As an avid investor in private real estate deals and funds for the past seven years, I'm now reaping the rewards of my investments. With the window for receiving distributions opening up, I'm excited to share my experiences and insights with you. Investing in heartland real estate has proven to be a wise decision, particularly due to the unexpected impact of the pandemic as people flocked to more affordable areas of the country.

While I did encounter a few setbacks with some investments in one fund, overall, the majority of my investments have yielded positive returns. One notable success story was a multifamily investment that recently paid out $122,423.04 in distributions, resulting in an impressive compound annual return of approximately 15.3% over five years. It's important to note that this investment is part of a fund that encompasses over 10 properties, demonstrating the power of diversification.

Image Source: Sanaulac

Image Source: Sanaulac

Seven Takeaways From Investing In Private Real Estate For Seven Years

Receiving a substantial amount like $122,423.04 in private real estate distributions has had a significant impact on my financial well-being. It provides a comforting sense of security for my family of four, especially considering the uncertainties of our current times.

This windfall also came as a pleasant surprise, given that my total distributions for the year prior to this were only $2,603 from a RealtyShares fund now managed by IIRR Management Services. Therefore, I believe it's essential to share my thoughts on long-term private real estate investing, particularly with platforms like Fundrise, which happens to be my favorite.

Image Source: Sanaulac

Image Source: Sanaulac

1) Investing is a temporary expense

One crucial mindset shift in wealth-building is treating investments as necessary expenses. By doing so, you're securing your financial future and creating a safety net for when you decide to step away from work. This recent windfall has only reinforced my confidence in providing for my family during uncertain times. As properties are sold and investments mature, the initial expenses incurred transform into liquid assets that continue to generate income.

If your goal is to accumulate wealth while enjoying your present lifestyle, consider "tricking" yourself into allocating as much as possible towards investments. The more you invest, the greater your potential returns.

2) Take action on your investment thesis

When I initially invested in private real estate in 2016, 2017, and 2018, I didn't know for certain how heartland real estate would perform. However, based on my thesis following Trump's election victory in 2016, I took a leap of faith and invested a total of $810,000 across various funds and individual properties. My belief in the BURL real estate investing rule and the availability of real estate crowdfunding platforms made it easier to act on my convictions.

It's crucial to take risks and act on your investment thesis. By doing so, you may experience both gains and losses along the way. However, these experiences will allow you to diversify your portfolio and fine-tune your investment strategies.

3) Give your investments time to compound

One of the most appealing aspects of investing in private real estate is that it often takes years to generate returns. This goes against the prevailing desire for immediate gratification. Many of the funds I've invested in deploy their raised capital over a three-year period, followed by distributions over a span of 5-10 years.

The longer you let your investments compound, the greater your overall returns are likely to be. As a real estate investor, aim to adopt a long-term approach. Although challenges may arise, such as tenant issues or property maintenance, rest assured that your returns can be generated without having to handle these day-to-day concerns. Selecting the right sponsors and identifying the best real estate deals is key, as it can be challenging to evaluate opportunities in a timely manner. This is why I prefer investing in real estate funds as they provide a diversified portfolio of properties.

Investing long-term provides mental relief

Once you've committed your capital to a private investment, you can often forget about it for a significant period. While you will receive quarterly statements on the progress of your investments, for the most part, you can relax knowing that a team of professionals is looking after your best interests. They are incentivized to perform well, as their success is tied to future business opportunities. As a father responsible for my family's financial security, entrusting my capital to experienced investment professionals relieves me of a considerable mental burden.

Sometimes, accumulating significant capital can create pressure to act hastily without considering the potential risks. It's crucial to strike a balance between spending and investing intentionally.

4) To invest easier, think of your capital being in separate buckets

Making it easier to reinvest a substantial amount of money requires a strategic approach. When I sold my rental property, I reinvested $550,000 into private real estate investments by considering these funds as part of the same real estate bucket. By doing so, I could make investments of $50,000 to $75,000 at a time.

