Image source: JazzIRT/E+ via Getty Images

Image source: JazzIRT/E+ via Getty Images

Introduction

Real Estate Investment Trusts (REITs) have witnessed a resurgence in share prices as the pandemic recedes and the real estate sector shows resilience. One REIT that stands out is Medical Properties Trust (NYSE:MPW). With a significant portfolio of hospitals worldwide, MPW operates in an area of inelastic demand, making it an attractive choice for long-term income investors. Although the stock has experienced a YTD loss, the current dividend yield of 5.45% and a promising P/FFO Ratio make it a compelling opportunity for future returns.

REIT Investments: Diversify Your Portfolio

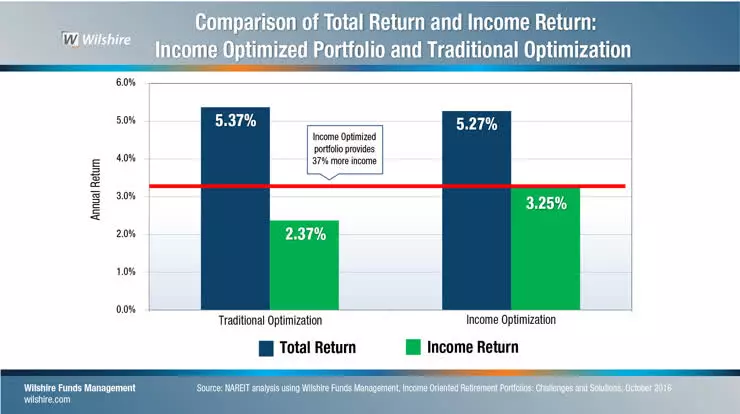

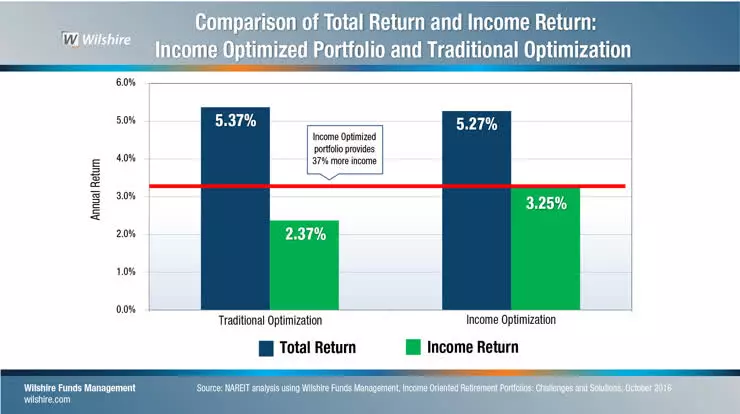

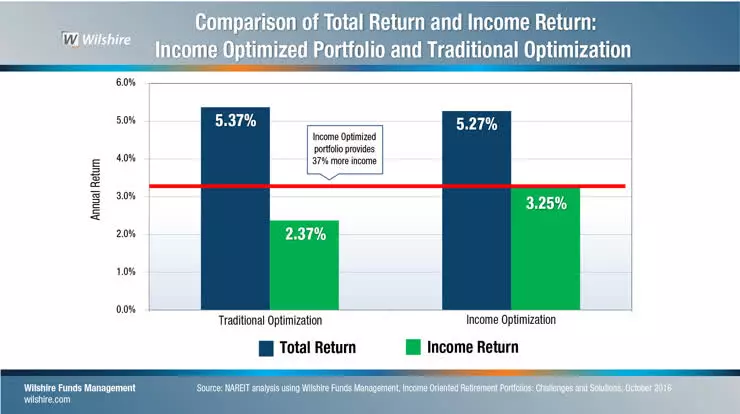

REITs offer competitive returns based on steady dividend income and moderate long-term share price appreciation. Moreover, they act as effective portfolio diversifiers, lowering overall portfolio risk due to their low correlation with other assets. In fact, a study by Wilshire Funds Management revealed that including REITs in retirement portfolios can yield a nearly 40% gain in income returns, while maintaining similar total returns and risk profiles compared to portfolios with traditional investments.

