Image Source: Space_Cat/iStock via Getty Images

Image Source: Space_Cat/iStock via Getty Images

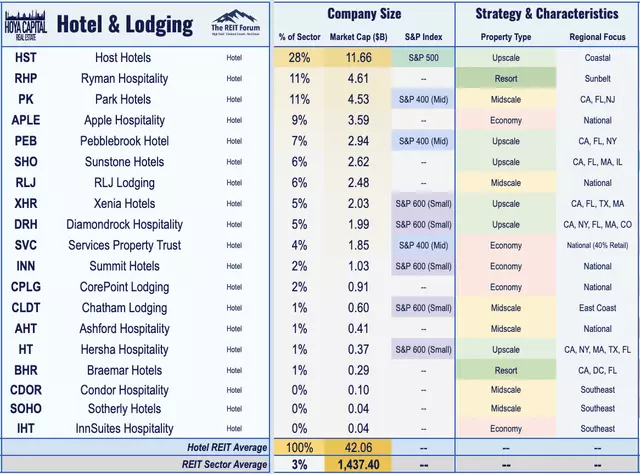

REIT Rankings: Hotels

(Hoya Capital Real Estate, Co-Produced with Colorado WMF)

(Hoya Capital Real Estate, Co-Produced with Colorado WMF)

Hotel REIT Sector Overview

It was supposed to be a memorable summer for hotel REITs and the tourism industry. However, with the resurgence of COVID variants, the industry has faced setbacks. Since vaccines became widely available in late April, hotel REITs have been the weakest-performing property sector. The risks for hotel REITs remain skewed to the downside as valuations aren't attractive enough to accept near-zero dividend yields and assume the risk of subsequent pandemic setbacks.

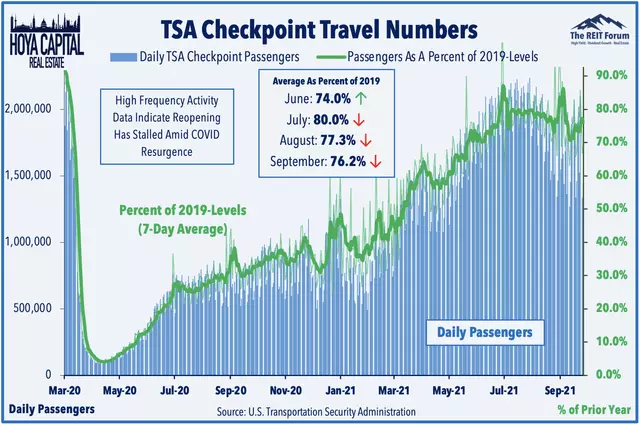

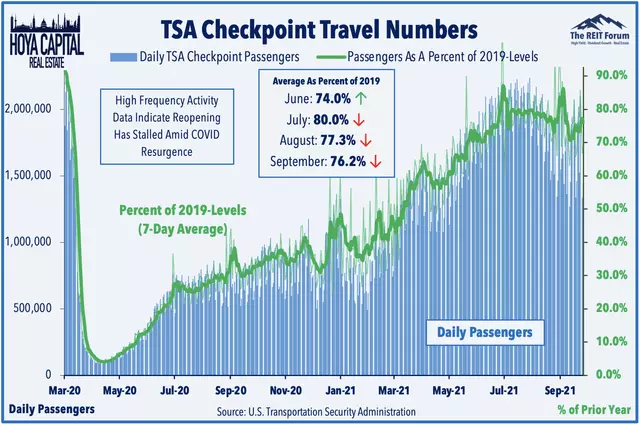

The "fourth wave" of the COVID pandemic hit the domestic tourism industry hard, especially during the late-summer season and the anticipated return of business travel in the fall. Domestic travel saw a decline in August and September, stalling the industry's recovery. Additionally, the surge in energy prices, with gasoline prices reaching seven-year highs, poses a new looming headwind.

Hotel occupancy rates, closely correlated with domestic airline travel, have also experienced a slump. Although occupancy rates briefly recovered to pre-pandemic levels during the early summer, they have since stabilized below 2019 levels. While some regions show better occupancy rates, such as Tampa reporting rates above 2019 levels, San Francisco continues to struggle.

