Image Source: imamember/iStock via Getty Images

Image Source: imamember/iStock via Getty Images

REIT Rankings: Apartments

Image Source: Hoya Capital

Image Source: Hoya Capital

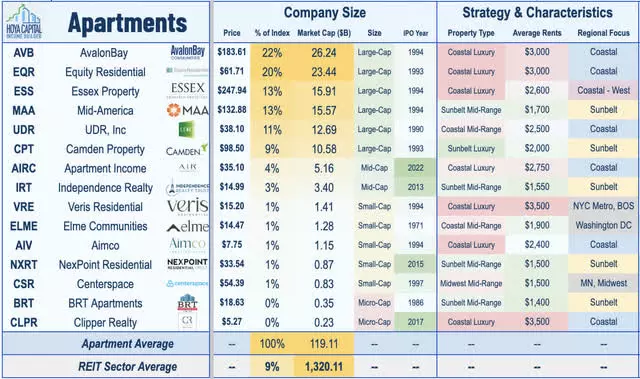

The apartment rental market in the United States has always been highly competitive, with apartment Real Estate Investment Trusts (REITs) playing a significant role. Within the Hoya Capital Apartment REIT Index, there are fifteen exchange-listed U.S. apartment REITs, collectively accounting for approximately $120B in market value. These REITs own around 600,000 rental units, representing about 2.5% of the 23 million apartment units in the country.

Apartment REITs tend to focus on the upper tiers of the market, with most of them reporting average rents above the national average of $1,350 per month. Over the years, these REITs have become fully integrated owners and operators of multifamily communities, and some have even become active multifamily homebuilders.

Image Source: Hoya Capital

Image Source: Hoya Capital

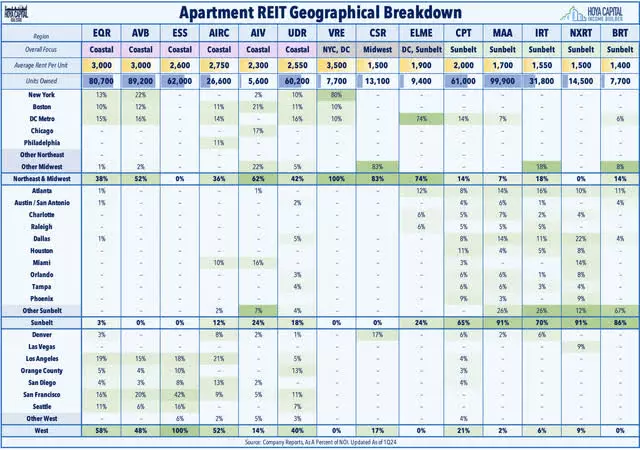

Geographic focus is crucial for efficient residential property management, and larger apartment REITs typically adopt a regional approach. The major Coastal REITs include Equity Residential (EQR), AvalonBay (AVB), Essex (ESS), UDR (UDR), and Apartment Income (AIRC). On the other hand, the major Sunbelt-focused REITs include Mid-America (MAA), Camden (CPT), Independence Realty (IRT), and NexPoint Residential (NXRT). Centerspace (CSR) primarily focuses on Midwest and Mountain West markets.

Some newer apartment REITs have even more concentrated geographic portfolios. Veris Residential (VRE), formerly known as Mack Cali, generates about 80% of its revenues from the New York City metro region, while Elme Communities (ELME), formerly Washington REIT, operates almost exclusively in Washington, DC.

Image Source: Hoya Capital

Image Source: Hoya Capital

Apartment REIT Fundamentals

In recent years, apartment REITs have experienced mixed performance. While they reported impressive earnings growth in 2022, the sector faced challenges in 2023 due to the deceleration of residential rents. The Hoya Capital Apartment REIT Index produced total returns of 7.2% in 2023, lagging behind the broader market benchmark Vanguard Real Estate ETF (VNQ) and the S&P 500 (SPY).

Despite the underperformance, apartment REITs have shown resilience. Average Funds From Operations (FFO) growth for the sector in 2022 was 20%, and they are on track to achieve 5% growth in 2023 based on recent guidance.

