Published on May 18th, 2023 by Aristofanis Papadatos

The current investing environment poses unique challenges for income-oriented investors. With the surge of inflation reaching a 40-year high last year, the Federal Reserve has been raising interest rates at an unprecedented pace to cool the economy. As a result, the economy has slowed down lately, and the risk of an upcoming recession has significantly increased.

However, there is a sector that has historically proved resilient to recessions: Apartment Real Estate Investment Trusts (REITs). These companies, which own and operate apartment communities, have the advantage of providing an essential service – housing. In this article, we will discuss the prospects of the top 10 apartment REITs that income-oriented investors should consider in the current investing environment.

Apartment REITs #10: Mid-America Apartment Communities (MAA)

Mid-America Apartment Communities is a REIT that owns, operates, and acquires apartment communities primarily in the Southeast, Southwest, and mid-Atlantic regions of the U.S. With a market capitalization of $18 billion, MAA has a substantial presence in the market.

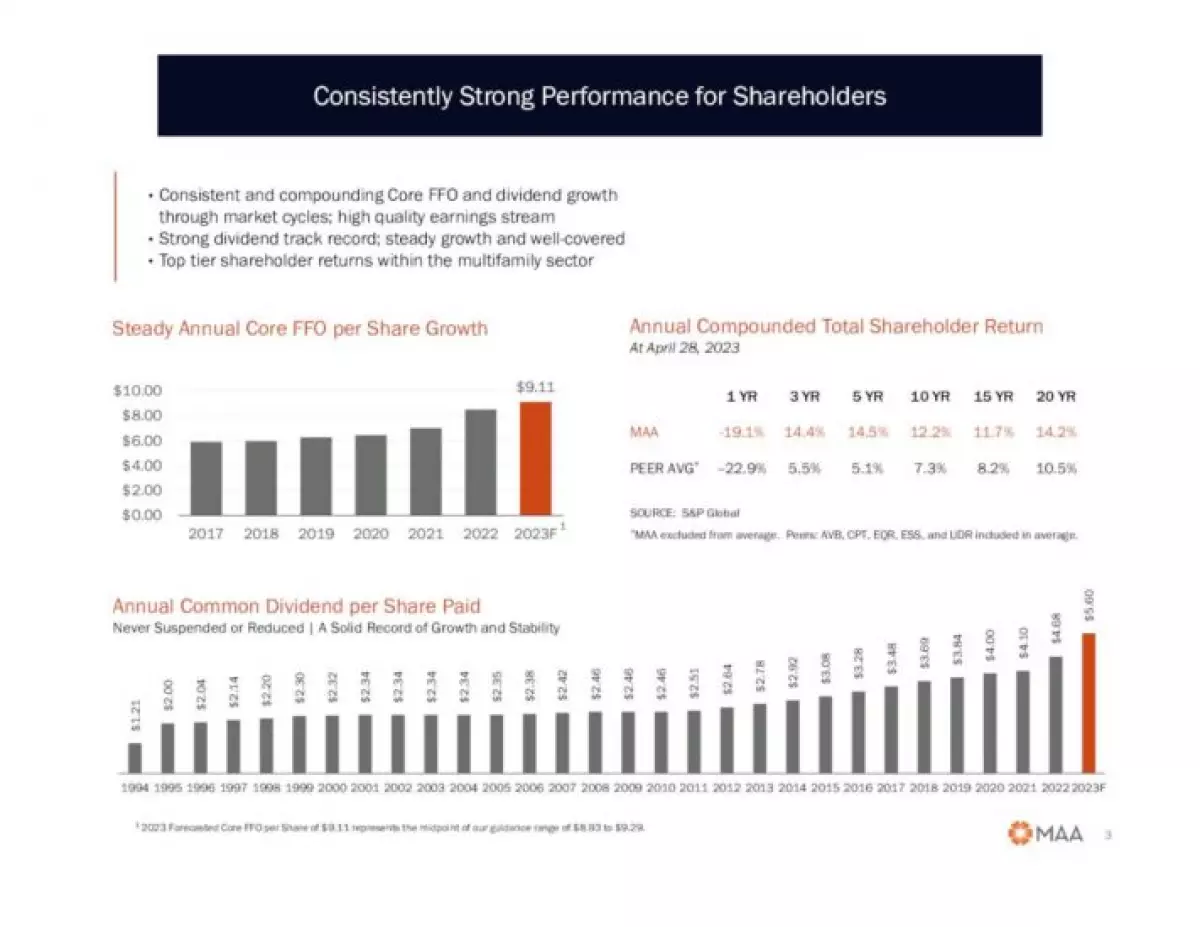

MAA's focus on the Sunbelt Region, which has exhibited superior population and economic growth in the long run, has allowed the REIT to offer exceptional returns to its shareholders. In fact, MAA has outperformed its peers by a wide margin in almost any time frame over the last two decades, as depicted in the chart below:

Source: Investor Presentation

Source: Investor Presentation

Furthermore, MAA has managed to maintain its dividend without any cuts for the past 30 years—a testament to its resilience during recessions. Although the current dividend yield may seem lackluster at 3.7%, MAA has a healthy payout ratio of 61% and has grown its dividend by 11% per year on average over the last three years.

