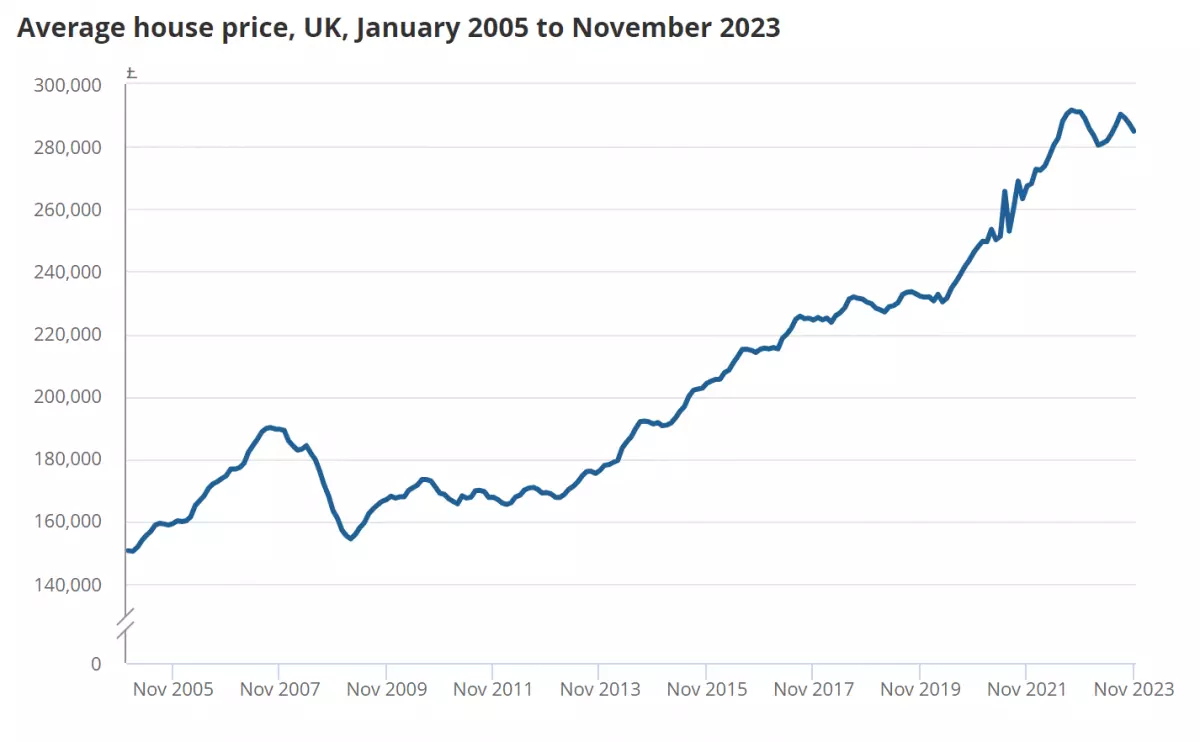

Average UK house prices fell in November 2023 at their fastest rate for 13 years, according to the latest figures from the Office for National Statistics (ONS). With demand for homes picking up due to big cuts in mortgage rates, we explore where prices could head in 2024.

