Understanding IRS Form 8582 Instructions

IRS Form 8582 is an essential document for noncorporate taxpayers who want to report passive activity losses and offset them against passive activity income. By using this form, taxpayers can effectively manage their taxable income and reduce their overall tax liability.

In this comprehensive guide, we will walk you through the important details of IRS Form 8582, ensuring that you have a clear understanding of its purpose and how to complete it accurately. Whether you're a tax professional or an individual taxpayer, this guide will provide you with valuable insights and step-by-step instructions.

How to Complete IRS Form 8582

Part I: Passive Activity Loss

Before we delve into the specific sections of the form, it's important to note that Parts IV and V must be completed before starting with Part I. We will follow the chronological order presented on the form to simplify the process.

In Part I, you will include the calculations from two sections:

- Lines 1a-1d: Real estate rental activities with active participation (from Part IV).

- Lines 2a-2d: All other passive income activities (from Part V).

Line 1

To complete Line 1, you will enter the following:

- Line 1a: Enter the amount from Part IV, column (a).

- Line 1b: Enter the amount from Part IV, column (b).

- Line 1c: Enter the amount from Part IV, column (c).

- Line 1d: Combine lines 1a-1c.

Line 2

For Line 2, follow these steps:

- Line 2a: Enter the amount from Part V, column (a).

- Line 2b: Enter the amount from Part V, column (b).

- Line 2c: Enter the amount from Part V, column (c).

- Line 2d: Combine lines 2a-2c.

Line 3

On Line 3, you will combine lines 1d and 2d.

- If Line 1d shows a loss, proceed to Part II.

- If Line 2d shows a loss and Line 1d is zero or more, skip Part II and proceed to Line 3 (Part III).

Part II: Special Allowance for Rental Real Estate Activities with Active Participation

In Part II, you will calculate the maximum special allowance for real estate rentals.

Line 4

On Line 4, enter the smaller number of:

- Loss on Line 1d.

- Loss on Line 3.

Line 5

For Line 5, enter $150,000, unless your filing status is Married Filing Separately (MFS). If that's the case, follow the form instructions and enter $75,000.

Line 6

Enter your modified adjusted gross income (MAGI) on Line 6. For this form, MAGI includes your adjusted gross income (AGI) minus the following:

- Passive income or loss included on Form 8582.

- Rental activity losses allowed to real estate professionals.

- Overall loss from a publicly traded partnership (PTP).

- Taxable Social Security and Tier 1 railroad retirement benefits.

- Deductible IRA contributions.

- Deductible contributions to select pension plans.

- Deduction allowed for the deduction of self-employment income taxes.

- Interest income exclusion from Series EE and I savings bond used to pay higher education expenses.

- Exclusion of amounts received under an employer’s adoption assistance program.

- Student loan interest deduction.

- Deductions allowed for foreign-derived intangible income.

If Line 6 is greater than Line 5, skip Lines 7 and 8 and enter '0' on Line 9. Otherwise, proceed to Line 7.

Line 7

Subtract Line 6 from Line 5.

Line 8

Multiply Line 7 by 50%, but don't enter a number greater than:

- $25,000 if filing under a household status other than MFS.

- $12,500 if filing as MFS.

Line 9

Enter the smaller of Line 4 or Line 8. If Line 6 was greater than Line 5, enter '0'.

Part III: Total Losses Allowed

In Part III, you will calculate the total passive losses allowed.

Line 10

Add the total income from Lines 1a and 2a.

Line 11

Add Lines 9 and 10 and enter the total here. You will use Parts IV through IX to determine which unallowed losses will be carried forward to future tax years and which allowed losses you can use to lower your taxable income, as well as where to report them on your tax return.

