Image Source: sanaulac.vn

Image Source: sanaulac.vn

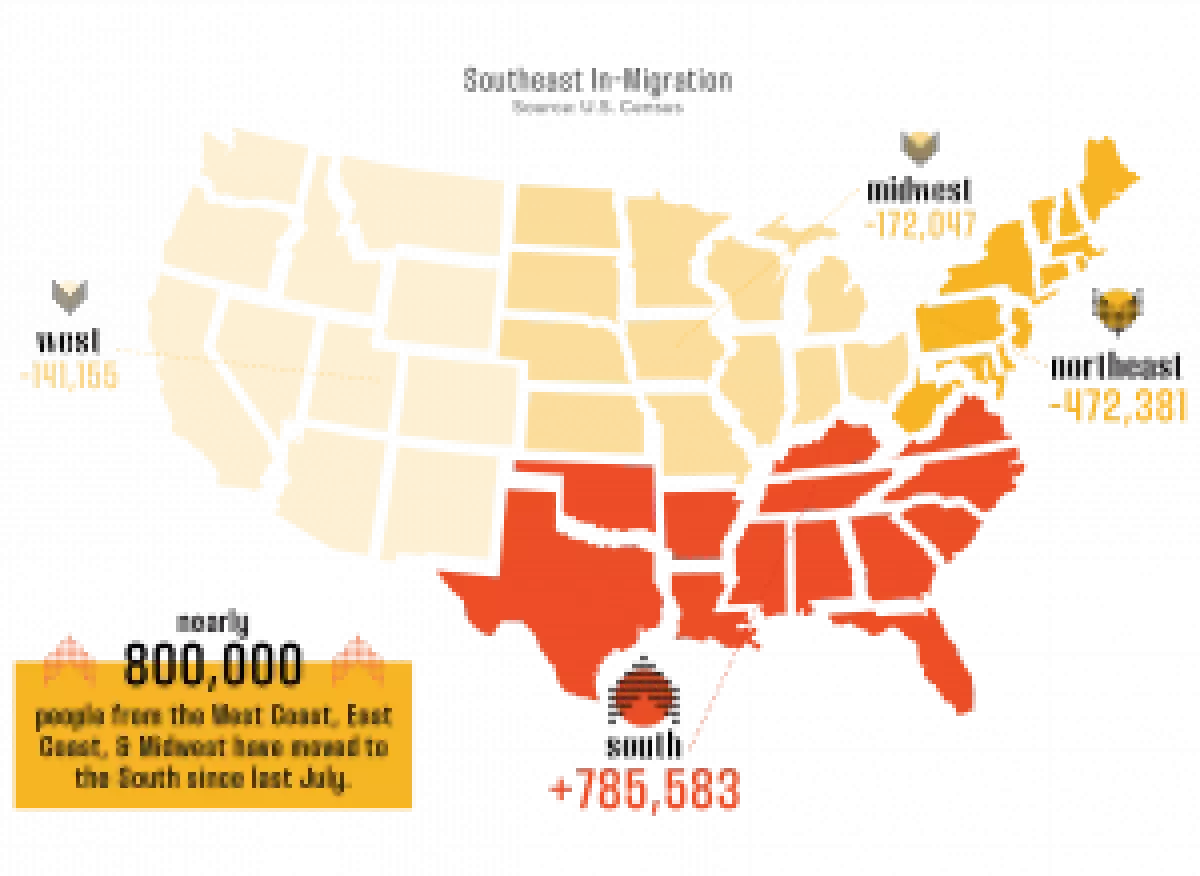

The COVID-19 pandemic prompted a reevaluation of housing, lifestyle, and workplace preferences. People sought refuge from crowded cities and looked for affordable living costs, open spaces, and vibrant entertainment options. This shift in demand has turned the Southeast into a popular destination for relocation, attracting both individuals and investors.

Industrial Market on the Rise

The Southeast boasts one of the strongest industrial supply pipelines in the country. The rise of e-commerce and the need for manufacturing and shipping centers have fueled the demand for industrial assets. Companies are now opting for more rural, cost-effective regions to house their warehouses. The Southeast's business-friendly metros have attracted manufacturing and logistics companies, leading to historic market pricing and low vacancy rates.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

Atlanta's Industrial Boom

Atlanta, the capital city of Georgia, has established itself as a regional and national distribution hub. The city's robust infrastructure, strong workforce, international airport, and port access have attracted Fortune 500 companies like Amazon, Delta, and Microsoft. As competition increases, industrial rent rates in Atlanta have seen a staggering 12.9 percent year-over-year growth.

Multifamily Market Recovery

The Southeast's multifamily market has rebounded significantly since the pandemic. Most markets are experiencing a robust recovery, with record-high rent growth and historically low vacancy rates. The influx of Fortune 500 companies to the region has fueled the need for housing, attracting investors seeking strong demographics and tax-friendly business environments.

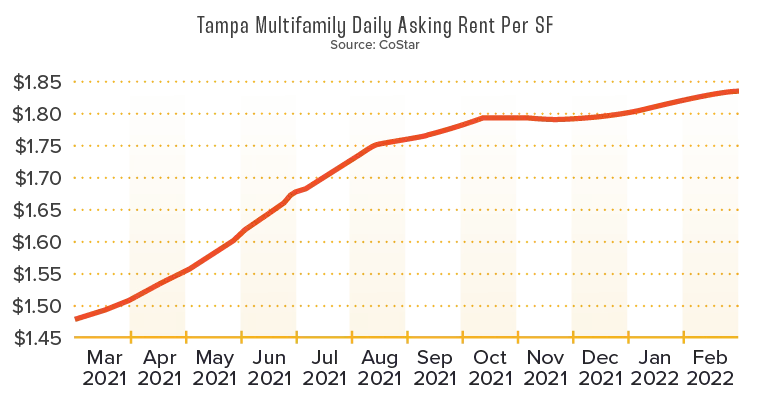

Tampa & Fort Lauderdale's Multifamily Boom

Tampa and Fort Lauderdale have witnessed extraordinary growth in the multifamily sector. Tampa's record move-ins in 2021 have driven pricing and pushed vacancy rates below five percent. Fort Lauderdale has experienced considerable rent growth, increased leasing activity, and net absorption. The slow supply pipeline in Fort Lauderdale has added to the competitive and pricey market.