After reducing my exposure to San Francisco real estate by selling a property for $2.74 million ($800,000 mortgage, $2.74 million selling price), I diversified and reinvested a portion of the proceeds in real estate opportunities elsewhere in America. San Francisco offered a cap rate of only 2.5%, whereas other areas provided an 8% cap rate. By reallocating my capital, I could invest 1/3rd less and still earn the same income.

I chose to spread the remaining $1.25 million among stocks and California municipal bonds, as I became more risk-averse after becoming a father in 2017. Thinking in terms of separate buckets and percentages can make reinvesting more manageable, particularly when faced with a significant amount of capital to allocate.

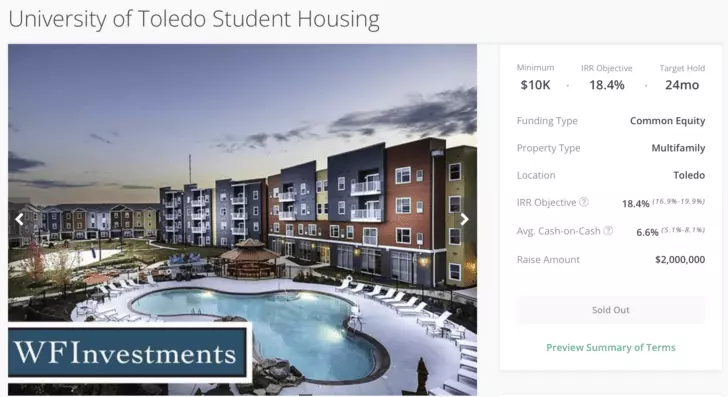

5) You will likely lose money, so don't forget to diversify

Despite the recent windfall, I must acknowledge that not all investments have been successful. I experienced a complete loss with one investment in a fund, resulting in my $50,000 position going to zero. This particular investment was a student housing complex in Toledo, Ohio, which proved to be a failure due to various factors such as excessive spending by the sponsor, lack of equity cushion, and the impact of the COVID-19 pandemic.

It's crucial to diversify your private real estate portfolio to mitigate the risks associated with individual investments. Extensive due diligence on sponsors is necessary, even when investing through platforms like CrowdStreet or RealtyMogul. While these platforms perform their due diligence, it's essential to go a step further and evaluate the sponsor's track record, returns, and leadership experience. Unexpected events can occur, underscoring the importance of diversification.

Beware: All Marketing Material For A Real Estate Deal Looks Great

When evaluating real estate investment opportunities, it's vital not to be swayed solely by marketing material. Every deal may seem appealing if marketing is executed effectively. Always approach investments with a healthy degree of skepticism and carefully assess potential risks.

Platform risk is also a consideration. For instance, PeerStreet, a real estate debt platform, filed for bankruptcy recently. While existing debts are unaffected, creditors to PeerStreet will bear the consequences. Conduct thorough research before making any investment decisions, and remember that losses are inevitable when investing in risk assets. Therefore, it's crucial to invest in a risk-appropriate manner and diversify your portfolio.

6) Live where you want, invest where the returns are potentially the highest

One of the significant benefits of investing in private real estate syndication deals is the flexibility to invest where the potential returns are greatest while living in a location of your choice. Money today is more fungible and fluid, thanks to innovation and the internet. Harnessing these advancements allows you to take advantage of investment opportunities in profitable areas while residing in your preferred location. This has been particularly evident with the recent trend of people relocating to lower-cost areas of the country.

Image Source: Sanaulac

Image Source: Sanaulac

7) To reduce tax liability, forecast your real estate investment distributions

If you anticipate a significant amount of investment distributions in a particular year, it's wise to plan ahead to optimize your tax liability. For instance, if you foresee a surge in distributions, you may choose to work less or reduce side hustles. Small business owners have the advantage of adjusting their own income and capital expenditure to optimize their tax situation.