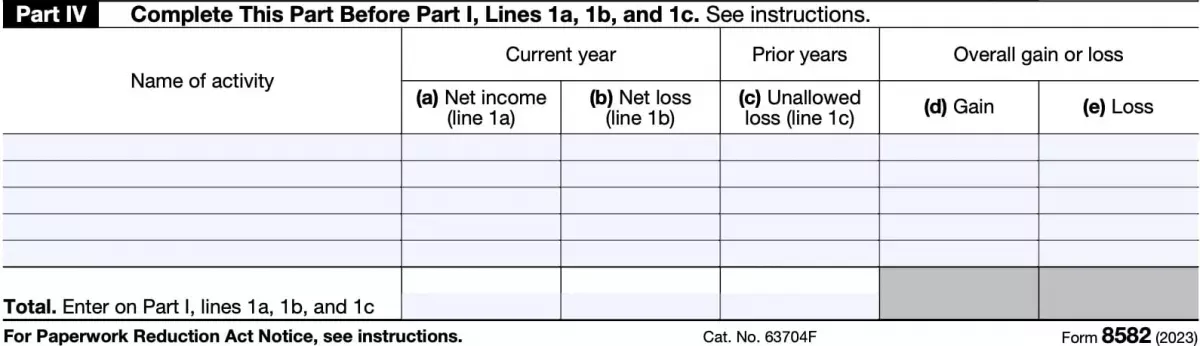

Part IV and Part V: Completing Rental Real Estate and Other Passive Activities

Part IV and Part V of IRS Form 8582 provide detailed sections to report rental real estate activities and other passive activities. These sections will help you determine the amounts you need to enter on Part I of the form.

For a visual reference, please see the images below:

Caption: Taxpayers need to complete Part IV before Line 1

Caption: Taxpayers need to complete Part IV before Line 1

Caption: Complete Part V before starting Lines 2a, 2b, and 2c

Caption: Complete Part V before starting Lines 2a, 2b, and 2c

Part VI: Allocation of Special Allowance for Rental Real Estate Activities

If an amount is shown on Part II, Line 9, you will use Part VI to allocate the special allowance among your rental real estate activities. List all activities with an overall loss in Column (e) of Part IV.

For each activity, list:

- Activity name.

- Form or schedule and line number (e.g., IRS Schedule E, Line 28A).

- Column (a): Loss.

- Column (b): Ratio.

- Column (c): Special allowance.

- Column (d): Subtract Column (c) from Column (a).

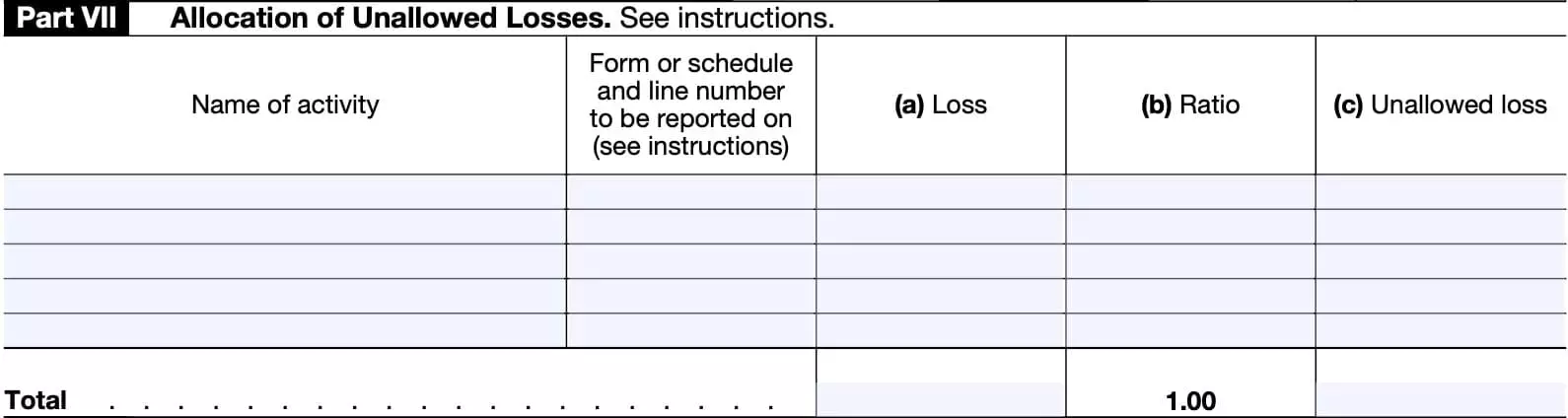

Part VII: Allocation of Unallowed Losses

Complete Part VII if any activities show an overall loss in Column (e) of Part V or losses in Column (d) of Part VI (or Column (e) of Part IV if Part VI is not applicable).

For each activity, include:

- Activity name.

- Form or schedule and line number.