The Carolinas' Expanding Apartment Markets

The Carolinas have seen rapid expansion in their apartment markets, particularly in higher-end properties. Charlotte's average rent per square foot is slightly below the national average, but the city boasts a vacancy rate of only 3.7 percent. The Carolinas offer more affordable rent rates compared to other Southeastern cities, attracting tenants and investors alike.

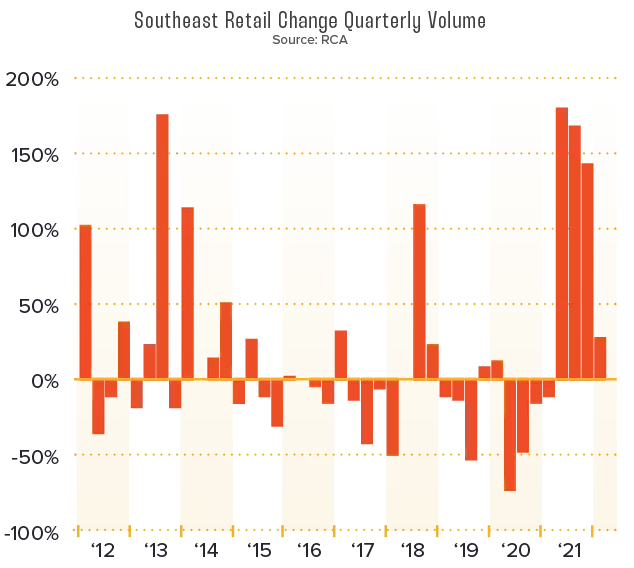

Retail Resurgence

Southeast retail has thrived with the influx of new consumers to the region. Out-of-state investors from New York and California have driven activity, putting pressure on local investors. Discount retailers, grocery-anchored centers, and fitness centers are performing exceptionally well in the Southeast, catering to the evolving consumer preferences.

Miami's Lucrative Retail Market

Miami's retail market is one of the most expensive in the U.S., with cap rates well below the national average. The city's strong development pipeline, combined with intense competition, makes it a challenging market to enter. However, Miami continues to attract investors with its high sales volume and prime location.

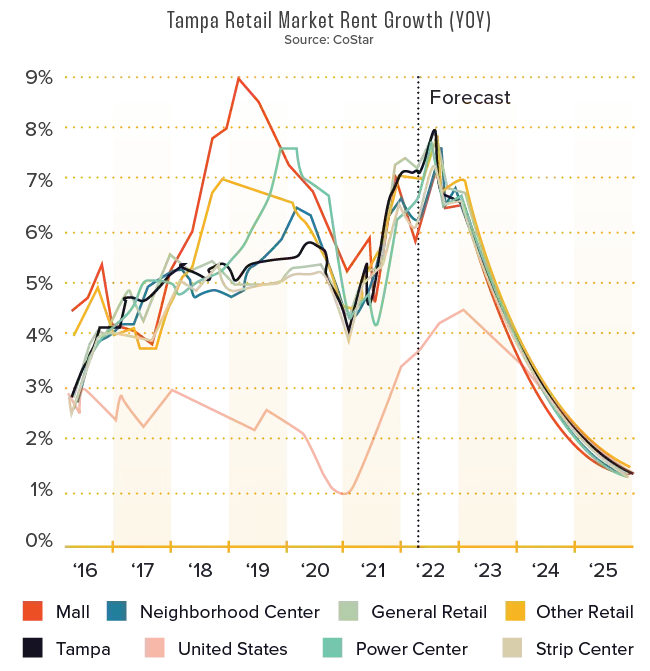

Tampa's Tourist-Friendly Retail Sector

Tampa's retail sector benefits not only from the local population but also from a strong tourist presence. The city's tourism quickly rebounded after the pandemic, contributing to its retail sector's recovery. Downtown Tampa, in particular, has seen significant development activity, including the Water Street Tampa project, a multi-billion dollar development that promises a mix of retail, residential, and commercial spaces.

Shopping Centers Evolving

Shopping centers in the Southeast have adapted to changing consumer habits by offering a mix of retail and entertainment experiences. Landlords who have embraced this evolution have enjoyed strong occupancy and tenant performance.

Nashville's Dynamic Retail Landscape

Nashville is a prime example of how retail and shopping centers are evolving. The city's rapid expansion in jobs and population has paved the way for new development projects that cater to changing consumer habits. Mixed-use projects, such as Fifth + Broadway, have become increasingly common, offering more than just retail spaces.

A Promising Future

The Southeastern market is poised for continued growth in commercial real estate sectors. Industrial and multifamily assets are top performers, attracting investors with their strong sales volume and transaction activity. Retail in major metros is setting record highs in rent and record lows in vacancies. As investors pursue safe and profitable opportunities, the Southeast remains resilient and well-positioned for long-term growth.

Conversationally written by an accomplished SEO specialist and skilled copywriter.