In my 26-year career in the real estate industry, I have had the privilege of running one of the most successful brokerages in the nation and even building a brokerage from the ground up. Along the way, we encountered the challenge of deciding which splits and fees to offer in order to attract the right agents while also maintaining profitability.

Today, I want to share with you an important lesson I learned: how you pay your agents can be more important than how much you pay them. After all, it doesn't matter what your splits and fees are if you don't have any agents. In this article, I'll discuss the most common splits, monthly fees, and additional services that successful brokerages are using to attract top agents in 2022. I'll also provide insights on how you can increase your revenue with additional fees and highlight common mistakes to avoid when designing compensation plans.

The Numbers Game: Transaction Fee Models

In recent years, the transaction fee model has gained popularity, thanks in part to the advancements in cloud-based real estate software. This model offers basic brokerage services for a low monthly fee, with an additional "transaction fee" charged upon a successful sale. Other services like marketing, training, and errors and omissions insurance (E&O) are typically purchased separately by the agent.

Transaction fee models usually have a monthly fee ranging from $35 to $75, depending on the resources offered by the brokerage. These resources may include lead generation websites, a customer relationship manager (CRM), or access to a central office. The transaction fees due upon commission earnings range from $250 to $500, significantly lower than a traditional split. Some transaction fee models even cap these fees for top-producing agents who achieve certain production milestones.

Is the Transaction Fee Model Right for Your Brokerage?

While I personally haven't worked for or owned a transaction fee model brokerage, I have coached broker owners who have. Based on my experience, this business model can be highly profitable—once you have over 200 agents! The challenge lies in growing your agent count rapidly enough to reach the break-even point before depleting your working capital.

Traditionally, this model required agents to work remotely, as it was difficult to convince seasoned agents accustomed to working in an office. However, with the impact of COVID-19, attitudes towards remote work may have shifted. If you're starting a brick-and-mortar brokerage and want to minimize the risk of losing money in the initial months, you may want to consider other compensation models.

Share the Wealth: Split Compensation Models

Despite the rise of alternative models, the split commission model remains the most common in the real estate industry. This model originated in the 1950s when brokerages focused on attracting customers through marketing, while agents handled the transactional aspect. Commissions earned were then split between the brokerage and the agent.

Most split compensation models have a low monthly fee, with agents agreeing to pay a larger portion of their commissions to the brokerage. There are three types of split compensation models: the traditional split, the graduated split, and the split to a cap. Let's explore each and see which agents they attract.

The Traditional Split Agent Compensation Model

Traditional split models, often found in small boutique brokerages or those providing leads to agents, offer a traditional split with no cap. If I were to open another boutique-style brokerage today, I would offer a traditional split and provide all-inclusive services at no additional cost to the agent. In fact, I might even cover expenses such as marketing costs, MLS fees, E&O insurance, and National Association of Realtors (NAR) dues in exchange for a larger share of the commission.

Is the Traditional Split Model Right for Your Brokerage?

The traditional split model is ideal if you plan to provide leads or comprehensive services to your agents. It works especially well for smaller brokerages with less than 10 agents, as higher splits make it easier to maintain profitability. Additionally, you can avoid the complexities of agent billing.

However, the challenge with a traditional split arises when agents become successful and the larger split becomes burdensome on their finances. If you want a compensation model that retains top-producing agents, consider the next split option.

