When you hear the term "house flipping," you may envision the dramatic before-and-after transformations showcased on popular home improvement shows. However, flipping houses is not just about visual transformations; it's a strategic real estate investment tactic that has gained popularity for its potential to generate significant income. In this beginner's guide, we will walk you through the essentials of flipping houses, from understanding the basics to mastering the art of the sale. Whether you're a seasoned investor or just starting out, this guide is designed to help you succeed in this lucrative venture.

Understanding House Flipping

At its core, flipping houses involves purchasing a property, typically one that requires repair or renovation, and selling it at a higher price to make a profit. This process goes beyond simple cosmetic changes; it requires market savvy, budgeting skills, and an eye for properties with potential. The ultimate goal is to increase the home's value and sell it for a profit within a relatively short period, especially in a booming real estate market.

Caption: Flipping a house involves purchasing a property, renovating it, and selling it for a profit.

Caption: Flipping a house involves purchasing a property, renovating it, and selling it for a profit.

Pros and Cons of House Flipping

Flipping homes, like any investment, comes with both advantages and disadvantages. Here are some key points to consider:

Pros

- Profit Potential: Flipping houses can lead to significant profits, especially if you accurately estimate costs and time the market well.

- Valuable Experience: Each flip can enhance your real estate and renovation knowledge, benefiting future investments.

- Increase Neighborhood Property Value: Successful flips can improve neighborhoods by transforming dilapidated properties into desirable homes.

Cons

- Financial Risks: Flipping houses can be unpredictable and financially risky. It can also be emotionally exhausting if you lack the correct team, mentality, and discipline.

- Time Commitment: Flipping houses can be time-consuming, from finding the right property to managing renovations. Having the right systems and teams in place can help streamline the process.

- Unexpected Issues: Renovations often uncover additional problems, leading to unforeseen expenses and delays.

- Legal Ramifications: There is a possibility of a lawsuit if you sell a property with unresolved problems or purchase a property with unclear title ownership.

The 70% Rule in Real Estate

One essential rule in home flipping is to keep your financial risk low while maximizing potential returns. The 70% rule suggests that an investor should not spend more than 70% of a property's after-repair value (ARV) minus the necessary repairs. The ARV is the value of a house once all repairs have been made.

For instance, if a property's ARV is $100,000 and it needs $20,000 in repairs, the 70% rule suggests that you should pay no more than $50,000 for the property:

$100,000 (ARV) x 0.70 (70% Rule) = $70,000 - $20,000 (Cost of Repairs) = $50,000This rule serves as a safeguard to ensure a profit margin after all expenses of flipping the house.

Finding Houses to Flip

Finding the right properties to flip is crucial for success. Here are several strategies you can use:

- Look on foreclosure sites: Start your search on foreclosure listing sites such as Foreclosures.com. Many banks and lenders also provide their own real estate-owned listings.

- Attend auctions: Probate and foreclosure auctions are great places to find properties being sold at deep discounts. However, be prepared for bidding wars, where offering all-cash might be the most compelling bid.

- Drive around: Take a drive around your target neighborhood and look for signs of distressed properties, such as boarded-up windows or overgrown yards. Write down the address and conduct online research to find the owner or seller.

- Join your local REI group: Networking with other real estate professionals through local investment clubs, online forums, and meet-ups can connect you with potential deals and partnerships.

- Network with wholesalers: Wholesalers specialize in finding undervalued properties and resell them to third parties. Working with wholesalers can offer you great deals on properties to flip.

- Work with an agent: Consider adding a real estate agent to your team, especially if you lack experience or are unfamiliar with the market. Licensed agents have access to multiple listing services, allowing you to locate undervalued properties more effectively.

