Image source: KenWiedemann/iStock Unreleased via Getty Images

Image source: KenWiedemann/iStock Unreleased via Getty Images

Introduction

It's time to revisit RPT Realty's (RPT) preferred shares, trading as RPT.PD. These preferred shares have seen a decrease in price due to rising interest rates, bringing the preferred dividend yield to an attractive 7.5%. In this article, we'll explore the reasons why these preferred shares are worth considering.

A Look at RPT's Q2 Results

Understanding the performance of the REIT is crucial in evaluating the preferred shares. In the second quarter, RPT Realty reported an improvement in Funds From Operations (FFO). The FFO per common unit is projected to exceed $1.05 for the full year. This indicates a positive trajectory for the company and strengthens the case for the preferred shares.

The Terms of the Preferred Share and its Coverage Ratios

The preferred shares offer a 7.25% preferred dividend yield, equating to a quarterly preferred dividend of $0.90625. An intriguing feature of these shares is the absence of a call provision. Owners of preferred shares have the option to convert them into common units at a conversion price of $14.41/share. This conversion feature allows preferred shareholders to potentially benefit from an increase in the underlying unit's share price.

Moreover, the FFO calculation reveals a strong coverage ratio for the preferred dividends. The preferred dividend coverage ratio stands at just under 1,500%, indicating that less than 7% of the FFO is required to cover the preferred dividends. Additionally, the preferred shares represent a relatively small portion of the REIT's equity value, ensuring their coverage and stability.

RPT Realty's Recent Successes and Future Prospects

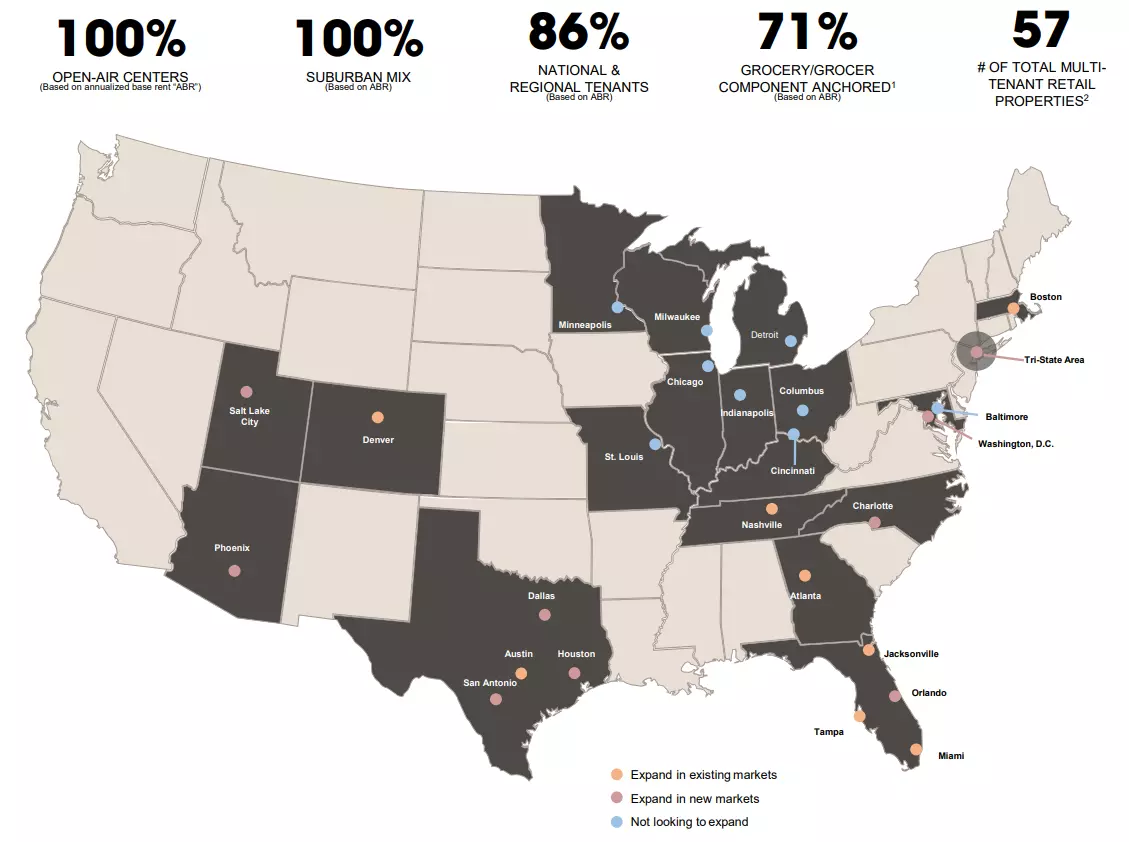

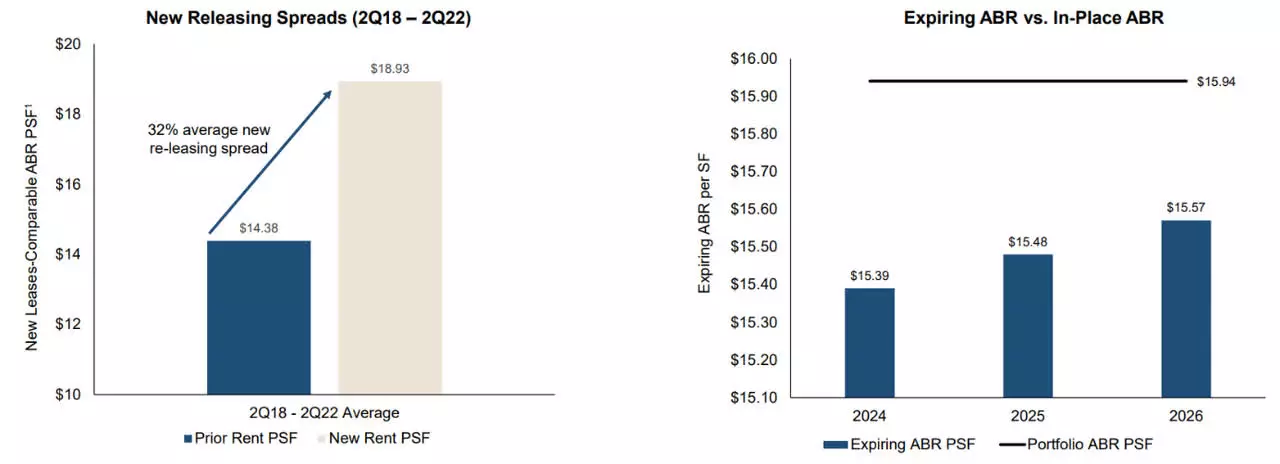

RPT Realty continues to make significant strides in its industry. The recent acquisition of the Mary Brickell Village property, coupled with the focus on grocery-anchored commercial real estate, showcases the REIT's commitment to strategic growth. Additionally, healthy leasing spreads and a potential improvement in rental income further contribute to the positive outlook.

Investment Thesis

Despite Mizuho's downgrade of RPT Realty's advice from "buy" to "neutral," this shift in recommendation does not significantly impact the preferred shareholders. Even in the event of a 40% decline in asset value, the preferred shares remain protected. Furthermore, the common units, with a P/FFO ratio of approximately 9.5, present an appealing investment opportunity. However, for income-focused investors, the 7.5% preferred dividend yield is an irresistible offer in terms of risk/reward.

Image source: RPT Realty Investor Relations

Image source: RPT Realty Investor Relations