The Chinese are increasingly investing in real estate across the United States, focusing on expensive properties in densely populated areas such as California, New York, and Washington state. While this trend is not new, a recent survey of realtors confirms that Chinese investors continue to pour money into the U.S. real estate market. So, why are they so interested in American properties?

A Shift in Foreign Investors

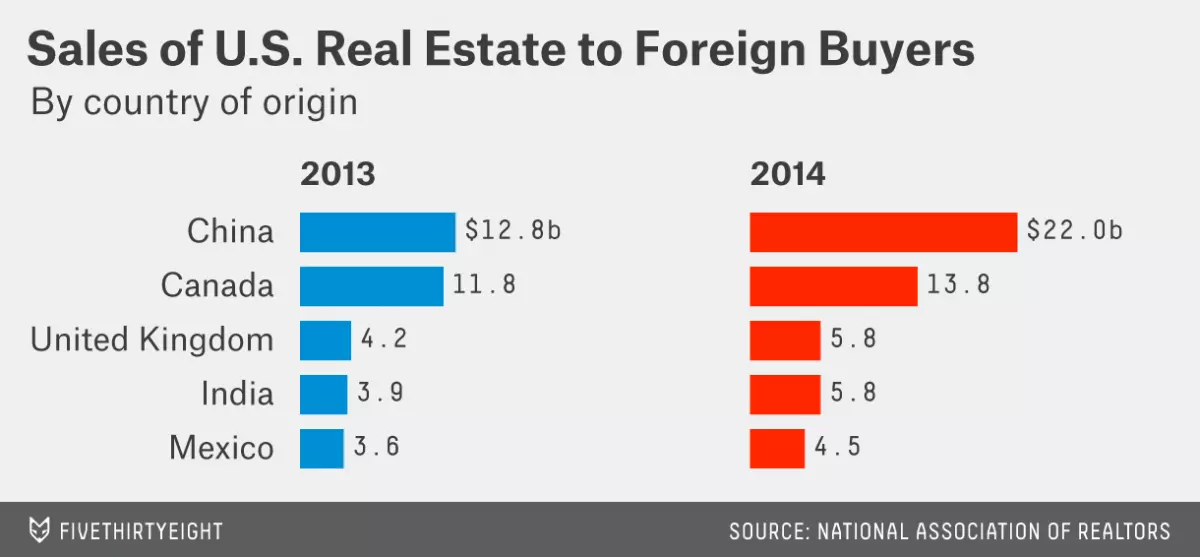

Historically, foreign buyers in the U.S. real estate market have come from various countries, including Japan, Russia, and Saudi Arabia. However, in recent years, Chinese investors have taken the lead. According to Jonathan Miller of Miller Samuel Inc., a real estate appraisal firm, Chinese buyers now make up a significant portion of Manhattan's condo and townhouse market, with their share estimated to be as high as 30 to 40 percent.

Chinese Preference for Urban Areas

Unlike buyers from other countries who prefer vacation homes in suburban or rural areas, the Chinese have a strong inclination towards urban living. The National Realtors Association (NAR) survey found that Chinese buyers have a higher preference for central city and urban real estate areas. This preference is evident in their search behavior on real estate websites, where they show a greater interest in properties located in dense urban areas.

Figure 1: Chinese buyers' interest in U.S. real estate

Figure 1: Chinese buyers' interest in U.S. real estate

The Appeal of Secure Investments

One of the key reasons behind the surge in Chinese investment in U.S. real estate is the perception of it being a safe and secure investment. The NAR survey reveals that 25 percent of realtors cited U.S. real estate as a secure investment, up from 20 percent in 2009. The stability and profitability of the U.S. market make it an attractive choice for Chinese investors looking to expand their portfolios with reliable assets.

Increased Wealth and Access to Credit

China's economic growth and expanded credit availability have also contributed to the rise of Chinese investment in U.S. real estate. Chinese buyers now have greater means to invest in properties abroad. A report by JPMorgan highlights the significant increase in household credit-to-GDP ratio in China, indicating a boom in credit and greater purchasing power.

