Investing is all about making smart decisions that align with your financial goals and circumstances. When it comes to choosing between real estate and bonds, there are several factors to consider. In this article, we'll explore the pros and cons of each investment option to help you make an informed decision.

Real Estate: A Wealth-Building Asset

Real estate has long been hailed as one of the best ways to build wealth. Unlike bonds, real estate offers the opportunity for both capital appreciation and regular rental income. Owning property can act as a forced savings account, helping you build home equity over time. Additionally, real estate tends to benefit from inflation, making it a valuable asset in the long run.

With the recent increase in remote work and the demand for housing, the value of real estate has soared. Many investors are taking advantage of the current market conditions to purchase rental properties and multifamily units.

Bonds: A Steady Return with Higher Yields

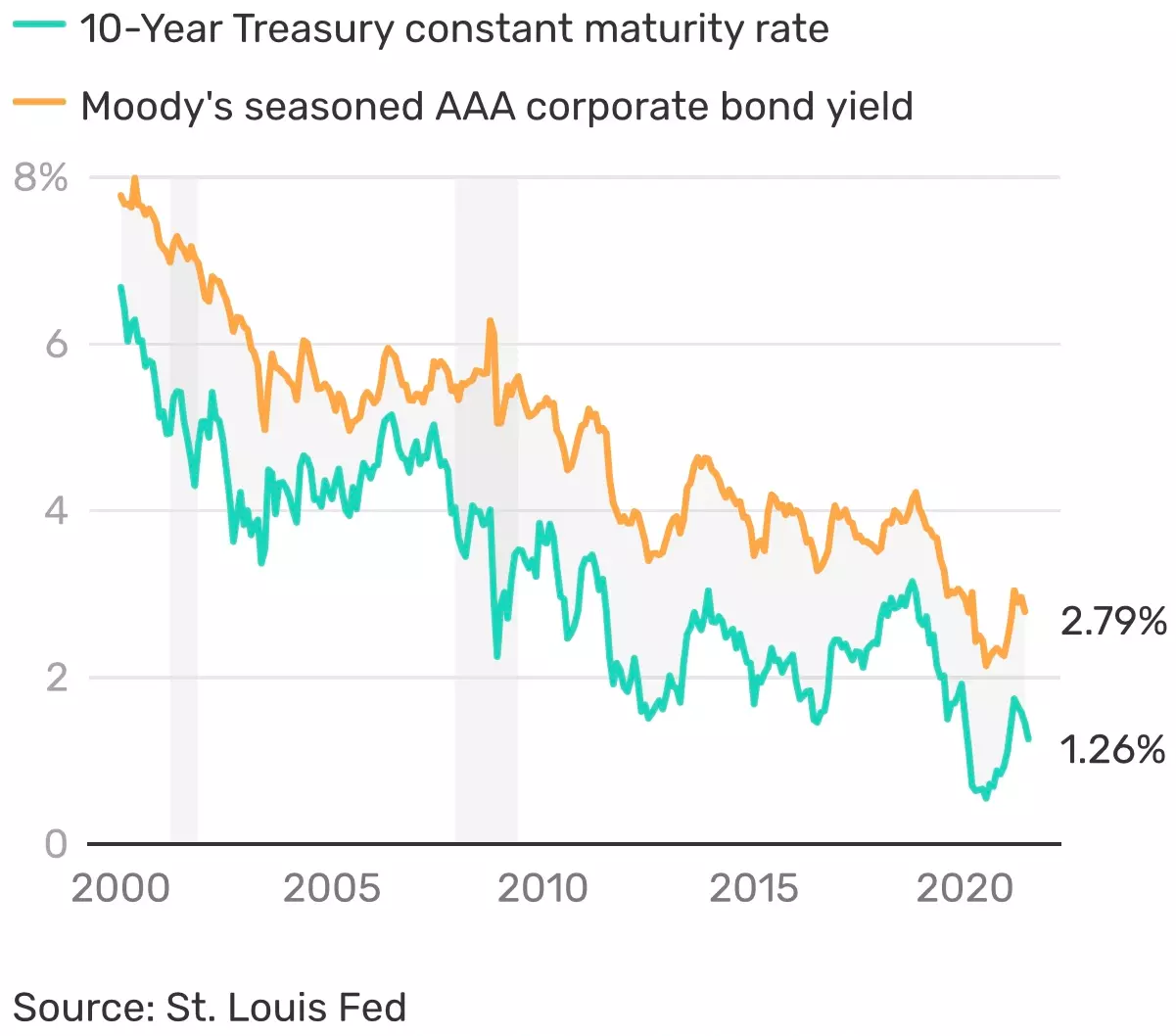

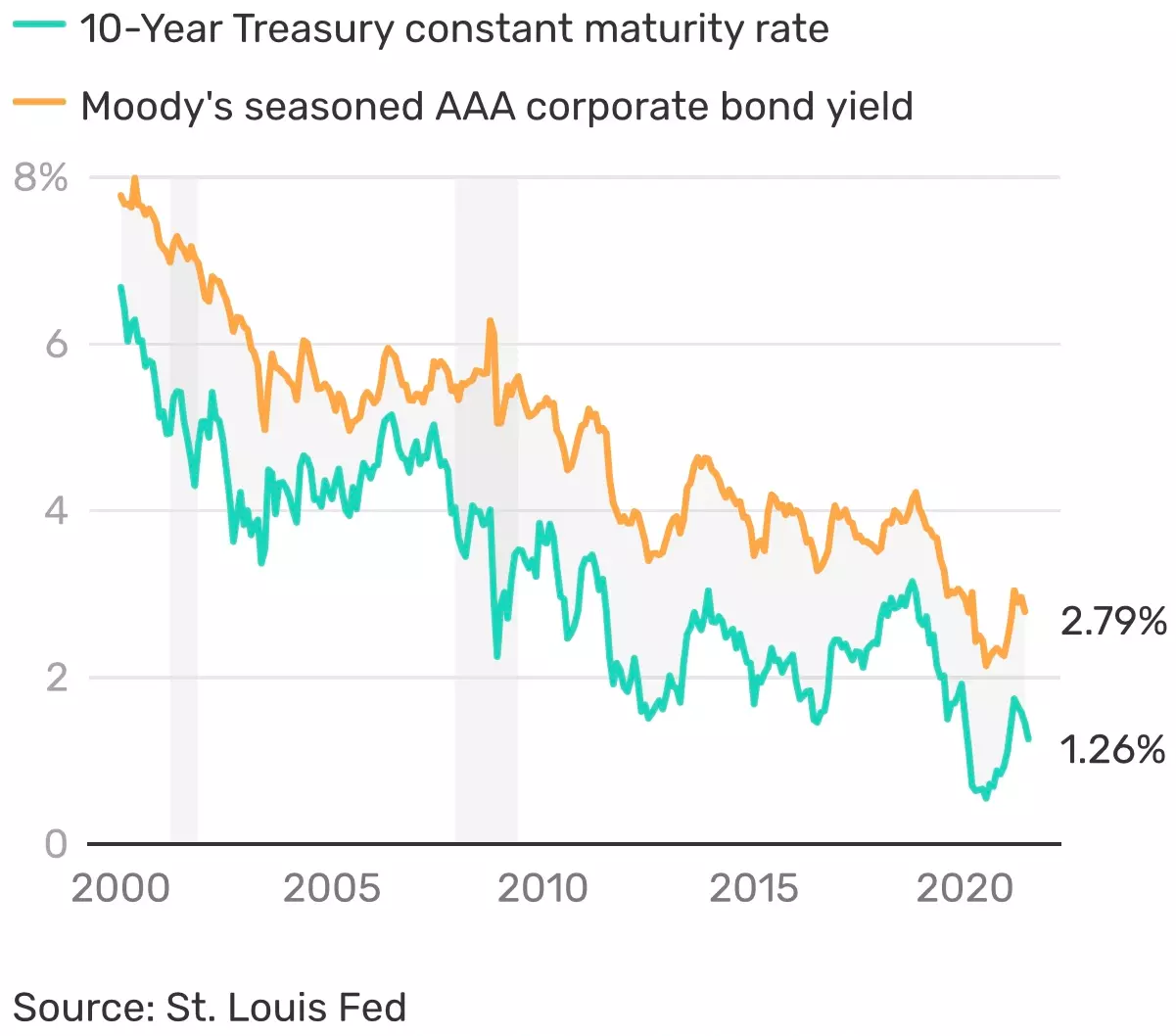

Bonds have their own appeal, especially in today's market. With higher yields, bonds offer attractive returns, providing a steady income stream. You can now get 5%+ by owning Treasury bonds, which is a great deal considering inflation rates are below 3.5%.

