Welcome to the Housing Market Trends December 2023 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends December 2023

The housing market is ever-evolving, and the housing market trends December are no different. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends to help keep you informed as you determine what’s best for you.

- Not enough homes for sale to meet buyer demand as inventory remains low

- Low inventory means home prices (value) will likely not crash, but the rate of home price appreciation appears to be stabilizing

- Home affordability remains challenging for home buyers

- Interest rates dropped over 0.5% in November (source: Freddie Mac)

- Multifamily living hits an all-time high in 2022 and remains a growing trend

- Homeownership remains a top contributor to American net worth

Home Prices - Definitely Not Crashing, but Stabilizing?

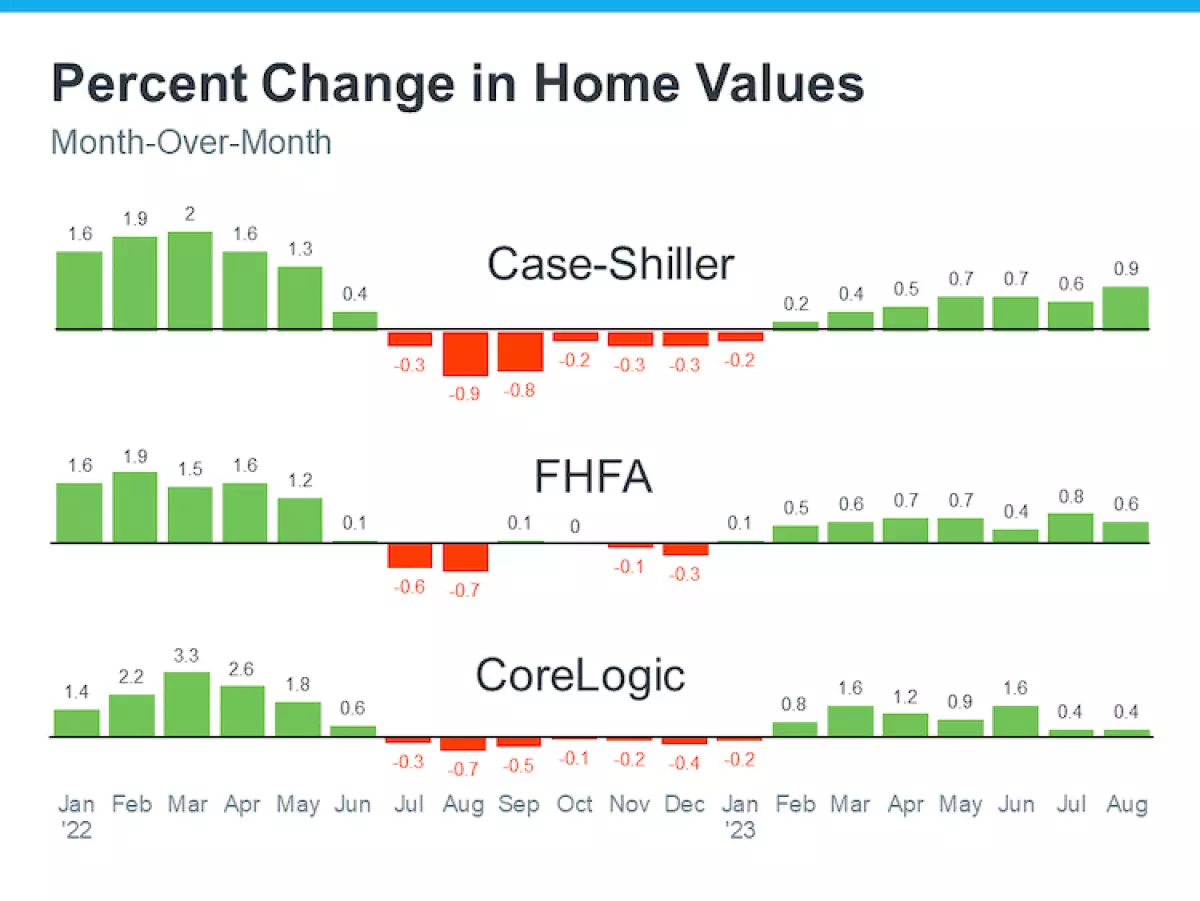

The three index reports show similar housing market trends, however, please note the CoreLogic report is not seasonally adjusted. Usually, this is the time of year when price appreciation would decelerate, but with Case-Shiller, we see that is not the case. This is interesting because some market experts are saying the housing market prices may reaccelerate.

The other two reports are showing more modest pricing increases month over month.