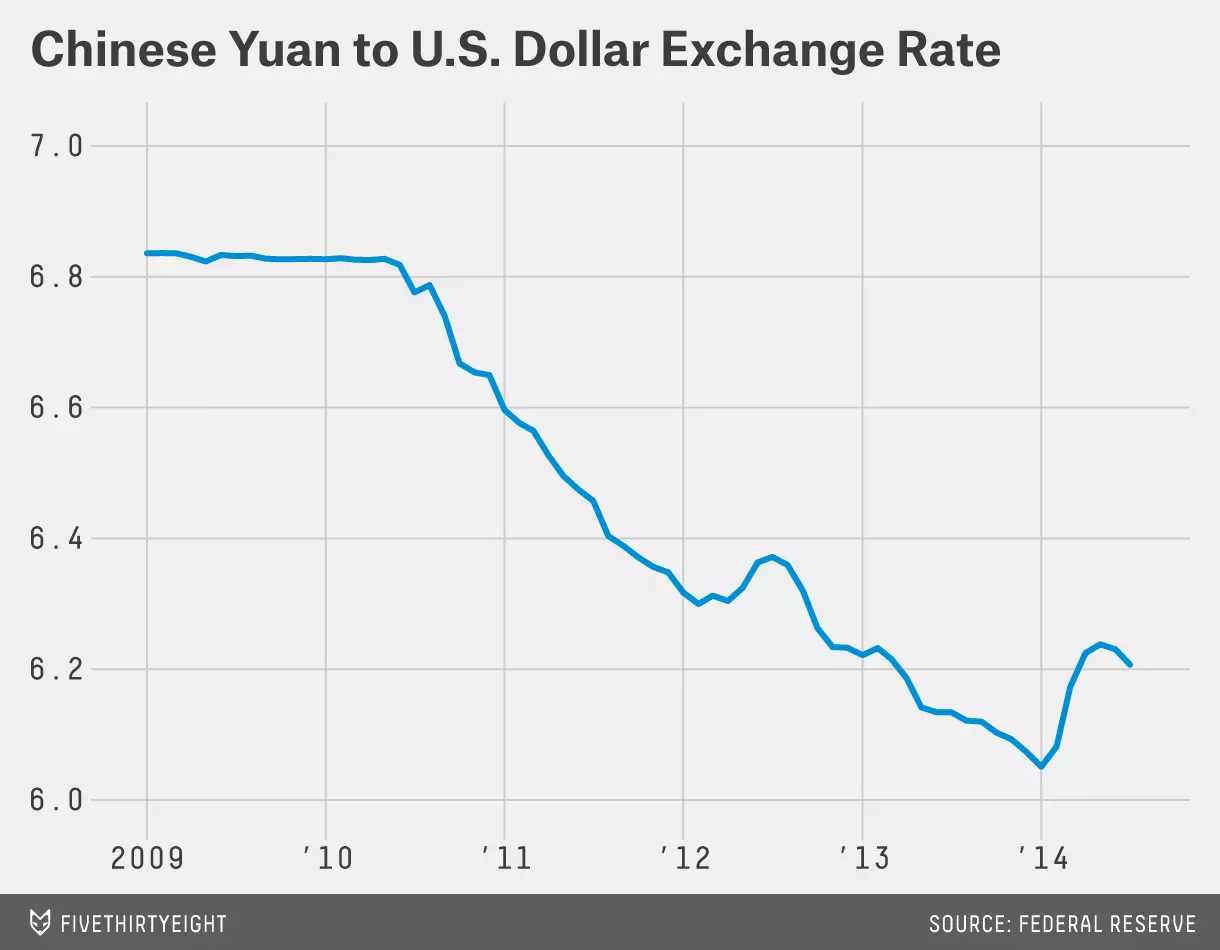

Favorable Exchange Rates

Exchange rate fluctuations have played a crucial role in encouraging Chinese investors to buy U.S. real estate. As the U.S. dollar has depreciated against the yuan, Chinese buyers have gained more buying power, making American assets even more appealing. Approximately 75 percent of realtors surveyed stated that the exchange rate was a significant factor influencing their clients' decision to invest.

Figure 2: Chinese investors searching for real estate in urban areas

Figure 2: Chinese investors searching for real estate in urban areas

Cooling Chinese Housing Market

China's housing market, which experienced substantial growth for several years, now shows signs of cooling down. Some indicators suggest that the market may be overvalued, and increased regulatory constraints on real estate purchases have made investing in foreign real estate an attractive alternative for Chinese investors.

Implications for Housing Affordability

While Chinese investment in U.S. real estate brings economic benefits and opportunities, it may also impact the affordability of housing in major American cities. With Chinese buyers targeting high-priced properties in cities like New York and Los Angeles, the competition for housing could potentially drive prices even higher.

Chinese investors' growing interest in the U.S. real estate market reflects their desire for secure investments, increased wealth, favorable exchange rates, and a cooling housing market at home. As this trend continues to evolve, it will be interesting to see how it shapes the real estate landscape and the broader economy.