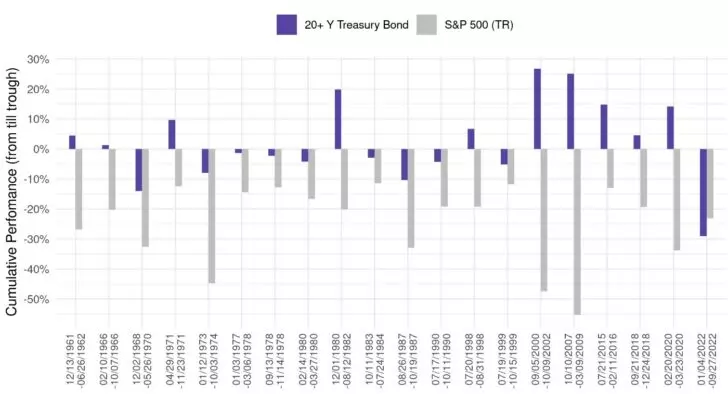

Bonds also offer diversification from stocks, as they tend to perform well when stocks are doing poorly. They have historically outperformed during economic downturns and market crises. However, it's worth noting that bonds can experience fluctuations in value, especially during volatile market conditions.

Making the Right Choice

Choosing between real estate and bonds depends on several factors, including your financial situation, risk tolerance, and investment goals. Here are some reasons why you might lean towards one option over the other:

Reasons to Invest in Bonds:

- Diversification: Bonds offer a way to diversify your investment portfolio and lower volatility.

- Lower-risk investment: Bonds can be a less risky option for those looking to invest a down payment to buy a house or rental property.

- Passive investment: If you prefer a passive investment approach without dealing with tenants or property maintenance, bonds might be a better fit.

- Tax advantages: Certain types of bonds, such as municipal bonds and US Treasury bonds, offer tax advantages, making them attractive to high-income taxpayers.

Reasons to Invest in Real Estate:

- Wealth-building potential: Real estate has the potential for both capital appreciation and rental income, providing an opportunity to build long-term wealth.

- Inflation hedge: Real estate can act as a hedge against inflation, as rental income and property values tend to rise with inflation.

- Control and improvement: Unlike bonds, real estate investments allow you to have more control and actively enhance the value of your properties through renovations and expansions.

- Tax benefits: Real estate offers various tax benefits, including depreciation deductions, mortgage interest deductions, and tax-free profits upon sale.