Image source: REIT.com

Image source: REIT.com

Furthermore, in times of high inflation, REITs can be an even more valuable addition to investment portfolios. Historical data shows that REITs outperform during moderate inflation periods compared to low inflation periods in terms of market returns and operating fundamentals. With current inflation levels exceeding 2.5%, now is an opportune time to consider adding REITs to investment portfolios.

The chart below demonstrates that REITs have outperformed the S&P 500 by total returns of over 3.9% during periods of moderate inflation. In addition, during Q2 and Q3 2021, REITs' Same-Store Net Operating Income (SSNOI) surpassed the annualized inflation rate by 23 basis points and 187 basis points, respectively, when the Consumer Price Index (CPI) jumped over 5%.

Image source: REIT.com

Image source: REIT.com

Company Overview

Medical Properties Trust, Inc. is a self-advised Healthcare REIT with nearly two decades of experience in acquiring and developing net-leased hospital facilities. The company owns 438 properties globally, primarily in the United States and the United Kingdom. Its portfolio includes General Acute Care Hospitals, Inpatient Rehabilitation Hospitals, Behavioral Health Facilities, Freestanding ER/Urgent Care Facilities, and Long-Term Acute Care Hospitals.

The company's properties have average lease terms of 10 to 20 years in the United States, with options for 5-year extensions. In Europe, 87% of the holdings are set to mature after 2030. These lease terms include a 2% escalation to account for inflationary effects. Additionally, the company relies on long-term fixed-rate debt facilities, which contribute significantly to its growth and expansion.

During the 4th Quarter earnings call, the company's CEO highlighted MPW's ongoing acquisition strategy, which added $3.9 billion in investments across five countries and nine operators, including five new ones. This continued double-digit growth showcases MPW's strong position in the market.

Image source: MPW

Image source: MPW

High Yield Dividends: Slow but Steady Growth

MPW distributes approximately all its earnings to shareholders, resulting in a high payout ratio of around 100%. The current annualized Dividend Yield of 5.65% surpasses the Healthcare Real Estate sector's average yield of 4.05% and the REIT industry average dividend yield of 2.85%. This makes MPW an attractive option for income investors looking for reliable passive income.

MPW has consistently increased its dividend distributions each year for almost a decade. Although the recent dividend increase of 1 penny or 3.6% may seem minor, it underscores the company's commitment to providing returns to its shareholders. However, investors seeking higher dividend growth rates may want to explore other companies in the REIT market.

High Debt but No Red Flags

MPW has a debt-to-equity ratio of almost 134%. While this may appear high, it's important to note that 96% of the company's $11.28 billion debt consists of fixed-rate obligations with interest rates between 2.5% and 5.25%. This results in an interest expense of $367 million for 2021. The Net Debt to Annualized Adjusted EBITDA ratio indicates that, on average, it would take MPW approximately 6.4 years to pay off its debt, assuming constant net debt and EBITDA. The company stated during the earnings call that it expects this ratio to return to its historical range, signaling no cause for concern.

MPW's 2021 FFO of $811 million provides a good interest coverage ratio of around 2.5, although it lags behind the industry average of 4.5. However, the company has adeptly managed its liabilities, evidenced by actions such as settling a debt with a 6% interest rate by raising a 3.5% loan during Q3. Consequently, the rewards outweigh the risks associated with MPW's debt.

Valuation

With a Price to FFO ratio of approximately 11.7 times, MPW is considerably cheaper than the Healthcare REIT industry average of 19.78. Assuming a P/FFO ratio of 19.78, the share price would be over $34, indicating a potential upside of almost 70%. However, it's important to note that the P/FFO ratio cannot be the sole measure of valuation. Companies with lower P/E or P/FFO multiples are generally better rewarded by the stock market, but other factors must also be considered.

Considering MPW's focus on double-digit asset and FFO growth, along with consistent dividend increases, potential investors can reasonably expect attractive returns by the end of this year.

Conclusion

Adding a REIT like MPW to your portfolio can enhance diversification, reduce overall portfolio risk, and improve optimal returns. As interest rates rise and inflationary pressures ease into a more moderate range, this year presents an excellent opportunity to include REITs in your investment strategy.

MPW's astute management of its debt structure, inflation-protected lease terms, and commitment to growth and expansion are indicative of a well-run organization. When combined with the current valuation, MPW offers potential investors an attractive entry point. For income investors seeking reliable passive income, MPW is a solid investment option that can provide consistent and substantial returns.