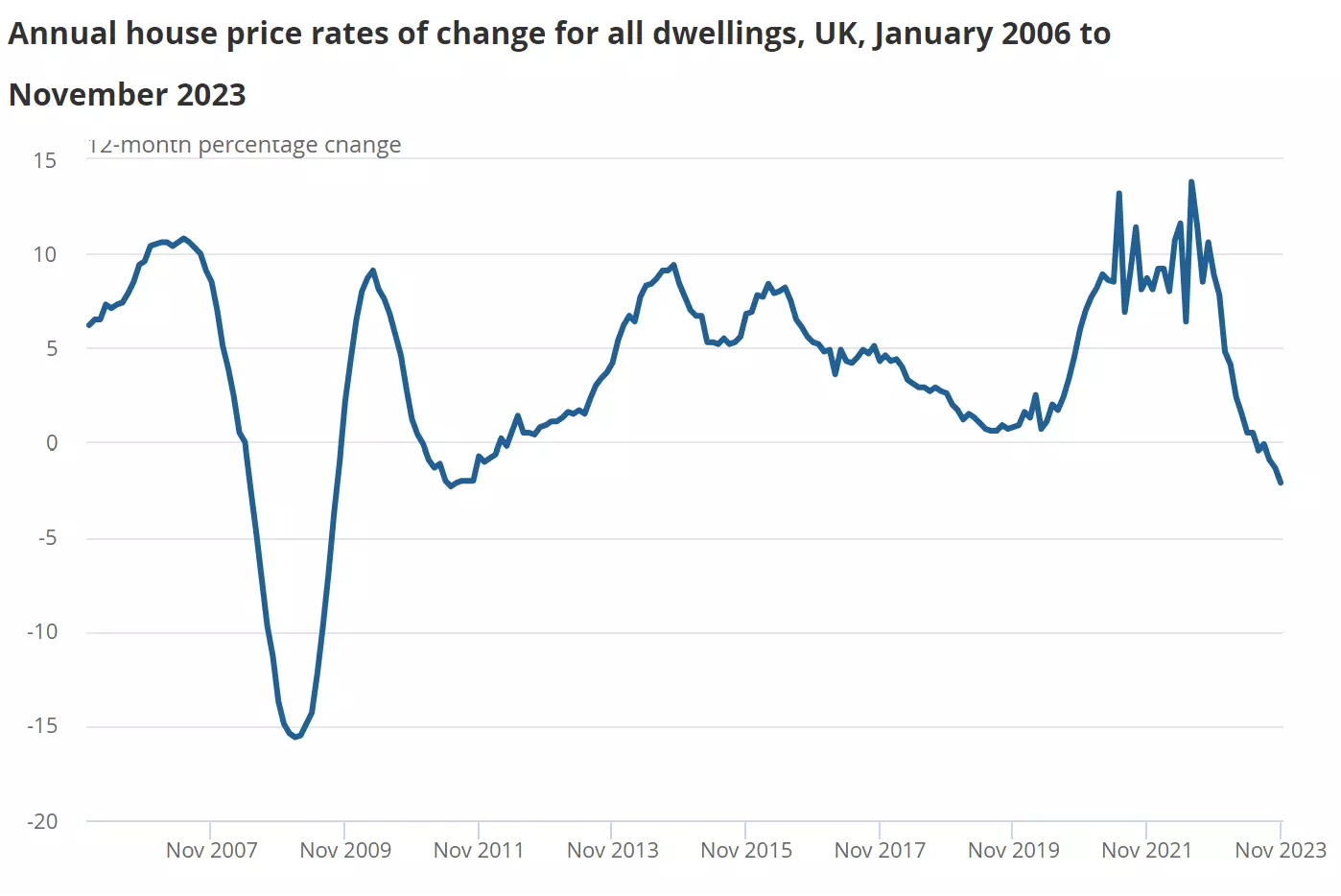

Property prices fell for the third month in a row in November, down 2.1% in the year, as high mortgage rates, rents, and the cost of living crunch continued to weigh on the market. The biggest drops were seen in London, where prices fell by an average of 6% in a year.

The average UK property now stands at £285,000 - a fall of £6,000 since November 2022. However, with mortgage rates falling significantly from their summer highs, and inflation well below its October 2022 peak, some experts are now forecasting house prices to rise in 2024.

In this article, we explain why house prices are so high, the regional variations in house prices, how house prices differ for different types of property, and most importantly, whether house prices will crash in 2024.

Are House Prices Going Down?

The latest ONS figures show that the average UK house price was £6,000 cheaper in November than the previous year. This is the fastest annual drop since 2011 and the third month in a row that prices have gone down.

According to the Nationwide house price index, UK house prices ended 2023 down 1.8% compared with December 2022 and almost 4.5% below the all-time high recorded in late summer 2022.

Falls in house prices and the number of sales have been attributed to a mixture of high mortgage rates, cost of living pressures, and low market confidence.

“It reflects just how dire things were at the tail end of the summer when so many of these sales were agreed,” says Sarah Coles, head of personal finance at Hargreaves Lansdown.

“While mortgage rates have fallen in the months since, we’re not out of the woods yet. The market still faces some serious challenges, which could pull prices even lower.”

However, first-time buyers shouldn’t get too excited yet either. Despite recent trends, house prices are still significantly higher than they were before the onset of the pandemic. In February 2020, the average home cost £230,609 - approximately £50,000 less than today.

Source: ONS

Source: ONS

Why Are House Prices So High?

Despite recent house price falls, they are still high by historical standards and have been rising much faster than wages.

The average price of a UK home has nearly trebled since the turn of the century and increased by more than 60% over the last decade, according to Nationwide building society.

In 1999, you could expect to buy a median house in England for 4.4 times the median income. In 2022, that had doubled to more than 8 times the median income.