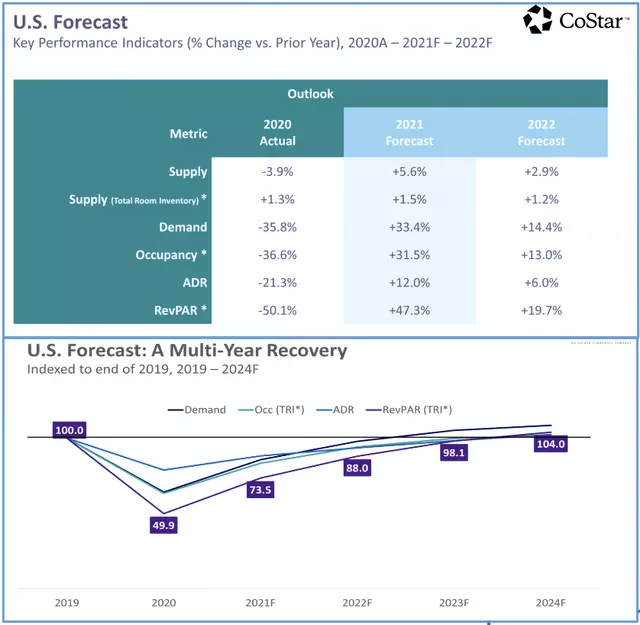

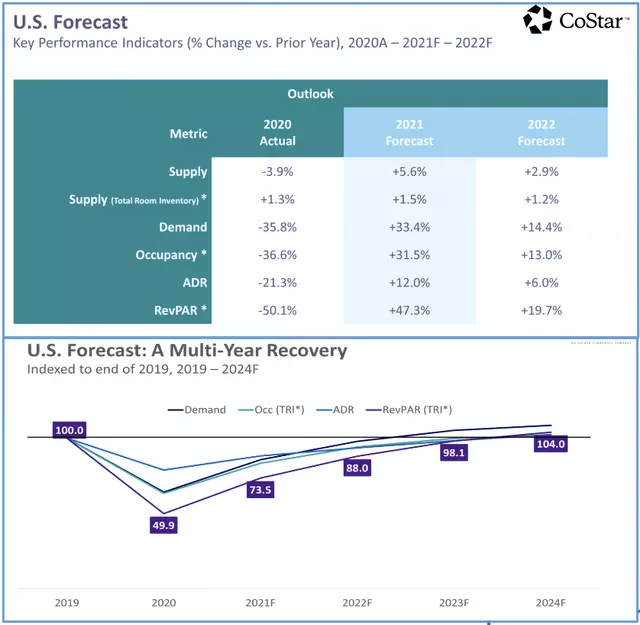

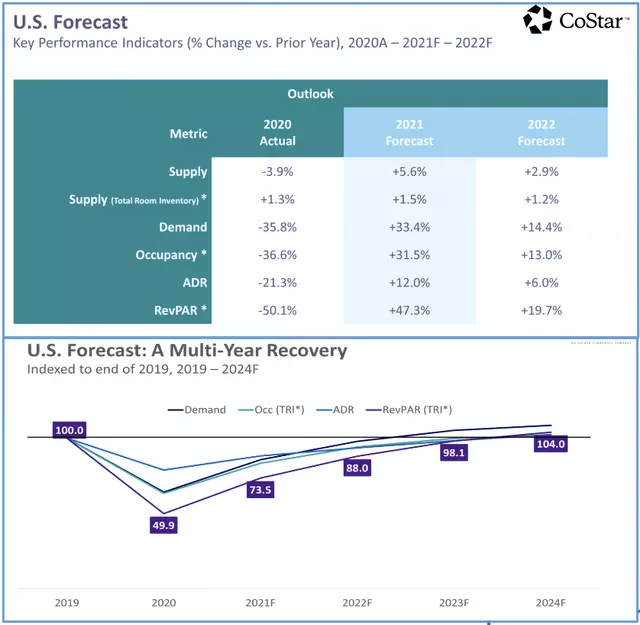

According to STR, a full occupancy recovery is not expected until 2023, with Revenue Per Available Room (RevPAR) rebounding fully in 2024. Transient business, group, and international travel continue to face headwinds, impacting the industry's recovery. Occupancy rates and daily rates for hotel rooms remain lower than pre-pandemic levels.

