The housing market is constantly evolving, and it's crucial to stay informed about the latest trends and projections. In this midyear update of the Realtor.com National Housing Forecast for 2022, there are some interesting insights that can help home shoppers make educated decisions. Let's dive in and explore what the forecast has to offer.

A Changing Economic Landscape

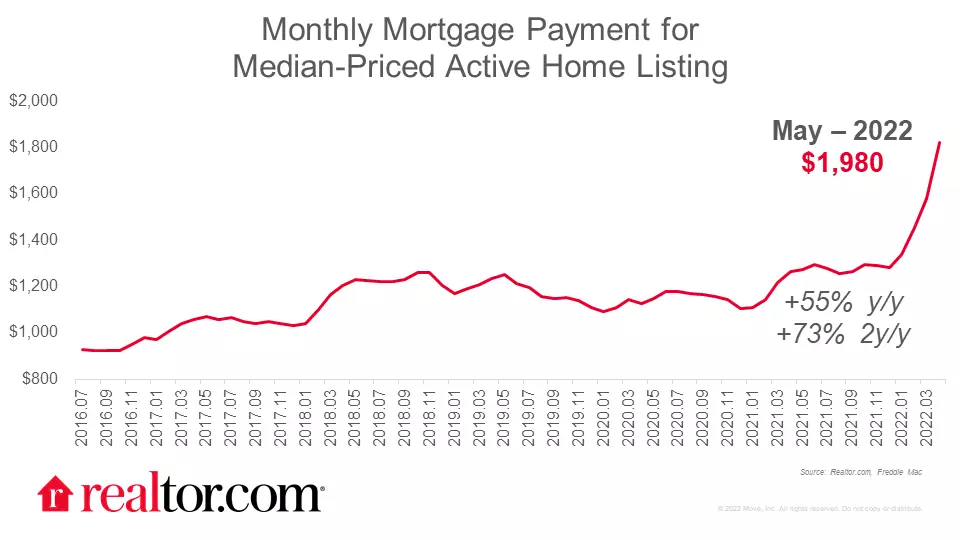

The shift in financial conditions has had a significant impact on the housing market. With inflation rates soaring and monetary policy pivoting, there are several factors to consider when looking at the forecast. The Federal Reserve's decision to raise short-term rates and their plan for further rate hikes have caused mortgage rates to climb. In fact, rates have already exceeded 5% for over a month, which has led to higher monthly mortgage payments for homebuyers.

Fig1: Fed Funds Rate Expectations Shift

Fig1: Fed Funds Rate Expectations Shift

However, despite the tightening financial conditions, employment and income remain high, which supports the demand for housing. The unemployment rate is hovering just above its pre-pandemic low, and wages are growing at an above-average rate. Although inflation poses challenges, the strong economy and job market confidence are enabling workers to change jobs at higher rates than before.

Fig2: 2022 Unemployment Rate Trend

Fig2: 2022 Unemployment Rate Trend

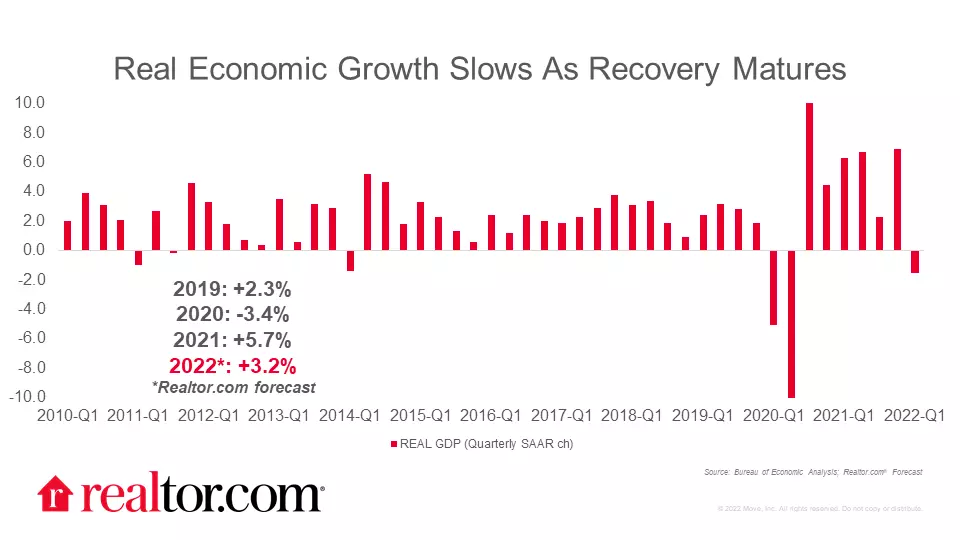

Economic growth, however, has slowed due to inflation and tighter financial conditions. The forecast for Gross Domestic Product (GDP) has been revised down from +4.3% to +3.2%. As pandemic aid tapers off and global uncertainties persist, overall growth faces challenges. These uncertainties include the war in Ukraine and ongoing economic disruptions caused by China's COVID policies.