A shortage of housing stock and high demand for properties has certainly inflated prices. But a significant factor has been the low interest rates since the financial crash.

People were more able to afford mortgages because borrowing money was cheap. This is no longer the case.

The Bank of England has increased the base rate 14 times from its record low of 0.1% in December 2021. The base interest rate now sits at 5.25%. As a result, average mortgage rates shot up from around 2.3% for a two-year fix at the end of 2021 to over 5.5% now. They reached 6.85% in summer 2022.

You can read more about why the central bank has been raising rates.

Will House Prices Crash in 2024?

While we can’t say for sure what the future holds, a recent dip in mortgage rates combined with falls in house prices seen in 2023 have raised expectations that the market could recover somewhat this year.

However, mortgage rates remain at their highest level in 16 years, and we’re still in a cost of living crunch with frozen tax thresholds putting pressure on household budgets.

Here are various predictions for how house prices will change in 2024:

- Property website Rightmove anticipates a modest 1% fall in house prices by the end of 2024. Property website Zoopla is also conservative with its forecast, estimating that house prices will fall by just 2% this year.

- Estate agent Savills predicts that UK property prices will fall by 3% in 2024, before recovering in 2025 and rising by 3.5%.

- Lloyds Bank has forecast a further 2.4% decrease in house prices over 2024. It expects prices to then recover slightly in 2025.

However, Knight Frank changed its forecast in the wake of mortgage rate falls and expectations of cuts to the base rate in 2024. The global property consultancy now expects house prices to rise by 3% this year, rather than a fall of 4% that it had previously estimated.

Interest Rates May Begin to Fall Soon, Which Could Drive House Prices Up

In its latest meeting, the Bank of England again voted to hold the base rate at its current level of 5.25%. Despite a small rise in the latest figures, inflation has fallen faster than predicted, which could mean that cuts to the base rate could follow soon after.

“We expect mortgage rates to fall slowly in the coming months,” said Zoopla. “Once they get below 4.5%, we’ll see more buyers return to the housing market.”

A host of lenders have slashed their mortgage rates since the start of 2024, with some fixed deals available that are below 4%. However, these deals tend to be for borrowers with the largest deposits. The average two-year fixed-rate mortgage is now over 5.5%.

Even if mortgage rates stay as high as they are at the moment, it’s unlikely that property prices will crash.

“Based on our current economic assumptions, we anticipate a gradual rather than a precipitous decline [in house prices],” said Kim Kinnaird, a mortgage director at Halifax.

Demand still tends to outstrip the supply of homes in many areas across the UK. Wages are still rising even faster than inflation, putting homeowners in a better financial position, while falling mortgage rates are enticing buyers to return to the market. In this scenario, prices could actually rise rather than crash.

Source: ONS

Source: ONS

What Are the Regional Variations in House Prices?

There are differences in house price movement depending on where you live within the UK, according to the latest ONS figures for the year to November 2023:

- North East: -0.4%

- Yorkshire and the Humber: -0.8%

- North West: -2%

- South East: -2.3%

- East Midlands: -3%

- East: -3.3%

- West Midlands: -3.4%

- South West: -4.1%

- London: -6%

London’s house prices remain the most expensive in the UK at £505,000 in November, down from £516,000 the previous month.

By contrast, the northeast has the lowest average house price of all English regions at £160,000.

Average annual house prices to November 2023 decreased in England to £302,000 (-2.9%) and in Wales to £213,000 (-2.4%), but increased in Scotland to £194,000 (2.2%).

House price figures in Northern Ireland are released every three months, with the next data set out in February.

How Do Prices Differ for Different Types of Property?

The pandemic saw our housing preferences shift away from flats to detached family homes with gardens and space for a home office. Mortgage lenders have continued to see differences in price trends between property types.

Figures from Nationwide Building Society of average asking prices between 2020 and 2022 showed:

- A detached property increased by 26%, or nearly £78,000

- Flats increased by 13.4% on average, or £23,000

According to the latest ONS statistics, other property types fell in price, with terraces down 3.8%.

Is now a good time to buy a house? We help you weigh up the pros and cons.

By considering the current state of the housing market, mortgage rates, and economic factors, prospective buyers can make informed decisions. While there may be some dips and fluctuations in house prices, the long-term trend suggests that buying a property can still be a sound investment.

So, will house prices fall in 2024? It's hard to say for certain, but with the possibility of falling mortgage rates and a recovering market, it seems unlikely that there will be a drastic crash. As always, it's important to do thorough research and consult with experts before making any major financial decisions.