Conversely, if you expect fewer distributions, you may choose to increase your income without incurring a substantial tax bill. This can be achieved through taking on additional consulting jobs or reducing capital expenditure, which can lead to a higher business income.

Creating a spreadsheet to map out your anticipated distributions year by year can help you plan accordingly. For example, my forecast for 2022 involved projecting $112,800 in total real estate crowdfunding distributions, of which approximately $62,423 constituted taxable gains.

How I Reinvested The Real Estate Proceeds

Fortunately, I didn't require the $122,423 windfall for immediate financial needs. Consequently, I distributed the proceeds across various investment opportunities. Here's how I allocated the funds:

- 30% to a Fundrise fund that focuses on single-family homes in the Sunbelt

- 20% to fund my capital calls for two Kleiner Perkins venture funds

- 10% to a new venture debt fund

- 25% in the S&P 500 and tech stocks that experienced a downturn

- 10% to US Treasury bonds yielding over 5%

- 5% as a donation to the Pomeroy Rehabilitation Center for disabled youth and adults

The goal is to approach investment and reinvestment in a methodical manner. By continuously allocating and reinvesting capital, I aim to optimize returns. For instance, I hope to see the initial $122,423 grow to $200,000 in the next five years. Additionally, I believe there's an opportunity to purchase real estate in 2023 as prices potentially soften due to high mortgage rates. I anticipate a decline in mortgage rates in subsequent years, coupled with unleashed pent-up demand. Life goes on, and people still get married, have children, find new jobs, and more.

Real Estate Is The Gift That Usually Keeps On Giving

As a real estate investor, your primary goal is to hold on to your investments for as long as possible. This philosophy aligns with owning stock index funds, where prolonged holding often leads to greater returns. Eventually, though, it's essential to enjoy the fruits of your investments and improve your quality of life.

Receiving distributions from private real estate investments is akin to receiving surprise gifts. The exact amount and timing may be uncertain, but the investments made in the past ensure that these gifts will eventually materialize. Presently, nearly 50% of my passive income portfolio comes from real estate investments. Without the income generated from severance and rental properties, I would not have had the courage to leave my job in 2012.

Investing In Physical Assets Provides Comfort

Looking ahead, I'm investing in real estate for the benefit of my two young children. I believe that in 20 years, they will marvel at how inexpensive real estate prices were in our time. Therefore, I'm investing in real estate on their behalf, as they are not yet able to do so themselves.

The same principle applies to investments in rare books with autographs. While some may question the rationale behind such investments, I find joy in reading and investing in physical products that can be cherished. The initial investment required for rare books is minimal, but the potential returns can be enormous.

Investing in physical assets brings both financial potential and the enjoyment of ownership. Even if the returns do not meet expectations, you will have still derived pleasure from your investments during the holding period. Additionally, it's crucial to diversify your investments to manage risk effectively.

I have cherished memories associated with various properties I've owned, as well as collections like Chinese coins and my father's baseball memorabilia. It's important to savor your investments and your life simultaneously—a winning combination.

Private Real Estate Questions And Suggestions

Are you a private real estate investor? What has your experience been, particularly since the pandemic began? If you've recently received a real estate investment windfall, how are you reinvesting the proceeds?

My favorite platform for private real estate investing is Fundrise, which allows you to build a passive income stream. With over $3.5 billion under management and more than 400,000 investors, Fundrise focuses on single-family and multi-family properties in the Sunbelt region. Sign up and explore the opportunities they offer.

Image Source: Sanaulac

Image Source: Sanaulac

For more in-depth personal finance content, join over 65,000 other subscribers and sign up for the free Financial Samurai newsletter. Launched in 2009, Financial Samurai is one of the largest independently-owned personal finance websites.

Remember, investing in private real estate can provide a reliable stream of income that contributes to your financial well-being. Embrace the opportunities it presents and enjoy the journey towards greater financial freedom!