The Graduated Split Agent Compensation Model

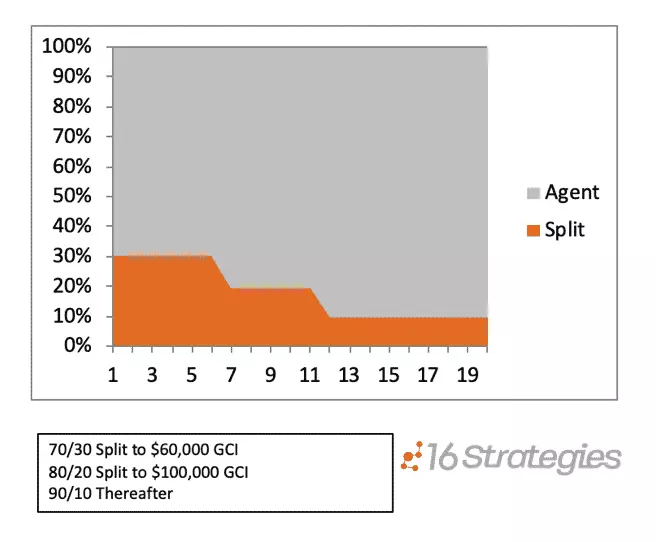

The graduated split compensation model is similar to the traditional split but rewards agents with a higher split as they reach certain milestones. For example, an agent may start with a 70/30 split, but when they achieve $60,000 in gross commissions earned (GCI), the split shifts to 80/20. Upon reaching $100,000 GCI, the agent enjoys a 90/10 split for the remainder of their fiscal cycle.

Agents' splits may reset to the initial level on their anniversary, or if they can demonstrate the likelihood of producing the same or higher GCI, they may be restarted at the higher level. This system motivates agents to increase productivity and fosters retention among top producers.

Is the Graduated Split Model Right for Your Brokerage?

The graduated split model is a solution for retaining top producers, which may be challenging with the previous compensation model. Moreover, it enhances your ability to recruit and retain agents, enabling your brokerage to grow beyond 10 agents.

The Split to a Cap Agent Compensation Model

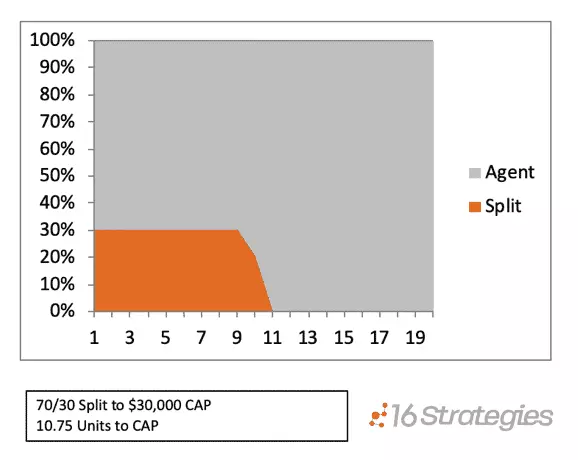

Some brokerages offer a split to a "cap." In this model, the term "cap" refers to a maximum amount an agent pays within a fiscal year. For instance, a brokerage may offer a 70/30 split to a cap of $30,000. Under this plan, agents pay 30% of their commissions until they reach the $30,000 cap.

Once the cap is reached, agents receive 100% of their commissions for the rest of the fiscal year. However, agents generally don't have to guarantee or repay the brokerage for any shortfall if they fail to reach the cap.

The split to a cap model has gained popularity because it accommodates multiple agent types. Keller Williams, Coldwell Banker, and eXp are among the companies offering this model, allowing new agents to start with lower monthly expenses while limiting costs when they become top producers.

Is the Split to a Cap Model Right for Your Brokerage?

While you may be tempted to adopt this model, starting with it can pose challenges in maintaining profitability month-over-month with fewer than 40 agents. Higher-producing agents may reach their cap within a few months, leaving you to support them without receiving commission revenue. Thus, I suggest considering a traditional split or graduated split model until you have at least 40 agents.

Monthly Fee Compensation Models

The monthly fee model resembles a landlord-tenant relationship. Brokers (landlords) provide all necessary services for agents to succeed in their real estate careers in exchange for a fixed monthly fee. Agents (tenants) pay for additional features like training, marketing, private offices, and transaction coordination separately.

Similar to tenants, agents sign an agreement to pay a monthly fee to cover brokerage services. In return, they receive 100% of the commission earned. Monthly fee models generally charge less than comparable split models. For example, a brokerage with a cap of $20,000 may offer a monthly fee of $1,200 ($1,200 x 12 = $14,400) for similar services. This is because revenue is guaranteed, regardless of an agent's home sales.

Is the Monthly Fee Model Right for Your Brokerage?

