Are you searching for lucrative investment opportunities in the Golden State? Despite the challenges posed by the pandemic, the California housing market is slowly making a comeback. While home prices are on the rise and rents are fluctuating in some cities, there is still a strong demand for rental properties in California.

California is a unique place that offers a perfect blend of natural beauty, economic opportunities, and a desirable lifestyle. From the stunning beaches of Southern California to the glamour of Los Angeles, and from the breathtaking mountain parks to the charming NAPA Valley wine region, California has it all. The state's pleasant climate, technological advancements, fertile farming regions, and coastal vacation destinations attract both tourists and new residents.

In light of the increasing popularity of remote work, many tech and non-tech professionals find the allure of California hard to resist, especially with its proximity to Silicon Valley. As a result, demand for rental properties remains high, and there is ample opportunity for creative investors in the modular and built-to-rent markets.

It's important for investors to adopt an innovative mindset and embrace new technologies and business models to maximize their profitability. The real estate market has evolved, and relying on outdated strategies can lead to disappointment. PropTech, which encompasses various dimensions of real estate technology, is the key to success in today's housing markets.

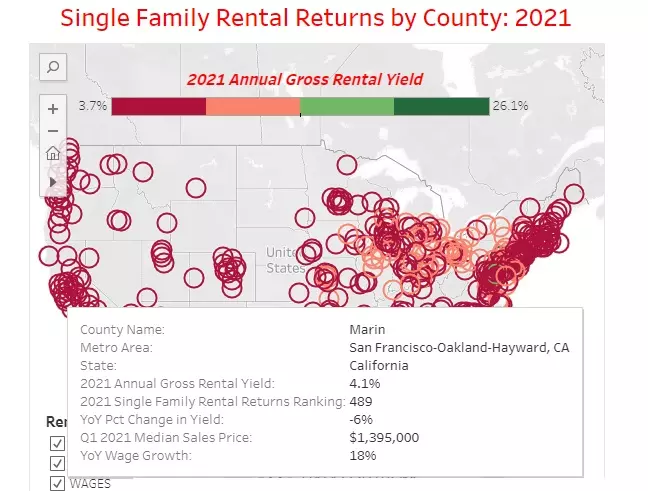

Before diving into individual rent yields and cap rates, it's essential to understand the bigger picture. According to Attom Data's latest report, the average annual gross rental yield across 495 counties in the United States was 7.7% in 2021, a slight decrease from the previous year's average of 8.4%. However, it's worth noting that these figures were influenced by the pandemic.

Furthermore, renting a property is often more affordable than buying in many U.S. counties, as revealed by Attom Data's 2023 Rental Affordability Report. This report shows that renting a three-bedroom property is more affordable than owning a similarly sized home in 95% of the analyzed counties.

Although California has faced challenges due to the pandemic and high taxes, there are signs of economic recovery. Rent prices are rising faster in Southern California, which is a positive development for investors looking to generate revenue. Orange County, Monterey County, and Riverside County are among the least affordable areas in the United States, and with the anticipated economic recovery, both rent and home prices could experience significant growth.

Now, let's explore some of the best cities and communities in California for rental property investment.

Best Communities and Cities to Buy Rental Income Property

When it comes to choosing the right location for rental property investment, factors such as neighborhood character, schools, safety, and job opportunities play a crucial role. Surprisingly, Northern California cities have emerged as more desirable options according to experts. Here are some revised and updated recommendations:

- Dos Palos

- Buellton

- Williams

- Big Bear Lake

- La Habra Heights

- Calistoga

- Indian Wells

- Woodside

- Solvang

- Gustine

Rental Property Investors and Management Firms

The rental income property sector has witnessed significant growth, largely driven by small and medium-sized investors owning anywhere from 3 to 100 properties. With the current high interest rates, many small investors may need to sell their portfolios, presenting an opportunity for corporate investors to acquire properties at attractive prices.

Efficiencies in acquisition, financing, and property management have contributed to the growth of property portfolios ranging from 3 to 10 rentals and 11 to 100 rental properties. Attom Data has launched a rent yield calculator tool that utilizes their extensive database of rental properties, making it a valuable resource for investors.

Let's take a look at the rent yields in selected major California cities according to Attom Data's most recent report (2019):

-

San Francisco/Oakland: Rent yields are down 6%, but renter wages have increased by 18% in 2021. The gross annual yield stands at 4%.

-

Los Angeles: Rent yields have dropped by 7%, while renter wages have increased by 9% in 2021. The gross annual yield is 4.7%.

-

San Diego: Rent yields have decreased by 8%, but renter wages have risen by 11% in 2021. The gross annual yield is 5.2%.

-

Butte County: Rent yields have risen by 7%, and renter wages have increased by 9% in 2021. The gross annual yield is 8.1%.

-

Shasta/Redding: Rent yields have experienced a significant increase of 20%, and renter wages have also increased by 9% in 2021. The gross annual yield is 7.6%.

-

Sonoma: Rent yields have risen by 1%, and renter wages have increased by 11% in 2021. The gross annual yield is 5.6%.

Most California cities have faced challenges in terms of declining rent yields, but with rising wages and employment opportunities, it's crucial to select the right rental types in the best neighborhoods to maximize profitability.

Is California the Ideal Choice?

California has always been an attractive destination for rental property investment due to its beautiful beaches, ocean views, pleasant weather, and resilient economy. Major corporations such as Google, Oracle, Wells Fargo, Apple, Intel, and Synnex have chosen California as their headquarters.

When considering the California housing outlook, it's important to note that the construction industry has experienced fluctuations, with new developments in Los Angeles, San Francisco, and San Diego. Current market conditions have led to higher resale prices, making it more challenging to buy and rent out properties profitably in major cities. However, there are still opportunities in certain urban neighborhoods.

Top Communities to Buy Rental Property

To help you make informed decisions, here are additional recommendations from Home Snacks and Niche.com for the best communities to buy rental property in California:

Home Snacks:

- Dos Palos

- Buellton

- Williams

- Big Bear Lake

- La Habra Heights

- Calistoga

- Indian Wells

- Woodside

- Solvang

- Gustine

Niche.com:

- Newcastle, Sacramento

- Seal Beach, Los Angeles

- Madeira Acres, Fresno

- Green Acres, Bakersfield

- Pacheko, Oakland

- Gold River, Sacramento

- Woodbridge, Stockton

- Mountain House, Tracy

- Desert Edge, Riverside

- Los Altos Hills, San Jose

- Folsom, Sacramento

- Eldorado Hills, Sacramento

- Sunnyside, Fresno

- Lincoln Village, Stockton

- Clovis, Fresno

- Val Verde, Los Angeles

- Rolling Hills, Los Angeles

- West Park, Fresno

- Valle Vista, Riverside

- El Dorado Hills, Sacramento

- Vineyard, Sacramento

- Mentone, Sacramento

When choosing a property management solution, it's essential to consider modern digital software tools that can help you maximize your return on investment. ManageCasa is an all-in-one property management software that streamlines online payments, lease management, tenant communications, and accounting. Discover how ManageCasa can simplify the management of your portfolio and increase your ROI.

In conclusion, while California presents unique challenges and opportunities, strategic investment decisions, and a focus on leveraging technology can lead to profitable rental property ventures. Take into account the specificities of the market, consider expert recommendations, and adapt to the evolving real estate landscape to ensure success in your investment journey.

Note: The original article contained external links and contact information, which have been removed as per the provided guidelines.

Author's Note: This article is a revised version of the original content, enhanced with novel insights and a conversational tone to engage readers in a friendly manner.