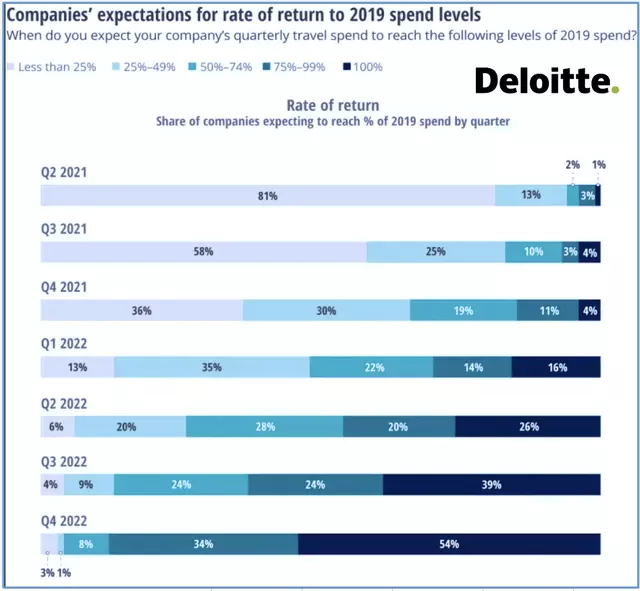

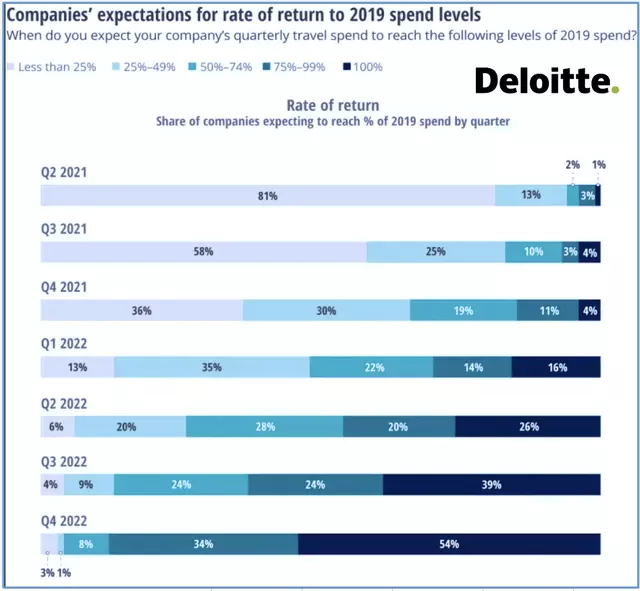

The return to the office and business travel has not happened as planned. Corporate events and conventions scheduled for this fall have been postponed, leading to further challenges for hotels heavily reliant on business travel and conventions. A recent Deloitte survey shows that many corporations expect to spend less on business travel through at least 2022.

The recovery for hotel REITs heavily reliant on conventions and group bookings has been slower. Upscale hotel REITs, such as Pebblebrook, Host Hotels, and Park Hotels, have seen lower occupancy gains and RevPAR compared to hotel REITs focused on the lower end of the price spectrum, which have shown better recovery.