Key 2022 Housing Trends

State of Housing - The Market Settles Down as Home Sales Moderate, and Price Growth Eases

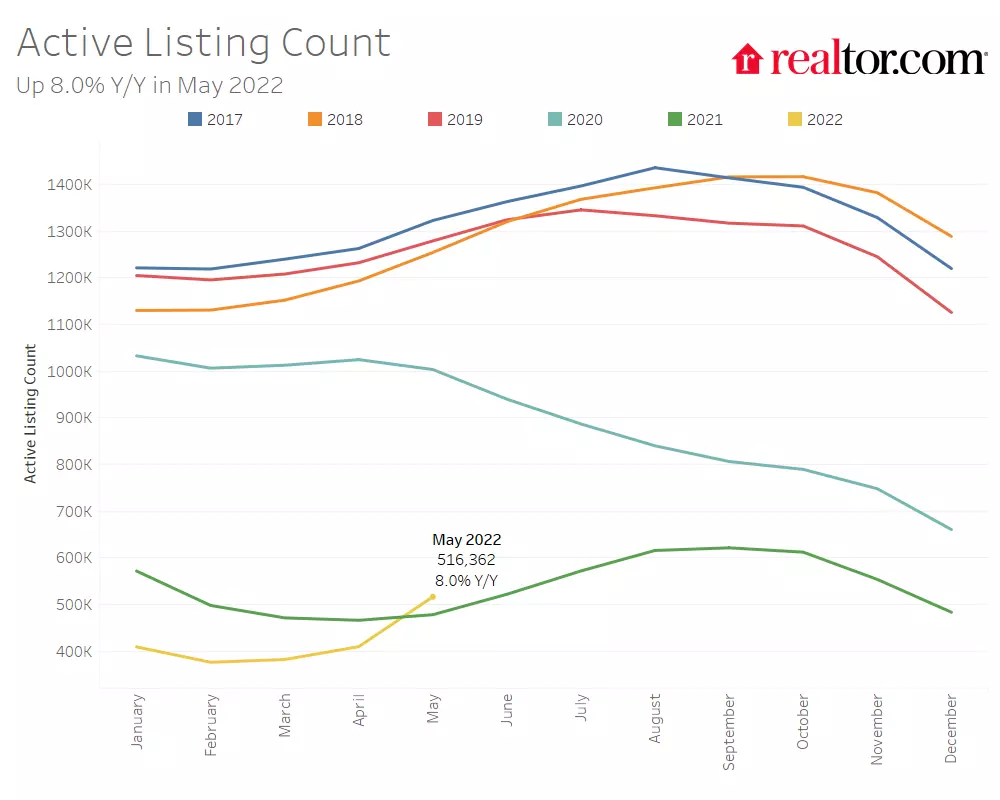

The housing market has experienced significant ups and downs in recent years. The pandemic initially halted sales momentum, but as the economy reopened, home sales activity surged. In 2022, the early-year housing frenzy has given way to tough budget realities, leading some buyers to postpone their plans due to rising costs. As a result, home sales are expected to decline by 6.7% this year.

Fig3: Active Home Listings

Fig3: Active Home Listings

Builders are ramping up their efforts to tackle the housing undersupply. The government's plan to make it easier to permit and fund smaller, more affordable homes is expected to lead to increased construction. Despite rising costs and labor shortages, single-family housing starts are projected to hit a new 16-year high in 2022.

Home Buyers See the Number of Options Improve, but Costs Remain High for Both Buyers and Renters

While housing costs remain high, the number of homes for sale is expected to continue growing. As homeowners look to capitalize on favorable market conditions and adjust to changing needs, home shoppers will have more choices. This may lead to a cycle where more sellers enter the market, increasing options for buyers.

For renters, fast-growing rents may fuel persistence in home shopping, especially for millennials near prime first-time home buying age. Despite the challenges, shifting market conditions may make this fall an opportune time to buy a home.

Home Sellers Face More Competition, but Seller-Buyers Get More Options

Homeowners in advantageous positions, especially those with significant equity, will likely capitalize on favorable market conditions. This will increase competition and re-balance the housing market, which has leaned heavily in favor of sellers. However, seller-buyers will benefit from having more options to choose from, mitigating some of the challenges posed by higher home prices and mortgage rates.

It's important for potential sellers to closely follow market information and adjust their expectations accordingly. While recent sellers have benefited from a competitive market, it's important to note that not all offers are successful, and some sellers may need to reduce their asking prices to find buyers.

Conclusion

The midyear update of the 2022 Housing Market Forecast provides valuable insights into the current state of the housing market. With mortgage rates climbing, sales moderating, and price growth easing, home shoppers have more options to consider. Builders are stepping up their efforts to tackle the housing undersupply, and homebuyers can expect an increase in available homes. While costs remain high, staying informed and adaptable can help buyers and sellers navigate a changing real estate landscape.

If you want to stay up to date on the latest data and research, subscribe to our mailing list for monthly updates and notifications.

Please note that the images used in this article are sourced from the original article.