- Column (a): Loss.

- Column (b): Ratio.

- Column (c): Unallowed loss.

To calculate the unallowed loss for Column (c), follow these steps:

- Line A: Enter, as a positive amount, Part I, Line 3.

- Line B: Enter Part II, Line 9.

- Line C: Subtract Line B from Line A.

Next, multiply the ratio in Column (b) by the amount in Line C. This is the number you'll place in Column (c) for each activity.

Part VIII: Allowed Losses

Use Part VIII for any activity listed in Part VII where the entire loss is reported on one form or schedule without the need to identify separate transactions.

For each activity, list:

- Activity name.

- Form or schedule and line number.

- Column (a): Loss.

- Column (b): Unallowed.

- Column (c): Allowed loss.

For Column (a), add the total losses reported in Columns (b) and (c) from Parts IV and V.

Column (b) is the same number as Column (c) from Part VII.

To calculate Column (c), subtract Column (b) from Column (a). This is your allowed loss.

Part IX: Activities with Losses Reported on Two or More Forms or Schedules

Part IX is intended for taxpayers with activities that have losses reported on two or more forms or schedules, and those losses cause a difference in tax liability or fall into different sections of the same schedule.

Examples of forms and schedules that might be involved include:

- IRS Schedule C, Profit or Loss from Business.

- IRS Schedule E, Supplemental Income & Loss.

- IRS Schedule F, Profit or Loss from Farming.

- IRS Form 8949, Sales and Dispositions of Capital Assets.

Due to the complexity of this part, it is recommended to have a tax professional assist you. However, you can find additional instructions on the IRS website, which provide guidance based on the forms and schedules involved.

Who Needs to File IRS Form 8582?

Individuals, estates, and trusts that have passive activity deductions are required to file IRS Form 8582, unless they qualify for an exception.

Passive Activity Loss Exceptions

There are certain exceptions to the passive activity loss limitations:

- Taxpayers who qualify for a special allowance as a real estate professional actively participating in rental real estate activities.

- Taxpayers who sell their interest in the passive activity in the same tax year as incurring the activity loss.

Special Allowance for Rental Real Estate Activities

Real estate professionals who meet specific criteria can take advantage of a special allowance that allows them to report rental real estate losses on Schedule E, instead of Form 8582. To qualify for this allowance, the following conditions must be met:

- Real estate rental activities with active participation are the only passive activity.

- No passive loss carryover from a prior-year tax return.

- Total loss is $25,000 or less ($12,500 for married individuals filing separate returns).

- If married and filing separately, the taxpayer lived apart from their spouse for the entire taxable year.

- Modified adjusted gross income (MAGI) is $50,000 or less for single individuals ($100,000 if married filing jointly).

- The taxpayer does not hold any real estate rental properties in a trust, estate, or as a limited partner in a limited partnership.

Any rental real estate activity that does not meet the criteria for the real estate professional allowance is considered a passive rental real estate activity.

What Activities Are Not Considered Passive Activities?

According to the Internal Revenue Service (IRS), the following activities are considered nonpassive activities:

- Trade in which you materially participated for the tax year. The IRS uses various tests to determine material participation, with the most common being whether the taxpayer worked at least 500 hours during the tax year in that business activity.

- Rental real estate activity in which you materially participated as a real estate professional.

- Working interest in an oil or gas well, as long as it is owned directly by the taxpayer.

- Trading personal property for the owners of interests in this activity.

If you need to determine whether your business activity is subject to passive loss rules, it is recommended to consult with a tax advisor.

Frequently Asked Questions

Here are some common questions taxpayers have about IRS Form 8582:

Where can I get a copy of IRS Form 8582?

You can download a copy of IRS Form 8582 from the IRS website or by using the file provided below.

What are the related tax forms?

IRS Form 8582 is just one of the many fillable tax forms provided by the IRS to assist taxpayers in reducing their tax preparation costs. To access more forms and articles like this, visit our free fillable tax forms page. Unlike the IRS, our articles provide detailed instructions for each tax form, along with video walkthroughs. You can subscribe to our YouTube channel to watch all of our helpful videos.

What do you think?

Let us know your thoughts on this article in the comments section. If you found it helpful, please share, pin, or tag us. If you have any additional tips, feel free to share them as well. Your feedback is valuable to us!