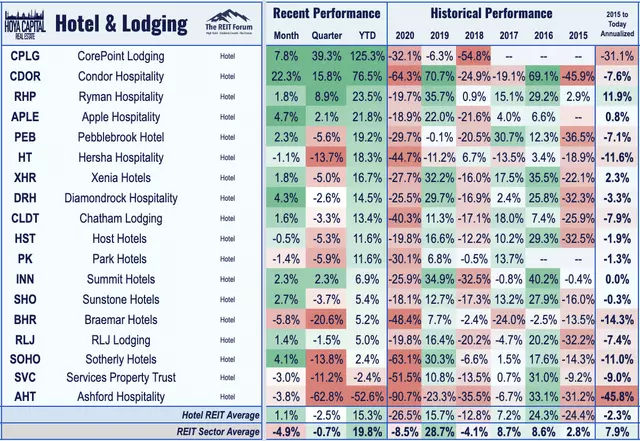

Hotel REIT Stock Performance

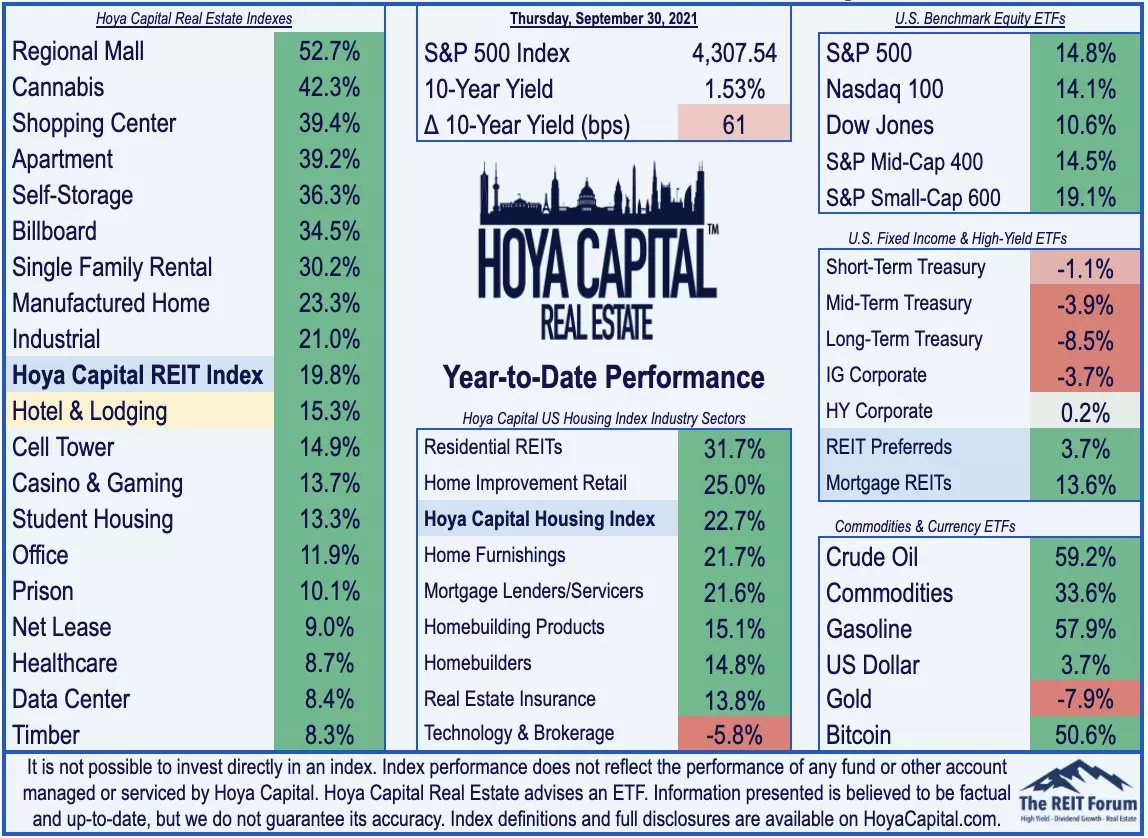

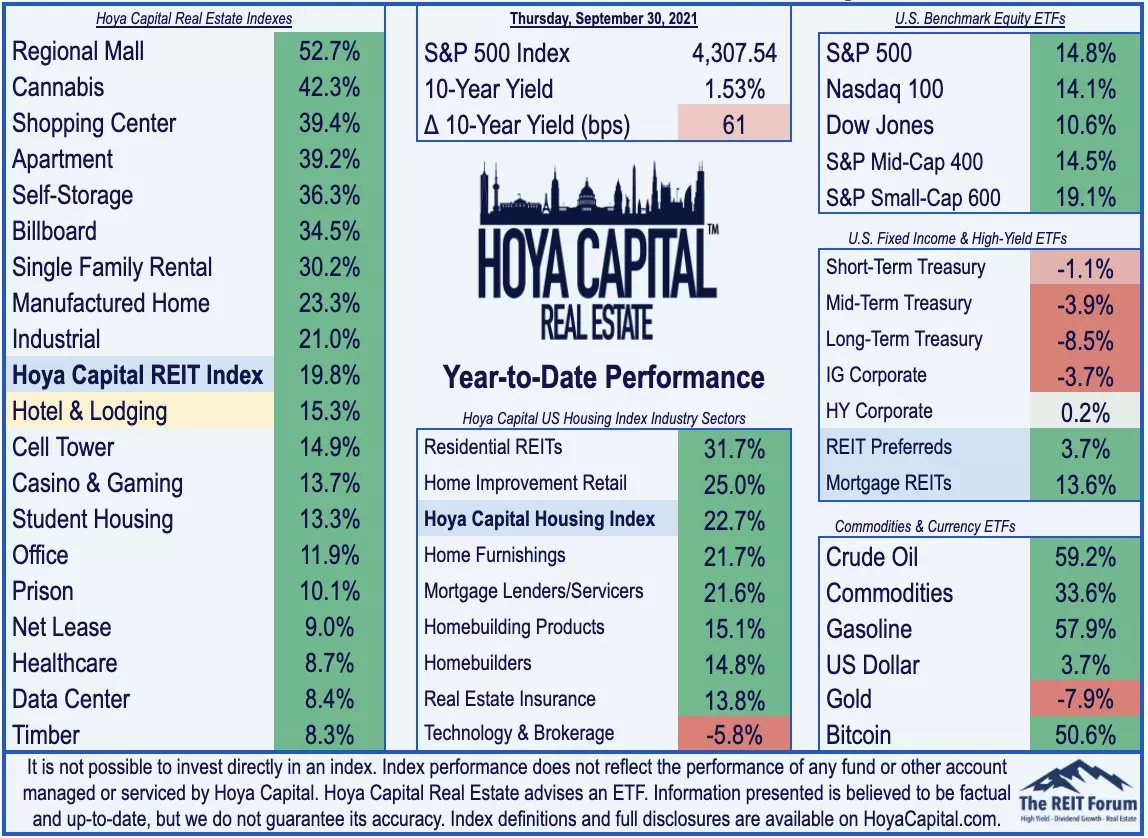

Hotel REITs, like the global leisure and tourism industry, were severely impacted in the early stages of the pandemic. However, a post-vaccine recovery led to share price gains. Yet, hotel REITs and the broader hospitality industry have stalled in the past six months due to the "fourth wave" of the pandemic. While hotel REITs have outperformed the S&P 500 ETF, their gains have been slightly lower than the Vanguard Real Estate ETF.

Small-cap CorePoint Lodging has experienced significant gains this year, while Condor Hospitality has doubled its value after entering into an agreement with Blackstone for the sale of its hotel portfolio. Most hotel REITs have seen positive returns this year, with economy and mid-scale segments performing well. However, some REITs, such as Ashford Hospitality, have faced challenges due to balance sheet issues.

Deeper Dive: Hotel REIT Economics

Hotel ownership is a capital-intensive business, with companies like Marriott, Hilton, Hyatt, Choice Hotels, and Extended Stay primarily managing hotels on behalf of property owners. Hotel REITs operate under a relatively asset-heavy model and have lower margins compared to hotel operators. They are highly sensitive to supply and demand conditions and historically pay sizable dividends to investors.

Short-term home rental firms such as Airbnb have negatively impacted hotel operators, leading to a compromised pricing power on critical nights. Hotel REITs have faced challenges due to their operating profile, with lower margins and higher operating leverage. However, the hotel development pipeline is showing signs of cooling, which may benefit the industry in the long run.

