Explore the World of REITs

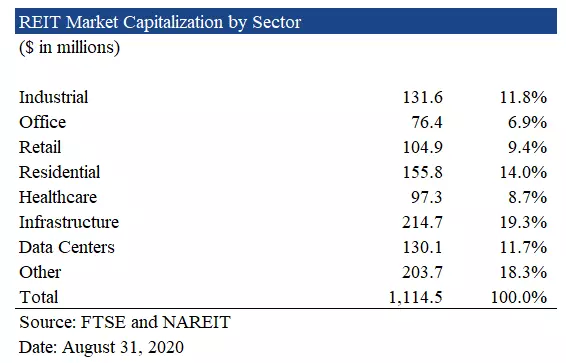

Are you looking for a tax-efficient and diversified alternative for real estate investment? Look no further than Real Estate Investment Trusts (REITs). With a market cap of $1 trillion in the US alone, REITs offer investors access to a diverse portfolio of income-producing real estate assets.

How Does a REIT Work?

REITs invest in various types of properties, specializing in specific sectors. Publicly traded REITs provide investors with an opportunity to own shares in a diversified collection of real estate assets, similar to investing in mutual funds. Unlike regular companies, REITs must distribute at least 90% of their annual profits to shareholders as dividends.

The dividend requirement not only yields high returns but also offers tax advantages. The dividend yield on REIT stocks is above 4%, significantly higher than the overall yield of the S&P 500.

Why Invest in REITs?

REITs offer several advantages over direct real estate ownership. They provide liquidity, allowing investors to easily buy and sell shares. Additionally, REITs require low capital intensity, making it more accessible for individuals to invest with relatively lower upfront capital.

Diversification is another key benefit. Investors can easily diversify their real estate portfolio by investing in multiple property types across different geographies. Furthermore, REITs offer investors a degree of control over management and strategy.

Historical Returns: REITs vs Real Estate

When comparing returns, it's important to note that REITs have generated an impressive 10% annualized return over the long run. In contrast, real estate assets have grown at a slower pace of 2-3% annually. However, this comparison is not straightforward.

One significant factor that influences returns is leverage. Equity REITs have an average debt-to-total value ratio of 37.0%, amplifying returns (and risk). On the other hand, direct real estate investment allows for higher leverage, potentially increasing returns even further.

The Largest REITs

Curious about the biggest players in the REIT industry? Here is a list of the top 20 largest public REITs globally, ranked by market capitalization:

- American Tower Corp.

- Prologis, Inc.

- Crown Castle International Corp.

- Simon Property Group, Inc.

- Digital Realty Trust, Inc.

- Public Storage

- Welltower, Inc.

- AvalonBay Communities, Inc.

- Realty Income Corp.

- Weyerhaeuser Co.

- Equity Residential

- Alexandria Real Estate Equities, Inc.

- Healthpeak Properties, Inc.

- Ventas, Inc.

- Extra Space Storage, Inc.

- Sun Communities, Inc.

- Duke Realty Corp.

- Essex Property Trust, Inc.

- Mid-America Apartment Communities, Inc.

- Boston Properties, Inc.

Tax Advantages of REITs

One of the major attractions of REITs is their tax advantages. REITs enjoy preferential tax treatment, as their income is not taxed at the corporate level. Instead, the income is taxed only at the individual shareholder level. This tax advantage sets REITs apart from C-corporations, which are subject to double taxation.

To qualify for this tax status, REITs must distribute at least 90% of their profits as dividends.

REIT Dividends: An Investor's Perspective

REIT dividends are cash distributions to shareholders. Nearly all of a REIT's profits are distributed as dividends. While these dividends are taxed at ordinary income tax rates, it is important to note that REITs entirely avoid corporate-level taxation.

In contrast, C-corporations face taxes at both the corporate level and individual level on dividend distributions, albeit at lower capital gains rates.

REIT vs. C-Corp: Understanding the Difference

The fundamental difference between REITs and C-Corporations lies in their taxation structure. REITs operate under single pass-through taxation, while C-Corporations face double taxation.

REITs pass their profits through to shareholders, who are then responsible for individual-level taxation. In contrast, C-Corporations are taxed at the corporate level before distributing dividends, which are then taxed again at the individual level.

How to Qualify as a REIT?

To qualify as a REIT, companies must meet specific requirements:

- Dividends: At least 90% of taxable income must be distributed as dividends.

- Gross income: A minimum of 75% of gross income must come from real estate-related sources.

- Assets: At least 75% of assets must be real estate, mortgages, equity in other REITs, cash, or government securities.

- Shareholders: A REIT must have at least 100 shareholders, with no more than 50% owned by 5 or fewer individuals.

- Entity: REITs must be domestic corporations for federal tax purposes.

Exploring Different Types of REITs

REITs can be categorized into equity REITs and mortgage REITs. Equity REITs directly own and operate real estate properties, while mortgage REITs hold mortgages and collect income from interest payments.

REITs can also be internally or externally managed. Internal management refers to REITs that have their management team as employees. External management involves hiring a management company to oversee the real estate portfolio.

Analyzing REITs: Key Metrics to Consider

When evaluating REITs, investors focus on financial metrics specific to the real estate industry. Key metrics include Net Operating Income (NOI), Funds from Operations (FFO), Adjusted Funds from Operations (AFFO), and Capitalization Rate (Cap Rate).

NOI measures operating profits, while FFO and AFFO provide insights into cash generated from operations. Cap Rate, on the other hand, reflects the property's operating profit as a percentage of its value.

Building a REIT Financial Model

Creating a financial model for a REIT involves forecasting financial statements and applying valuation methodologies such as Net Asset Value (NAV) and Discounted Cash Flow (DCF) analysis. Understanding REIT-specific metrics and ratios, such as FFO and AFFO, is crucial for accurate modeling.

Valuing REITs: Different Approaches

To determine the value of a REIT, analysts use approaches such as Net Asset Value (NAV), Discounted Cash Flow (DCF), Dividend Discount Model (DDM), and Multiples and Cap Rates. The most commonly used methods are NAV and DDM due to their relevance to REITs' unique characteristics.

Exploring Other Real Estate Companies

Aside from REITs, the real estate landscape includes entities like real estate private equity firms, Real Estate Investment Management firms, and Real Estate Operating Companies (REOCs). While these companies share similarities with REITs, their risk tolerance, portfolio composition, and operational strategies differ.

Investing in REITs offers individuals a tax-efficient and diversified option for real estate investment. With their unique advantages, REITs continue to attract investors seeking income-producing assets with long-term growth potential.