Investing in real estate has long been seen as a profitable venture, but the barriers to entry have often prevented ordinary individuals from participating in the ownership of commercial properties. However, Real Estate Investment Trusts (REITs) in Canada have changed the game, allowing small investors to reap the benefits of stability, growth, and diversification that were once exclusive to institutional investors. In this article, we'll explore the world of REITs in Canada, their impact on the economy, and why they are a popular choice for retirement investments.

The Rise of REITs in Canada

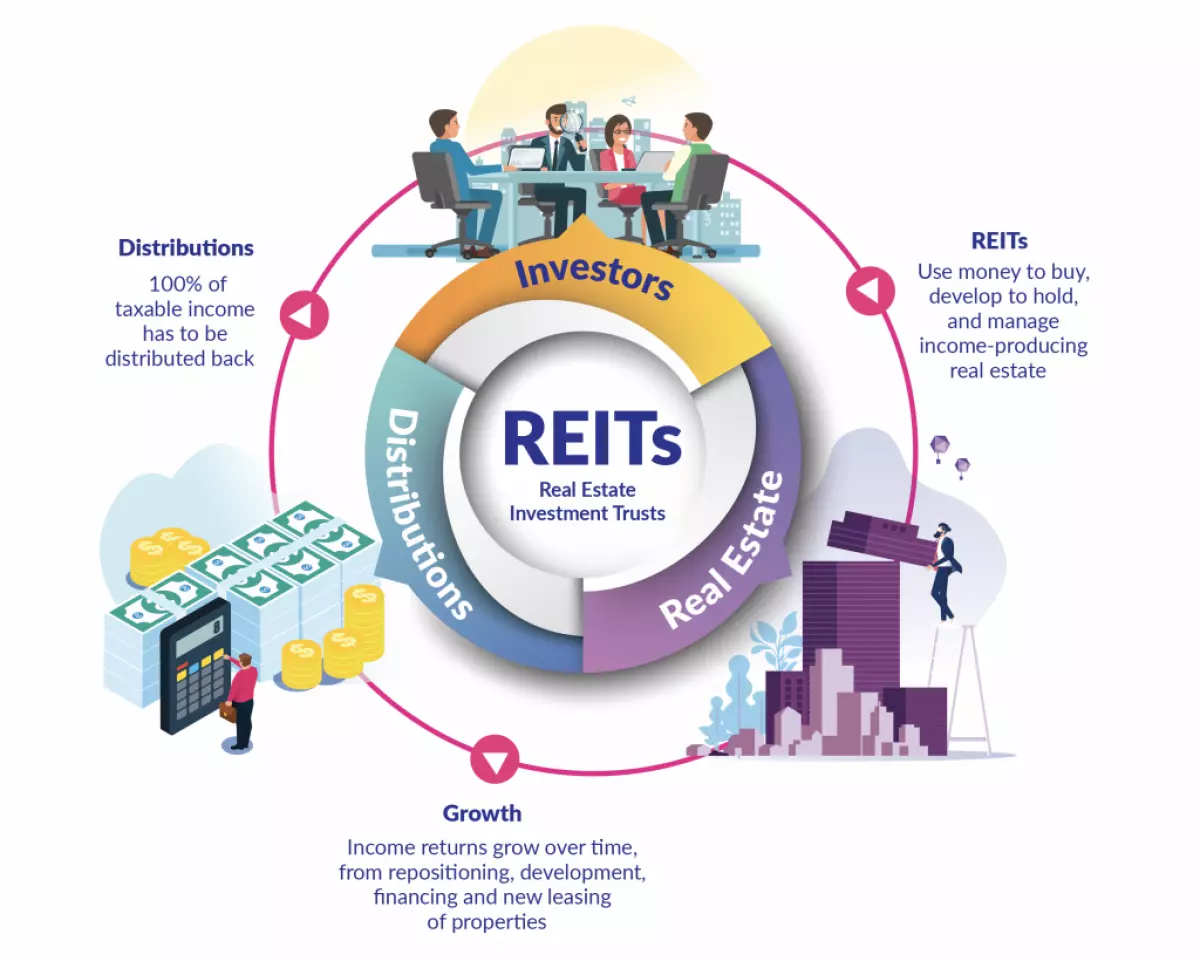

REITs, modeled after mutual funds, aggregate capital to build, acquire, operate, and update income-producing real estate assets such as office buildings, apartments, retail properties, and industrial facilities. They provide individual investors with the opportunity to participate in different sectors of the real estate market without the need for substantial capital.

One of the key advantages of investing in REITs is that the income earned by a REIT is passed on to its unit holders, giving investors similar benefits to direct property owners. Additionally, individuals who invest in REITs benefit from enhanced buying power, diversification, liquidity, and professional management, similar to investing in a mutual fund.

REITs provide an opportunity for small investors to participate in the ownership of income-producing real estate assets.

REITs provide an opportunity for small investors to participate in the ownership of income-producing real estate assets.

Canadians and REIT Investments for Retirement

Many Canadians rely on REIT income to fund their retirement. In fact, investing in REITs through retirement funds, such as mutual funds and ETFs, has become a popular strategy among Canadians. This approach provides similar characteristics to retirement pension funds and ensures a stable source of income during retirement.

Boosting the Canadian Economy

REITs play a vital role in the Canadian economy. By encouraging capital formation, REITs enable small investors to participate in the ownership of all types of real estate assets on an equal basis as wealthier investors. This not only democratizes access to real estate investments but also keeps capital within Canada, benefiting Canadians as a whole.

The Magnitude of the Canadian REIT Market

The Canadian REIT industry has experienced significant growth since its inception in 1993. With a current market cap of approximately $80 billion, Canadian REITs have provided stable income and growth to millions of Canadians. Furthermore, the average distribution yield of Canadian publicly traded REITs stands at an impressive 4.7% [2].

Canadian REITs invest across various asset classes, including office buildings, retail properties, industrial facilities, and multi-family developments. This diversified approach ensures a strong portfolio that can withstand market fluctuations while providing consistent returns.

The Strengths of Canadian REITs

Canadian REITs are governed by strict regulations and operate with strong governance controls. These regulations ensure that REITs acquire or develop income-producing real properties for the long term. Additionally, they are required to provide regular distributions to investors, making them an attractive option for retirement income.

Regulation also brings transparency and oversight, as Canadian REITs are subject to strict scrutiny by securities regulators. This level of governance sets Canadian REITs apart from their counterparts and instills confidence in investors.

Moreover, Canadian publicly traded REITs are tax neutral. They distribute all taxable income to investors, who are then taxed accordingly. This integration mechanism ensures fairness and makes REITs an attractive option for both investors and governments.

Lastly, the professional management of REIT properties ensures that high industry and real estate standards are met. REITs prioritize maintenance, regular capital improvements, and tenant satisfaction, making them reliable investments that deliver long-term value.

In conclusion, REITs in Canada have revolutionized the real estate investment landscape, offering small investors the opportunity to participate in income-producing assets that were once reserved for the wealthy. With their stable income, diversification, and potential for growth, REITs have become a popular choice for retirement investments in Canada. So why limit yourself to home ownership when you can become a part-owner of commercial properties through REITs? Take advantage of this lucrative investment avenue and secure your financial future with Canadian REITs.

References:

[1] As at March 1st, 2021. Source RBC Capital Markets DMI

[2] As at March 1st, 2021. Source RBC Capital Markets DMI