In the first half of 2022, we experienced strong price appreciation, only to see it cool off and almost correct itself in the 2nd half of 2022. Since February 2023, all we’ve experienced is pricing appreciation, but it is likely to be cooling slightly and getting more to a normal level of month-over-month appreciation.

This is good news for buyers who are struggling to find a home that meets their primary needs, for a price they can afford.

For sellers, this is also good news because it seems your home is likely to maintain its value and even better, continue to appreciate at a “normal” market level. That means the outlook does not appear to reflect any home price increases you need to worry about.

The three price index reports shown here analyze home pricing from select U.S. markets and may not be a reflection of your local market. So remember to speak with our local Homes for Heroes real estate specialist to find out about your local market, and allow them to assist in coming up with a game plan to buy the home you want or sell your home based on current market conditions.

Graph of three housing market trends lines showing percent change in home values month over month Jan 2022 - Aug 2023 for CoreLogic, FHFA, Case-Shiller, Keeping Current Matters November-2023

Graph of three housing market trends lines showing percent change in home values month over month Jan 2022 - Aug 2023 for CoreLogic, FHFA, Case-Shiller, Keeping Current Matters November-2023

Home Affordability is Still Challenging

Home affordability is tough right now. The average monthly mortgage payment made by U.S. homeowners has increased dramatically since January 2021.

But it isn’t just the increase in home prices causing this increase. Another major factor is mortgage interest rates.

Bar graph monthly mortgage payments Jan 2021 - Aug 2023 reported by NAR, Keeping Current Matters November 2023

Bar graph monthly mortgage payments Jan 2021 - Aug 2023 reported by NAR, Keeping Current Matters November 2023

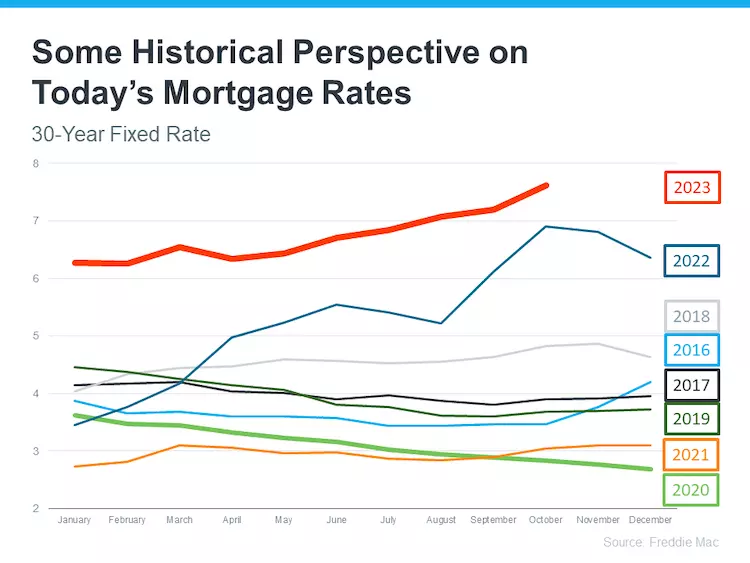

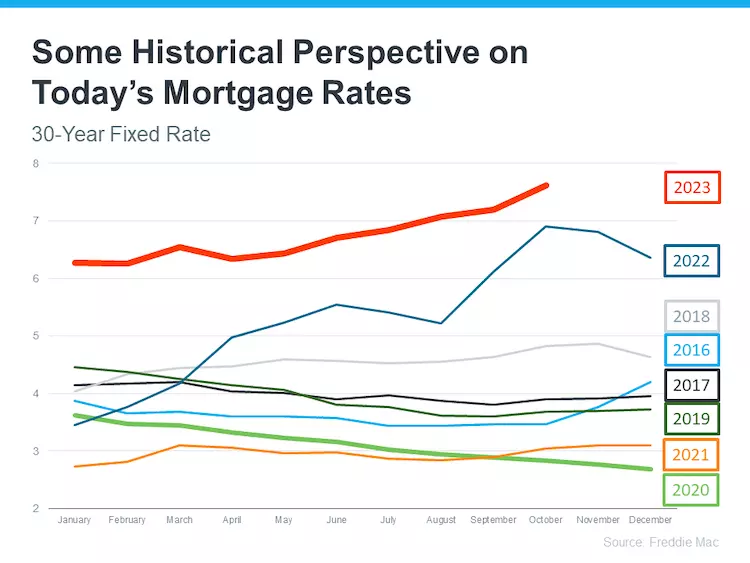

From 2016 until the beginning of 2022, home mortgage rates were under 5 percent. Then in Q2 2022, mortgage rates started to climb dramatically. As of November 30, 2023, Freddie Mac is reporting a 30-year fixed-rate mortgage at 7.22%, and a 15-year fixed-rate mortgage at 6.56%. That’s a big jump in two years.

