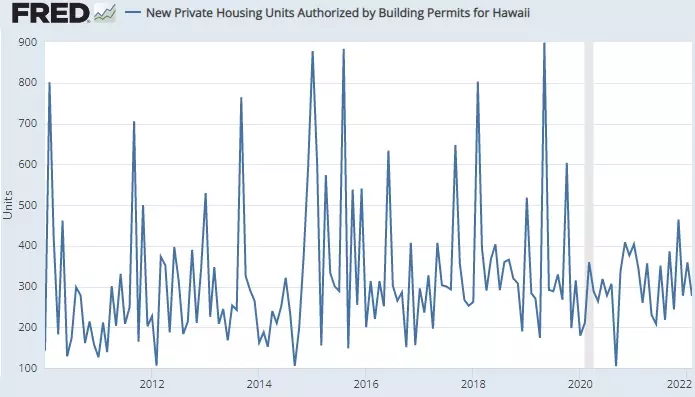

Building Permits

Building permits reflect future construction trends and volume in Hawaii. In the third quarter of 2021, private building authorizations increased by $94.2 million or 11.2% compared to the same period in the previous year. This growth indicates that builders are responding to the demand; however, more construction is needed to keep up with the increasing housing demand.

Hawaii's Strong Economy

Hawaii's economy is closely tied to overall US economic activity, tourism, and Japan's economy. While tourism spending experienced a slight drop in recent months, there is projected steady and strong growth as travel restrictions ease. Hawaii's real GDP growth is expected to increase, supporting higher apartment rental prices in the coming years.

Investing in Hawaii's Housing Market

Investing in Hawaii's housing market presents both challenges and opportunities. Limited housing supply, high demand, and a strong economy make it an attractive option for real estate investors. However, the high cost of living and renting can pose difficulties for residents. Understanding the market conditions, buyer relief programs, and property types is crucial for making informed investment decisions.

When it comes to buying property in Hawaii, it's important to work with a reputable property management company that understands the unique aspects of the market. Look for companies that utilize modern cloud-based property management solutions to optimize management and control costs.

For more information on property management companies and housing markets, explore our related articles on property management software, rental housing, and other housing markets in California and Florida.

Contact us at 415 800 1245 to learn more.

Additional Housing and Property Management Topics: Property Management Software, Rental Housing, California Housing Market, Hawaii Property Management Companies, Las Vegas Housing Market, Florida Housing Market, Florida Rental Properties, Best Florida Cities to Buy Property, Best Cities to Buy Property in California, Best Type of Property to Buy, California Property Management Companies, HOA Software.