Introduction

The digitalization of markets has had a profound impact on various industries, and real estate is no exception. Over the past few years, the concept of tokenization has revolutionized the real estate industry by reducing market barriers, increasing liquidity, improving transparency, and automating middleman processes. In this article, we will delve into the world of real estate tokenization, exploring what it is, how it works, its advantages and challenges, and how it compares to traditional Real Estate Investment Trusts (REITs).

Background

The traditional real estate market is valued at a staggering $280 trillion, making it one of the largest markets globally. However, it is also known for its high investment costs, inefficiency, and lack of transparency. Tokenization addresses these issues by leveraging blockchain technology to break down properties into digital tokens that are stored on a decentralized database. This allows investors to own fractional shares of real estate assets, removing the need for direct property management.

According to a recent study by Moore Global, even if just 0.5% of the total global property market were to be tokenized in the next five years, it would become a $1.4 trillion market. This highlights the immense potential of real estate tokenization in broadening market participation and increasing the investment pool for both traditional and non-traditional investors. However, this emerging market also comes with its own set of challenges, including taxation, regulation, and governance.

How Does Tokenization Work?

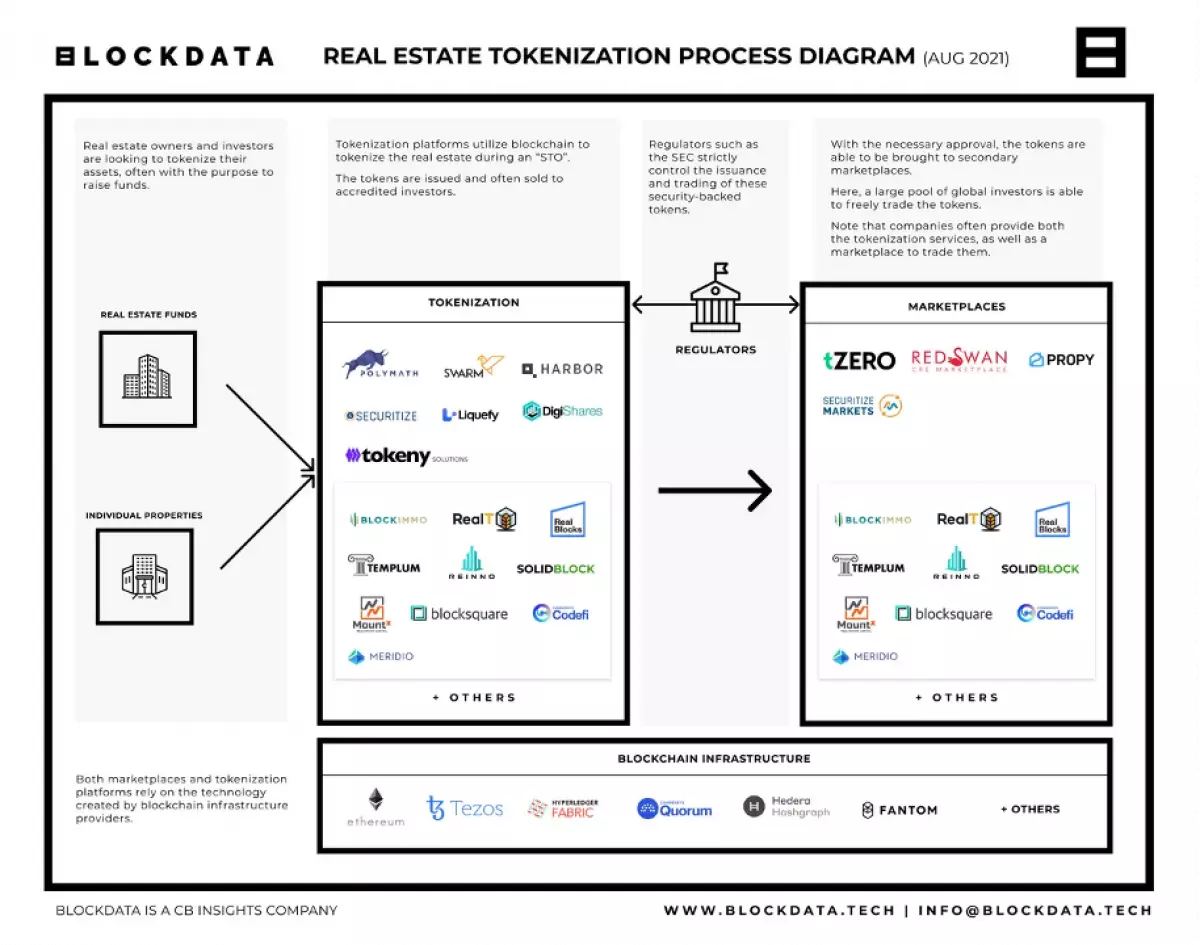

There are three main phases involved in the tokenization process:

Phase 1 - Deal Structuring and Shareholders

Property owners determine the type of asset they want to tokenize and decide on the governance structure. They can choose to form a Special Purpose Vehicle (SPV), become part of a Real Estate Fund or a REIT, or adopt other types of investment structures. However, the rights and responsibilities of tokenized real estate shareholders are still unclear due to the novelty of this investment form and the complexities surrounding its regulation and taxation.

