China's property market has always played a crucial role in the global economy, impacting various sectors and stakeholders, from investors to local governments. However, recent developments have caused concerns over financial stability and economic growth. In this article, we will take a closer look at the ongoing crisis in China's property market, its key players, and the steps being taken to address the situation.

Background: China’s property market and the economy

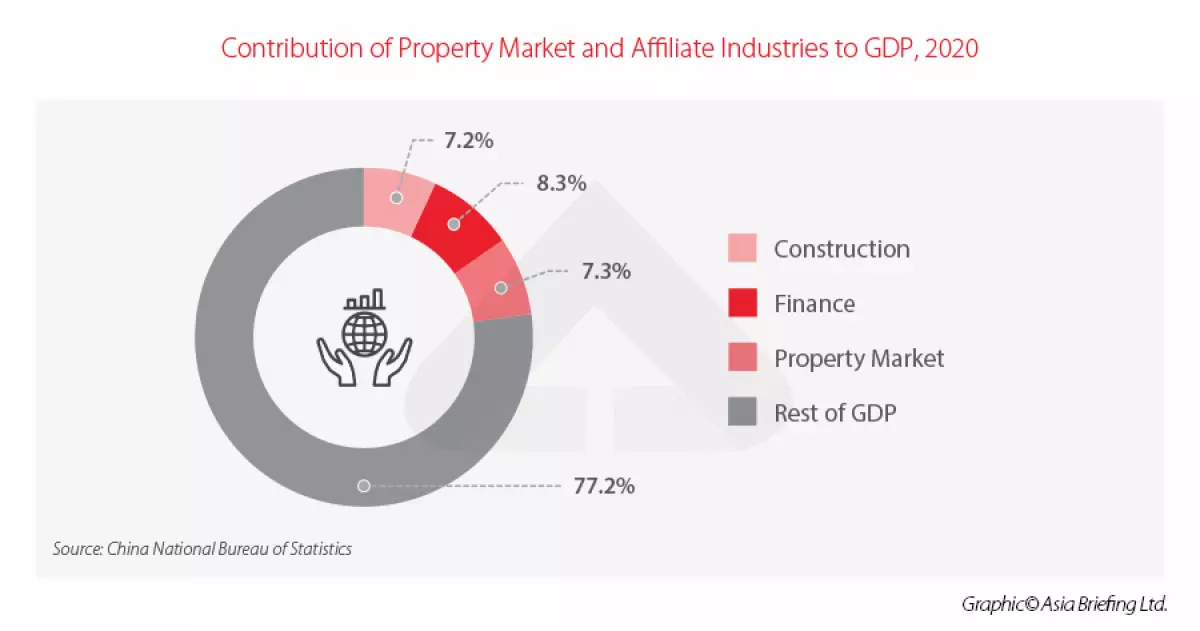

China's property market has been a significant driver of the economy since the country opened its markets in the 1980s. It contributes a substantial percentage to the GDP and provides employment opportunities in industries such as construction and finance. The demand for housing, driven by factors like cultural traditions and investment potential, has led to soaring prices and a reliance on debt.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

Key players and stakeholders in China’s property market

The property market in China is complex and intertwined with various stakeholders. Homeowners and prospective homeowners, who view property as a source of stability and investment, play a significant role. Property developers, some of the largest companies in China, fuel the market's growth but face immense pressure due to debt and financial obligations. Banks and financial institutions provide necessary funding to developers but face risks in case of defaults. Lastly, local governments rely on land sales and financing vehicles to stimulate economic growth.

Crisis in China’s property market

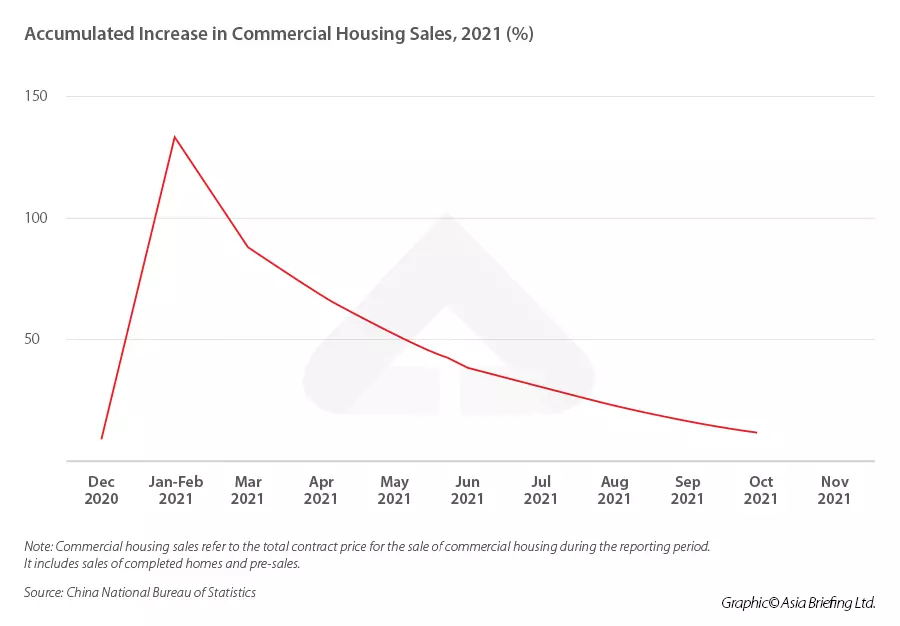

China's property market crisis has been brewing for years, fueled by mounting debt and speculative spending. The government's introduction of the "three red lines" policy in 2020 aimed to control debt levels, but it led to the downfall of major developers like Evergrande. This crisis has caused a decline in house prices, sales, and construction, impacting the overall economy. Local governments, heavily reliant on land sales, also face financial challenges.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

How is China tackling the property market crisis?

The Chinese government is implementing measures to address the challenges in the property market. It has relaxed the criteria for debt refinancing to provide relief to developers and is increasing liquidity for local governments through the issuance of special purpose bonds. The introduction of a property tax is also being considered to curb speculative spending. However, the effectiveness of these measures and their long-term impact remains to be seen.

2022 and beyond - what's next for China’s property market?

The outlook for China's property market in 2022 depends on the policies adopted by the government. Investment in the sector is expected to grow, albeit at a slower pace than in previous years. Policy options include easing restrictions on loans, adjusting land transfer policies, and promoting the construction of public rental housing. The government's commitment to reducing debt and diversifying the economy suggests that the property market may face further challenges in the coming years.

In conclusion, China's property market is at a critical juncture, with significant implications for the economy and various stakeholders. The ongoing crisis highlights the need for sustainable growth and prudent financial practices. As the government navigates these challenges, it remains to be seen how the property market will evolve and its impact on the global economy.

Note: This article is for informational purposes only and does not constitute financial or investment advice. Please consult with a professional advisor before making any financial decisions.