Image Source: Hoya Capital

Image Source: Hoya Capital

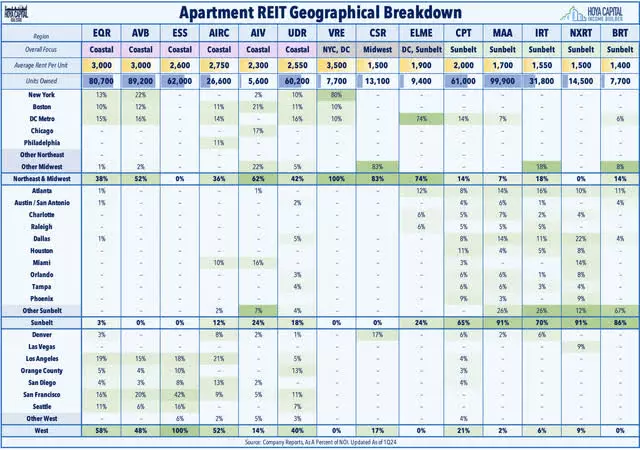

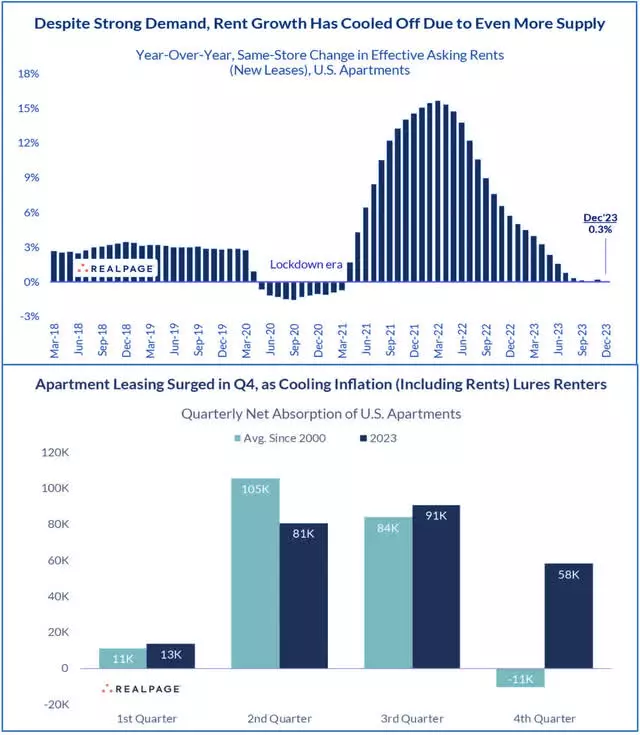

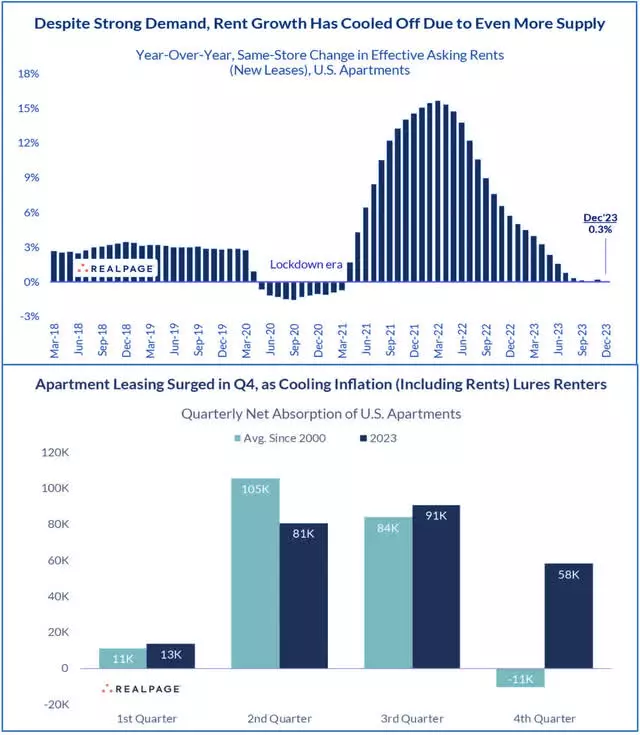

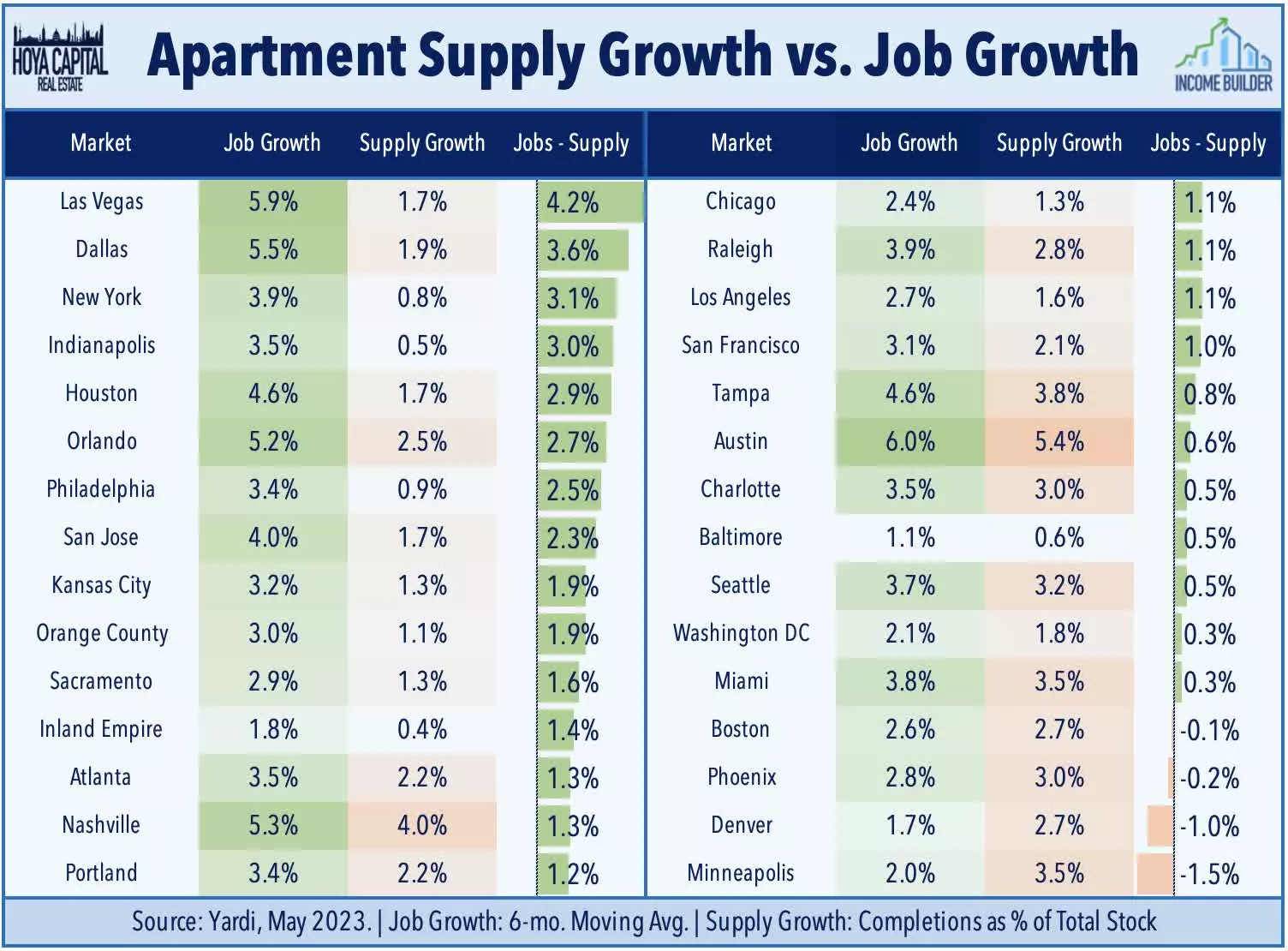

While rent growth has slowed and vacancy rates have ticked up, the predicted "crash" in the rental market has not materialized. Demand remains strong, driven by solid job growth, unaffordability of homeownership, favorable demographics, and increased immigration. Renewal rent growth has remained relatively healthy, offsetting the increased concessions on new leases.

