New Hampshire is known for its beautiful landscapes, charming towns, and favorable tax environment. However, property tax rates in the state can vary significantly from town to town. Understanding these rates is essential for homeowners and potential buyers in New Hampshire. In this article, we'll provide you with a town-by-town list of property tax rates, along with valuable insights and comparisons.

Which New Hampshire Towns have the Highest Property Tax Rate?

When it comes to property tax rates, some towns in New Hampshire stand out. Claremont, for instance, boasts the highest property tax rate in the state, with a staggering rate of 41.68. Following closely behind are Lisbon (34.28) and Northumberland (33.06). Living in these towns means facing higher property taxes compared to other areas. Let's explore more about the towns with the highest property tax rates in New Hampshire.

New Hampshire Towns with the Highest Property Tax Rates

To give you a clearer picture, here are the top ten towns in New Hampshire with the highest property tax rates:

Which Towns have the Lowest Property Tax Rates in New Hampshire?

On the other end of the spectrum, some towns in New Hampshire offer lower property tax rates, making them more affordable options for homeowners. Windsor boasts the lowest property tax rate in the state, with a rate of 3.39. Hart's Location follows closely with a rate of 4.19, and New Castle with a rate of 4.50. These towns provide an excellent opportunity for homeowners to save on property taxes.

New Hampshire Towns with the Lowest Property Tax Rates

Here are ten New Hampshire towns with the lowest property tax rates:

Comparing New Hampshire Towns with the Highest Property Tax Rates vs. Low Property Tax Rates

To understand the impact of property tax rates, let's compare two towns in New Hampshire: Windsor and Claremont. Windsor has the lowest property tax rate in the state (3.39), while Claremont boasts the highest (41.68). This significant difference means that for the same assessed property value, living in Claremont is considerably more expensive due to higher property taxes.

For example, if a home in Hebron has an assessed value of $500,000, the property tax would be $1695 per year. However, in Claremont, a home with the same assessed value would have a property tax of $20,840 annually. Consequently, living in Claremont would cost the homeowner an additional $19,145 per year compared to Hebron!