Hotel REIT Dividend Yields

Maintaining dividends has been challenging for hotel REITs, especially with occupancy rates remaining low. Dividend cuts were widespread in the hotel REIT sector last year, resulting in the sector having low dividend yields. Currently, hotel REITs pay an average dividend yield of just 0.1%, significantly lower than the market-cap-weighted average and the Hoya Capital High Dividend Yield Index.

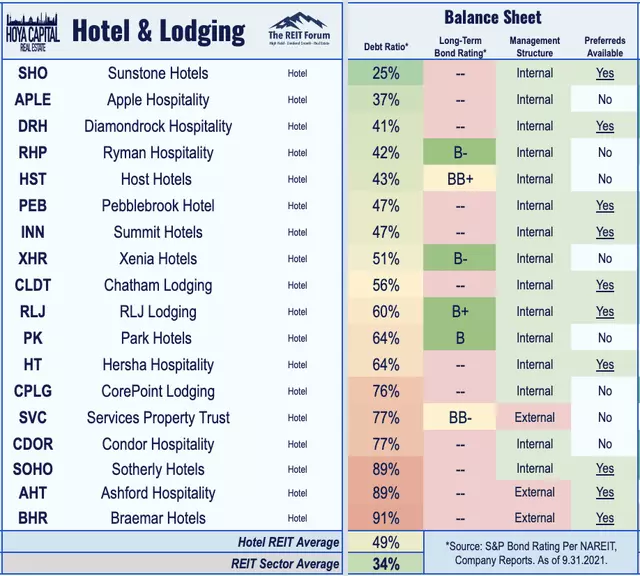

Access to capital and government stimulus programs prevented a catastrophe, but many hotel REITs have been slow to restore their dividends. Only four out of the eighteen hotel REITs continue to pay a nominal $0.01 quarterly dividend. Preferred securities for several hotel REITs were also affected, with some suspending preferred distributions.

Key Takeaways: Winter Is Coming

The resurgence of COVID variants has affected the hotel REITs and the tourism industry, hindering a full recovery. Business travel and the return to the office have not materialized as expected, impacting hotels heavily reliant on these segments. Risks remain skewed to the downside for hotel REITs, and valuations are not attractive enough to compensate for near-zero dividend yields and potential pandemic setbacks.

For a detailed analysis of all real estate sectors, including hotels, check out Hoya Capital's quarterly reports. Please note that Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE, and they are long all components in the Hoya Capital Housing 100 Index and the Hoya Capital High Dividend Yield Index.

Disclosure: The information provided is for informational purposes only. Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. Index definitions and a complete list of holdings are available on our website.