Image: ntzolov/E+ via Getty Images

Image: ntzolov/E+ via Getty Images

In the ever-evolving world of real estate investment trusts (REITs), it's crucial to identify the sectors that are likely to outperform in the coming year. While there are several promising REIT sectors, apartments stand out as an excellent investment opportunity for 2022 due to the ongoing housing shortage. With residential rents skyrocketing across the country, investing in apartment REITs could lead to significant returns.

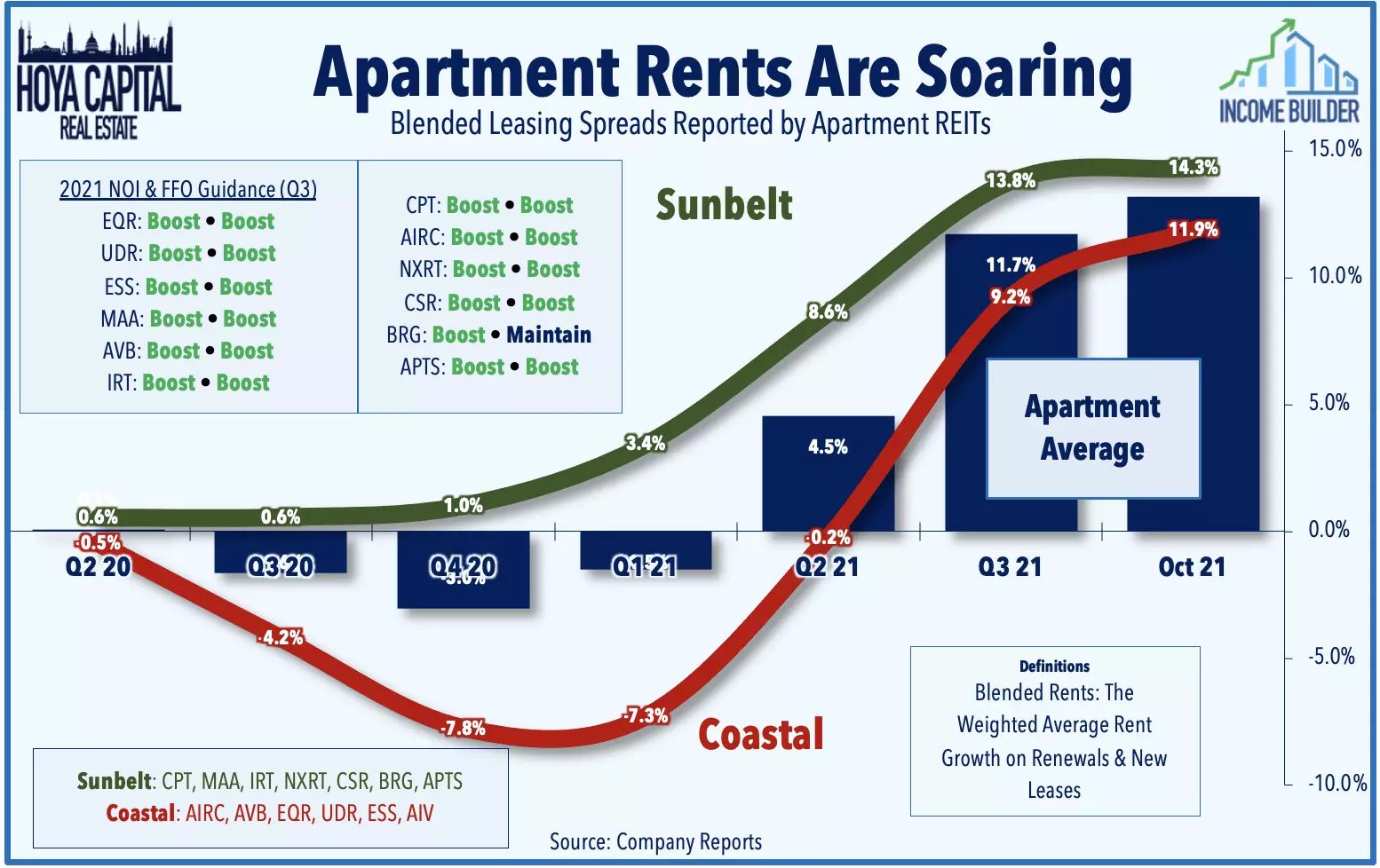

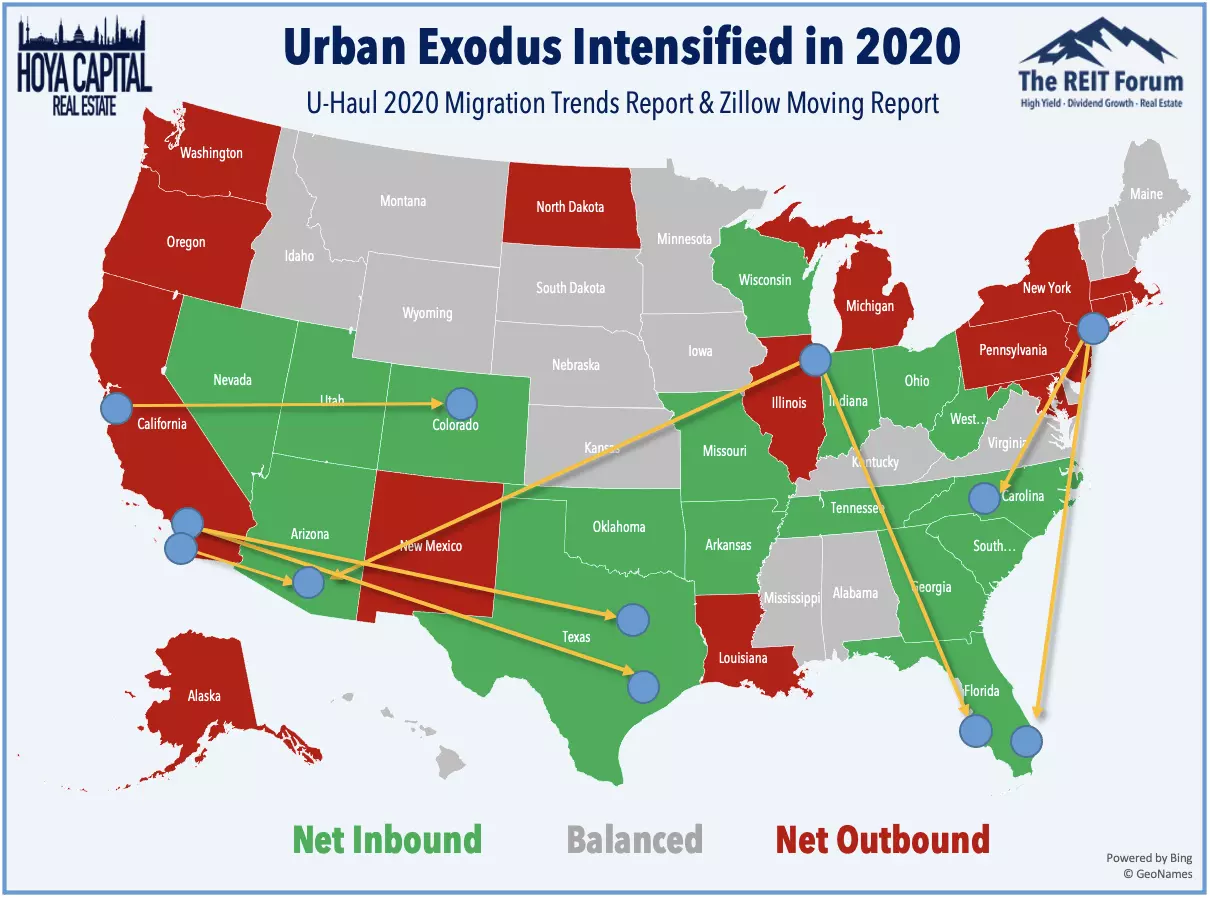

According to a sector overview by Hoya Capital, residential rents are soaring at an unprecedented rate. This surge is particularly pronounced in the Sunbelt, where new lease spreads reached an impressive 21% in Q3 2021. Additionally, all ten REITs that provided data on new lease rates reported double-digit increases in Q3 2021, with average rent growth on renewals climbing into double-digits for the first time on record in October.

Image: Hoya Capital

Image: Hoya Capital

The housing industry is facing a severe undersupply, with estimates suggesting a shortage of 3.8 million homes in the United States. With just 2% of the total inventory owned by REITs, there are ample opportunities for significant growth in this sector.

When it comes to investing in REITs, it's essential to consider the balance sheets of the companies in question. Overleveraging can lead to significant risks, as observed during the Great Recession. Therefore, it's wise to opt for REITs with solid balance sheets and a prudent approach to debt management. This ensures stability and resilience during unexpected economic downturns.

Based on these considerations, several primary and secondary candidates emerge from the pool of 18 apartment REITs. By evaluating their liquidity ratio, debt ratio, and debt/EBITDA, it becomes clear which companies exhibit financial prudence. It is crucial to focus on companies with average or better balance sheets and investment grade ratings.

Image: Hoya Capital

Image: Hoya Capital

Moving on to the growth potential, it's important to assess a company's revenue growth rate. In the apartment REIT sector, companies like AvalonBay Communities (AVB), Mid-America Apartment Communities (MAA), and Equity Residential (EQR) have experienced revenue shrinkage over the past three years. In contrast, Camden Property Trust (CPT) stands out with impressive growth rates in funds from operations (FFO) and total cash from operations (TCFO).

Dividend safety is another crucial factor to consider. By analyzing dividend yields and growth rates, investors can gauge the stability of a REIT's dividend. While CPT falls slightly below the average yield for the apartment REIT sector, its above-average dividend growth offsets this concern.