The Historical Returns

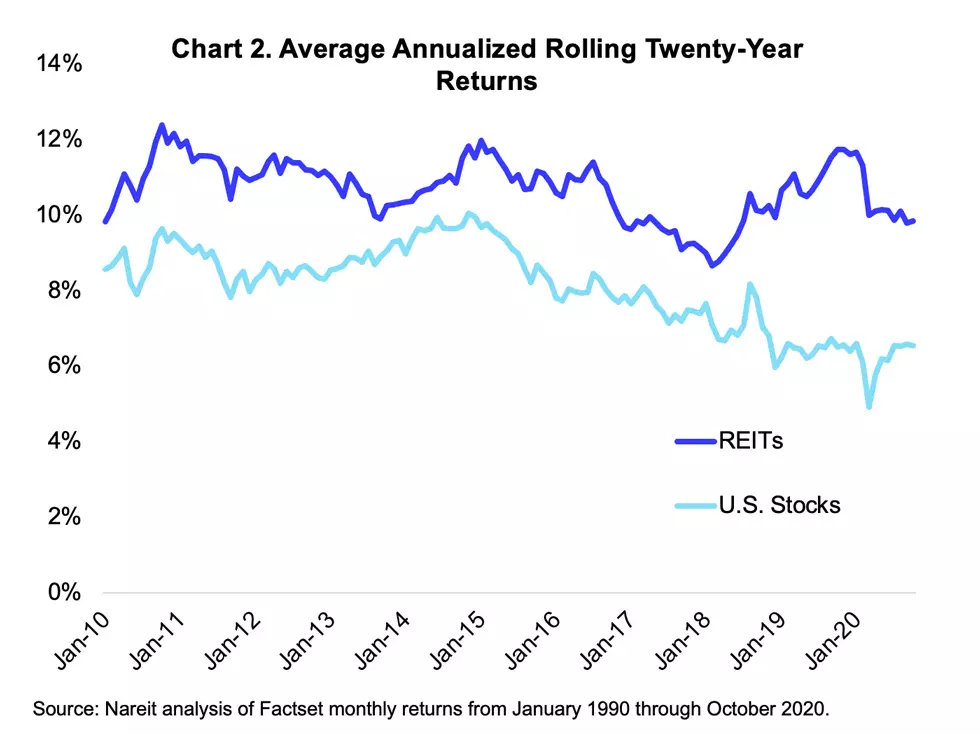

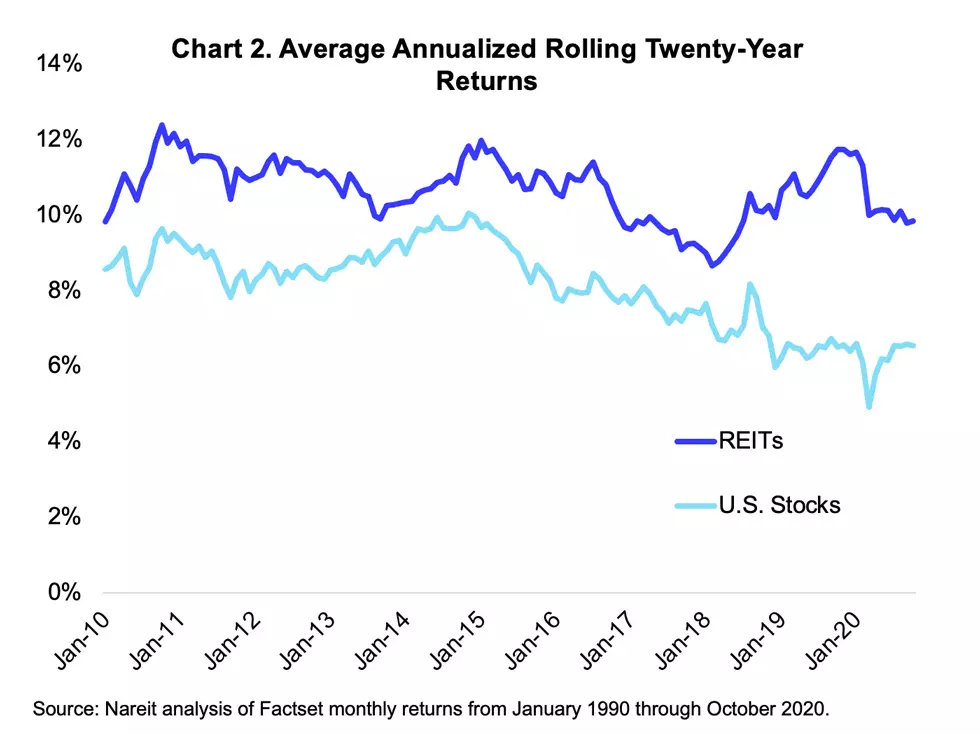

Looking at historical returns can provide additional insights into the performance of real estate and bonds. From 1926 to 2016, the aggregate bond market had an average return of about 5.4%, while housing prices increased by an average annualized rate of 3.7% between 1928 and 2013. Real estate investment trusts (REITs) performed even better, with an average annual return of 10.5%.

Investing in Both Bonds and Real Estate Today

Diversification is often key to a well-rounded investment strategy. Today, many investors choose to invest in both bonds and real estate to balance risk and returns. Dollar-cost averaging into a diversified real estate fund is an excellent option for most investors. Alternatively, if you're an accredited investor with the time and interest, building your own real estate portfolio through reputable platforms like CrowdStreet can be a rewarding experience.

In conclusion, there are compelling reasons to invest in both real estate and bonds. It ultimately depends on your financial goals, risk appetite, and personal circumstances. By carefully considering these factors and understanding the unique advantages of each investment option, you can make an informed decision that aligns with your long-term financial success.

Image Source:

Caption: Some bond funds have outperformed stock funds since 2000 - Real Estate Or Bonds: Which Is A Better Investment?

Caption: Some bond funds have outperformed stock funds since 2000 - Real Estate Or Bonds: Which Is A Better Investment?

Caption: US treasury bond performance versus stocks

Caption: US treasury bond performance versus stocks

Caption: Corporate bond yield versus 10-year bond yield

Caption: Corporate bond yield versus 10-year bond yield

Caption: Historical returns of U.S. stocks, U.S. bonds, and inflation compared to 10-year Vanguard median forecast

Caption: Historical returns of U.S. stocks, U.S. bonds, and inflation compared to 10-year Vanguard median forecast

Caption: Historical return for REITs versus U.S. stocks

Caption: Historical return for REITs versus U.S. stocks

So, whether you choose to invest in real estate, bonds, or a combination of both, ensure you have a well-diversified portfolio that aligns with your financial goals and risk tolerance. Happy investing!

Note: The content of this article is for informational purposes only. It does not constitute financial advice. Always do your own research and consult with a qualified financial advisor before making any investment decisions.