If you've ever wondered about the earning potential of real estate agents in California, you're not alone. With the diverse landscape and varying housing markets, it's no surprise that the salaries of real estate agents in the Golden State can differ greatly. In this article, we'll take a closer look at the average earnings of California agents and explore the factors that contribute to this variation.

The Average Salary of Real Estate Agents in California

According to research conducted by Indeed.com in the fall of 2022, the average annual salary for real estate agents in California was $91,363. However, it's important to note that this figure only provides a general overview. To truly understand the earning potential in this profession, we need to delve deeper into the details.

Factors Influencing Real Estate Agent Earnings

As with any occupation, real estate agent salaries can be influenced by a multitude of factors. One such factor is the amount of time and effort invested in the job. It's no secret that hard work pays off, and the same principle applies to real estate. The more hours and dedication put into serving clients and closing deals, the higher the potential earnings.

Location is another key factor that affects real estate agent salaries. In California, just like in any other state, the housing market varies from region to region. The larger metropolitan areas, such as Los Angeles and San Francisco, present different opportunities and challenges compared to more rural areas. Therefore, it's not surprising to see significant differences in earnings between agents in different parts of the state.

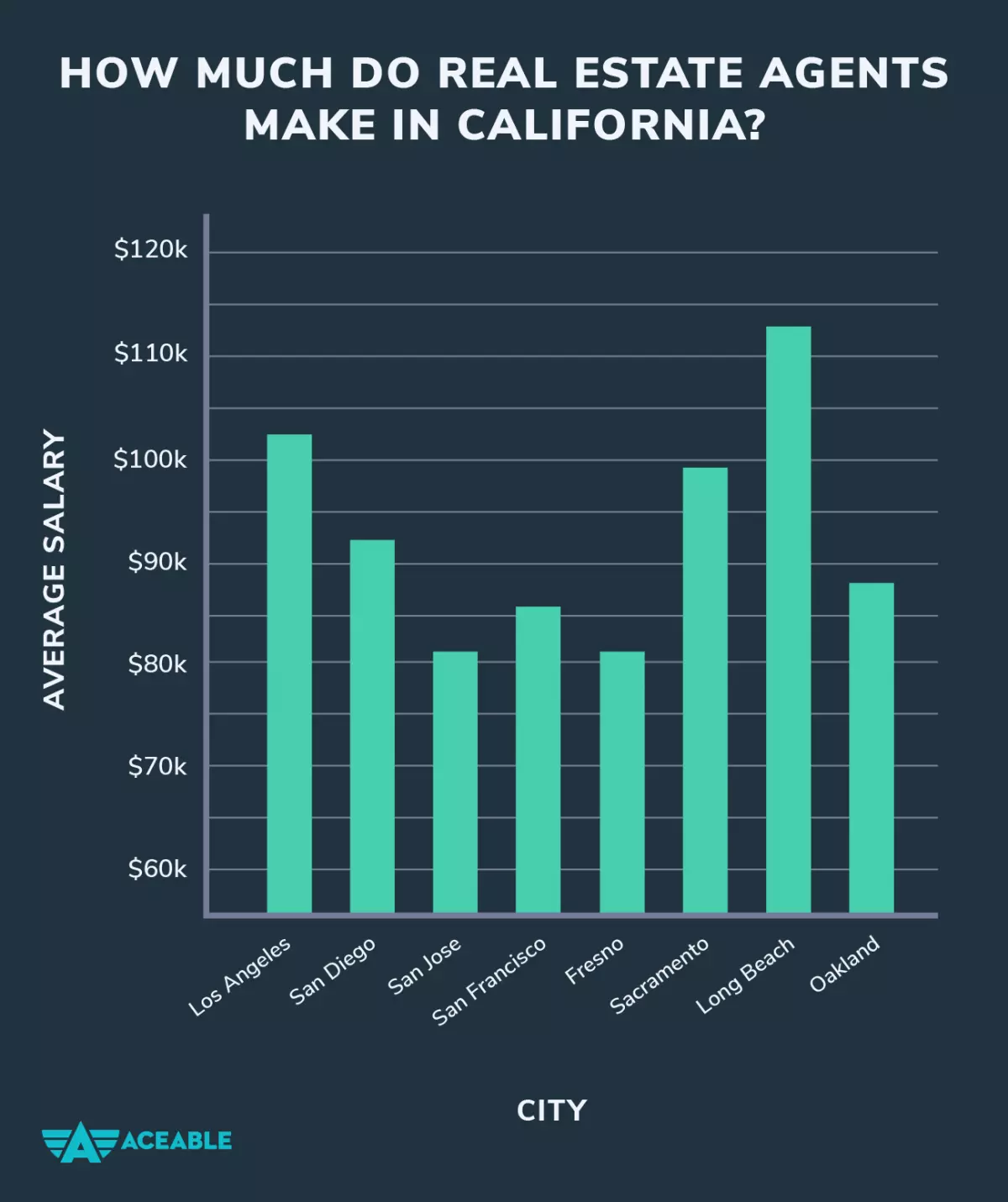

Real Estate Agent Earnings in California's Metros

To understand the disparities in real estate agent earnings within California, we can look at the largest cities in the state. According to Indeed.com's research, here's what real estate agents are making in the 10 largest cities:

- Los Angeles: $83,840

- San Diego: $77,901

- San Jose: $93,847

- San Francisco: $102,964

- Fresno: $62,047

- Sacramento: $68,835

- Long Beach: $71,371

- Oakland: $87,314

- Bakersfield: $51,227

- Anaheim: $74,473

Remember, these figures represent average salaries and can vary depending on individual circumstances and market conditions. It's essential to consider these numbers as a starting point rather than a definitive benchmark.

Understanding Agent Commission Splits in California

When it comes to real estate transactions, commission splits play a vital role in determining how much agents take home. In California, there are several commission splits to consider.

