Kwarkot/iStock via Getty Images

Kwarkot/iStock via Getty Images

An Introduction to REITs

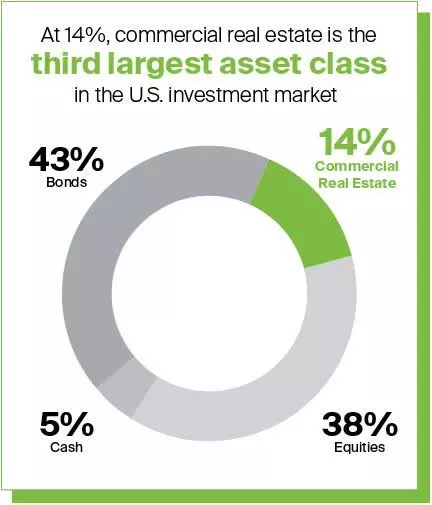

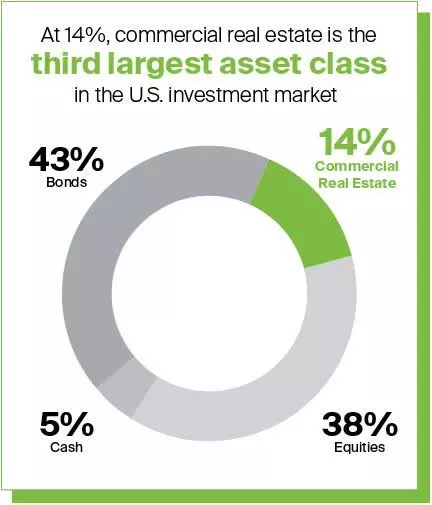

REITs, or Real Estate Investment Trusts, offer individuals a unique opportunity to invest in real estate assets and generate a steady stream of income. These trusts have become the third-largest asset class in the United States, providing investors with a diversified portfolio of real estate assets. Recognized for their historical benefits, REITs offer:

- Dividend Benefits and Inflation Protection: REITs provide an income stream that can act as an inflationary hedge, offering higher yields than bonds and protection against rising inflation.

- Competitive Long-Term Performance: REITs have historically delivered long-term total returns comparable to stocks and better returns than bonds. Their attractive yields make them an appealing choice in today's low-yield bond market.

- Portfolio Diversification: With their distinct asset class, REITs offer a valuable opportunity to diversify investment portfolios and maximize returns without taking on additional risk.

- Liquidity: REITs are traded on major stock exchanges, providing investors with instant access to their funds. Unlike bonds, which are subject to supply and demand, REITs offer attractive return potential regardless of inflation levels.

Image Source: Why invest in Real Estate Investment Trusts (REITs)?

Image Source: Why invest in Real Estate Investment Trusts (REITs)?

How Do REITs Perform In An Inflationary Environment?

REITs are known for their ability to capitalize on long-term secular trends and offer protection against inflation. As economies recover from the pandemic and inflationary concerns persist, many investors are turning to real assets, including REITs, to safeguard their portfolios.

Publicly traded REITs, such as American Tower Corporation (AMT), enable investors to own a diversified portfolio of income-generating real estate properties. However, it's crucial to assess each REIT individually to determine its value. While AMT remains a dominant player in the wireless and broadcast infrastructure space, its high valuation may make it less appealing compared to other REITs.

Source: Seeking Alpha Premium

Source: Seeking Alpha Premium

It's essential to consider more attractively priced REITs when building your portfolio. Here are our top five REIT recommendations:

