Picture: Fundrise, Real Estate Investing, Crowdfunding

Picture: Fundrise, Real Estate Investing, Crowdfunding

Introduction: Have you been searching for investment opportunities in today's record-setting stock market? As an investor, I am determined to find ways to grow my wealth and increase my passive income. In addition to researching individual stocks and Vanguard ETFs, I have been exploring the potential of Fundrise, an online real estate crowdfunding platform. In this article, I will discuss my investment strategy and the reasons behind my decision to invest in Fundrise.

The Current Stock Market Environment

Finding undervalued dividend stocks has become increasingly challenging in the current stock market. Despite the pandemic and economic indicators, the market continues to soar. The stock market has been breaking records on a daily basis, leaving investors amazed. While this is great news, it also means that there are limited investment opportunities available. However, I believe that real estate investments can provide a stable income source in such a climate.

Picture: S&P 500 Record

Picture: S&P 500 Record

Fundrise's Performance During the Pandemic

During these uncertain times, it is crucial to evaluate how an investment platform like Fundrise has performed. Founded in 2012, Fundrise has shown incredible growth, amassing close to $5 billion in real estate assets. When the pandemic hit, Fundrise took measures to preserve capital and reduce risk. Although they temporarily reduced their dividend, their Net Asset Value (NAV) continued to increase steadily throughout the first half of 2020. This performance supports my confidence in Fundrise as a long-term investment.

Actions Taken by Fundrise's Management During the Pandemic & The Results

Fundrise's management implemented several strategies to deal with the impact of the pandemic. They suspended redemptions from investors and temporarily reduced their dividend to ensure the stability of their investment portfolio. I appreciate their transparency in communicating these changes to investors. The performance chart provided by Fundrise shows that their NAV had a positive and consistent growth trend, which aligns with my investment objectives.

Picture: Fundrise performance 2020

Picture: Fundrise performance 2020

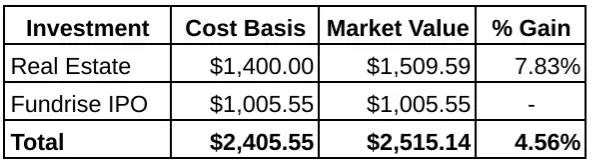

My Fundrise Investment Performance

Since starting my Fundrise journey in 2019, I have seen positive results. My investment has grown from $2,405.55 to over $2,515.14 (excluding a pending $200 transaction). The core real estate holdings have provided steady dividend income, and my investment in Fundrise's IPO has also shown promise. My dividend yield, which is close to 5% even after the temporary reduction, makes Fundrise an attractive addition to my portfolio.

Picture: Fundrise dividends

Picture: Fundrise dividends

My Fundrise Investment Strategy for 2020 & Beyond

With a booming stock market and limited undervalued investment opportunities, now is the time to focus on high-quality assets that generate passive income. Consequently, my wife and I have developed a plan to invest additional funds in Fundrise.

Invest $200 in August 2020

Frustrated by the scarcity of investment options, we decided to invest an extra $200 in August. This investment will substantially increase our position in the Real Estate fund and generate additional dividend income.

Invest $100 Monthly Going Forward

To ensure consistent growth, we have set up a recurring investment plan. Starting from now on, we will be investing $100 per month into Fundrise. This systematic approach will gradually increase our position, complementing our regular equity investments.

Picture: Fundrise Automatic Investment

Picture: Fundrise Automatic Investment

Summary

By the end of this year, our total investment in Fundrise will exceed $3,000. Although this amount may seem small in the grand scheme of our portfolio, it represents steady growth in my overall financial picture. Despite the current stock market conditions, I am confident in the reliability and performance of Fundrise. The combination of manual and automated investments will ensure a stable and gradually increasing passive income stream.

Do you invest in Fundrise? What do you think of my approach in today's stock market? How are you dealing with the shortage of undervalued dividend stocks? Let's discuss and share our strategies for financial success!

Bert

P.S. - Don't forget to Subscribe to our YouTube Channel!