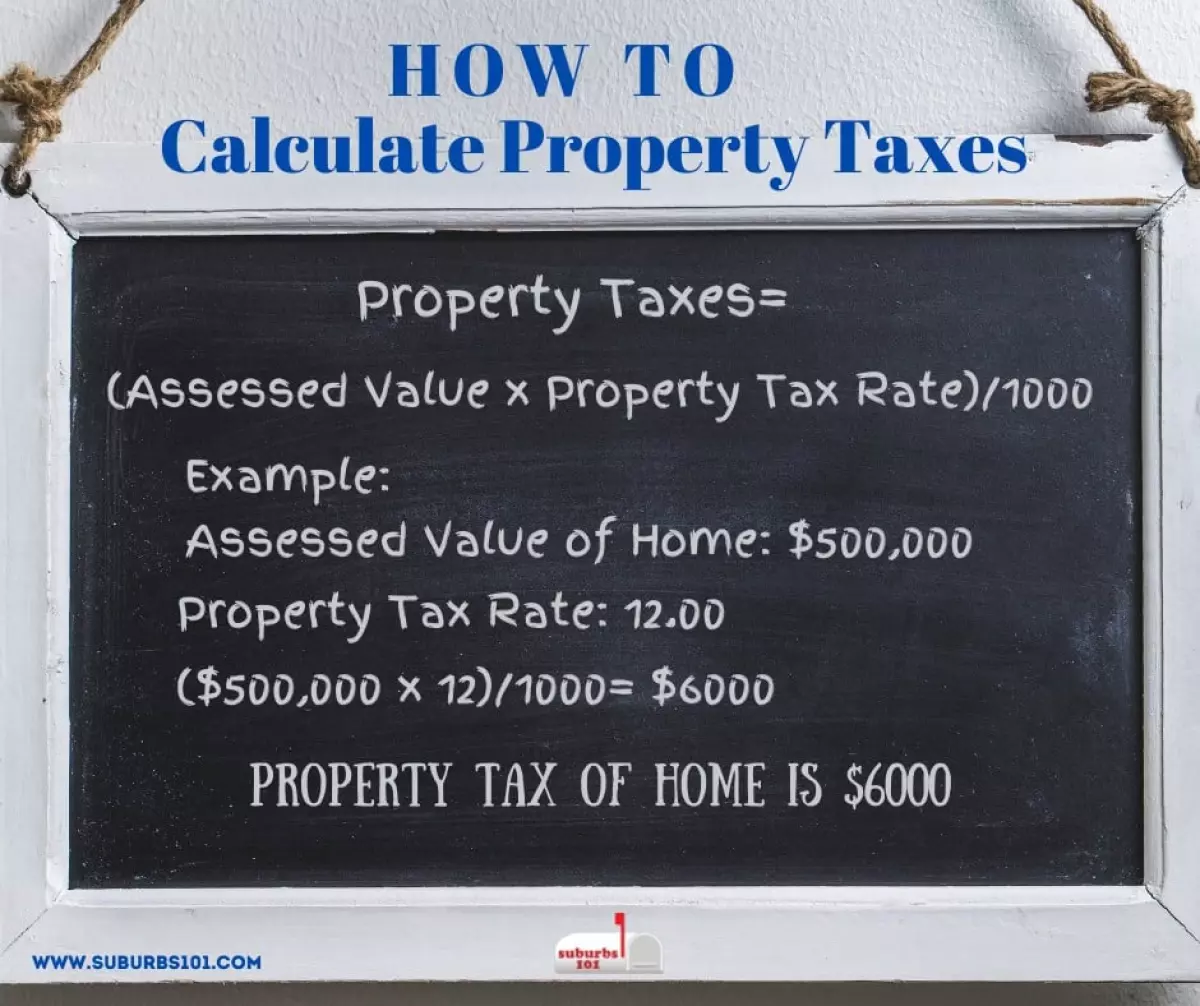

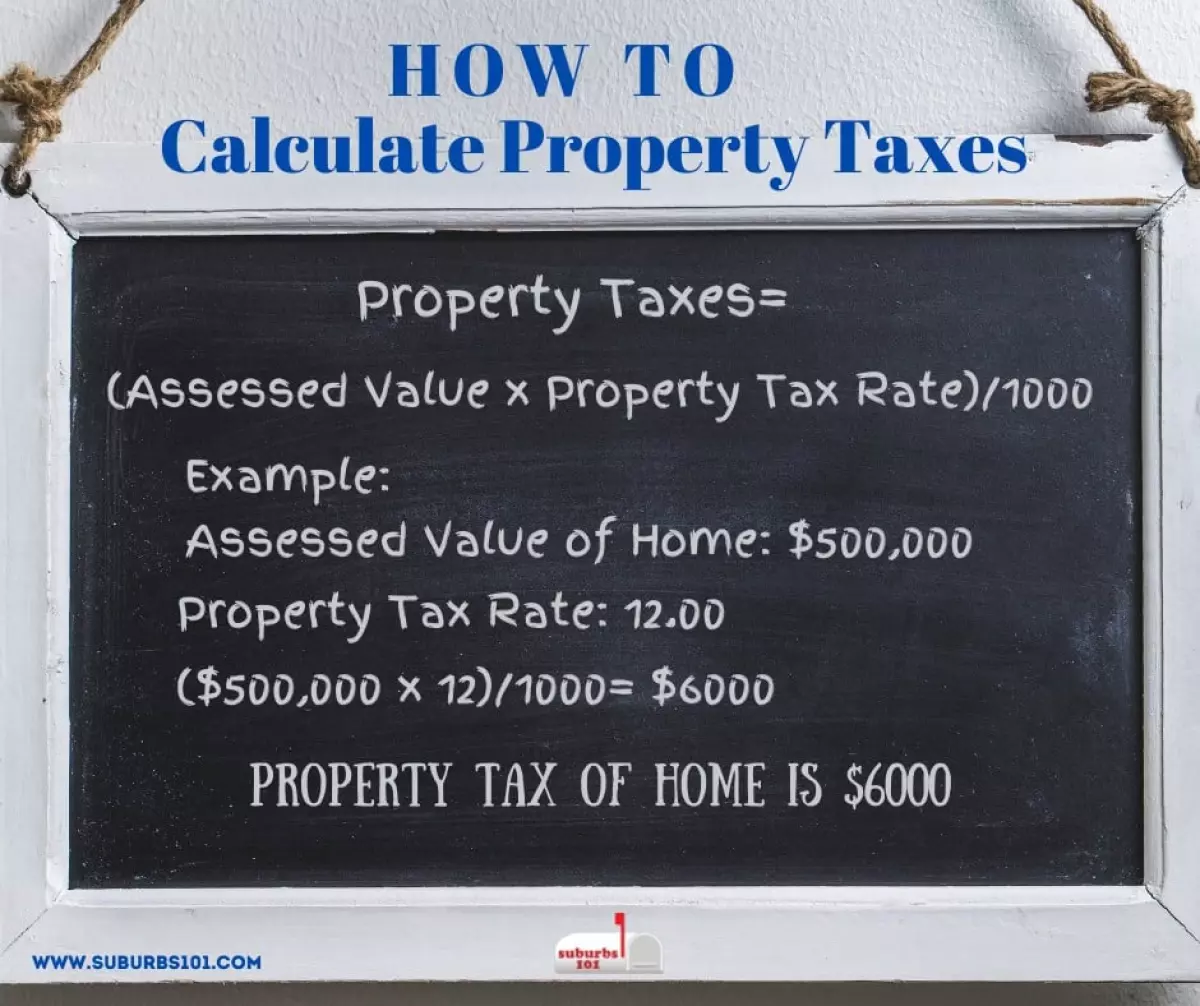

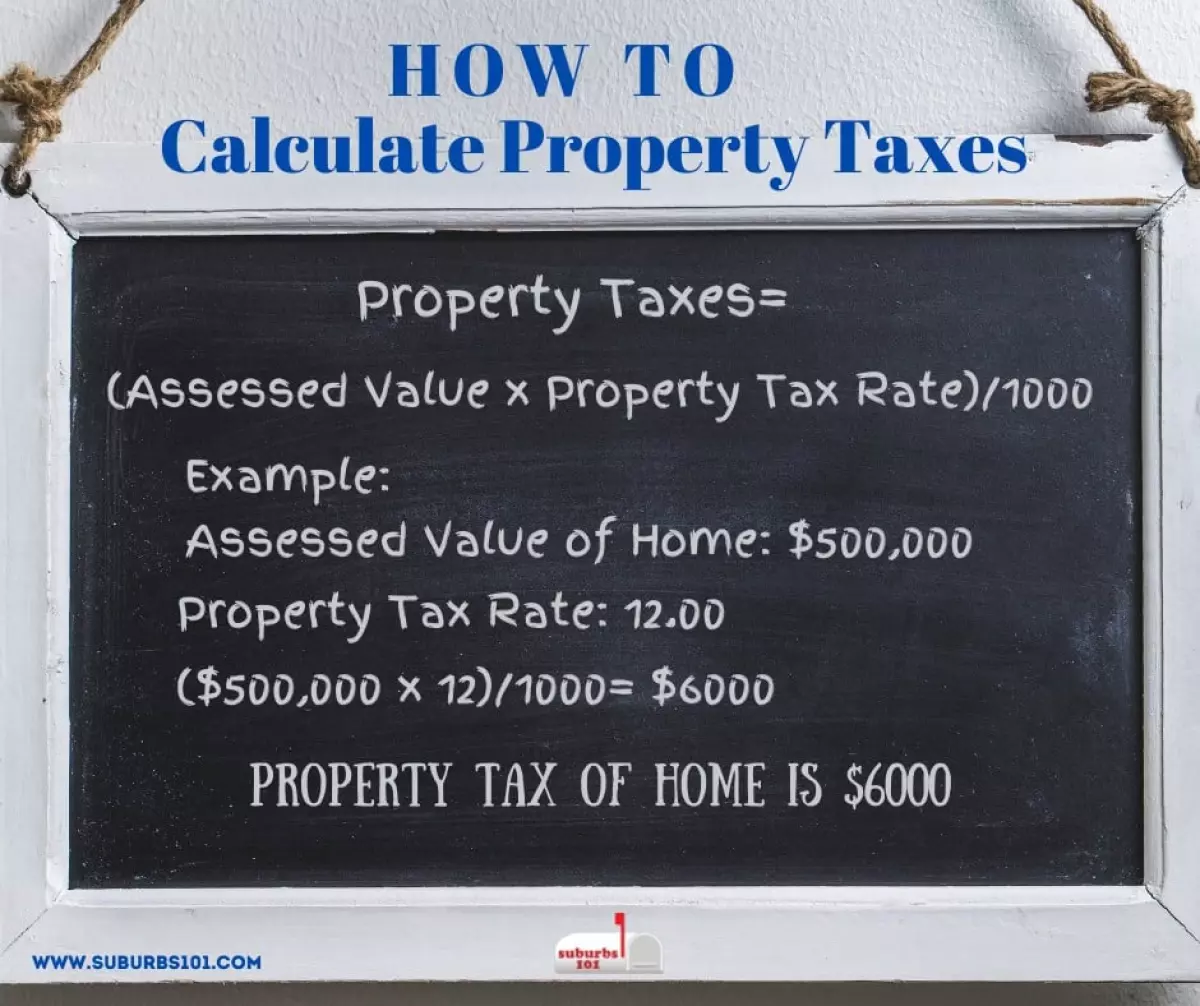

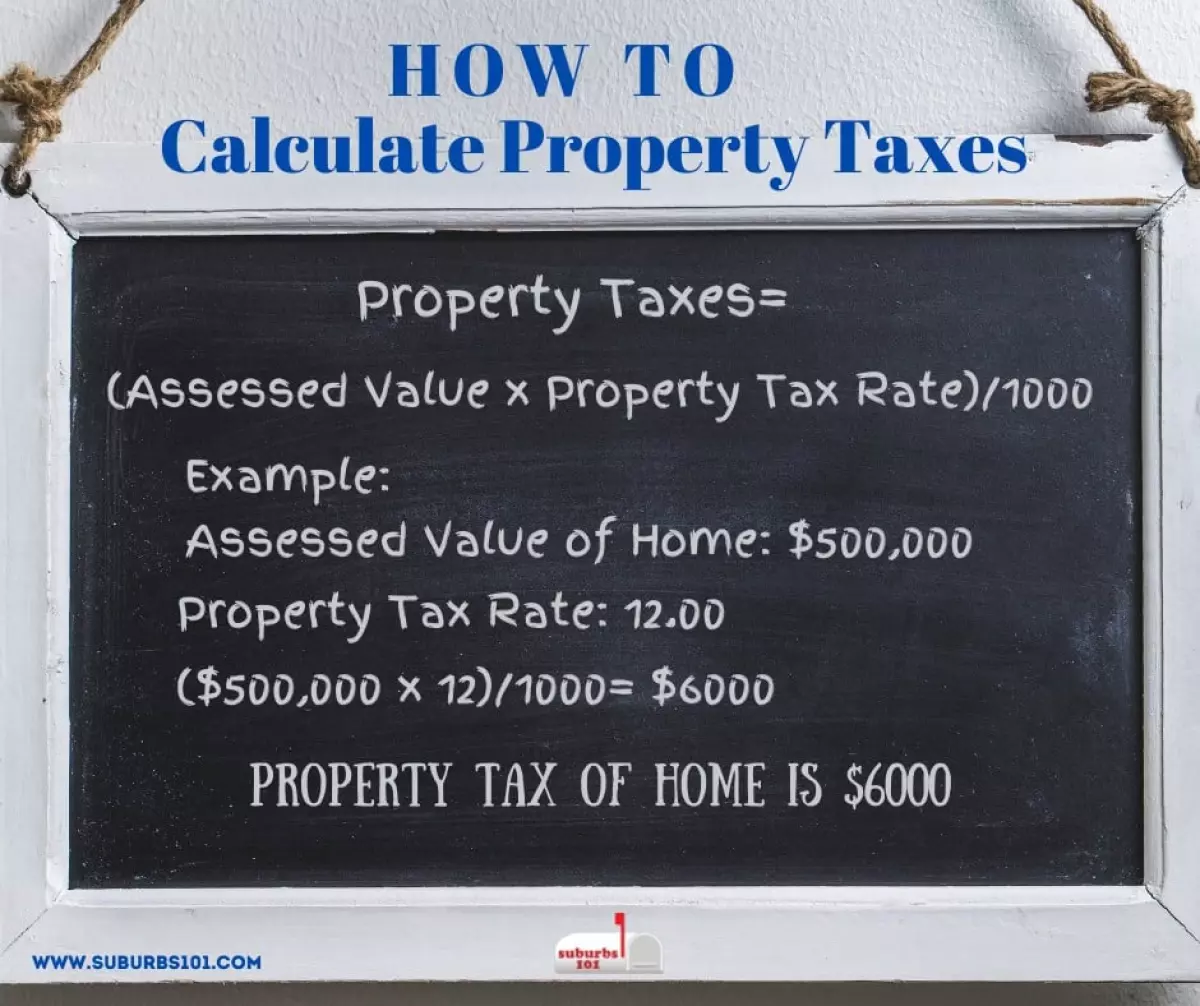

How to Calculate New Hampshire Property Taxes

Understanding how property taxes are calculated is vital for homeowners in New Hampshire. The formula to calculate property taxes in the state is relatively straightforward: (Assessed Value x Property Tax Rate) / 1000 = New Hampshire Property Tax. Let's consider the example of a home in Concord assessed at $500,000, with a property tax rate of 25.89. By applying the formula, the property taxes for this home in Concord would be $12,945 per year.

Infographic on How to Calculate New Hampshire Property Taxes

2023 New Hampshire Property Tax Rates (Town by Town List)

For a complete list of property tax rates for every town in New Hampshire, refer to the following table. Please note that these rates are specific to the year 2022 as they are set at the end of each year.

New Hampshire Property Tax Calculator

To estimate your own New Hampshire property taxes, use the property tax calculator below. Simply look up your property tax rate from the table provided above. Keep in mind that this calculator provides an estimation only and should not be considered as the exact amount.

You May Also Be Interested In:

- Jobs that Pay over 100k a Year without a degree in New Hampshire (video)

- What are the Highest Paying Jobs in New Hampshire? (and lowest paying jobs)

Want More Suburbs 101?

Follow us on Instagram, like us on Facebook, subscribe to our YouTube Channel, and sign up for our Weekly Newsletter. Stay updated with the latest news, insights, and tips on living in New Hampshire.

Remember, knowledge is power when it comes to property taxes in New Hampshire. Understanding the variations among towns will help you make informed decisions when buying or owning a home in the Granite State.