The good news is the 30-year fixed-rate mortgage has been trending down every week since the beginning of November 2023. It started the month at 7.76% and ended the month at 7.22%, with a decrease of 0.54%. When you’re in the market as a potential home buyer looking to take on a new mortgage, a half percent can be the difference in whether you can afford a home or not, so decreases in mortgage rates are a welcomed sight for home buyers.

Line graph YOY 2016 - YTD 2023 by month of 30-year fixed mortgage rates, source Freddie Mac, Keeping Current Matters November 2023

Line graph YOY 2016 - YTD 2023 by month of 30-year fixed mortgage rates, source Freddie Mac, Keeping Current Matters November 2023

Even with the current interest rates over 7 percent, people still want to buy a home. The above graph shows the results of a survey conducted by the National Association of Home Builders. 17% of the prospective home buyers who responded to the survey in Q3 2023 said they are planning to buy a home in the next 12 months. That’s a big deal. Because that’s what the respondents said at the peak of the housing boom during the pandemic.

What does that mean for your potential home buyers? Well, the market could remain competitive with so many potential home buyers looking to get it done in the next 12 months. And, that's good news for home sellers looking to sell for the best price.

Trend: Buying Home for Multigenerational Living

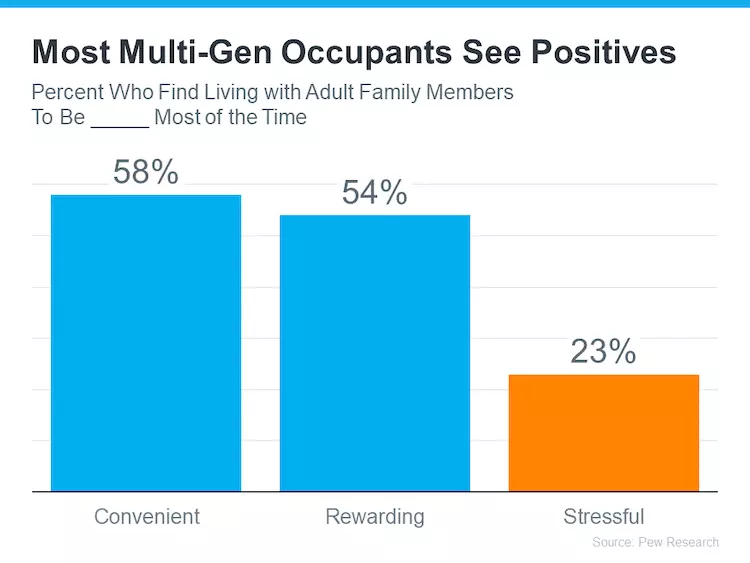

Due to the lack of inventory and the issues with home affordability right now, a growing housing market trend in December is the consideration of multigenerational living. It has become more appealing for some would-be home buyers and is not such a far-fetched idea for their family.

What is Multigenerational Living?

Multigenerational living means two or more ADULT generations living in the same house. An example could be grandparents moving in with their adult children and grandchildren. Another common option is when adult siblings share a home, and this may or may not include partners and/or children of each sibling.

From 2021 to 2022, people who chose multigenerational living increased by 30%, so this is a growing trend. In 2022, according to data from the National Association of Realtors, multigenerational homes rose to 14%, and that’s an all-time high.

Now, there are legitimate pros and cons to choosing this kind of living arrangement. Some say, no way, while others find it to be a great option.

Benefits of Multigenerational Living

- Share Expenses - Sharing the cost of the home, bills, and groceries can be a big money saver, especially for young families who are still building their finances and wealth.

- Built-in Childcare - Grandparents may find this living arrangement appealing simply because they can get more quality time with their grandkids. This also allows mom and dad the chance to take care of other responsibilities or simply go on a date!

- Care for Aging Parents - Living in the same home with an aging parent can help you keep a close eye on how they are doing, spend more quality time with them, and assist with more challenging tasks if needed.

Speaking of financial benefits, Fannie Mae announced a significant policy change recently as it pertains to multifamily living. Instead of their previous multifamily financing requirement of 15-25% down payment, they will now accept 5% down payments for owner-occupied, 2-, 3-, and 4-unit homes.

Not to mention the financial benefit we provide for our local heroes, with an average savings of $3,000 when you purchase a home with our local real estate specialist. Sign up to speak with a member of our team to find out more.

Now, that said, we need to look at potential challenges to this type of living arrangement.

Potential Issues of Multigenerational Living

- Privacy - If you’re an independent or private person, couple, or family, sharing a home with others can be challenging.