The REIT has also grown its funds from operations (FFO) per share at a 7.7% average annual rate over the last decade, with a slight stumble in 2020 due to the pandemic. However, as the impact of the pandemic subsides, MAA has returned to growth mode.

With its focus on expanding its asset portfolio and enhancing customer value through the rollout of smart home technology, MAA is expected to grow its FFO per share and dividend by at least 5% per year on average over the next five years.

For more detailed information about Mid-America Apartment Communities (MAA), you can download our Sure Analysis report on the company.

Apartment REITs #9: Camden Property Trust (CPT)

Headquartered in Houston, Texas, Camden Property Trust is one of the largest publicly traded multifamily real estate companies in the U.S. The REIT owns, manages, and develops multifamily apartment communities, with a current portfolio of 178 properties that contain 60,652 apartments.

Camden Property Trust has a strong performance record, with consistent growth in its FFO per share. Over the last decade, the REIT has achieved an average annual growth rate of 5.4%. Even during the pandemic-induced recession in 2020, Camden Property Trust posted only a 3% decrease in its FFO per share while continuing to raise its dividend.

The REIT enjoyed robust business momentum in 2022, with record same-store revenue growth of 11.2% and net operating income growth of 14.6%. Additionally, it achieved a new all-time high for FFO per share at $6.59.

Camden Property Trust offers a dividend yield of 3.5% and has a solid payout ratio of 58%. With its strong business momentum and room for future growth, Camden Property Trust is well-positioned for long-term success.

For more detailed information about Camden Property Trust (CPT), you can download our Sure Analysis report on the company.

Apartment REITs #8: American Homes 4 Rent (AMH)

Based in Maryland, American Homes 4 Rent is an internally managed REIT that focuses on acquiring, developing, renovating, operating, and leasing single-family homes as rental properties. The REIT holds nearly 58,000 single-family properties in over 30 sub-markets of metropolitan statistical areas in 21 states.

AMH has exhibited exceptional performance, growing its FFO per share every year since its formation, at a 13.2% average annual rate. Although its dividend yield is currently 2.5%, which may seem lackluster for a REIT, AMH has more than doubled its dividend in the last two years. With a healthy payout ratio of 55% and promising growth prospects, AMH is likely to continue growing its dividend at a fast pace.

The REIT benefits from the superior growth of its markets, with a focus on areas experiencing high economic growth. This broad geographic diversification has contributed to its success. Additionally, AMH has an average occupancy rate of 97.1% and properties with an average age of 17 years.

For more detailed information about American Homes 4 Rent (AMH), you can download our Sure Analysis report on the company.

Apartment REITs #7: UMH Properties (UMH)

UMH Properties is one of the largest manufactured housing landlords in the U.S., with a diverse portfolio of tens of thousands of developed sites and 135 communities across the midwestern and northeastern regions. Manufactured homes have proven to be resilient to recessions due to their affordability compared to conventional homes.

UMH Properties grew its FFO per share by 11% in 2020, demonstrating its resilience during the severe recession caused by the coronavirus crisis. Over the last decade, the REIT has achieved an average annual growth rate of 3.8% in its FFO per share.

The REIT has promising growth prospects thanks to its exposure to the Marcellus & Utica Shale regions, which have the potential to become significant sources of natural gas. As development activity in these areas accelerates, UMH Properties is likely to benefit from a strong tailwind.

UMH Properties currently offers a dividend yield of 5.2%, which is higher than other REITs mentioned earlier. However, it has an elevated payout ratio of 90% and a material debt load, which may limit its ability to grow the dividend at a fast pace. Nevertheless, the REIT's attractive yield and growth potential make it an interesting choice for income-oriented investors.

For more detailed information about UMH Properties (UMH), you can download our Sure Analysis report on the company.

Apartment REITs #6: Equity Residential (EQR)

Equity Residential is one of the largest publicly-traded owners and operators of high-quality rental apartment properties in the U.S., with a portfolio primarily located in urban and dense suburban communities. The REIT's properties are located in affluent areas around major cities such as Boston, New York, Washington, D.C., Southern California, San Francisco, Seattle, and Denver.

Equity Residential benefits from the favorable characteristics of its target market: affluent renters who are highly educated, well-employed, and have high incomes. As a result, these renters devote approximately 20% of their incomes to rent, which allows Equity Residential to increase rent rates year after year.

Furthermore, the REIT benefits from a wide deficit between housing demand and supply in the U.S. Since the Great Recession, the gap has been estimated to be more than 5 million apartment units. This robust demand provides strong pricing power to Equity Residential.

For more detailed information about Equity Residential (EQR), you can download our Sure Analysis report on the company.

Apartment REITs #5: American Assets Trust (AAT)

American Assets Trust has a diverse portfolio of office, retail, and residential properties primarily located in California, Oregon, Washington, and Hawaii. With its acquisition, improvement, and development strategies, the REIT focuses on submarkets with favorable supply and demand characteristics and high barriers to entry.

