The real estate market has been on a frenzied rise over the past few years, making it challenging for many homebuyers. However, for those who have managed to buy a home, the return on investment has been substantial. With homes appreciating at a record pace, investors are now looking towards rental properties as a potential source of returns. While institutional investors have been quick to capitalize on the current market conditions, smaller-scale investors can also find opportunities. However, before diving into the rental property market, potential landlords must carefully assess how rapid shifts in real estate values could impact their investments in the short and long term.

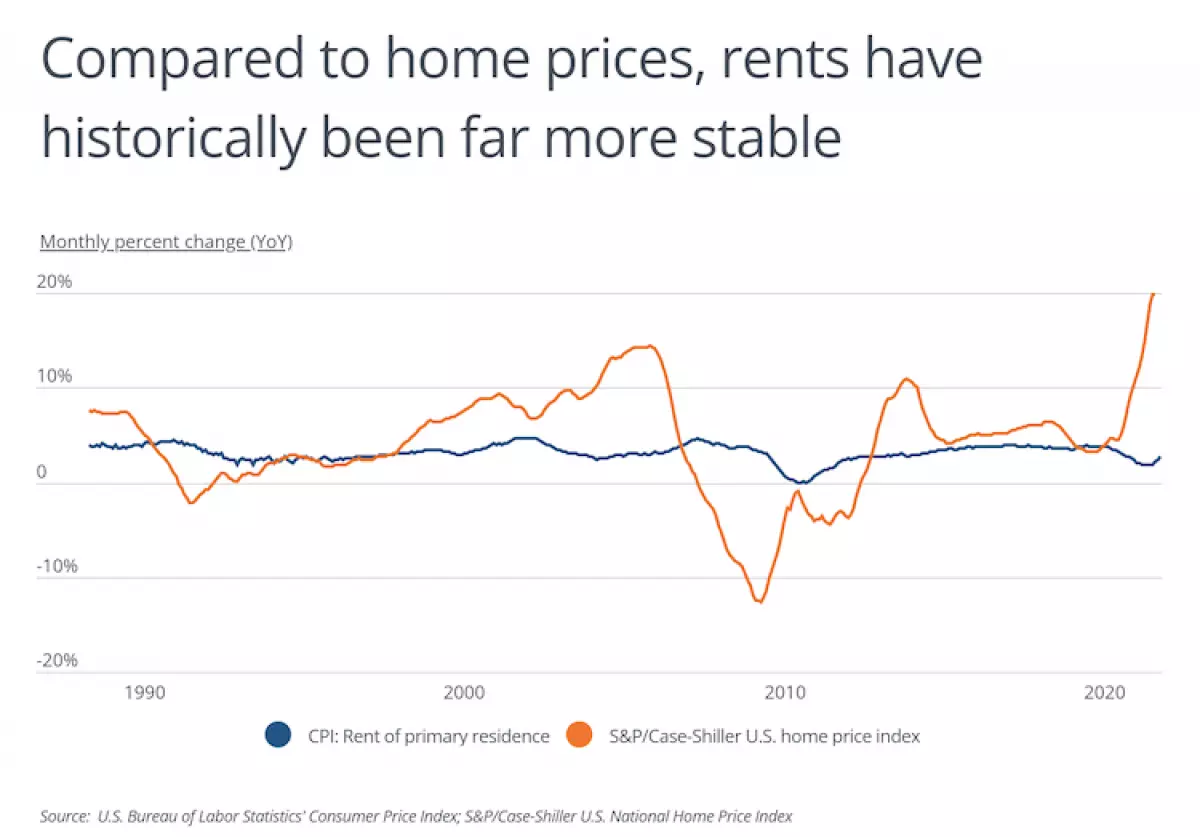

As home prices continue to soar, it is important to note that they have shown a fair amount of volatility over time, especially when compared to rents. While prices experienced rapid growth during the real estate bubble of the early to mid-2000s, they later collapsed when the bubble burst. It took several years for home prices to recover, and it wasn't until the recent spike in 2020 that they reached new heights. In contrast, rents have shown more stability, growing steadily at a rate between 2 and 5 percent annually, with only a slight dip during the Great Recession and the past year.

