The housing market in Corpus Christi, like the rest of the country, has experienced a surprising surge during the COVID-19 pandemic. Real estate agents initially anticipated a decline, given the struggling economy. However, the pandemic has created opportunities for many individuals who are now taking advantage of the low interest rates and affordable homes in Corpus Christi. Whether you're a first-time homebuyer or not, here's what local real estate agents Gene Guernsey and Candy Crisman-Lopez have to say about buying a home in Corpus Christi.

What to Look for in a Real Estate Agent and Mortgage Loan Officer

When embarking on your home buying journey, it's crucial to find a reliable real estate agent and mortgage loan officer who can guide you through the process. Your real estate agent should educate you on the expenses you'll incur as a homeowner, such as home maintenance and repairs. They should also provide insights on the different types of loans available, down payment requirements, interest rates, and monthly payment options. Additionally, your mortgage officer can assist you in exploring state or federal government assistance programs that may offer grants or lower interest rates for buyers with certain income levels.

First-time homebuyers are taking advantage of the low interest rates in Corpus Christi

First-time homebuyers are taking advantage of the low interest rates in Corpus Christi

Determining Your Down Payment Amount

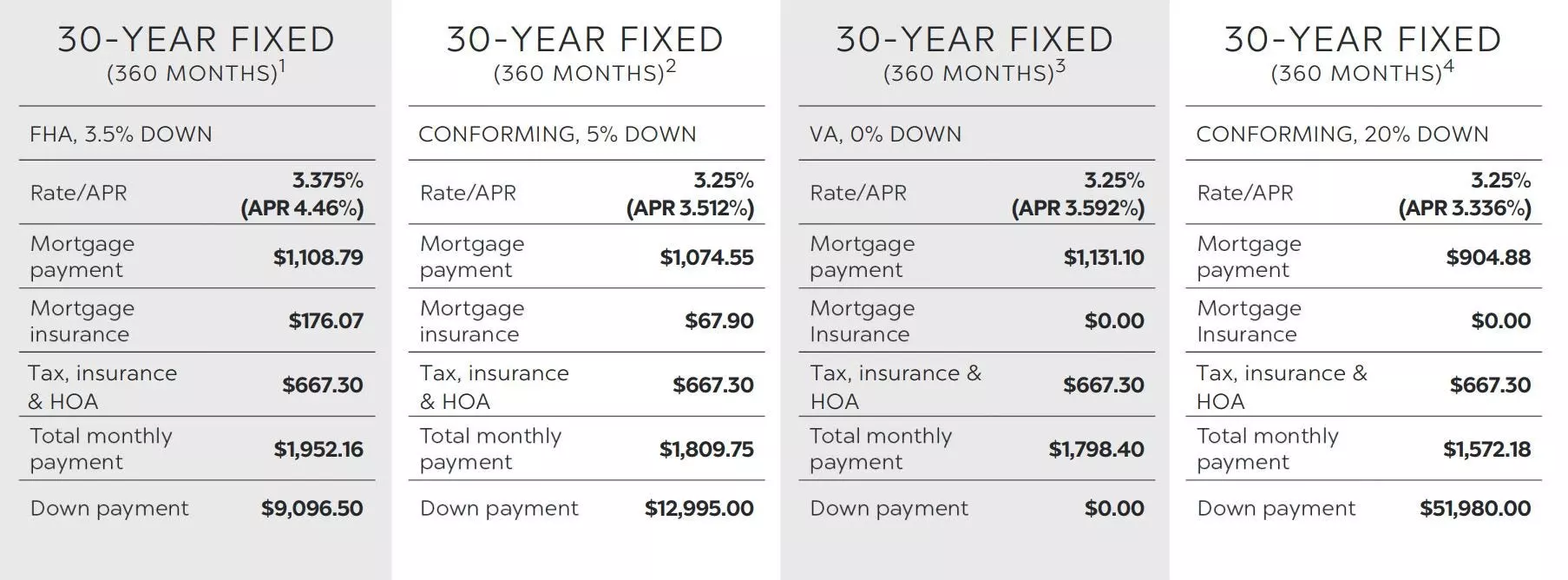

Your mortgage officer will guide you in determining the appropriate down payment amount based on the type of loan you choose. Different loan options, such as conventional loans or government-backed loans offered by organizations like the Federal Housing Administration, Department of Veterans Affairs, and the Department of Agriculture, have varying down payment requirements. For instance, FHA loans typically require a minimum down payment of 3.5% of the home price, while conventional loans often encourage a 20% down payment.

A rough estimate of a mortgage payment for a home priced around $260,000 is $1,700. That includes the house

A rough estimate of a mortgage payment for a home priced around $260,000 is $1,700. That includes the house

Finding Assistance Programs

There are several federal and state government assistance programs available to help you find your dream home. According to Rachel Gomez, vice president of mortgage lending for the Guaranteed Rate branch in Corpus Christi, state programs are often preferable. Here are a few programs you can explore:

MPM Homes under construction Krypton Drive on Wednesday, Feb. 3, 2021.

MPM Homes under construction Krypton Drive on Wednesday, Feb. 3, 2021.

State Help for Homebuyers

-

SETH GoldStar Program: This program offers a forgivable second lien of up to 7% of your loan amount, which can be used towards your down payment and closing costs. It provides a 30-year fixed-rate mortgage with options for FHA, VA, USDA, and Conventional loans.

-

Texas Homebuyer Program: The Texas Department of Housing and Community Affairs offers various assistance programs, such as Homebuyer Assistance with New Construction or Rehabilitation, Texas Bootstrap Loan Program, My First Texas Home, My Choice Texas Home, and Texas Mortgage Credit Certificate. These programs provide mortgage loans at fixed interest rates, down payment assistance, and cost assistance programs, depending on your eligibility.

-

Texas State Affordable Housing Corporation: This organization offers grants to qualifying low-income households with disabilities or those located in rural communities. These grants cover home repairs, accessibility modifications, and supportive housing services for households at risk of homelessness.

Devonshire Custom Homes along Willow Weep Drive on Wednesday, Feb. 3, 2021.

Devonshire Custom Homes along Willow Weep Drive on Wednesday, Feb. 3, 2021.

Must-Know Tips for Buying a Home in Corpus Christi

Don't be discouraged by high home prices. The current low interest rates make it an opportune time to buy a house. As prices are expected to remain high, waiting may result in higher monthly payments when interest rates eventually rise. To negotiate successfully, it's essential to get preapproved for a mortgage loan before making an offer. Base your offer on recent comparable sales in the neighborhood and be confident in your price. When purchasing a home, always have it inspected to ensure you know exactly what you're investing in.

First-time homebuyers are taking advantage of the low interest rates in Corpus Christi

First-time homebuyers are taking advantage of the low interest rates in Corpus Christi

For more information on Corpus Christi's housing market, you can explore the following articles:

- Affordability: Corpus Christi homes for sale: What's the median home value? Can you afford it?

- A how-to: Here's what you need to know about buying or selling a home in the Corpus Christi area.

- The market: Corpus Christi home price appreciation takes a tumble. Is the market cooling off?

Remember, when navigating the world of real estate, it's crucial to seek reliable advice and assistance from experienced professionals. Corpus Christi offers a range of government programs and local resources to help you find and secure your dream home.

Kathryn Cargo follows business openings and developments while reporting on the impacts of the city government’s decisions. See our subscription options and special offers at Caller.com/subscribe.