Over the last eleven years, American Assets Trust has grown its FFO per share at a 7.0% average annual rate. In 2020, the REIT faced challenges due to the pandemic but has since recovered, achieving record FFO per share in 2022.

The current dividend yield for American Assets Trust is 7.0%, which is a nearly 10-year high. This high yield is primarily a result of the impact of high interest rates on the REIT's interest expense and concerns about the work-from-home trend affecting office properties. However, with a healthy payout ratio of 59% and decent growth prospects, American Assets Trust is likely to maintain its generous dividend, making it an appealing choice for income-oriented investors.

For more detailed information about American Assets Trust (AAT), you can download our Sure Analysis report on the company.

Apartment REITs #4: Essex Property Trust (ESS)

Essex Property Trust focuses on investing in multifamily residential properties on the west coast of the U.S., particularly in California and Washington. With a long track record of success, the REIT has consistently delivered high total returns since its IPO in 1994. Essex Property Trust is also a Dividend Aristocrat, having raised its dividend for 28 consecutive years.

The REIT's performance during the pandemic was impressive, with only a 7% decrease in its bottom line in 2020. Essex Property Trust has fully recovered from the downturn, achieving record FFO per share in 2022. Additionally, the company has a lower risk level than many other REITs due to its investment credit ratings and a balanced approach to leverage.

Essex Property Trust offers a dividend yield of 4.3%. With a solid payout ratio of 58%, a healthy balance sheet, and a resilient business model, the REIT is well-positioned to continue raising its dividend for years to come.

For more detailed information about Essex Property Trust (ESS), you can download our Sure Analysis report on the company.

Apartment REITs #3: Equity LifeStyle Properties (ELS)

Equity LifeStyle Properties is a REIT that focuses on the ownership and operation of lifestyle-oriented properties, including manufactured home and recreational vehicle communities. The REIT has consistently outperformed the S&P 500 and the REIT sector over the last decade, offering a total return of 344%, compared to 217% and 88%, respectively.

Equity LifeStyle Properties has achieved an average annual growth rate of 9.0% in FFO per share and 21% in dividends over the last 16 years. It benefits from having only 7.5% of its debt as floating rate debt, reducing the impact of high interest rates on interest expense. The REIT also has a strong interest coverage ratio of 5.5, allowing it to withstand economic slowdowns.

Despite a relatively low dividend yield of 2.6%, Equity LifeStyle Properties has a solid payout ratio of 63% and ample room to grow its FFO per share. This combination positions the REIT to continue raising its dividend at a fast pace.

For more detailed information about Equity LifeStyle Properties (ELS), you can download our Sure Analysis report on the company.

Apartment REITs #2: UDR (UDR)

UDR, also known as United Dominion Realty Trust, is a luxury apartment REIT with a focus on high barrier-to-entry markets in the U.S. The REIT owns, operates, acquires, renovates, and develops multifamily apartment communities.

UDR has consistently grown its FFO per share, achieving an average annual growth rate of 6.2% over the last decade. The REIT has also paid a dividend for 201 consecutive quarters and has increased its dividend for 13 consecutive years at a 6.7% average annual rate.

Currently, UDR offers a nearly decade-high dividend yield of 4.1%. With a reasonable payout ratio of 74% and a robust business model, UDR is likely to continue raising its dividend in the years to come.

For more detailed information about UDR (UDR), you can download our Sure Analysis report on the company.

Apartment REITs #1: AvalonBay Communities (AVB)

AvalonBay Communities is a $25 billion multifamily REIT with a portfolio of several hundred apartment communities. The REIT focuses on owning top-tier properties in major metropolitan areas such as New England, New York/New Jersey, Washington D.C., California, and the Pacific Northwest.

AvalonBay Communities has consistently grown its FFO per share, achieving an average annual growth rate of 5.1% over the last decade. The REIT also weathered the pandemic well, with only a 7% decrease in its bottom line in 2020. In 2022, it achieved another record FFO per share and is on track to grow it by another 7% this year.

The REIT currently offers a nearly decade-high dividend yield of 3.7%. With a reasonable leverage ratio, a strong interest coverage ratio, and a healthy payout ratio of 63%, AvalonBay Communities is likely to continue delivering a stable and growing dividend.

For more detailed information about AvalonBay Communities (AVB), you can download our Sure Analysis report on the company.

Final Thoughts

Apartment REITs are often overlooked by investors, but they have proven to be resilient and lucrative investments. In the current investing environment, where the risk of an upcoming recession is increasing, income-oriented investors should consider including apartment REITs in their portfolios.

These top 10 apartment REITs offer income-oriented investors a range of attractive options. From Mid-America Apartment Communities' consistent outperformance to AvalonBay Communities' stable dividend growth, these REITs have a solid track record and promising prospects.

If you are interested in finding high-quality dividend growth stocks and other high-yield securities, Sure Dividend offers various resources to assist you in making informed investment decisions.

Please note that this article is for informational purposes only and does not constitute financial advice. It is always recommended to conduct thorough research and seek the advice of a qualified financial professional before making any investment decisions.

To access Sure Dividend's resources and reports on high-quality dividend growth stocks and high-yield securities, visit Sure Dividend.