The relative stability of rents compared to the current surge in home prices will play a significant role in how potential real estate investors evaluate properties. As sale prices increase, so do the initial investment and ongoing costs. This can limit the cash flow from the investment if rents fail to keep pace. On the flip side, rapid appreciation in home values can lead to a higher overall return when the property is eventually sold.

Image: The Best U.S. Cities to Invest in a Rental Property

Image: The Best U.S. Cities to Invest in a Rental Property

One key indicator that investors use to assess the quality of an investment is the gross rent multiplier. This ratio is calculated by dividing the price of a real estate investment by the gross annual rental income. Generally, a lower ratio is viewed as a favorable investment because it means the rental income will recoup the cost of the property more quickly. However, as investment prices rise, so does the gross rent multiplier.

Another factor influenced by rising home prices is property taxes. With higher home values, property owners face larger annual property tax burdens, which can reduce cash flow. Fortunately, property tax rates vary widely by location, and many parts of the country have effective tax rates of less than 1%.

Considering these factors, real estate investors can narrow down the best locations for investment. Markets with a low gross rent multiplier, low property taxes, and a positive outlook for future property value growth offer the most favorable conditions for potential investors. In the United States, many of these locations are found in the South. Southern states tend to have lower housing prices and property taxes compared to other regions. Additionally, the rapid growth in the South is expected to drive up property values as more people seek housing opportunities.

Image: The Best U.S. Cities to Invest in a Rental Property

Image: The Best U.S. Cities to Invest in a Rental Property

Now let's explore some of the best metropolitan areas in the United States to invest in a rental property:

The Best Large Metros for Investing in Rental Property

15. Nashville-Davidson-Murfreesboro-Franklin, TN

- Composite index: 53.27

- Gross rent multiplier: 21.4

- Median monthly rent: $1,422

- Median home price: $365,573

- Year-over-year change in home price: +20.9%

- Forecasted home price growth: +19.0%

- Effective property tax rate: 0.56%

- Year-over-year change in population: +1.4%

14. Miami-Fort Lauderdale-Pompano Beach, FL

- Composite index: 53.81

- Gross rent multiplier: 17.4

- Median monthly rent: $1,798

- Median home price: $375,082

- Year-over-year change in home price: +18.2%

- Forecasted home price growth: +20.6%

- Effective property tax rate: 0.92%

- Year-over-year change in population: +0.1%

13. Charlotte-Concord-Gastonia, NC-SC

- Composite index: 54.74

- Gross rent multiplier: 20.3

- Median monthly rent: $1,306

- Median home price: $317,876

- Year-over-year change in home price: +23.8%

- Forecasted home price growth: +23.0%

- Effective property tax rate: 0.77%

- Year-over-year change in population: +1.7%

Learn more about Charlotte investment properties here.

12. Las Vegas-Henderson-Paradise, NV

- Composite index: 55.19

- Gross rent multiplier: 21.2

- Median monthly rent: $1,488

- Median home price: $378,476

- Year-over-year change in home price: +24.1%

- Forecasted home price growth: +18.5%

- Effective property tax rate: 0.58%

- Year-over-year change in population: +1.8%

11. San Antonio-New Braunfels, TX

- Composite index: 55.41

- Gross rent multiplier: 16.6

- Median monthly rent: $1,308

- Median home price: $260,466

- Year-over-year change in home price: +19.3%

- Forecasted home price growth: +17.6%

- Effective property tax rate: 1.62%

- Year-over-year change in population: +1.6%

10. Houston-The Woodlands-Sugar Land, TX

- Composite index: 55.76

- Gross rent multiplier: 15.8

- Median monthly rent: $1,410

- Median home price: $267,794

- Year-over-year change in home price: +17.9%

- Forecasted home price growth: +15.5%

- Effective property tax rate: 1.67%

- Year-over-year change in population: +1.3%

Learn more about Houston investment properties here.