Firstly, the total commission paid by the seller typically ranges from 1% to 6% of the sales price. The standard commission falls between 5% and 6%. However, high-priced properties, valued at $1 million or more, might have a lower commission rate of 4% to 5%. The exact amount is negotiated between the seller and the listing agent before signing the contract.

The commission split between the listing agent and the buyer agent is usually 50/50. Occasionally, a listing might provide a higher split to the buyer agent to attract more leads. On the other hand, the listing agent might offer just 2.5% to the buyer agent while taking 3.5% to cover selling expenses.

Dual agency is another possible scenario, wherein the listing agent represents both the buyer and the seller. In such cases, the listing agent receives the full commission.

Finally, the commission split between the agent and the broker must be considered. The broker receives the proceeds from a sale and then pays the agent their share. The commission split can vary from agent to agent, even within the same brokerage. New agents may start with a 50/50 split, while seasoned agents can negotiate splits of 70/30 or 80/20.

It's worth noting that there are other commission scenarios to consider, such as paying a monthly broker fee and keeping 100% of the commission, or a sliding scale commission split that becomes more advantageous as sales increase. Additionally, be aware of potential additional broker fees per sale, month, or year.

Tax Considerations for California Real Estate Agents

Last but not least, taxes play a significant role in determining the net income of real estate agents in California. As independent contractors, agents are responsible for paying their own taxes, including income tax and the self-employment tax, which covers Medicare and Social Security taxes.

California, known for its high taxes, has a progressive income tax system with ten different tax brackets. The highest state income tax bracket is 12.3%, but that only applies to individual income over $625,370 or married-filing-jointly income over $1,250,739. California agents and brokers can expect to pay anywhere between 0% and 9.3% in state income tax.

Therefore, it's crucial for real estate agents in California to set aside a portion of their earnings for taxes and make estimated quarterly tax payments to the IRS.

Conclusion

Being a real estate agent in California offers the potential for a rewarding career. While the average annual salary for California agents stands at $91,363, it's important to recognize the variations based on factors such as location, commission splits, and taxes. By understanding the nuances of the real estate market in California and maximizing their efforts, agents can aim to become some of the highest-paid professionals in their field.

How much do real estate agents make in California? Image Source: Sanaulac.vn

How much do real estate agents make in California? Image Source: Sanaulac.vn