The monthly fee model provides more predictable revenue compared to split models, especially when your brokerage reaches its optimal size (10 to 30 agents). Unlike split models, your income is not reliant on market fluctuations, seasonal trends, or your agents' sales.

However, attracting new, newer, and low-producing agents can pose a challenge with this model. RE/MAX faced a similar issue in the early 2000s, as the average age of their agents surpassed the industry average. To address this, RE/MAX began offering both splits to accommodate new agents and a fixed monthly fee for mid-level and top producers.

How to Increase Revenue With Additional Fees

Due to the competitive nature of the real estate industry, increasing brokerage fees to keep up with inflation can be challenging. Many brokerages have had to explore additional fees and services to generate more revenue. These new fees and services have become commonplace for agents and can be easily adopted to create additional revenue for your brokerage.

Here are some examples of additional fees and services that can boost revenue:

| Fee | Description | Estimated Cost |

|---|---|---|

| Agent Transaction Fee | Transaction fee charged to the agent at closing | $100-$250 |

| Buyer Transaction Fee | Transaction fee charged to the buyer at closing | $200-$350 |

| Listing Transaction Fee | Transaction fee charged to the seller at closing | $200-$350 |

| Personal Transaction Fee | Fee charged to agents on personal transactions when no commission or split is involved | $300-$500 |

| Franchise Fee | Fee paid by agent to the franchisor | 5-8% of GCI |

| Desk Fee | Fee for a reserved desk or area in the office | $50-$150 |

| Office Fee | Fee for a private or shared office (includes desk) | $200-$1,000 |

| Brokerage Advertising Fee | Monthly fee paid to support marketing the brokerage | $25/month |

| Annual Fees | Annual renewal fee | $300-$1,100 |

| Setup Fees | Fee charged to the agent when they join (includes business cards, website setup, announcement) | $150-$300 |

| Errors and Omissions Insurance Fees | Monthly, quarterly, annual, or per transaction fee for E&O coverage | $25-$60/month or $150/transaction |

| Transaction Coordination | Contract-to-closing file management (optional) | $300-$600/transaction |

| Showing Service Fee | Monthly or per listing fee for showing services | $20/month or $75/listing |

| Signs and Lockboxes | Sign rental and installation (optional) | $75-$150/listing |

| Open House Signs | Rental and installation of open house signs (optional) | $50-$100/listing |

| Listing Marketing Fee | Listing marketing packages (optional) | $300-$600/listing |

| Individual Property Website | Individual property website (optional) | $50-$100/listing |

| Listing Presentations | Professional quality printed listing presentation (optional) | $25-$50/listing |

| Just Listed/Just Sold Cards | 100 cards printed and mailed, includes postage (optional) | $100-$200/listing |

| Listing Photography | Professional listing photography, drone photography (optional) | $150-$400/listing |

| New Agent Training | Training for new agents (often included in an increased split) | 10-20% additional split |

| Advanced Training | Annual onsite or offsite training events | $50-$500 |

| Mentoring | Mentoring usually tied to an increased split | 10% additional split |

| Coaching | Coaching fee, split between coach and brokerage | $500-$100/month |

| Continuing Education | Fee for continuing education sessions | $20/CE credit hour |

Common Mistakes to Avoid When Selecting a Compensation Model

When designing your compensation plan and building your brokerage's financial model, it's important to avoid common mistakes. Here are three pitfalls to watch out for:

1. Copying Your Current Brokerage

Many aspiring brokerage owners tend to replicate the business model of their former brokerage, aiming to improve upon it. However, this approach overlooks other compensation models that may be a better fit for you as a broker owner and for the types of agents you want to attract. Don't limit yourself—explore different models to find the one that suits your vision.

2. Offering a Compensation Model to Please All Agents

Recruiting real estate agents presents a challenge, as their needs vary at different stages of their careers. Newer agents seek training and personal attention, while mid-level agents value community and reasonable fees. Top producers and teams require the flexibility to grow without their expenses outpacing revenue.