Image: Hoya Capital

Image: Hoya Capital

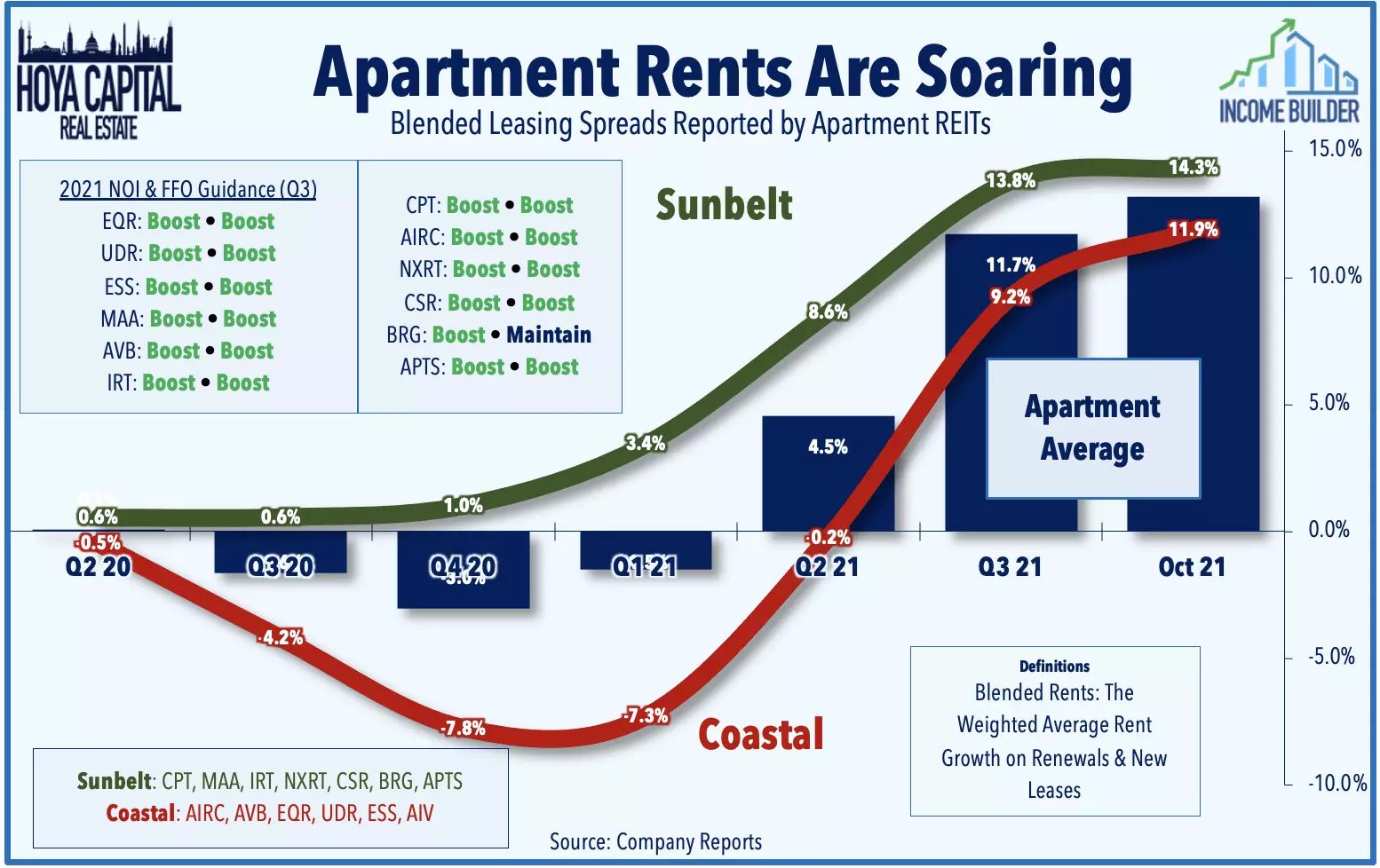

In addition to financial considerations, it's crucial to evaluate a company's exposure to key markets. The ongoing internal migration in the United States, with people leaving large urban areas and gravitating towards the sunbelt and smaller cities, presents significant investment opportunities. Camden Property Trust's focus on the sunbelt region positions it well to benefit from this trend.

Considering all these factors, Camden Property Trust emerges as the clear winner for 2022. With a sound balance sheet, impressive growth rates, dividend safety, and a substantial presence in the sunbelt and suburban markets, Camden Property Trust offers a well-rounded investment opportunity.

Image: Camden Property Trust

Image: Camden Property Trust

Camden Property Trust stands out among its peers as the top choice for exposure to the apartment REIT sector in 2022. Its prudent financial management, strong growth potential, and strategic market positioning make it an attractive investment option.

As always, it's important to conduct thorough research and consult with financial experts before making any investment decisions. However, if you're considering investing in just one apartment REIT for 2022, Camden Property Trust is the clear frontrunner.