- Space - Or lack thereof, is closely related to privacy. When you put everyone under one roof, especially in a home designed for a single family, things can get cramped real quick.

- Different Beliefs, Values, and Lifestyles - When something is acceptable for one person but not for another, things can get difficult and may take some extra work and compromise to overcome.

- Stress - Taking care of grandchildren or aging parents can be difficult and even become overwhelming.

If multigenerational living is something you’re considering for your family, please be sure to have an honest conversation with all involved. Before you commit to anything, you will all need to set clear rules and boundaries. And, it might not be a bad idea to do a dry run for a short period of time to see how things go before making a life-changing decision for you and your family.

Rent vs. Mortgage Payment - Look at Net Worth Potential

The housing market trend of December, in most cases, is a rent payment will be less than a mortgage payment.

BUT, if you buy a home now with a fixed mortgage rate, more than likely your monthly mortgage payment will be locked in for the next 30 years (unless your local taxes or home insurance rates dramatically increase).

You cannot say that if you choose to rent. You’re at the mercy of the market and your landlord. If you’re considering renting long-term, what will rent be 5 or 10 years from now?

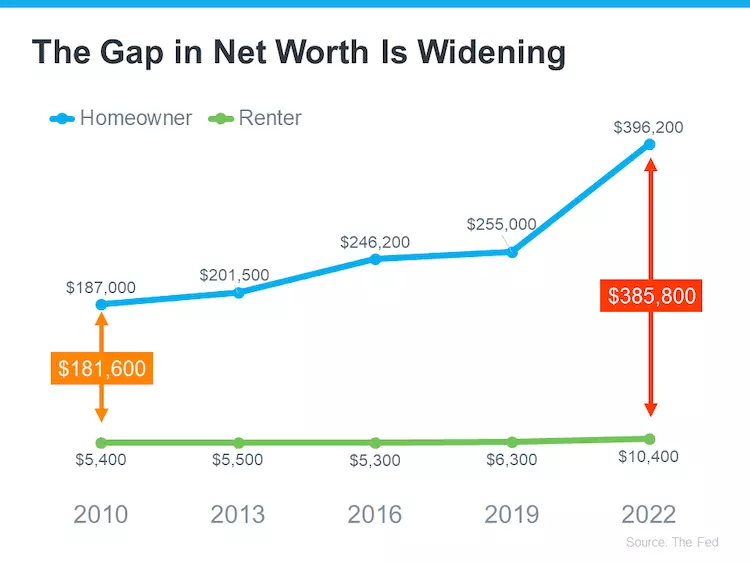

This is an important graph. The Fed does a study every three years called the Survey of Consumer Finances, where they take a look at consumer net worth between homeowners and renters.

Line graph comparative trends between homeowner vs. renter in net worth from 2010 to 2022, source federal survey consumer finance, Keeping Current Matters November 2023

Line graph comparative trends between homeowner vs. renter in net worth from 2010 to 2022, source federal survey consumer finance, Keeping Current Matters November 2023

The huge gap in 2022 between homeowner and renter will likely not continue because that likely happened due to the dramatic price appreciation and rush in home buying during the pandemic when interest rates were lower. So, the blue line will likely go down and normalize a bit.

But, the green line will likely remain flat, and the gap will likely continue to widen slightly every three years between a homeowner versus a renter’s net worth. Owning a home in the U.S. is still the #1 way to build your net worth.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military, and veterans, healthcare workers, and teachers; buy, sell, and refinance their home or mortgage. But if you work with their local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage. They refer to these savings as Hero Rewards, and the average amount received after closing on a home is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of the team. There’s no obligation. After you sign up, they will contact you to ask a few questions and help you determine the appropriate next steps for you. When you’re ready, they will connect you with their local real estate and/or mortgage specialists in your area to assist you through every step and save you money when it’s all done.

It is how Homes for Heroes and their local specialists thank community heroes, like you, for your dedicated and valuable service.

LIST OF SOURCES:

- https://www.spglobal.com/spdji/en/indices/indicators/sp-corelogic-case-shiller-us-national-home-price-nsa-index/#news-research

- https://www.fhfa.gov/DataTools/Downloads/Pages/House-Price-Index.aspx

- https://www.corelogic.com/category/intelligence/reports/home-price-insights/

- https://cdn.nar.realtor//sites/default/files/documents/hai-08-2023-housing-affordability-index-2023-10-13.pdf

- https://eyeonhousing.org/2023/10/housing-demand-caught-between-high-rates-demographics/

- https://www.pewresearch.org/social-trends/2022/03/24/financial-issues-top-the-list-of-reasons-u-s-adults-live-in-multigenerational-homes/

- https://www.federalreserve.gov/publications/files/scf23.pdf