Agree Realty Corporation

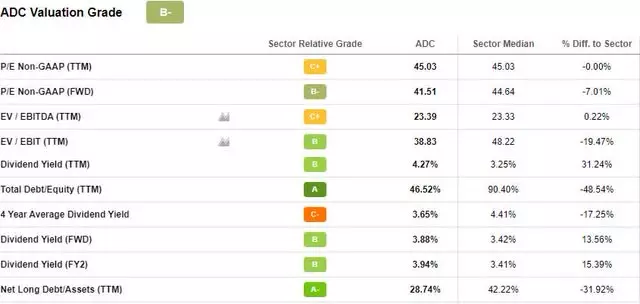

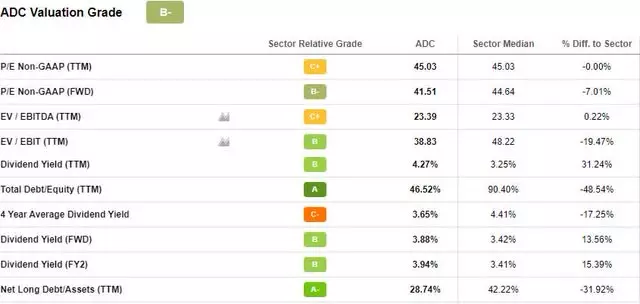

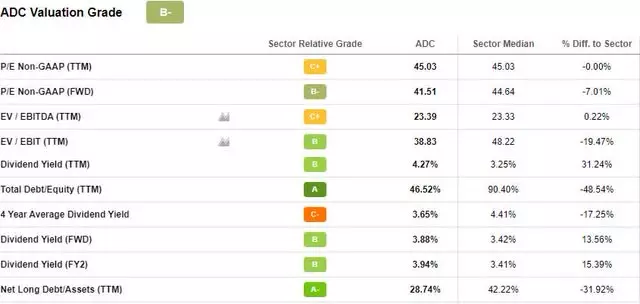

Agree Realty Corporation (ADC) is a net-lease REIT that focuses on acquiring and developing retail properties leased to tenants. With a strong balance sheet, attractive dividend yield, and favorable valuation metrics, ADC presents an enticing investment opportunity.

Source: Seeking Alpha Premium

Source: Seeking Alpha Premium

ADC's growth and profitability metrics remain positive, making it a top pick despite its slightly expensive valuation. The company's focus on best-in-class retail net lease opportunities, combined with its monthly dividend payout and increasing investment-grade tenant exposure, positions ADC for long-term growth.

STAG Industrial, Inc.

STAG Industrial, Inc. (STAG) is a leader in environmental, social, and governance (ESG) practices. This REIT focuses on acquiring and operating single-tenant industrial properties. With a reasonably attractive valuation compared to its peers, STAG offers significant potential for income and growth.

Source: Seeking Alpha Premium

Source: Seeking Alpha Premium

STAG's third-quarter results showcased solid performance, exceeding expectations and demonstrating growth in revenue and funds from operations (FFO). The high demand for rental spaces further supports the company's growth potential. With a strong momentum grade, STAG is well-positioned for future success.

Regency Centers Corporation

Regency Centers Corporation (REG) is one of the largest shopping center operators, focusing on housing grocers and retailers. As economies recover and retail sales bounce back, shopping center REITs like REG offer opportunities for investment.

Source: Seeking Alpha Premium

Source: Seeking Alpha Premium

REG boasts a solid valuation, a forward price-to-earnings ratio below the sector average, and strong Q3 results. With an A- revisions grade and a dividend increase, REG is expected to continue its steady growth. As shoppers' demand for goods increases, the value of shopping center REITs rises.

Essential Properties Realty Trust, Inc.

Essential Properties Realty Trust, Inc. (EPRT) focuses on owning and managing single-tenant net-leased properties. By leasing to middle-market companies in service- and experience-based sectors, EPRT maintains a robust portfolio.

Source: Seeking Alpha Premium

Source: Seeking Alpha Premium

EPRT's Q3 results were impressive, with significant revenue growth and an increased dividend. The company's commitment to sound business fundamentals and its ability to adapt to changing market conditions contributes to its success. EPRT offers investors a unique opportunity to invest in a fast-growing net lease REIT.

Alpine Income Property Trust, Inc.

Alpine Income Property Trust, Inc. (PINE) is a newer net-lease REIT that specializes in owning high-quality commercial income properties. With an attractive valuation and strong growth potential, PINE presents an appealing investment option.

Source: Seeking Alpha Premium

Source: Seeking Alpha Premium

PINE's Q3 earnings exceeded expectations, demonstrating robust growth and increasing rental revenue. With a favorable valuation and a high dividend yield, PINE presents an opportunity to capitalize on the net-lease sector's growth.

Conclusion: Secure Your Financial Future with REITs

Investing in REITs can provide stability and long-term growth for your portfolio. As we navigate an inflationary environment, these top five REITs for 2022 offer great value and attractive yields. With their strong fundamentals, steady income streams, and the potential to inflation-proof your investments, these REITs can help secure your financial future.

Remember, REITs are just one piece of the puzzle. Consider diversifying your portfolio with top financial and energy stocks to further protect against inflation. By leveraging reliable investment research tools and resources, you can make informed decisions that align with your financial goals.