Unlock the secrets to achieving capital growth and fueling your investment success

Are you ready to take your investment game to the next level? If you're a risk-taker looking to achieve substantial growth, then the concept of "capital growth" is your key to success. In this comprehensive guide, we will delve deep into the principles of capital growth and explore the asset classes that can propel your investments to new heights. Get ready to learn everything you need to know about capital growth, including how it works as an investment strategy, how to fuel growth in real estate, various growth investments, and the advantages and disadvantages of growth strategies.

Understanding Capital Growth Strategy

Capital growth, also known as capital appreciation, is the appreciation of the value of an investment over time. It's the ultimate goal for investors who are seeking substantial returns. But how exactly is capital growth calculated? The formula is simple: it's the difference between the current market value of the investment and the original purchase price. Let's take a closer look at an example:

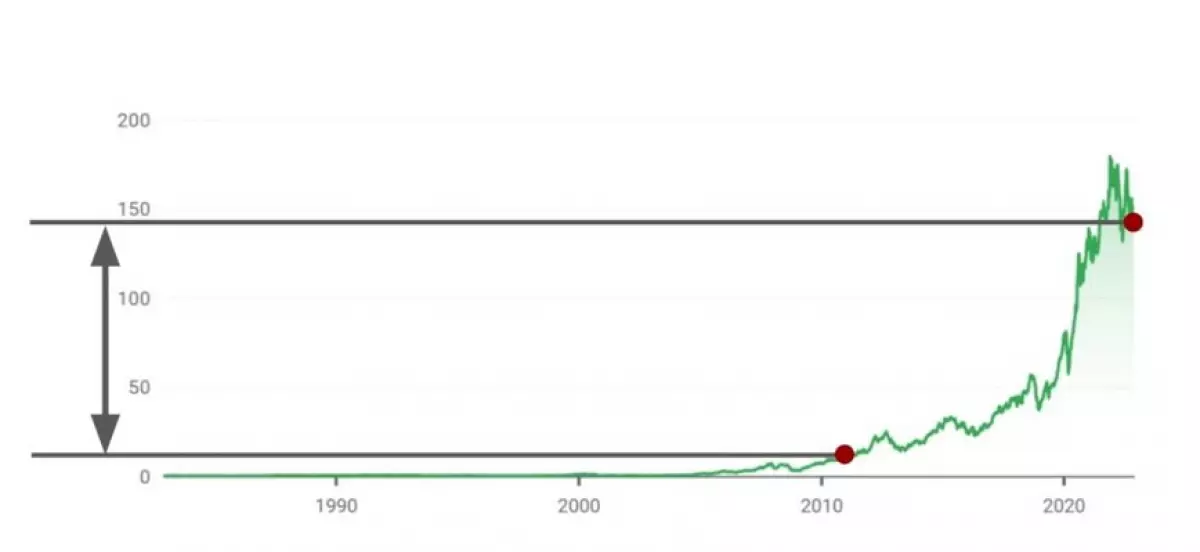

Suppose you bought Apple stock (NASDAQ: AAPL) at $9.82 a share in 2010. With the stock's current price at around $134 a share, your capital growth would be approximately $124.18 per share. It's incredible to witness such impressive growth, but finding low-valued stocks with the potential for explosive growth like Apple is rare. Keep in mind that higher growth potential usually comes with higher risks.

Source: Google Finance

Source: Google Finance

The Power of a Capital Growth Strategy

The objective of growth capital investors is to acquire assets with significant growth potential. While the allure of astronomical gains may be tempting, it's crucial to acknowledge that not every investment can replicate the success of Apple stock. In reality, achieving such exceptional returns requires meticulous research, due diligence, and a diversification process to minimize risks.

Diversification plays a crucial role in a capital growth strategy. By including assets with moderate to high growth potential and low correlation to each other, investors can reduce the impact of any one investment's performance on their overall portfolio.

Exploring Capital Growth Investments

When it comes to capital growth investments, two asset classes stand out: equities and real estate. Equities, particularly high-growth stocks in the technology or biotech sectors, have historically generated substantial returns. However, they come with a high level of risk. Non-dividend-paying companies often present the best opportunities for capital growth since they reinvest their profits to fuel further expansion.

