Real estate is widely regarded as one of the best asset classes for building wealth. It offers the potential for both capital appreciation and a steady cash flow through rents or dividends. In this article, we will explore how you can earn income by investing in Fundrise eREITs, which are private real estate funds available online.

Fundrise - A Leader in Real Estate Crowdfunding

Fundrise, founded in 2012 in Washington DC, is a leading real estate crowdfunding platform with over $3.3 billion in assets. They are pioneers in the eREIT space and offer both accredited and non-accredited investors an opportunity to invest in commercial real estate across the country.

Previously, only high net worth individuals and institutional investors had access to this mid-market segment of real estate. Fundrise has democratized real estate investing, allowing everyday investors to benefit from this lucrative asset class.

Fundrise Income Opportunities

Real estate investments generate returns through income and appreciation. Dividends are a distribution of rental payments or investment proceeds after a sale. With Fundrise eREITs, investors receive income in proportion to their share ownership.

For example, if one person owns 100 shares and another person owns 1,000 shares of the same investment, the latter is entitled to a 10X greater portion of the return. Dividend returns are prorated based on ownership duration, meaning investors receive their share of income earned during their ownership.

How Fundrise eREIT Generates Income

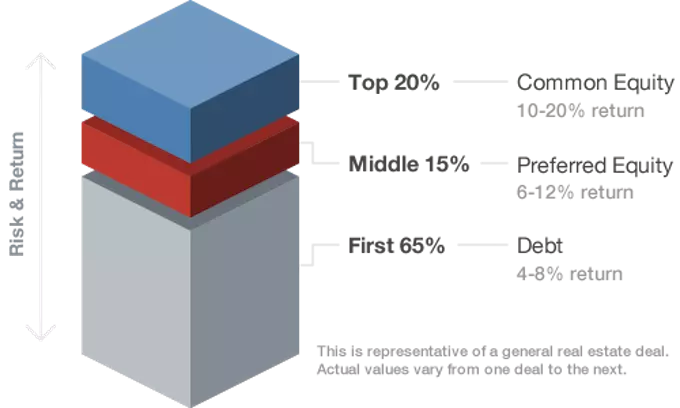

Fundrise eREITs generate income through loan interest payments and equity investments. Debt investments involve lending money to real estate developers who pay interest on the principal lent. Loans typically carry a fixed interest rate, making them a reliable source of income.

Fundrise carefully selects debt investments that offer strong positions to investors, such as senior secured debt and mezzanine debt. These investments safeguard against losses and provide potential income. With senior debt investments, investor capital is senior to the sponsor or borrower, ensuring payment priority.

Equity investments, on the other hand, provide income potential through a claim on a percentage of rental income from properties. Fundrise eREITs invest in a diverse portfolio of properties, some of which are sold after improvements for profits, generating additional cash flow.

Fundrise Dividend Distribution

Fundrise eREITs are legally required to derive at least 75% of their gross income from real estate-related sources and distribute at least 90% of their taxable income as dividends. Dividends are paid in cash, and many investors choose to reinvest them through Fundrise's dividend reinvestment program.

The payout of dividends is not dependent on the value of the shares themselves, so investors don't need to sell any shares to receive dividends. This passive approach to investing allows for a stream of "residual" income without any added effort.

Real Estate Appreciation Potential

While generating a steady stream of income, real estate investments can also appreciate in value. When a property is sold, equity investors can realize gains in addition to the income earned during the investment period.

Appreciation can be captured throughout the investment's lifetime, but some is only realized at the property level upon sale. Fundrise eREITs allow investors to hedge and keep the income flowing by investing in a portfolio of properties with turnover over time.

Three Fundrise Investment Plans

Fundrise offers three investment plans to cater to different investor preferences.

1. Supplemental Income Plan

The Supplemental Income Plan is designed to earn more income than appreciation. It focuses more heavily on debt investments, which provide a steady stream of income through dividends. While the potential lump sum payment capturing appreciation may be smaller, regular dividend payments are larger in this plan.

2. Long-Term Growth Plan

The Long-Term Growth Plan aims to capture returns from property appreciation over the long term. It is weighted towards eREITs that allow investors to benefit from potential increases in property values. Regular dividends are still provided through a mix of debt and equity investments.

3. Balanced Plan

The Balanced Plan combines elements of the Supplemental Income and Long-Term Growth Plans. Investors seeking both income and potential appreciation can find a middle ground with this plan. It offers a balanced allocation between debt and equity investments.

Fundrise Growth and Performance

According to their Form 1 Semi-Annual Report, Fundrise manages over $3.3 billion in assets and has over 400,000 active investors. Their platform portfolio has yielded an impressive 10.79% average return over five years. In comparison, the Vanguard Total Stock Market ETF and the Vanguard Real Estate ETF have achieved returns of 7.92% and 7.4%, respectively.

Fundrise's outperformance in 2018, with a more than 14% return over the Vanguard Total Stock Market ETF, showcases their success. Their model of diversifying into real estate through a direct, low-cost technology platform has proven to be a superior investment alternative to owning only publicly traded stocks and bonds.

Explore Fundrise eREITs

If you are looking for a passive way to invest in real estate with less hassle and lower capital outlay, Fundrise is worth exploring. By investing in a Fundrise eREIT, you can diversify your holdings and potentially benefit from the income and appreciation offered by commercial real estate.

Consider the available investment plans, such as the Supplemental Income Plan for dependable income or the Long-Term Growth Plan for potential appreciation. Diversifying into non-coastal city real estate markets with Fundrise can be a great opportunity, especially considering lower valuations and higher yields.

About the Author

Sam started Financial Samurai in 2009 as a way to make sense of the financial crisis. He has extensive experience in the finance industry, having worked at Goldman Sachs and Credit Suisse for 13 years. Sam owns properties in San Francisco, Lake Tahoe, and Honolulu, with a significant investment in real estate crowdfunding.

After achieving financial freedom at the age of 34, Sam enjoys sharing insights on achieving financial independence and helping others along their journey. Fundrise is a sponsor of Financial Samurai, and Sam has invested over $134,000 in Fundrise funds, diversifying away from expensive San Francisco real estate.

Remember, investing in real estate involves risks, and it is important to do thorough research and consider your investment goals before making any decisions.