Image Source: Hoya Capital

Image Source: Hoya Capital

Deeper Dive: Macro Fundamentals

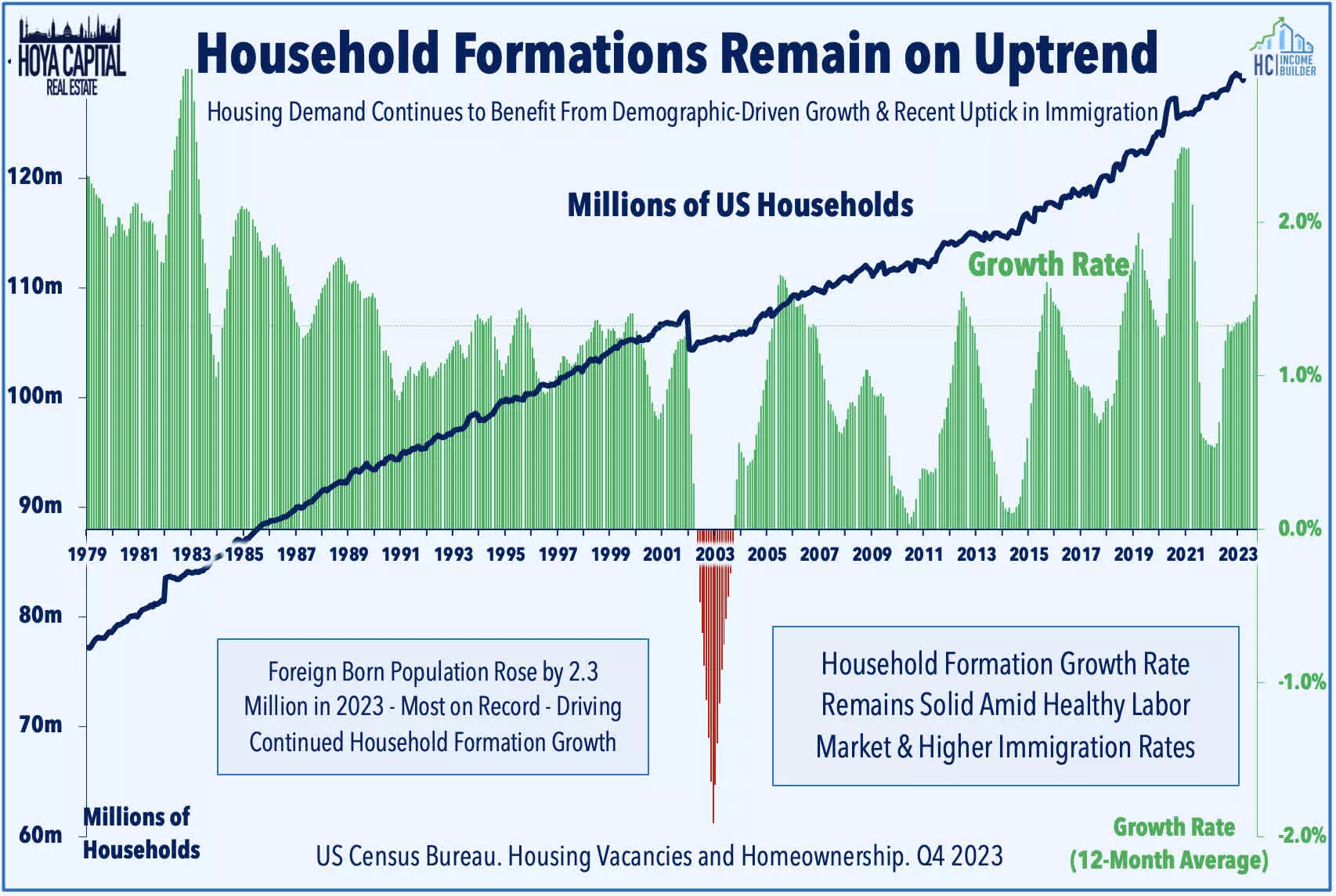

The apartment rental market's positive outlook is supported by strong demographic trends. The millennial generation, the largest cohort in U.S. history, is entering the market, creating high housing demand. Additionally, household formation trends, fueled by the "Work From Home era," have accelerated, resulting in increased demand for rental units.

Moreover, population estimates have been understated, primarily due to the undercounting of immigrant populations, leading to stronger-than-expected household formations. In 2023, net international migration added over 2.3 million people to the U.S. population.

Image Source: Hoya Capital

Image Source: Hoya Capital

South Carolina and Florida experienced the highest population growth in 2023, while New York faced significant outflows. The South was the fastest-growing region, followed by the Midwest and the West, while the Northeast region recorded a decline in population.

Image Source: Hoya Capital

Image Source: Hoya Capital

Balance Sheets & External Growth Prospects

The larger apartment REITs have strong balance sheets and investment-grade credit ratings, making them well-positioned to navigate market challenges. These REITs have the flexibility to seize external growth opportunities or increase future distributions.