On the other hand, real estate investments offer tangible assets that appreciate over time. While rental income is one way to generate returns, capital growth in real estate focuses on the property's value appreciation. Investors can choose between different strategies, such as investing in promising but undervalued regions or established areas with moderate growth potential. However, real estate investments can also carry liquidity risks, requiring long-term commitment to realize optimal returns.

Other capital growth investment options include investment funds, such as mutual funds and exchange-traded funds (ETFs). These pre-packaged investment vehicles offer diversification with varying risk levels, allowing investors to align their preferences with the desired growth strategy. Additionally, commodities like oil, gold, gas, or natural gas can lead to capital growth through an increase in value over time.

The Pros and Cons of Capital Growth Strategies

Advantages of a Capital Growth Strategy

With careful planning and informed investment decisions, a capital growth strategy can provide numerous advantages:

-

Wealth Building: Capital appreciation is the key to building wealth. By purchasing assets at a bargain price and selling them at a high price, investors can create a robust portfolio that generates substantial revenue.

-

Tax Deferment: A capital growth strategy offers a tax advantage, as taxes on investments are deferred until they are sold. Dividend-paying capital growth securities and rental income from real estate properties provide an opportunity to defer taxes on capital appreciation.

-

Meeting Long-Term Goals: If you're looking to achieve long-term investment rewards, a well-executed capital growth strategy can help you realize those goals. Whether it's retirement savings or building a sizeable estate to pass down to future generations, capital growth can be a powerful tool.

Disadvantages of a Capital Growth Strategy

However, it's essential to acknowledge the potential drawbacks that come with a capital growth strategy:

-

Significant Losses: Capital growth investments carry medium to high risk levels. As a result, you face the possibility of losing a substantial portion of your capital. Investors with a low-risk tolerance may be better suited for income or preservation investment strategies.

-

Liquidity Challenges: Capital growth strategies often require a long-term investment horizon. You must be prepared to have a significant amount of capital tied up for an extended period before realizing the desired appreciation.

-

Limited Short-Term Returns: Capital growth stocks are typically long-term investments, and they may not yield immediate returns. Patience and a focus on long-term growth are necessary for success.

Is a Capital Growth Strategy Right for You?

Ideal capital growth investors possess a high-risk tolerance, patience, and the financial resources to commit a significant portion of their capital to long-term equity growth. Research, due diligence, and diversification are essential for success. However, even novice investors can benefit from capital growth investments by opting for managed index funds, participating in 401(k) plans, or incorporating capital growth assets into a market-neutral portfolio.

Ultimately, the decision to pursue a capital growth strategy depends on your individual circumstances and investing preferences. Consulting a financial advisor or professional can guide you in making the best investment decisions aligned with your goals and risk tolerance.

Q&A

Q: Do real estate and equity capital growth investors follow the same strategy?

A: While real estate can generate rental income and equities can earn dividends, capital growth investors focus on the appreciation of asset values. However, there are specific real estate investment strategies optimized for capital growth, such as value-add real estate and opportunistic investment strategies.

Q: Do I need to be an experienced investor to benefit from a capital growth strategy?

A: No, even novice investors can benefit from capital growth investments. Options include purchasing shares in managed index funds, 401(k) plans, or maintaining a market-neutral portfolio with capital growth assets.

Q: Which asset class offers the best growth potential for capital investors?

A: Stocks provide investors with significant potential for long-term capital appreciation. Patient investors who hold onto stocks for around 15 years can reap substantial returns.

Q: Where should I invest for long-term growth?

A: The ideal investment for long-term growth depends on various factors, including your financial goals, risk tolerance, and investment time horizon. Consider options such as the stock market, real estate, bonds, or mutual funds. However, it's crucial to remember that investing carries risks, and consulting a financial advisor is a wise decision.

Stay Informed with Paperfree Magazine

For more insightful content and the latest updates on investment strategies, subscribe to Paperfree Magazine. Join our community of forward-thinking investors dedicated to maximizing their wealth and achieving financial freedom.

Loading…