How to Flip Houses: A Step-by-Step Process

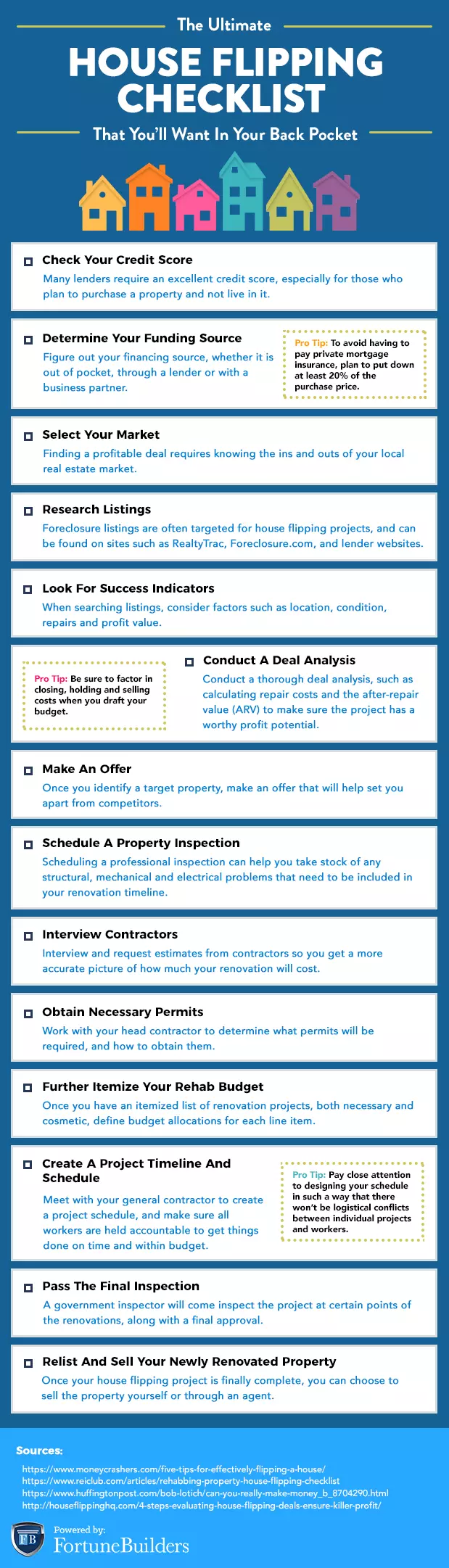

Starting in the house flipping industry requires a structured approach. Here's a step-by-step process to guide you through your first flip:

Caption: A step-by-step process to guide you through your first house flip.

Caption: A step-by-step process to guide you through your first house flip.

1. Check Your Credit Score

Evaluate your current financial situation, including your credit score. This information will be important when seeking funding for your projects.

2. Determine Your Funding Source

Research and compare different funding options, such as traditional financing, private lenders, crowdsourcing, or personal funding. Choose the option that best fits your needs and offers favorable terms.

3. Select Your Market

Choose a market that has the potential for a successful house-flipping business. Consider factors such as housing demand, median home prices, property types, and neighborhood resources.

4. Research Listings

Start searching for property listings on websites like Zillow.com and Realtor.com. Additionally, explore public records and newspapers for foreclosure listings, which can often lead to profitable flips.

5. Look for Successful Indicators

When reviewing property listings, pay attention to factors such as location, property condition, and potential rehab costs. These indicators will help you assess the profitability of a potential flip.

6. Conduct a Deal Analysis

Use key numbers, such as the after-rehab value (ARV), to predict the potential profit of a property. Add the renovation value to the property purchase price to calculate the ARV accurately.

7. Make an Offer

Determine the right purchase price based on your ARV analysis and make a strong offer. Securing the right purchase price is crucial to the success of your flip.

8. Schedule a Property Inspection

Hire a professional property inspector to identify any potential issues with the house. This step will help you negotiate a lower buying price or plan for necessary repairs in your budget.

9. Interview Contractors

Find reliable contractors who can provide accurate estimates for repair costs and timelines. Take the time to interview multiple contractors and find the right fit for your project.

10. Obtain Necessary Permits

Ensure that you obtain all the necessary permits before starting the renovation process. Consult local government websites to understand the permit requirements in your area.

11. Further Itemize Your Rehab Budget

Review the estimated costs of all the necessary renovations and prioritize them accordingly. This will help you stay within budget and avoid any surprises during the renovation process.

12. Create a Project Timeline and Schedule

Finalize a timeline and schedule for the renovation in collaboration with your contractor. Leave room for unexpected issues that may arise during the project.

13. Pass the Final Inspection

After completing the renovation, schedule a final inspection to ensure that the changes meet all code requirements. Do a final walk-through with your contractor to ensure nothing was missed.

14. Re-list and Sell Your Newly Renovated Property

List the renovated property for sale. Consider whether working with a real estate agent will benefit your sale and explore effective marketing strategies to attract potential buyers.

House Flipping Mistakes to Avoid

Even experienced professionals can stumble when flipping houses. Here are some common pitfalls to avoid:

- Overestimating ARV: Conduct thorough market research and consult with real estate experts to ensure realistic estimates of a property's selling price. Use comparable sales in the area as a guide.

- Underestimating Costs: Add a contingency of at least 10-20% to your projected renovation budget to account for unexpected expenses. Regularly review and adjust your budget as the project progresses.

- Skipping Inspections: Invest in a reliable property inspector to uncover potential issues early on. Inspections help you negotiate a lower buying price and avoid costly surprises.

Misconceptions in House Flipping

Several misconceptions surround house flipping that may deter beginners. Understanding the reality behind these misconceptions is key to preparing for success:

Need Tons of Your Own Money

Contrary to popular belief, you do not need a large amount of personal capital to start flipping houses. Creative financing options, such as hard money loans, traditional mortgages, and partnerships with investors, can provide the necessary funding with minimal personal investment.

Need Good Credit

While good credit opens up more financing options, it is not the sole determinant of success in house flipping. Hard money lenders, for example, focus more on the property's value and potential profit. Partnering with someone with strong credit or seeking credit repair services are viable strategies.

Can't Flip Houses Part-Time

Flipping houses can be adapted to fit a part-time schedule. Building a reliable team, including a contractor, real estate agent, and real estate attorney, allows you to delegate tasks and manage the process effectively.

Conclusion

Flipping houses can be a rewarding venture if approached with diligence, research, and realistic expectations. This guide has equipped you with foundational knowledge, from understanding what flipping entails to effectively selling your first flip. While flipping houses carries risks, the financial and personal rewards can be substantial. Armed with this roadmap, you are ready to embark on your house-flipping journey, navigate challenges, and capitalize on opportunities. Get started today and take advantage of the current opportunities in the real estate market!

Caption: Get started on your house-flipping journey and take advantage of the real estate market opportunities.

Caption: Get started on your house-flipping journey and take advantage of the real estate market opportunities.