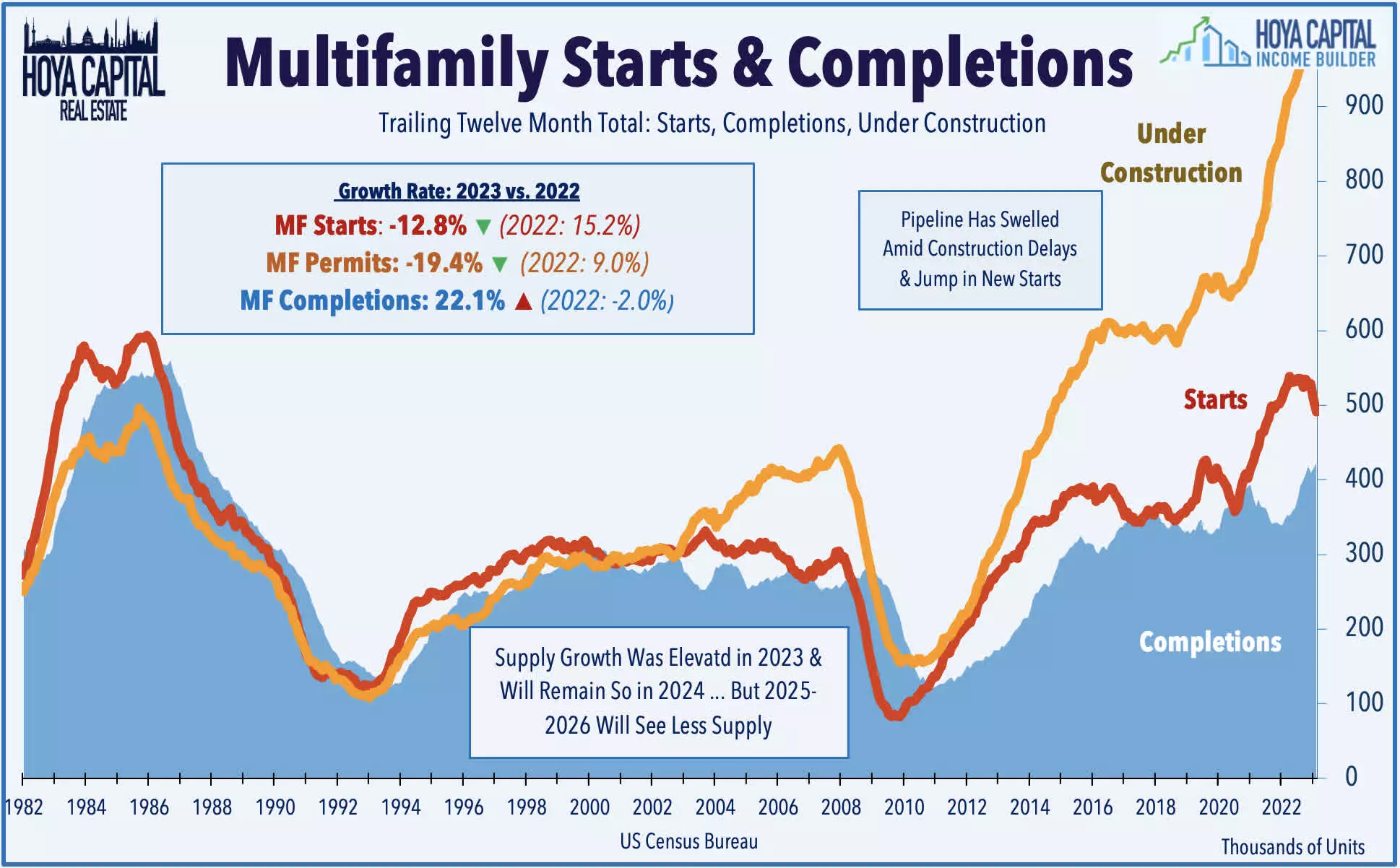

While supply growth has been a concern, these well-capitalized REITs can take advantage of current distressed market conditions. Historically, public equity REITs have regained market share in periods of higher interest rates and limited access to cheap private debt.

Image Source: Hoya Capital

Image Source: Hoya Capital

Apartment REIT Dividend Yields

Apartment REITs have shown stability in their dividend payments throughout the pandemic, making them an attractive option for income-seeking investors. The average dividend yield for apartment REITs is 4.1%, slightly higher than the sector average. These REITs tend to payout around 60% of their available cash flow, leaving room for future growth or acquisitions.

Image Source: Hoya Capital

Image Source: Hoya Capital

Takeaway: Deep Discounts As Supply Worries Ease

Despite the challenges faced by apartment REITs in recent years, the market remains optimistic. Rent growth has cooled off, but demand continues to remain robust. The supply of new rental units has increased, but it has been offset by strong job growth, unaffordability of homeownership, and favorable demographics.

While single-family housing remains a favorable investment option, the apartment rental market is poised for a return to "inflation-plus" levels of rent growth. The market still faces a shortage of housing units, creating opportunities for apartment REITs to thrive.

Image Source: Hoya Capital

Image Source: Hoya Capital

In conclusion, the apartment rental market offers potential for investors seeking long-term growth and stable income. With strategic geographic focus, strong fundamentals, and favorable dividend yields, apartment REITs present an enticing opportunity in today's real estate landscape.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. Hoya Capital has long positions in all components of the Hoya Capital Housing 100 Index and Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.