Attempting to create a compensation model that satisfies all agent types, regardless of their phase in the business, is a mistake. Unless you have substantial investment capital, it's unlikely you can immediately support all types of agents. It's best to focus on one agent type first, building your brokerage around their needs. As you achieve profitability, you can broaden services and compensation plans to attract a wider range of agents.

3. Overestimating Agent Production

When building your brokerage's financial model, avoid overestimating agent production. This is a common mistake in business planning. Analyze data for your market area to determine the typical agent performance. In our analysis of 6,000 real estate agents in Colorado, we found that nearly 35% did fewer than one transaction, and a staggering 85% did less than six transactions annually.

Conduct similar research for your area to make more accurate assumptions in your financial models. This way, you can adjust your agent count, splits, and fees accordingly. BrokerMetrics provides market and agent analysis software that can help you with this process.

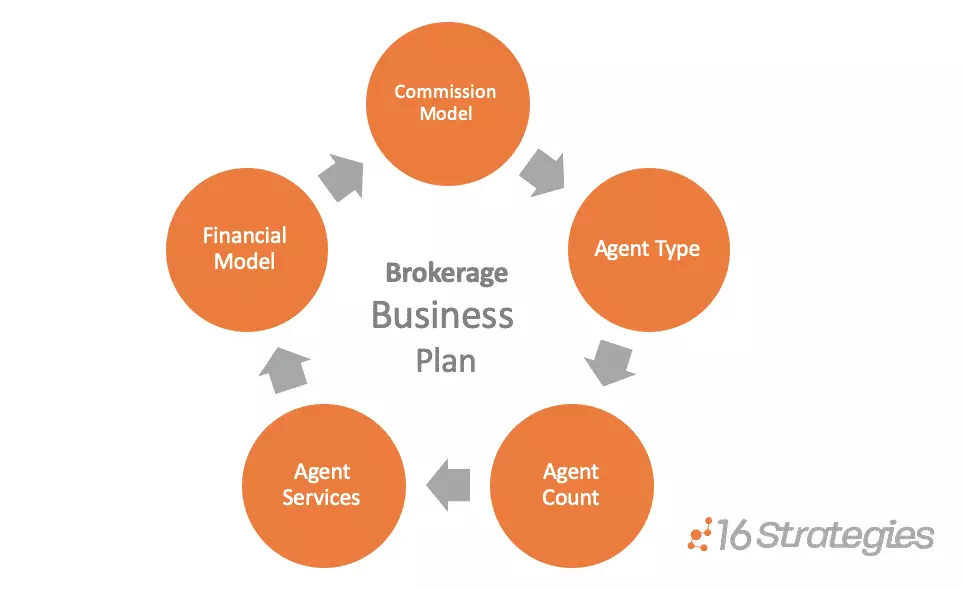

Your Compensation Model Shapes Your Business Plan

Your chosen compensation model, the type of agents you recruit, and the fees you charge play a crucial role in your brokerage's business plan. They determine the agent count required to remain profitable and the services your brokerage must offer to attract and retain those agents.

Once you've determined your compensation model, target agent type, agent count, and required services, you can calculate the overall costs involved. If the expenses exceed your expectations, revisit your plan and make adjustments to achieve profitability while supporting the agents you want to work with. Designing a successful real estate brokerage begins with determining your compensation model.

If you need further assistance in creating your brokerage's financial model, feel free to reach out to me at my consulting company, 16 Strategies.

Over to You

Have you come across a compensation model that we overlooked? Share your thoughts in the comments or join our Facebook Mastermind Group here.

Further Reading for Aspiring Broker Owners

If you're planning to start your own real estate brokerage or are already in the process, check out our collection of industry insider articles on starting, running, and growing your brokerage:

- How to Create an Inspiring Mission, Vision & Values for Your Brokerage

- The Ultimate Guide to Recruiting Agents for Your Team or Brokerage

- Are Brick & Mortar Real Estate Offices a Waste of Money in 2022?

- How to Select the Right Office for Your Real Estate Brokerage

- The 5 Employees You Need to Hire to Grow Your Brokerage in 2022