Phase 2 - Selecting Tokenization Platform

Property owners select a tokenization platform that utilizes blockchain technology to create tokens and execute automated agreements between buyers and sellers. These agreements, known as smart contracts, contain predefined rules and behaviors that govern the lifecycle of the tokens. Smart contracts play a vital role in ensuring the security and transparency of the tokenized assets.

Phase 3 - Issuance, Regulation, and Distribution

During the Security Token Offering (STO) phase, digital tokens are created and issued on the blockchain, following regulatory standards. However, the regulatory landscape for tokenized real estate is still evolving, with different authorities categorizing these tokens differently. This variation in categorization creates uncertainties surrounding the tax and regulation structure of real estate tokens. Once regulatory standards are met, tokens can be freely traded in secondary marketplaces.

[Source]

[Source]

Advantages of Tokenization

Low Entry Barriers

Tokenization significantly reduces the high upfront costs associated with traditional real estate investments. By fractionalizing properties, tokenization allows everyday investors to access smaller portions of high-value assets, thereby increasing market accessibility and democratizing real estate investments. Additionally, tokenization streamlines processes, reduces middleman involvement, and eliminates the need for extensive paperwork and loan qualifications.

Diversification

With tokenization, investors can easily create diversified portfolios by purchasing shares of different types of real estate assets. This opens up opportunities to invest in malls, movie theaters, apartment complexes, and more, allowing for greater flexibility and risk mitigation.

Liquidity

Unlike traditional real estate investments, tokenized assets can be easily traded on blockchain networks, making the buying and selling process faster and more cost-effective. This increased liquidity opens up new possibilities for investors to exit their positions whenever they desire, reducing the capital lock-in period typically associated with real estate investments.

Efficiency

Tokenization leverages blockchain technology to automate processes, eliminating the need for intermediaries such as agents and brokers. By removing these middlemen, tokenization reduces overall transaction costs and speeds up the investment process. Smart contracts embedded in blockchain ensure transparent and efficient management of transactions, streamlining the entire investment process.

Transparency

Transparency is a fundamental characteristic of blockchain technology. Every transaction involving tokenized assets is permanently recorded on the blockchain, creating an immutable and publicly accessible ledger. This level of transparency not only increases trust but also provides investors with a comprehensive view of the history and performance of the asset.

Additional Capital

Tokenization allows real estate developers to tap into more capital by fractionalizing properties. This increased market participation leads to a greater influx of funds, enabling developers to finance their projects at any stage of development.

Challenges to Tokenization

Regulations

One of the main hurdles to the widespread adoption of real estate tokenization is the lack of clear and consistent regulatory frameworks. Different regulatory authorities categorize tokenized real estate differently, with some considering them securities and others treating them as property. This inconsistency creates uncertainty around taxation, regulation, and governance, discouraging potential investors and hindering the long-term viability of tokenization. Establishing a well-defined regulatory system is crucial to address the challenges associated with this emerging investment form.

Lack of Public Awareness

Despite the growing popularity of cryptocurrencies, real estate tokenization remains largely unknown to the general public. Limited market participation by large real estate companies and investors contributes to the lack of awareness surrounding this innovative investment opportunity. Raising public awareness and showcasing successful tokenization projects can play a crucial role in expanding the adoption of real estate tokens.

Volatility

Blockchain-based systems, including cryptocurrencies, are known for their volatility. While real estate tokens are backed by physical assets, the overall market volatility associated with cryptocurrencies can still impact investor sentiment. The unpredictable nature of digital assets and the potential for sudden market fluctuations pose challenges to the broader acceptance and stability of tokenization in the real estate industry.

Tokenization vs. REITs

Real Estate Investment Trusts (REITs) have long been a popular investment vehicle in the real estate industry. These entities offer various advantages, such as reduced market barriers, increased diversification, and simplified trading processes. However, tokenization differs from REITs in several key aspects:

- Regulatory System: REITs operate under a well-defined regulatory system that provides tax efficiency and clear guidelines. In contrast, the regulatory framework for real estate tokens is still evolving, leading to uncertainties and varying treatment across jurisdictions.

- Investment Accessibility: REITs often have investment minimums and historically offer low returns. Real estate tokens, on the other hand, are accessible to anyone and frequently have no minimum investment requirement, allowing for broader market participation.

- Investment Specificity: Tokenized real estate offers investors the opportunity to invest in specific properties, providing a more targeted and personalized investment experience compared to the broader asset portfolio of REITs.

St. Regis Tokenization Case

The St. Regis Aspen Resort case exemplifies the convergence between REITs and real estate tokens. In this case, the resort owner, Elevated Returns, offered ownership of the hotel through token sales. They created SEC-compliant Aspen Coins, which were tokens representing fractional ownership of the resort, priced at $1 per coin. This successful token offering demonstrated the potential of combining the regulatory structure of REITs with the secure and transparent nature of blockchain technology.

Conclusion

Real estate tokenization has the potential to transform the way people invest in real estate. By leveraging blockchain technology, tokenization reduces market barriers, increases liquidity, improves transparency, and introduces new investment opportunities for a broader range of investors. However, regulatory uncertainties and market volatility pose challenges to the widespread adoption of real estate tokens. To navigate this evolving landscape successfully, property owners should seek advice from legal, securities, tax, accounting, and real estate professionals to mitigate risks and maximize the benefits of tokenization.