Home Prices in Canada Experience Another Drop

It seems like the roller coaster ride for Canadian home prices continues unabated. According to the Home Price Benchmark Index for single-family houses by the Canadian Real Estate Association (CREA), home prices in Canada dropped by 1.7% in November from October. This marks the fifth consecutive month of month-to-month declines, bringing the year-over-year gain down to just 0.9%[^1^].

Since the peak-frenzy in March 2022, the benchmark price has fallen by a staggering 17.2%, or $162,000 in Canadian dollars, to a level of $788,200. Interestingly, this is the same level it reached in September 2021, on its way up[^1^].

The Bank of Canada's Role

The easy money era has come to an end, with the Bank of Canada hiking its overnight rate to 5.0% in July and keeping it there. The BoC had regularly pointed to the skyrocketing home prices in its pronouncements over the past two years, as prices reached unprecedented levels of craziness[^1^].

And now, the Bank of Canada must face another housing issue: the worst rent inflation since 1983. It seems that when one problem is solved, another arises, creating a continuous cycle of challenges for the central bank[^1^].

The Impact Across Different Markets

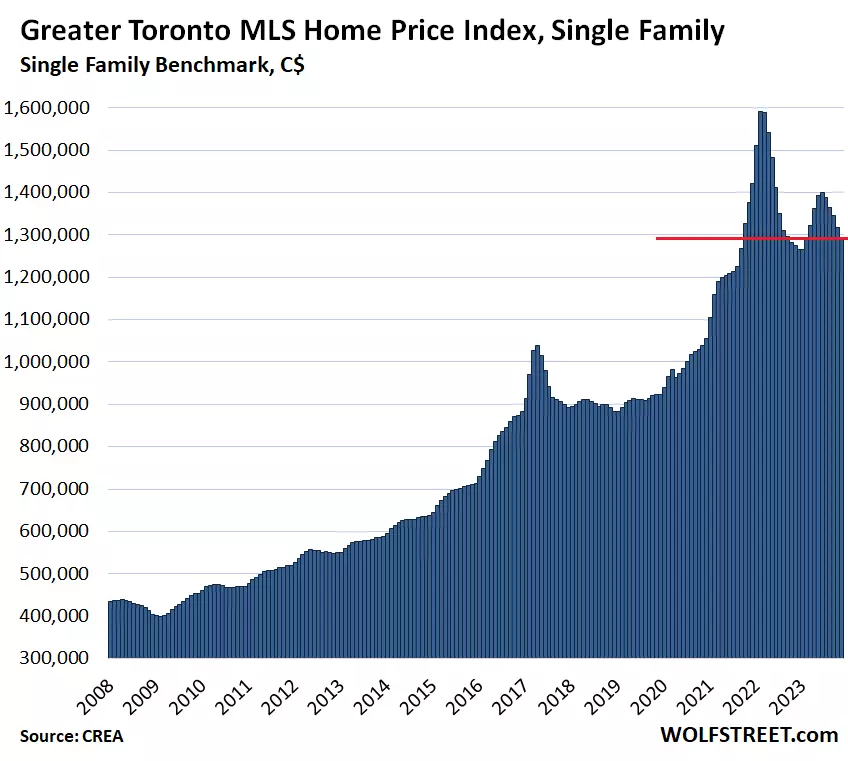

As with any fluctuating market, some areas have fared better than others. In the Greater Toronto Area (GTA), the benchmark price for single-family houses dropped by 2.0% in November from October, continuing the downward trend. Since its peak in February 2022, the benchmark price in GTA has plunged by 18.9%, or $300,000, and is now back to where it was in September 2021[^1^].

In the Hamilton-Burlington metro, part of the Greater Toronto and Hamilton Area, the single-family benchmark price also experienced a decline of 3.0% in November. This market has seen a significant drop of 25.4%, or $294,700, since its peak in February 2022[^1^].

The Greater Vancouver area also witnessed a slight dip of 0.8% in the benchmark price for single-family houses, bringing it to $1.985 million. However, compared to the previous year, prices have still increased by 6.7%[^1^].

Other markets like Victoria, Ottawa, Montreal, Halifax-Dartmouth, and Quebec City have experienced varied fluctuations in their single-family benchmark prices as well. Each market has its own unique story, with some seeing a decline while others have managed to maintain positive year-over-year gains[^1^].

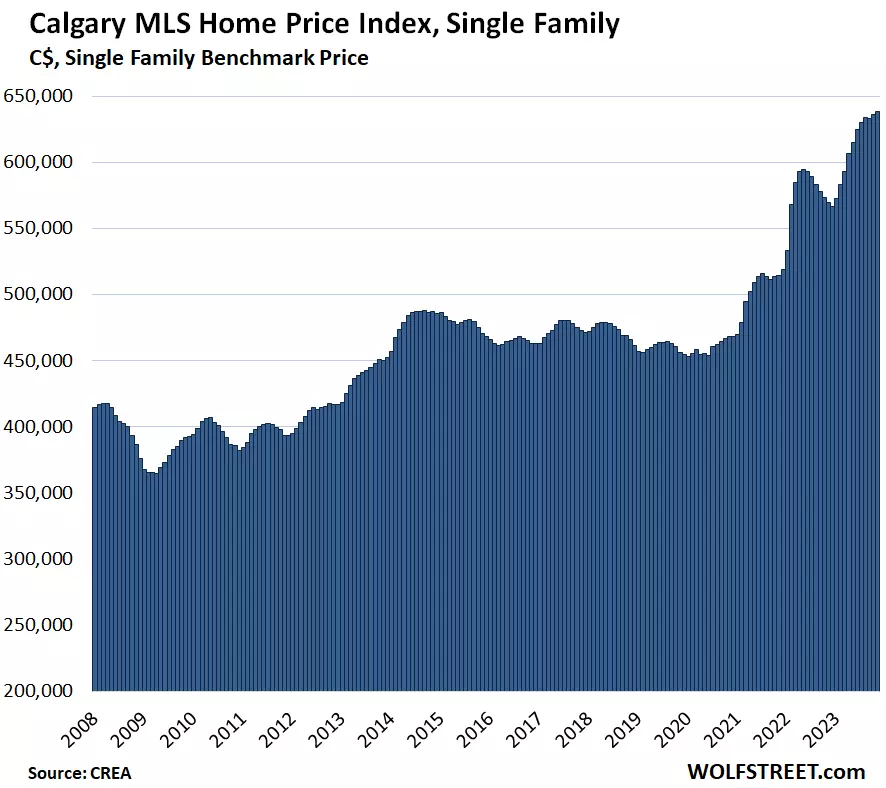

A graph depicting the head-and-shoulders chart of the housing market.

A graph depicting the head-and-shoulders chart of the housing market.

Conclusion

The Canadian housing market continues its roller coaster ride, with prices fluctuating and markets responding differently. It's a game of ups and downs, with central bank policies and market forces shaping the outcome. As we navigate this unpredictable terrain, it's essential to keep a close eye on the trends and be prepared for the unexpected twists and turns that lie ahead[^1^].

The Bank of Canada building.

The Bank of Canada building.

[^1^]: Original Article by Wolf Richter for WOLF STREET: Wolf Street.