9. Oklahoma City, OK

- Composite index: 57.21

- Gross rent multiplier: 15.0

- Median monthly rent: $1,056

- Median home price: $190,559

- Year-over-year change in home price: +13.7%

- Forecasted home price growth: +11.9%

- Effective property tax rate: 0.93%

- Year-over-year change in population: +1.1%

8. Phoenix-Mesa-Chandler, AZ

- Composite index: 57.45

- Gross rent multiplier: 21.7

- Median monthly rent: $1,572

- Median home price: $410,028

- Year-over-year change in home price: +32.2%

- Forecasted home price growth: +23.8%

- Effective property tax rate: 0.57%

- Year-over-year change in population: +2.1%

7. Memphis, TN-MS-AR

- Composite index: 59.35

- Gross rent multiplier: 15.3

- Median monthly rent: $1,077

- Median home price: $198,369

- Year-over-year change in home price: +17.7%

- Forecasted home price growth: +16.4%

- Effective property tax rate: 1.01%

- Year-over-year change in population: +0.2%

Learn more about Memphis investment properties here.

6. Tulsa, OK

- Composite index: 59.55

- Gross rent multiplier: 14.8

- Median monthly rent: $1,028

- Median home price: $181,919

- Year-over-year change in home price: +14.5%

- Forecasted home price growth: +14.1%

- Effective property tax rate: 0.95%

- Year-over-year change in population: +0.7%

5. Jacksonville, FL

- Composite index: 61.17

- Gross rent multiplier: 17.7

- Median monthly rent: $1,418

- Median home price: $301,415

- Year-over-year change in home price: +23.5%

- Forecasted home price growth: +23.8%

- Effective property tax rate: 0.90%

- Year-over-year change in population: +1.7%

Learn more about Jacksonville investment properties here.

4. Atlanta-Sandy Springs-Alpharetta, GA

- Composite index: 61.70

- Gross rent multiplier: 17.4

- Median monthly rent: $1,506

- Median home price: $315,033

- Year-over-year change in home price: +23.0%

- Forecasted home price growth: +23.9%

- Effective property tax rate: 0.88%

- Year-over-year change in population: +1.0%

3. Birmingham-Hoover, AL

- Composite index: 62.03

- Gross rent multiplier: 15.9

- Median monthly rent: $1,100

- Median home price: $210,425

- Year-over-year change in home price: +15.3%

- Forecasted home price growth: +13.2%

- Effective property tax rate: 0.49%

- Year-over-year change in population: +0.1%

Learn more about Birmingham investment properties here.

2. Orlando-Kissimmee-Sanford, FL

- Composite index: 63.00

- Gross rent multiplier: 16.0

- Median monthly rent: $1,678

- Median home price: $321,666

- Year-over-year change in home price: +18.7%

- Forecasted home price growth: +15.8%

- Effective property tax rate: 0.86%

- Year-over-year change in population: +1.2%

1. Tampa-St. Petersburg-Clearwater, FL

- Composite index: 65.26

- Gross rent multiplier: 17.0

- Median monthly rent: $1,523

- Median home price: $310,378

- Year-over-year change in home price: +27.7%

- Forecasted home price growth: +27.2%

- Effective property tax rate: 0.90%

- Year-over-year change in population: +1.4%

Methodology & Detailed Findings

To identify the best locations for buying a rental property, our researchers created a composite index based on five key factors that real estate investors consider when evaluating a market. These factors include the gross rent multiplier, recent and forecasted home price growth, effective property tax rates, and population growth.

Data sources used in our analysis include the U.S. Census Bureau, Zillow, and the Department of Housing and Urban Development. To ensure relevance, we only included locations with at least 100,000 residents and data available from all sources.

Investing in rental properties can be a lucrative venture, but it's crucial to carefully assess the market conditions and choose the right location. The cities listed here offer a combination of favorable factors for real estate investors seeking long-term returns.